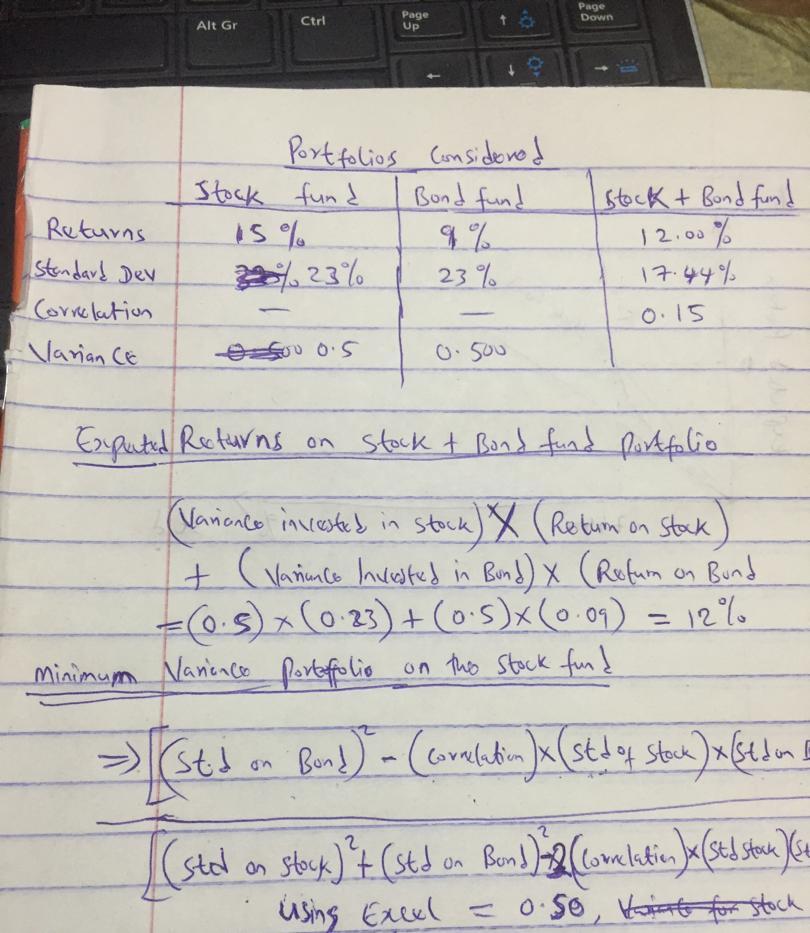

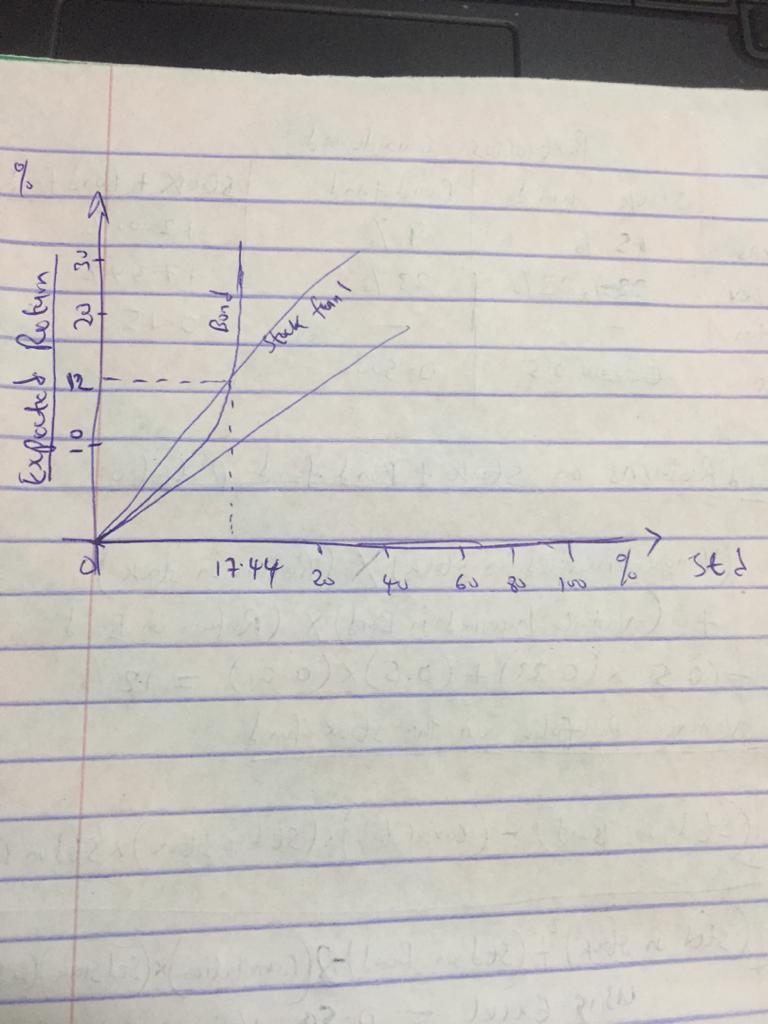

8. A pension fund manager is considering three mutual funds, a stock fund with expected return of 15% and standard deviation of 32%, a bond fund with expected return of 9% and standard deviation of 23%, and a money market fund with a sure rate of 5.5%. The correlation between the stock and bond funds is 0.15. Tabulate and draw the investment opportunity set of the two risky funds, using investment proportions for the stock fund from 0% to 100% in increments of 20%. What is the lowest-risk combination of the stock and bond funds

Answers

Answer:

The lowest risk combination is at : expected return = 12%

standard deviation = 17.44%

Explanation:

Three mutual funds

stock fund : 15% expected return, 23% standard deviation

Bond fund : 9% expected return , 23% standard deviation

money market : sure rate of 5.5%

correlation between stock and bond fund = 0.15

variance for stock fund = 0.5 ( solved using excel )

variance for bond fund = 1 - variance for stock = 1 - 0.5 = 0.500

attached below is the table and

Related Questions

On average, OCP receives 15 jobs per hour consisting of 50 percent standard, 30 percent deluxe, and 20 percent pro.

