According to ComScore's U.S. total video report, which of the following statements is TRUE? Group of answer choices Younger audiences are more likely to consume news content on smartphones than traditional news platforms. Millennials are less likely to watch TV from an internetconnected TV device (e.g. Roku, Apple TV, Google Chromecast) as well as via a gaming console (e.g. Xbox, PlayStation, etc.) or Blu-Ray Player. Millennials spend one-third of their original TV series consumption time watching on digital platforms, with computers driving the majority of that activity. Generally speaking, the younger the viewer the greater percentage of time spent watching on "traditional" TV sets.

Answers

Answer: Millennials spend one-third of their original TV series consumption time watching on digital platforms, with computers driving the majority of that activity.

Explanation:

The report showed that Millennials who are loosely defined as those who were born between the years 1981 and 1996, preferred to watch TV series on digital platforms and when they do watch TV, they do it time-shifted or with a computer connected to the Television and simply projecting what the computer is showing.

This trend by Millennials towards digital platforms was put down to the Millennials' need to watch videos on their own time and these digital platforms offer that by simply putting videos there and leaving you to click on them whenever you want.

Related Questions

You own a portfolio that is 34 percent invested in Stock X, 22 percent invested in Stock Y, and 44 percent invested in Stock Z. The expected returns on these three stocks are 11 percent, 18 percent, and 14 percent, respectively. What is the expected return on the portfolio

Answers

Answer:

13.86%

Explanation:

34% was invested into stock X with an expected return of 11%

22% was invested into stock Y with an expected return of 18%

44% was invested into stock Z with an expected return of 14%

The expected return on the portfolio can be calculated using the formula below

Expected return= Sum of ( weight of stock×return of stock)

= (0.34×11%)+(0.22×18%)+(0.44×14%)

= 3.74+3.96+6.16

= 13.86%

Hence the expected return on the portfolio is 13.86%

Suppose First Main Street Bank, Second Republic Bank, and Third Fidelity Bank all have zero excess reserves. The required reserve ratio is 25%. Manuel, a client of First Main Street Bank, deposits $1,800,000 into his checking account at First Main Street Bank.

Required:

Write down the table to show the effect of a new deposit on excess and required reserves

Answers

Answer:

Change in Excess Reserves $1,350,000

Change in Required Reserves $450,000

Explanation:

Preparation of the table to show the effect of a new deposit on excess and required reserves

Based on the information given since the REQUIRED RESERVE RATIO is 25%, which means that First Main Street Bank will hold 25% of its initial deposit leading to INCREASE in the REQUIRED RESERVE by the amount of $450,000 (25%*$1,800,000) while the remaining 75% (100%-25%) will be the EXCESS RESERVES of the amount of $1,350,000 (75%*$1,800,000).

Hence:

Amount Deposited: $1,800,000

Change in Excess Reserves=$1,350,000

Change in Required Reserves= $450,000

Therefore the effect of a new deposit on excess and required reserves will be:

Change in Excess Reserves $1,350,000

Change in Required Reserves $450,000

Suppose that the production function is y= 9k^0.5 N^0.5. With this production function, the marginal product of labor is MPN= 4.5K^0.5 N^-0.5. The capital stock is K= 25. The labor supply curve is NS= 100[(1-t)w]^2, where w is the real wage rate, t is the tax rate on labor income, and hence (1-t)w is the after-tax real wage rate.c.Suppose that a minimum wage of w=2 is imposed. If the tax rate on labor income, t, equals zero, what are the resulting values of employment and the real wage? Does the introduction of the minimum wage increase the total income of workers, taken as a group?

Answers

The resulting values for employment and the real wage are 70.3125 and $1.5811 per hour, respectively.

The introduction of the minimum wage does not increase the total income of workers taken as a group.

How to determine employment and real wageTo find the resulting values of employment and real wage, determine where the labor supply curve intersects the labor demand curve.

MPN =

\(4.5K^0.5 N^-0.5 = (9K N)^0.5 / (2KN)^0.5 = (9/2)^0.5 (K/N)^0.5 = w/P

\)

where P is the price of output, which we can assume is equal to 1.

This equation can be rearranged to solve for N:

N =

\((9/2) (K/w)^2\)

Plugging in K = 25 and w = 2, we get:

N =

\((9/2) (25/2^2) = 70.3125\)

To find the real wage, we can plug this value of N into the labor supply curve:

NS =

\(100[(1-t)w]^2 = 100(1-0)(2)^2\)

= 400

Since labor supply exceeds labor demand, the real wage will be bid down to the equilibrium level.