(a) How many jobs will arrive per hour at each station?

Answers

OCP receives 7.5 standard jobs, 4.5 deluxe jobs, and 3 pro jobs per hour at each station on average.

To solve this problem, we first need to calculate the number of standard, deluxe, and pro jobs that arrive per hour at OCP.

Given that OCP receives 15 jobs per hour consisting of 50% standard, 30% deluxe, and 20% pro, we can calculate the number of each type of job using percentages:

Number of standard jobs = 0.5 * 15 = 7.5

Number of deluxe jobs = 0.3 * 15 = 4.5

Number of pro jobs = 0.2 * 15 = 3

Therefore, on average, OCP receives 7.5 standard jobs, 4.5 deluxe jobs, and 3 pro jobs per hour.

To know more about average, here

brainly.com/question/29190876

#SPJ1

how do i give brainlyest

Answers

Answer:

when you ask a question and you get one answer you cant give someone brainliest until another person answers and after two people answer you chose which one is the best by clicking the little crown in the upper right corner of their answers

Explanation:

four accounting purpose ,what is the nature of the assumption as the length of life of an enterprise

Answers

Accounting suspicions 4 Accounting Assumptions are characterized as rules of activity or conduct which are inferred from involvement and practice, and when they demonstrate valuable, they ended up accepted standards of accounting.

4 basic assumptions of accounting are the pillars on which the structure of accounting is based. They are part of GAAP (Generally Accepted Accounting Principles).

1. Business entity concept

According to this assumption, the trade is treated as a unit or substance separated from its proprietors, leasers, supervisors, and others. In other words, the proprietor of an undertaking is continuously considered to be partitioned and unmistakable from the trade which he controls.2. Money measurements concept

The money related unit assumption implies that cash is the common denominator of financial action and gives an suitable premise for accounting estimation and analysis. That is, the money related unit is the foremost successful implies of communicating to interested parties changes in capital and trades of goods and services.3. Going concern Concept

It is also known as continuity assumption.Most accounting methods rely on the going concern assumption—that the company will have a long life. Despite numerous business failures, most companies have a fairly high continuance rate.4. Periodic concept

It is also known as the periodicity suspicion or period assumption. To degree the comes about of a company’s activity accurately, we would got to hold up until it liquidates. Decision-makers, in any case, cannot hold up that long for such data.To know more about accounting purposes visit:

https://brainly.com/question/13208263

#SPJ9

the united states measures its economy by how many goods and services are produced in a ___.; true or false? money is a factor of production.; economically, a \" need\" is something __________.; road building and purchasing military equipment are examples of purchasing by

Answers

1. The United States measures its economy by the amount of goods and services produced in a given year.

The size of a country's overall economy is typically measured by its GDP, which is the value of all final goods and services produced within a country in a given year.

Measuring GDP entails calculating the total dollar value of the production of millions of different goods and services smartphones, cars, music downloads, computers, steel, bananas, college educations, and all other new goods and services produced in the current year.

2. Capital is commonly used in economics to refer to money. Money, on the other hand, is not a factor of production because it is not directly involved in the production of a good or service. As a result, the answer is False.

Capital, on the other hand, facilitates production processes by allowing entrepreneurs and business owners to purchase capital goods or land or to pay wages.

3. A "need" in economic terms is something that is required to sustain life.

Simply put, a need is something that is required in order to survive. In economics, the concept of survival is real, which means that someone would die if their needs were not met. This includes necessities such as food, water, and shelter.

4. Road construction and military equipment purchases are examples of government purchases.

The government is in charge of purchasing military equipment and constructing roads. These purchases are classified as gross investment expenditures. The government treats this as its own asset when it invests. The government also purchases infrastructure projects such as roads and civil servant payrolls.

To learn more about economy, please refer:

https://brainly.com/question/22303652

#SPJ4

JoeFit, Inc. is using the basic FOQ model to manage its inventory for K2 microprocessors. The setup cost per order is $200 and the inventory carrying cost is $0.05 per chip per year. Suppose the company is placing the optimal order quantity in each order and the resulting total annual setup and carrying costs are $32,000. What is the annual demand of the K2 microprocessors

Answers

Answer:

51.2 million

Explanation:

The computation of the annual demand is shown below:

As we know that the total annual setup cost and the carrying cost would be equivalent to EOQ

Since the total annual setup cost & carrying cost is $32,000

So, for each it would be $16,000

Now

Total number of orders is

= $16000 ÷ $200

= 80 orders

And, Total inventory carrying cost = 0.05 × (EOQ ÷ 2)

$16000 = 0.05 × EOQ ÷ 2

$32000 ÷ 0.05 = EOQ

EOQ = 640000 units

Now

Total demand = 640000 × 80

= 51200000

= 51.2 million

The annual demand for the K2 microprocessors is 51.2 million.

The total annual setup and carrying costs are $32,000, therefore, the value of each will be:

= $32000/2

= $16000.

The total number of orders will be:

= 16000/200 = 80 orders

The economic order quantity will be:

16000 = 0.05 × (EOQ/2)

EOQ = 32000/0.05

EOQ = 640000

The total demand will be:

= 640000 × 80 = 51.2 million

In conclusion, the annual demand of the K2 microprocessors is 51.2 million.

Read related link on:

https://brainly.com/question/19542745

Jahar is very friendly and loves interacting with customers. He has a lot of knowledge about loans and the risks associated with them. In which Finance career does Jahar work? Business Finance Management Financial Investment Planning Insurance Services Banking and Related Services

Answers

Answer:

C

Explanation: I took the Unit Test and got it right!

Answer: C : Insurance Services

Explanation: this is on Edgenutiy unit test

Guys.. Pls... Just try to help me out.

1. If you were preparing a marketing plan for this hotel, how would you describe the

company, its positioning strategy, and its value proposition?

2. What do you want to know about the market- demographics and psychographics?

3. Describe each of the 4P’s as they relate to this hotel.

(Product, Place, Price, Promotion)

4. Without doing further research, who do you think is the target market?

5. Does the hotel have a brand image? If so, explain.

Answers

1. The hotel is a luxury resort with a unique positioning strategy that caters to affluent travelers seeking exclusivity and relaxation. Its value proposition is centered around creating unforgettable memories for guests.

2. Gathering demographic and psychographic data can help identify the hotel's target audience and their emotional and psychological needs.

How would you describe the company, its positioning strategy?The hotel is a luxury resort situated on a beautiful beach with breathtaking views. It caters to affluent travelers who value exclusivity, privacy, and relaxation. The hotel's positioning strategy is to offer an unparalleled experience by providing guests with top-notch amenities and services that meet and exceed their expectations.

The hotel's value proposition is centered around the idea of creating unforgettable memories for guests that they will cherish for a lifetime. By offering an exclusive, luxurious experience, the hotel seeks to differentiate itself from its competitors and attract high-end customers who are willing to pay a premium for superior service.

What do you want to know about the market- demographics and psychographics?To better understand the hotel's market, it would be helpful to gather information on the demographics and psychographics of its target audience. Demographic information such as age, income, education, and occupation would be useful in determining the hotel's target customer profile. Psychographic data, such as values, lifestyle, interests, and personality traits, can help identify the emotional and psychological needs of the target market.

Read more about 4Ps

brainly.com/question/28017239

#SPJ1

Which of the following would appear in the cash flows from investing activities section of the statement of cash flows?

a. Cash received from stock issued

b. Cash received from bonds payable

c. Depreciation expense on equipment

d. Cash paid for equipment

Answers

The correct answer is:

d. Cash paid for equipment

Cash flows from investing activities include transactions related to the acquisition or sale of long-term assets such as property, plant, and equipment. Cash paid for the purchase of equipment would be categorized as an investing activity because it involves the outflow of cash for the acquisition of a long-term asset.

Which of the following statements about debt financing is FALSE?

A. Debt financing comes from banks or other commercial

lenders.

B. When a bank gives a company a loan, they become partial

owners of the company.

C. Companies often have to pay interest when they use debt

financing.

D. It's harder for startups to get debt financing.

Answers

Answer:

B

Explanation:

Given integer variables seedVal, smallestVal, and greatestVal, output a winning lottery ticket consisting of three random numbers in the range of smallestVal to greatestVal inclusive. End each output with a newline.

Ex: If smallestVal is 30 and greatestVal is 80, then one possible output is:

65

61

41

how do I code this in c++?

Answers

If the user does not provide a seed value, the ctime library is used to seed the random number generator with the current time. This guarantees that the random numbers we receive are distinct each time the program is run.

What is meant by Ctime Library?The Ctime library is a library in the C++ programming language that furnishes capabilities for working with time and dates. Obtaining the current time, converting between various time formats, and performing arithmetic on dates and times are all supported by this application. Time and date values can be formatted and printed in a variety of ways using the Ctime library's functions. In general, it is a useful library for C++ programmers who must work with dates and times.

To know more about Programming Language, visit:

https://brainly.com/question/21859910

#SPJ1

Merchandising transactions.

ABC Company distributes merchandises to retail stores. During the month of July, the following merchandising transactions were occurred.

July 1: Purchased 600 units of merchandises on account from XYZ Manufacturers, FOB destination, terms 2/10, n/30. The merchandise has a list price of Birr 150 per unit with the trade discount of 20%. The appropriate party also made a cash payment of Birr 800 for freight on this date.

3: Sold merchandises on account to Satchel World for Birr 8,200. The cost of merchandises sold was Birr 5,400.

9: Paid XYZ Manufacturers in full.

12: Received payment in full from Satchel World.

17: Sold merchandises on account to Lady GoGo for Birr 5,400 which is subject to a sales tax of 15%. The cost of the merchandises sold was Birr 4,030.

18: Purchased merchandises on account for Birr 3,900 from Holiday Manufacturers, FOB shipping point, terms 1/10, n/30. The appropriate party also made a cash payment of Birr 750 for freight on this date.

20: Received Birr 900 credit for merchandises returned to Holiday Manufacturers.

21: Received payment in full from Lady GoGo.

22: Sold merchandises on account to Vagabond for Birr 6,400. The cost of merchandises sold was Birr 4,300.

30: Paid Holiday Manufacturers in full.

31: Granted Vagabond Birr 400 credit for merchandises returned costing Birr 280.

Instructions

Journalize the transactions for the month of July for ABC Company using:

Perpetual inventory system

Periodic inventory system

Answers

Journalizing the transactions for the month of July for ABC Company using the perpetual and periodic inventory systems is as follows:

Journal Entries under the Perpetual Method:July 1: Debit Inventory Birr 72,000

Credit Accounts Payable (XYZ Manufacturers) Birr 72,000

FOB destination, terms 2/10, n/30. The merchandise has a list price of Birr 150 per unit with a trade discount of 20%.