\((9/2)^0.5 (K/N)^0.5 = w/P

(9/2)^0.5 (25/N)^0.5 = 1/2

N = (9/2) (25/2^2) = 70.3125

w = 2(70.3125/100)^0.5 = 1.5811\)

The equilibrium real wage is $1.5811 per hour.

To determine whether the introduction of the minimum wage increases the total income of workers,

Total income before minimum wage = wN = 1.5811 x 70.3125 = $111.31

After the minimum wage of $2 is imposed, the real wage is fixed at $2, and the level of employment is determined by the intersection of the labor supply and demand curves at this wage:

N =

\((9/2) (25/2^2) / (2)^2 = 35.15625\)

Total income after minimum wage = wN = 2 x 35.15625 = $70.31

Since the total income of workers decreases from $111.31 to $70.31 after the minimum wage is imposed, the introduction of the minimum wage does not increase the total income of workers taken as a group.

Learn more on Real wage on https://brainly.com/question/1622389

#SPJ1

I included a screen shot of the question

Answers

Aberecrombie Fitch is discriminating aganist people or do you think thry exrcsing thier right as a private business to hire based of thier own needs example why or why not paragraphs 5 sentences

Answers

Answer:

They are a private business, but in this current climate its morally wrong, but they can still do it.

Explanation:

Just do it on your own kiddo. I gave you the base

At peak times, your restaurant serves 50 meals per hour that require a grill. Two meals can be on the grill at once and the average meal requires 6 minutes on the grill. How many grills do you need? ANSWER 3

Answers

Answer:3 grills

Explanation: Each grill can cook 20 meals in an hour so 3 grills is needed, the restaurant could cook 60 meals in one hour

Wally's Walleyes wants to introduce a new product that has a start-up cost of $7,800. The product has a 2-year life and will provide cash flows of $4,500 in Year 1 and $4,300 in Year 2. The required rate of return is 15 percent. Should the product be introduced? Why or why not?

Answers

The calculated NPV is negative, indicating that the present value of expected cash flows does not exceed the start-up cost of the project. In other words, the project is expected to generate a net loss.

To determine whether Wally's Walleyes should introduce the new product, we can calculate the net present value (NPV) of the project. The NPV measures the present value of expected cash flows, taking into account the required rate of return.

To calculate the NPV, we need to discount the cash flows using the required rate of return (15 percent). The formula for calculating NPV is:

NPV = Cash Flow Year 1 / (1 + Required Rate of Return)^1 + Cash Flow Year 2 / (1 + Required Rate of Return)^2 - Start-up Cost

\(NPV = $4,500 / (1 + 0.15)^1 + $4,300 / (1 + 0.15)^2 - $7,800\)

\(NPV = $4,500 / 1.15 + $4,300 / (1.15)^2 - $7,800\)

NPV = $3,913.04 + $3,537.41 - $7,800

NPV = -$350.55

For such more question on net loss:

https://brainly.com/question/28390284

#SPJ8

The smaller the number of good substitutes for a product, the greater will be the price elasticity of demand for it. True or False True False

Answers

Answer:

False.

Explanation:

A price elasticity of demand can be defined as a measure of the responsiveness of the quantity of a product demanded with respect to a change in price of the product, all things being equal.

Mathematically, the price elasticity of demand is given by the formula;

\( Price \; elasticity \; of \; demand = \frac {percent \; change \; in \; quantity \; demanded}{percent \; change \; in \; price}\)

The demand for goods is said to be elastic, when the quantity of goods demanded by consumers with respect to change in price is very large. Thus, the more easily a consumer can switch to a substitute product in relation to change in price, the greater the elasticity of demand.

A substitute product can be defined as a product that a consumer sees as an alternative to another product and as such would offer similar benefits or satisfaction to the consumer.

Generally, consumers would like to be buy a product as its price falls or become inexpensive.

Hence, the smaller the number of good substitutes for a product, the lesser will be the price elasticity of demand for it.

For substitute products (goods), the price elasticity of demand is always positive because the demand of a product increases when the price of its close substitute (alternative) increases.