July 3: Debit Accounts Receivable (Satchel World) Birr 8,200

Credit Sales Revenue Birr 8,200

Debit Cost of goods sold Birr 5,400

Credit Inventory Birr 5,400

July 9: Debit Accounts Payable (XYZ Manufacturers) Birr 72,000

Credit Cash Birr 70,560

Credit Cash Discounts Birr 1,440

July 12: Debit Cash Birr 8,200

Credit Accounts Receivable (Satchel World) Birr 8,200

July 17: Debit Accounts Receivable (Lady GoGo) Birr 6,210

Credit Sales Revenue Birr 5,400

Credit Sales Tax Payable Birr 810

Subject to a sales tax of 15%.

Debit Cost of goods sold Birr 4,030

Credit Inventory Birr 4,030

July 18: Debit Inventory Birr 3,900

Credit Accounts Payable (Holiday Manufacturers) Birr 3,900

FOB shipping point, terms 1/10, n/30.

Debit Freight-in Birr 750

Credit Cash Birr 750

July 20: Debit Accounts Payable (Holiday Manufacturers) Birr 900

Credit Inventory Birr 900

For merchandise returned to Holiday Manufacturers.

July 21: Debit Cash Birr 6,210

Credit Accounts Receivable (Lady GoGo) Birr 6,210

July 22: Debit Accounts Receivable (Vagabond) Birr 6,400

Credit Sales Revenue Birr 6,400

Debit Cost of goods sold Birr 4,300

Credit Inventory Birr 4,300

July 30: Debit Accounts Payable (Holiday Manufacturers) Birr 3,000

Credit Cash Birr 3,000

July 31: Debit Sales Returns Birr 400

Credit Accounts Receivable (Vagabond) Birr 400

Debit Inventory Birr 280

Credit Cost of goods sold Birr 280

For merchandises returned costing Birr 280.

Journal Entries under the Periodic Method:July 1: Debit Purchases Birr 72,000

Credit Accounts Payable (XYZ Manufacturers) Birr 72,000

FOB destination, terms 2/10, n/30. The merchandise has a list price of Birr 150 per unit with a trade discount of 20%.

July 3: Debit Accounts Receivable (Satchel World) Birr 8,200

Credit Sales Revenue Birr 8,200

July 9: Debit Accounts Payable (XYZ Manufacturers) Birr 72,000

Credit Cash Birr 70,560

Credit Cash Discounts Birr 1,440

July 12: Debit Cash Birr 8,200

Credit Accounts Receivable (Satchel World) Birr 8,200

July 17: Debit Accounts Receivable (Lady GoGo) Birr 6,210

Credit Sales Revenue Birr 5,400

Credit Sales Tax Payable Birr 810

Subject to a sales tax of 15%.

July 18: Debit Purchases Birr 3,900

Credit Accounts Payable (Holiday Manufacturers) Birr 3,900

FOB shipping point, terms 1/10, n/30.

Debit Freight-in Birr 750

Credit Cash Birr 750

July 20: Debit Accounts Payable (Holiday Manufacturers) Birr 900

Credit Purchases Return Birr 900

For merchandise returned to Holiday Manufacturers.

July 21: Debit Cash Birr 6,210

Credit Accounts Receivable (Lady GoGo) Birr 6,210

July 22: Debit Accounts Receivable (Vagabond) Birr 6,400

Credit Sales Revenue Birr 6,400

July 30: Debit Accounts Payable (Holiday Manufacturers) Birr 3,000

Credit Cash Birr 3,000

July 31: Debit Sales Returns Birr 400

Credit Accounts Receivable (Vagabond) Birr 400

Transaction Analysis under the Perpetual Method:July 1: Inventory Birr 72,000 Accounts Payable (XYZ Manufacturers) Birr 72,000

FOB destination, terms 2/10, n/30. The merchandise has a list price of Birr 150 per unit with a trade discount of 20%.

July 3: Accounts Receivable (Satchel World) Birr 8,200 Sales Revenue Birr 8,200

Cost of goods sold Birr 5,400 Inventory Birr 5,400

July 9: Accounts Payable (XYZ Manufacturers) Birr 72,000 Cash Birr 70,560 Cash Discounts Birr 1,440

July 12: Cash Birr 8,200 Accounts Receivable (Satchel World) Birr 8,200

July 17: Accounts Receivable (Lady GoGo) Birr 6,210 Sales Revenue Birr 5,400 Sales Tax Payable Birr 810

Subject to a sales tax of 15%.

Cost of goods sold Birr 4,030 Inventory Birr 4,030

July 18: Inventory Birr 3,900 Accounts Payable (Holiday Manufacturers) Birr 3,900 FOB shipping point, terms 1/10, n/30.

Freight-in Birr 750 Cash Birr 750

July 20: Accounts Payable (Holiday Manufacturers) Birr 900 Inventory Birr 900 For merchandise returned to Holiday Manufacturers.

July 21: Cash Birr 6,210 Accounts Receivable (Lady GoGo) Birr 6,210

22: Accounts Receivable (Vagabond) Birr 6,400 Sales Revenue Birr 6,400

Cost of goods sold Birr 4,300 Inventory Birr 4,300

July 30: Accounts Payable (Holiday Manufacturers) Birr 3,000 Cash Birr 3,000

July 31: Sales Returns Birr 400 Accounts Receivable (Vagabond) Birr 400

Inventory Birr 280 Cost of goods sold Birr 280

For merchandises returned costing Birr 280.