At Davide Corporation, direct materials are added at the beginning of the process and conversions costs are uniformly applied. Other details include:

WIP beginning (60% for conversion) 17,500 units

Units started 114,500 units

Units completed and transferred out 111,700 units

WIP ending (30% for conversion) 20,300 units

Beginning WIP direct materials $22,300

Beginning WIP conversion costs $19,700

Costs of materials added $370,000

Costs of conversion added $280,000

What is the total cost of units completed and transferred out?

Answers

Answer and Explanation:

For materials

Equivalent completed units = Completed units + WIP ending

= 111,700 + 20,300

= 132,000 units

Cost of materials = Beginning WIP + Cost of materials added

= 22,300 + 370,000

= $392,300

Cost of material per units = 392,300 ÷ 132,000

= $2.97197

For conversions

Equivalent completed units = Completed units + WIP ending

= 111,700 + 20,300 × 30%

= 117,790 units

Cost of Conversion = Beginning WIP + Cost of conversion added

= 19,700 + 280,000

= $299,700

Cost of conversion per units = 299,700 ÷ 117,790

= $2.54436

Total cost of units completed and transferred out

= 111,700 × (2.97197 + 2.54436)

= $616,174

Why does the scientific method not follow an exact order?

Answers

Through testing and experimentation, the scientific method establishes facts in an unbiased manner.

What is an scientific method?Making an observation, formulating a hypothesis, making a prediction, carrying out an experiment, and then evaluating the findings are the fundamental steps. The scientific method's principles can be used in various contexts, including business, technology, and scientific study.

A set of steps are used in the scientific process to establish facts or generate knowledge. The general procedure is generally known, but depending on what is being examined and who is performing it, each step's specifics may alter. Only questions that can be tested and either proven true or false can be answered using the scientific method.

Therefore, Through testing and experimentation, the scientific method establishes facts in an unbiased manner.

To learn more about scientific method, refer to the link:

https://brainly.com/question/7508826

#SPJ1

Gena Manufacturing Company has a fixed cost of $259,000 for the production of tubes. Estimated sales are 153,400 units. A before tax profit of $126,034 is desired by the controller. If the tubes sell for $22 each, what unit contribution margin is required to attain the profit target?

Answers

Answer:

$2.51

Explanation:

Gena Manufacturing Company calculation for contribution margin unit

Using this formula

Fixed cost + Tax profit/Estimated sales units

Let plug in the formula

Where:

Fixed cost =$259,000

Tax profit=$126,034

Estimated sales units=153,400

Hence:

(259,000 + 126,034) / 153,400

=$385,034/153,400

= $2.51

Therefore the contribution margin that is required to attain the profit target will be $2.51

What are payroll taxes?

Answers

Answer:

This is all the information I could find.

Two key aspects of financial planning are cash planning and profit planning. Cash planning involves the preparation of the cash budget and profit planning involves preparation of pro forma statements. To make cash budget and pro forma statements for a firm, accounting knowledge is needed. Do accounting courses you took before help you better understand how to make cash budget and pro forma income statement and balance sheet? Explain.

Answers

Yes. Accounting courses I took before helps us understand how to make cash budget and pro forma income statement and balance sheet.

Here's how accounting courses can help individuals in creating cash budgets, pro forma income statements, and balance sheets:

Cash Budget: Accounting courses teach students about the importance of cash flow management and how to prepare a cash budget. Pro Forma Income Statement: Accounting courses teach students how to analyze historical financial data and use it to forecast future performance. Balance Sheet: Accounting courses provide a comprehensive understanding of balance sheets and their components. Students learn how to analyze assets, liabilities, and shareholders' equity to assess the financial position of a company.By studying accounting, individuals gain a solid foundation in financial concepts, reporting standards, and analytical techniques. This knowledge equips them with the skills necessary to create cash budgets, pro forma income statements, and balance sheets effectively.

For such more question on cash budget:

https://brainly.com/question/28494878

#SPJ8

The reserve requirement is 15 percent. Lucy deposits $600 into a bank. By how much do excess reserves change

Answers

Answer:

$510

Explanation:

Calculation for By how much do excess reserves change

Using this formula

Change in excess reserve= Bank Deposits-(Reserve requirement*Deposit)

Let plug in the formula

Change in excess reserve=$600-($600*15%)

Change in excess reserve=$600-$90

Change in excess reserve=$510

Therefore By how much do excess reserves change is $510

Select the correct answer from each drop-down menu,

Jack has to pay

tax to the government for his house. This type of tax is

tax

Answers

Answer:

C) property

A) direct tax

Explanation:

Please help me is about economics

Answers

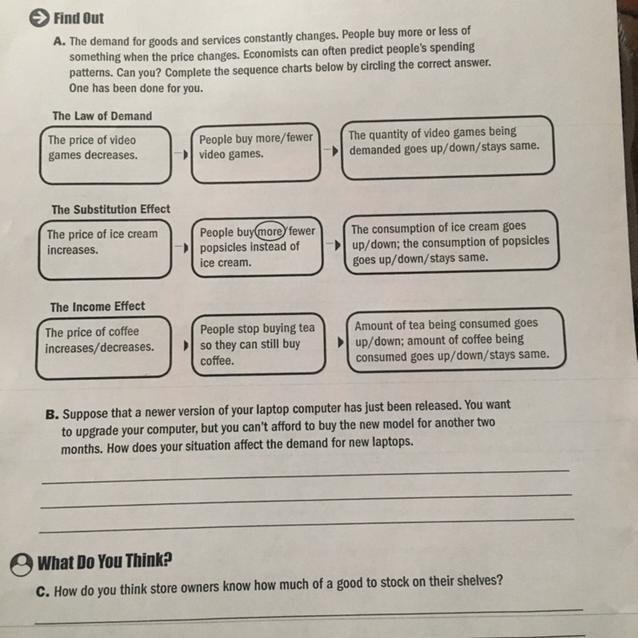

Prices and consumer demand are inversely related. This is referred to as the Law of Demand.

If video game prices fall, how will they impact demand?According to the law of supply, a price drop will cause a drop in the number of video games available. However, if video games are made more accessible, demand will rise. Price and demand are inversely related. The Law of Demand is what is used to describe this. Demand decreases as the price rises (but demand itself stays the same). Demand rises proportionately as prices decline.

What happens if the substitution effect causes the price of ice cream to increase?According to the substitution effect, as prices rise or incomes drop, individuals choose less expensive options. The replacement impact monitors the adjustments in consumer purchasing patterns brought on by price changes. More popsicles than ice cream will be purchased in the aforementioned scenario. Ice cream consumption will fall, while popsicles will rise in popularity.

What will happen to the price of coffee when people stop buying tea?If the price of coffee goes up, people stop buying tea and just buy coffee. Tea consumption declines while coffee consumption rises. The term "income effect" refers to the change in consumer spending that depends on income. This suggests that if their income increases, people will generally increase their spending. They might spend less if their income drops. The outcome has little bearing on what goods buyers will buy.

Learn more about the law of demand: brainly.com/question/10782448

#SPJ13

Which of the following statements are true?

a. Markets by definition involve the exchange of money for goods and services.

b. Markets are forums in which parties exchange goods and services at a "price," where the latter can be flexibly construed.

c. Your current economics course, the next election, and the dating scene can all be seen as markets.

Answers

Answer:

C

Explanation:

A market is a place where goods and services can be exchanged at a predetermined price. A market does not have to be a physical location. With the advent of technology, a market can exist virtually. Money can be used in the exchange of goods or services or goods can be used for the exchange. In the case where goods are used in the exchange, it is known as trade by barter

WHAT IS Segmentation,

Answers

Answer:

Segmentation is to divide something into separate parts or sections

Why are production possibilities curves helpful for businesses?

A. They show how many products will need to be sold to earn a

profit.

B. They show how producing one product affects production of

another.

C. They predict how a product's sales will rise and fall over time.

D. They compare production efficiency between multiple companies.

Answers

Answer: B - they show how producing one product affects production of another.

Explanation: Uses comparative advantage to allocate production factors, thus obtaining better efficiency

MotoSport is buying an asset that costs $730,000 and can be depreciated at 20 percent per year (Class 8) over its eight-year life. The asset is to be used in a three-year project; at the end of the project, the asset can be sold for $740,200. The company faces a tax rate of 26%. The sale of this asset will close the asset class. what is tax on CCA recapture

Answers

The tax on the CCA recapture is $306,332.

To calculate the tax on the Capital Cost Allowance (CCA) recapture, we need to determine the CCA claimed over the years and calculate the recaptured amount. The recaptured amount is the difference between the proceeds from the sale of the asset and the undepreciated capital cost (UCC) at the time of sale.