Transaction Analysis under the Periodic Method:Similar with some minor differences.

Learn more about journalizing business transactions at https://brainly.com/question/17201601

#SPJ1

What happens if you only make the minimum payment on your credit card statements

Answers

Yes, you can maintain the use of your credit card by making only the Minimum Payment Due each month. However, there won't be an interest-free time and you'll have to pay exorbitant interest rates.

What takes place when you only pay the minimum amount. Even though it's crucial to make at least the minimum payment each month, it's not recommended to carry a credit card balance from month to month because you'll accrue interest fees (unless you're taking advantage of an introductory 0% APR) and run the danger of going into debt. A minimum payment won't lower your credit score by itself because you aren't skipping a payment.

To learn more about Payment, click here.

https://brainly.com/question/15138283

#SPJ1

The person that most often interact with a customer before and after a purchase has been made in a called a

Answers

Answer:

The person that most often interact with a customer before and after a purchase has been made in a called a Salesman

Answer:

Im pretty sure its a salesman

Explanation:

What are some Drawbacks of business Debt?

Answers

Answer:Paying Back the Debt. Making payments to a bank or other lender can be stress-free if you have ample revenue flowing into your business. ...

High Interest Rates.

The Effect on Your Credit Rating.

Cash Flow Difficulties.

Explanation:

Explain what is meant by the saying that consumers "vote" with their dollars every time they buy products in the marketplace

Answers

What is meant by means of pronouncing that consumers "vote" with their greenbacks every time they purchase merchandise inside the marketplace when purchasers purchase something, they send a message to companies regarding their shopping for preferences, helping to direct use resources

The definition of a consumer is a person that buys goods and services. An instance of the customer is someone who purchases a brand new tv. A heterotrophic organism feeds on different organisms in a meal chain.

The consumer is the only one who's the end-person of any items or offerings. Any person, aside from the consumer who buys the product or offerings, and consumes the product via taking his/her permission is categorized as a customer.

Consumers represent the top trophic stages. not like producers, they can't make their personal food. To get electricity, they eat vegetation or different animals, even as some devour each. Scientists distinguish between numerous forms of customers. primary clients make up the second one trophic degree.

Learn more about Consumers here:brainly.com/question/380037

#SPJ9

1. I Co. recently began production of a new product, an electric clock, which required the investment of

$3,200,000 in assets. The costs of producing and selling 160,000 units of the clocks are estimated as

follows:

Variable costs:

Per unit

Direct labor

$

10

Direct materials

6

Factory overhead

$

4

Administrative and selling

$

5

EA

Fixed costs:

Manufacturing

Administrative and selling

$ 1,600,000

800,000

I Co. is considering establishing a price to sell it's electrical clock to the market. The CEO has

decided to use a cost plus approach to product pricing and that the clock must eam 10 percent on

it's invested assets.

Instructions: NOTE: SHOW ALL WORK

1. Determine the amount of desired profit from the production and sale of the

electric clock.

2. Assuming that the product cost concept is used, determine (a) total variable

cost per unit, the total fixed cost per unit, and the selling price per unit.

Answers

Answer:

I Co.

1. Desired profit = 10% of invested assets

= $3,200,000 x 10%

= $320,000

2a. Total Variable cost per unit

Variable costs Per unit :

Direct labor $ 10

Direct materials 6

Factory overhead $ 4

Variable Product Cost ($20)

Administrative and selling $ 5

Total Variable cost per unit $25

b. Total fixed cost per unit

Total fixed cost per unit = $2,400,000/160,000 = $15

c. The selling price per unit

Sales / quantity = $7,520,000/160,000 = $47

Explanation:

Data:

Variable costs Per unit :

Direct labor $ 10

Direct materials 6

Factory overhead $ 4

Variable Product Cost $20

Administrative and selling $ 5

Total Variable cost per unit $25

EA

Fixed costs:

Manufacturing $ 1,600,000

Administrative and selling 800,000

Total fixed costs $2,400,000

b) Cost-plus approach to product pricing: This approach requires the addition of the direct materials, direct labor, and overhead costs

c) Required profit = 10% of invested assets

= $3,200,000 x 10%

= $320,000

d) Product cost:

Variable cost = $20 x 160,000 = $3,200,000

Fixed manufacturing costs $1,600,000

Total production cost $4,800,000

Product cost per unit $4,800,000/160,000 = $30

e) Income Statement to determine Sales Revenue

Sales $7,520,000

Cost of goods sold

($30 x 160,000) 4,800,000

Gross profit $2,720,000

Fixed Costs:

Manufacturing $ 1,600,000

Administrative & selling 800,000

Profit $320,000

hester Corp. ended the year carrying $18,711,000 worth of inventory. Had they sold their entire inventory at their current prices, how much more revenue would it have brought to Chester Corp.

Answers

Answer:

$18,711,000

Explanation:

Based on the information given the amount of more revenue would it have brought to Chester Corp will be $18,711,000

Question 4 of 10

During a depression or recession, which of the following is most likely to

happen to interest rates?

A. Interest rates will likely decrease as the Federal Reserve Board

increases inflation rates.

O B. The Federal Reserve Board will likely lower interest rates.

O C. Interest rates will likely rise as the Federal Reserve board

decreases inflation rates.

O D. The Federal Reserve Board will likely raise interest rates.