Given that the asset costs $730,000 and has a depreciation rate of 20% per year (Class 8) over eight years, we can calculate the CCA claimed each year:

Year 1: $730,000 * 20% = $146,000

Year 2: $730,000 * 20% = $146,000

Year 3: $730,000 * 20% = $146,000

Year 4: $730,000 * 20% = $146,000

Year 5: $730,000 * 20% = $146,000

Year 6: $730,000 * 20% = $146,000

Year 7: $730,000 * 20% = $146,000

Year 8: $730,000 * 20% = $146,000

The total CCA claimed over the eight years is $1,168,000.

At the end of the project, the asset can be sold for $740,200. The UCC at the time of sale is the original cost of the asset minus the CCA claimed:

UCC = $730,000 - $1,168,000 = -$438,000

Since the UCC is negative, there is a recapture of CCA. The recapture amount is the proceeds from the sale minus the UCC:

Recapture Amount = $740,200 - (-$438,000) = $1,178,200

Now, we can calculate the tax on the CCA recapture by multiplying the recapture amount by the tax rate:

Tax on CCA Recapture = $1,178,200 * 26% = $306,332

for more such questions on tax

https://brainly.com/question/28798067

#SPJ11

Rather than merely counting media exposures, a better measure of marketing public relations effectiveness is the ________. A) number of promotional tools required B) effect it has on its market capitalization C) change in product awareness, comprehension, or attitude D) changes observed in media behavior E) impact it has on the company's market share

Answers

Answer:

D) changes observed in media behavior

Explanation:

The public relation effectiveness is the marketing principle, that is used t measure how effectively the public relation or paid campaign is moving their paid, earned share. There are various methods to measure this such as media content analysis, social media reach and engagement, and sales figures.

Windborn Company has 15,000 shares of cumulative preferred 1% stock, $100 par and 50,000 shares of $30 par common stock.

The following amounts were distributed as dividends:

20Y1 $30,000

20Y2 12,000

20Y3 45,000

Common Stock

(dividends per share)

I cannot figure out Y1 or Y3

Answers

The dividends per share for the common stock in year 1 (Y1) is $0.60 per share, and in year 3 (Y3) is $0.90 per share.

To calculate the dividends per share for the common stock in year 1 (Y1) and year 3 (Y3), we need to determine the total dividends distributed and divide them by the number of common shares outstanding.

Given information:

Cumulative preferred stock: 15,000 shares, 1% dividend

Common stock: 50,000 shares, $30 par value

Dividends distributed:

Y1: $30,000

Y2: $12,000

Y3: $45,000

First, let's calculate the dividends per share for the cumulative preferred stock in each year.

Dividends per share for cumulative preferred stock = (Par value * Dividend rate) / Number of preferred shares

Dividends per share for cumulative preferred stock = ($100 * 1%) / 15,000 shares

Dividends per share for cumulative preferred stock = $1 / 15,000

Dividends per share for cumulative preferred stock = $0.000067 per share

Now, let's calculate the dividends per share for the common stock in year 1 (Y1) and year 3 (Y3).

For Y1:

Total dividends for common stock = Dividends distributed - (Dividends per share for cumulative preferred stock * Number of preferred shares)

Total dividends for common stock = $30,000 - ($0.000067 * 15,000)

Total dividends for common stock = $30,000 - $1.005

Total dividends for common stock = $29,998.995

Dividends per share for common stock in Y1 = Total dividends for common stock / Number of common shares

Dividends per share for common stock in Y1 = $29,998.995 / 50,000 shares

Dividends per share for common stock in Y1 = $0.5999799 per share (rounded to $0.60 per share)

For Y3:

Total dividends for common stock = Dividends distributed - (Dividends per share for cumulative preferred stock * Number of preferred shares)

Total dividends for common stock = $45,000 - ($0.000067 * 15,000)

Total dividends for common stock = $45,000 - $1.005

Total dividends for common stock = $44,998.995

Dividends per share for common stock in Y3 = Total dividends for common stock / Number of common shares

Dividends per share for common stock in Y3 = $44,998.995 / 50,000 shares

Dividends per share for common stock in Y3 = $0.8999799 per share (rounded to $0.90 per share)

For such more question on dividends:

https://brainly.com/question/30360786

#SPJ8

which of the following influences quantity demanded and varies moving along a demand curve?

a. the price of the good

b. the prices of related goods

c. income

d. preferences

Answers

The price of the good impact the quantity demanded and changes when the demand curve moves.