SUBMIT

Answers

B.The federal reserve board will likely lower interest rates

Explanation:

pa brainliest po ako png taga sagot ng mga new question

A company had issued 10,000 bonds which had a par value of $50 and currently sold at $60. The company is expected to pay 10% interest for the next 5 years. In addition to this the preferred stock of the company is issued at $150 which a promised dividend of 8 per share. The common stock holders will receive $2 per share and this will grow T 8% for the first 3 years, 6% for the other 3 years and it will grow at 5% for indefinite period. Assume the tax rate is 35%. The capital structure of the company is composed of 600,000 common stock, 200,000 preferred stock and 100,000 is debt.

A) Find the cost of capital for each sources A) Find the weighted average cost of capital

Answers

To calculate the cost of capital for each source, we'll consider the cost of debt, cost of preferred stock, and cost of common stock.

1. Cost of Debt:

The cost of debt is the interest rate the company pays on its debt. In this case, the company has issued bonds with a par value of $50, currently selling at $60, and a coupon rate of 10% for 5 years.

Cost of Debt = (Interest Expense / (Bonds Market Value - Bond Discount)) * (1 - Tax Rate)

Interest Expense = Bonds Market Value * Coupon Rate

Bonds Market Value = Number of Bonds * Bond Selling Price

Number of Bonds = 10,000

Bond Selling Price = $60

Coupon Rate = 10%

Tax Rate = 35%

Interest Expense = $60 * 10,000 * 10% = $60,000

Bonds Market Value = 10,000 * $60 = $600,000

Bond Discount = Par Value - Bond Selling Price = $50 - $60 = -$10 (Negative value because the bond is selling at a premium)

Cost of Debt = ($60,000 / ($600,000 - (-$10))) * (1 - 0.35) = $6,000 / $600,010 * 0.65 = 0.064997 (approximately 6.50%)

2. Cost of Preferred Stock:

The cost of preferred stock is the dividend rate the company pays on its preferred stock. In this case, the preferred stock is issued at $150 with a promised dividend of $8 per share.

Cost of Preferred Stock = Dividend / Preferred Stock Price

Dividend = $8

Preferred Stock Price = $150

Cost of Preferred Stock = $8 / $150 = 0.053333 (approximately 5.33%)

3. Cost of Common Stock:

The cost of common stock is calculated using the dividend growth model. The dividend is expected to grow at different rates for different periods.

First 3 years: Dividend Growth Rate = 8%

Next 3 years: Dividend Growth Rate = 6%

Indefinite period: Dividend Growth Rate = 5%

Cost of Common Stock = Dividend / Current Stock Price + Growth Rate

Dividend = $2

Current Stock Price = Market Price

Growth Rate = Dividend Growth Rate

Cost of Common Stock = $2 / Market Price + Growth Rate

Weighted Average Cost of Capital (WACC):

The weighted average cost of capital is the weighted average of the costs of each source of capital, considering their respective proportions in the capital structure.

WACC = (Weight of Debt * Cost of Debt) + (Weight of Preferred Stock * Cost of Preferred Stock) + (Weight of Common Stock * Cost of Common Stock)

Weight of Debt = Debt / Total Capital

Weight of Preferred Stock = Preferred Stock / Total Capital

Weight of Common Stock = Common Stock / Total Capital

Debt = $100,000

Preferred Stock = $200,000

Common Stock = $600,000

Total Capital = Debt + Preferred Stock + Common Stock = $100,000 + $200,000 + $600,000 = $900,000

Weight of Debt = $100,000 / $900,000 = 0.111111 (approximately 11.11%)

Weight of Preferred Stock = $200,000 / $900,000 = 0.222222 (approximately 22.22%)

Weight of Common Stock = $600,000 / $900,000 = 0.666667 (approximately 66.67%)

WACC = (0.111111 * 6.50%) + (0.222222 * 5.

The cost of capital for each source can be calculated by determining the cost of debt, cost of preferred stock, and cost of common equity. The cost of debt is 8.33%, the cost of preferred stock is 5.33%, and the cost of common equity is 14.77%.

To find the cost of capital for each source, we will calculate the cost of debt, cost of preferred stock, and cost of common equity.

The cost of debt can be calculated using the formula: Cost of Debt = (Annual Interest Payment / Bond Price) x 100%. In this case, the bond price is $60 and the annual interest payment is 10% of the bond's par value of $50, so the cost of debt is (0.10 * $50 / $60) x 100% = 8.33%.

The cost of preferred stock can be calculated using the formula: Cost of Preferred Stock = Dividend / Stock Price. In this case, the dividend is $8 per share and the stock price is $150, so the cost of preferred stock is $8 / $150 = 5.33%.

The cost of common equity can be calculated using the Dividend Discount Model (DDM) formula: Cost of Common Equity = Dividend / Current Stock Price + Growth Rate. The growth rate for the first 3 years is 8%, for the following 3 years is 6%, and for an indefinite period is 5%. The dividend for common stock is $2 per share. The current stock price can be calculated using the market value of the common stock ($2 * 600,000 = $1,200,000) divided by the number of shares (600,000), which equals $2 per share. The cost of common equity is $2 / $2 + 0.08 + 0.06 + 0.05 = 14.77%.

Learn more about Cost of Capital here:https://brainly.com/question/37826404

#SPJ2

PROBLEM (23 POINTS)

Use the following information to PREPARE A RATIO ANALYSIS FOR Carton Co.

The following information pertains to Carlton Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.

Assets

Cash and short-term investments

$ 40,000

Accounts receivable (net)

25,000

Inventory

20,000

Property, plant and equipment

210,000

Total assets

$295,000

Liabilities and Stockholders’ Equity

Current liabilities

60,000

Long-term liabilities

85,000

Stockholders’ equity-common

150,000

Total liabilities and stockholders’ equity

$295,000

Income Statement

Net sales

$ 85,000

Cost of goods sold

45,000

Gross margin

40,000

Operating expenses

15,000

Interest expense

5,000

Net income

$ 20,000

EPS $3.33

Number of shares of common stock

6,000

Market price of common stock

$20

Total dividends paid

$5,400

Cash provided by operations

$30,000

Dividend per share $.90

Required:

Prepare a ratio analyses using the formulas presented on page 627. If a ratio not applied to Carton Co., write N/A.

Answers

Answer:

1. Current Ratio = Current assets / Current liabilities

= (40000+25000+20000)/60000

= 1.42

2. Quick Ratio = (Cash and short term investments + Accounts Receivable)/ Current Liabilities

= (40000+25000)/60000

= 1.08

3. Liquidity Ratio = (Cash and short term investments)/current Liabilities

= 40000/60000

= 0.67

4. Gross Profit Ratio = (Gross Profit / Net sales)*100

= 40000/85000*100

= 0.470588 * 100

= 47.06%

5. Operating Cost Ratio = (Operating Cost / Net sales)*100

= (45000+15000)/85000*100

= 70.59%

6. Operating profit Ratio = (operating profit/Net sales)*100

= (Gross Profit - Operating Expenses)/Net sales * 100

= (40000-15000)/85000*100

= 29.41%

7. Net Profit Ratio = Net Profit/Net Sales * 100

= 20000/85000*100

= 23.53%

8. Return on shareholder's Fund = Net Profit After Interest And Taxes/ Shareholders Funds * 100

= 20000/150000*100

= 13.33%

9. Return on Capital employed = Net Profit Before interest and Tax / (Total Assets - Current Liabilities)*100

= (20000+5000)/(295000-60000)*100

= 10.64%

10. Return on Total Assets = Net Profit Before interest and Tax / Total Assets * 100

= 25000/295000*100

= 8.47%

the summary of important trends in retailing are

Answers

Answer:

1 Investment in omni channel retail strategies

2 provide a personalized retail experience

3 Attend to the growing culture of immediacy

4 Expand into emerging markets and create a new channel

Huff Company presents the following items derived from its December 31, 2019, adjusted trial balance:

Sales (net) $124,000 Operating expenses $30,400

Interest expense 3,700 Common stock, $5 par 22,000

Cost of goods sold 66,200 Retained earnings, 1/1/201 945,800

The following information is also available for 2019 and is not reflected in the preceding accounts:The common stock has been outstanding all year. A cash dividend of $1.28 per share was declared and paid.

Land was sold at a pretax gain of $6,300

Division X (a major component of the company) was sold at a pretax gain of $4,700.

It had incurred a $9,500 pretax operating loss during 2019.

A tornado, which is an unusual event in the area, caused a $5,400 pretax loss.

The income tax rate on all items of income is 30%.

The average shareholders' equity is $90,000.

Required:

a. Prepare a 2016 multiple-step income statement for Huff.

b. Prepare a 2016 retained earnings statement.

Answers

Answer:

letter a.po sagot diyan

If the points on a scatterplot fall on a nearly straight line sloping upward, what do the two variables have? Explain your reasoning.

________________________________

Choose the correct answer below.

A.A strong positive correlation. A positive correlation is when both variables increase or decrease together, and a strong correlation is when the two variables lie close to a straight line.

B.A strong positive correlation. A positive correlation is when both variables increase together, and a strong correlation is when the two variables lie exactly on a straight line.

C.No correlation. The given information does not indicate a relationship between the two variables.

D.No correlation. There is only a correlation between two variables when one variable decreases while the other increases.

E.A weak negative correlation. A negative correlation is when both variables increase or decrease together, and a weak correlation is when the two variables lie close to a straight line.

F.A weak negative correlation. A negative correlation is when both variables increase together, and a weak correlation is when the two variables lie exactly on a straight line.

Answers

Option A is correct. Strong positive correlation. A positive correlation is when both variables are increasing or decreasing together, and a strong correlation is when the two variables are close to a straight line.

A positive correlation is a relationship between two variables that run in parallel. In the same direction. A positive correlation occurs when one variable decreases when the other variable decreases, or when one variable increases while the other variable increases. Since these two different variables are moving in the same direction, they are theoretically subject to the same external force.

A positive correlation is when one variable tends to decrease when the other variable decreases, or when one variable tends to increase when the other variable increases.

In finance, correlations are used to describe how individual stocks perform in relation to the broader market.

A beta of 1.0 represents a stock that correlates perfectly with the S&P 500. Values above 1.0 represent stocks with higher volatility than the S&P 500, while lower values represent stocks with lower volatility.

Know more about correlation here:

https://brainly.com/question/30780910

#SPJ1

How does an understanding of management and organizational behavior lead to organizational effectiveness and efficiency

Answers

Answer: Understanding the organizational behavior and management can lead to effectiveness and efficiency.

Explanation:

Each and every organization have a proper set of rules and regulations that helps in running the organization effectively.

The goals can be achieved only when the organizational behavior and management is made clear to the employees.Understanding the work make the work done in a effective manner.

The efficiency of the organization is increased by doing the work with the better understanding of the management and organizational behavior.

top level management essay

Answers

Based on the business and administrative concept, top-level management is the level of management that consists of an organization's board of directors and the chief executive or managing director.

Essay on Top-Level ManagementTop-level management is a term that is used to describe the highest level of executive management.

Generally, this management level is considered the ultimate source of power and authority since it oversees the goals, policies, and procedures of a company.

Examples of Top-level Management include the following:Chief Executive Officer (CEO)Chief Financial Officer (CFO)Chief Operating Officer (COO)Company President.Company Vice President.Hence, in this case, it is finally concluded that Top Level Management is crucial to any company's success.

Learn more about Top-Level Management here: https://brainly.com/question/14749711

#SPJ1

The aging of accounts receivable for Brett Company as of December 31 of the current year and estimated percentages of uncollectible accounts by age

group are presented in the table below. Calculate the estimate of uncollectible accounts expense. The balance of Allowance for Uncollectible Accounts

on December 31, before the adjusting entry is recorded, is a $236.89 credit

Age Group

Amount

Percent Uncollectible

Current

$16,485.18

20%

1-30

12,489.05

4.0%

31-60

6,958 18

80%

61-90

4,218 21

20.0%

Over 90

3,157 10

70.0%

$43,307 72

Current Balance of Allowance for Uncollectible Accounts

Estimated Addition to Allowance for Uncollectible Accounts

Answers

Answer:

hey

Explanation:

It took MegaTech, Inc., 100,000 labor-hours to produce the first of several oil-drilling rigs for Antarctic exploration. Your company, Natural Resources, Inc., has agreed to purchase the fifth (steady-state) oil-drilling rig from MegaTech’s manufacturing yard. Assume that MegaTech experiences a learning rate of 80%. At a labor rate of $35 per hour, what should you, as the purchasing agent, expect to pay for the fifth unit?

Answers

Mega Tech experiences a learning rate of 80%. At a labor rate of $35 per hour, I should as the purchasing agent, expect to pay for the fifth unit is $2,086,000.

A purchasing agent is a manager who aids in the choice and acquisition of goods and services. This is accomplished through compiling information about suppliers, costs, and goods, as well as screening it. Additionally, the agent has the authority to issue purchasing contracts, request vendor bids, and more.

Considering that Company MT learns at a rate of 80%

Work hours equal 100,000 hours.

$35 per hour labor rate

Observation: The fourth unit learning curve coefficient is listed in the learning curve table as 0.596.

According to the formula, the fifth unit is made up of:

Tn = T1C

T5 = 100.000 x 0.596

= 59,600 hours

Multiplying the hours by the hourly rate yields the cost:

T = 59.600 X ($35/hour) = 2,086.000

Consequently, as a purchasing agent, it is reasonable to anticipate paying $2,086,000 for the fifth unit.

Learn more about purchasing agent here

https://brainly.com/question/15439971

#SPJ9

DESCRIBE THE FUNCTIONS OF

PRELIMINARY DATA GATHERING?

Answers

Preliminary data gathering involves collecting and analyzing relevant information to establish a foundation for research or decision-making, including identifying objectives, assessing data availability, etc.

What are the Functions of Preliminary Data Gathering?Preliminary data gathering encompasses the initial acquisition and evaluation of pertinent information, serving as a basis for research or decision-making. It aids in defining project scope, goals, and needs, while also assessing data availability and quality.

This stage assists researchers and decision-makers in gaining insights, assessing project feasibility, recognizing potential obstacles, and formulating a strategic plan for subsequent data collection and analysis.

Learn more about Preliminary data gathering on:

https://brainly.com/question/14293427

#SPJ1

many influential economists, politicians, and business leaders think that a shift toward a more integrated and interdependent global economy is a good thing. there is evidence to support the theory that falling barriers to international trade and investment drive the global economy toward greater prosperity. there are, however, critics who argue against globalization. anecdotes, evidence, and arguments can be collected to support each side of the debate. international businesses need to understand the nature of the globalization debate and observe how their own practices may act in support of or against globalization. understanding how each side sees the issues can lead toward better solutions to the problems caused by globalization. match each argument for or against globalization below with the corresponding issue. socioeconomic development results across nations and people labor and labor standards jobs environment and health

Answers

The global economic system, which includes all economic activities carried out both within and between nations, including production, consumption, economic management, work generally, the exchange of monetary values, and the trade of goods and services, is referred to as the world economy or global economy.

Producers ---> Globalization Arguments Additional Markets in the Environment to Sell on -- Tougher regulations reduce pollution.Consumer----> More options for products Workers -- creation of improved sillsObjections to globalizationProducers----> can fail because of competitionThe surroundings -- Abuse results from inadequate regulations.Consumers----> Unaware of the manufacturing process Workers -- job losses resulting from competition.To know more about economy here

https://brainly.com/question/514447

#SPJ4

Which characteristic describes the privatization of Social Security?

A. increases the employer’s contribution to Social Security

B. raises the retirement age to claim full benefits to 70

C. enables Americans to invest their Social Security contributions in the stock market

D. reduces benefits across the board by 13 percent

E. obtains a loan from the Fed

Answers

Answer:

the answer is C because it makes sense...

Enables Americans to invest their Social Security contributions in the stock market - describes the privatization of Social Security. Hence option C is correct.

What are the characteristic of the privatization of Social Security?Privatization of Social Security refers to a proposal where individuals are allowed to invest their Social Security contributions into individual retirement accounts (IRAs) or other investments instead of the government-managed Social Security Trust Fund.

Under this system, individuals would have control over their retirement funds and would be able to invest in the stock market, bonds, and other financial instruments. This would also mean that individuals would be responsible for managing their own retirement funds and bearing the associated risks.

Options A and B do not describe privatization but rather refer to potential changes in the current Social Security system. A reduction in benefits, which is not necessarily associated with privatization. Option E is not related to the privatization of Social Security at all, but rather refers to obtaining a loan from the Federal Reserve.

Learn more about privatization here

https://brainly.com/question/7972968

#SPJ5