The following information should be considered:

The demand curve shows two things i.e. price of the good and the quantity demanded.The price should be shown on the vertical axis and the quantity demanded shown on the horizontal axis.Therefore all other options are incorrect.

Hence, we can conclude that the price of the good impact the quantity demanded and changes when the demand curve moves.

Learn more about the demand curve here: brainly.com/question/21220153

TIME REMAINING 56:28 Which of the following is an example of an equity investment? A. A loan B. A company bond C. A government bond D. A company's stock Please select the best answer from the choices provided A B C

Answers

An example of an equity investment is D. A company's stock

An equity investment is an investment in the ownership of a company or other entity, where the investor purchases a percentage of the company's shares. By doing so, the investor becomes a part-owner of the company, and as such, they may receive a portion of the company's profits through dividends or by selling their shares at a higher price.

Company stocks are the most common example of an equity investment. When an investor buys stocks, they are buying a portion of the ownership of that company, and therefore they are entitled to a share of the company's profits and assets. The value of a stock can increase or decrease based on the performance of the company and market conditions, making it a potentially high-risk but also high-reward investment. On the other hand, loans, company bonds, and government bonds are examples of debt investments, where the investor lends money to an entity in exchange for a fixed rate of return. Unlike equity investments, debt investments typically have a fixed interest rate and maturity date, and the investor does not own a portion of the company.

In summary, equity investments provide investors with an ownership stake in a company, while debt investments provide a fixed income stream. While equity investments can potentially offer higher returns, they also come with higher risks, and investors should carefully consider their investment objectives and risk tolerance before making any investment decisions.

for more such questions on investment

https://brainly.com/question/29547577

#SPJ11

In which type of analysis are corporate goals and plans compared with the existing manpower inventory to determine the training needs?

a. Organization analysis

b. Operation analysis

c. Individual analysis

d. None of the above

Answers

a. Organization analysis

Wilson was killed in an accident while he was on the job. Mary, Wilson's wife, received several payments as a result of Wilson's death. Review the payments below and determine the amount that is Mary’s Gross Income from each of the items below. Explain each answer. If calculations are required, round to the closest dollar and show your work.

a. Wilson's employer paid Mary an amount equal to Wilson's three months' salary ($52,400), which is what the employer does for all widows and widowers of deceased employees.

b. Wilson had $12,200 in accrued salary that was paid to Mary.

c. Wilson's employer had provided Wilson with group term life insurance of $255,000, which was payable to his widow in a lump sum. Premiums on this policy totaling $21,000 had been included in Wilson's gross income under § 79.

d. Wilson had purchased a life insurance policy (premiums totaled $198,000) that paid $397,000 in the event of accidental death. The proceeds were payable to Mary, who elected to receive installment payments as an annuity of $25,000 each year for a 28-year period. She received her first installment this year.

Answers

a. Since the three months' salary is worth $52,400, the Gross Income from this item is $52,400.

b. Wilson's accrued salary will total $12,200 in Gross Income.

c. The gross income that Mary will receive is $255,000 under the group term life insurance.

d. The gross income that Mary will receive is $397,000, despite the election too receive an annuity of $25,000 for each of the 28-year period.

What is the gross income?The gross income is the total amount of income earned or received over a period of time by an individual/household or a company. For individuals and households, the gross income includes wages, dividends, capital gains, business income, retirement distributions, and other incomes.

Gross income is stated before allowable deductions are made to arrive at the taxable or net income.

Learn more about gross income at https://brainly.com/question/13793671

Can someone help me with this ?

Answers

Answer:

come over

Explanation:

girls only and ima need hella yay

What will a contingency note contain?

Answers

Answer:

Contingencies are potential liabilities that might result because of a past event

Explanation:

Reasonably possible losses are only described in the notes and remote contingencies can be omitted entirely from financial statements.

what’s a president/ director statement

Answers

Answer:

director's statement is a written description in which a film director will explain the motive and vision behind making a particular film

Presidential statement is official pronouncements issued by the President of the United States at or near the time a bill is signed into law

Conan, a hotel owner, has recently decided to go ahead and pay the fee in order to be included in a GDS system. Why is this likely worth paying a fee to Conan?

Answers

It is worth paying a fee to Conan because the GDS is often used to tap into the corporate travel market. GDS has the ability to present hotels, flights, and car rentals in one simple interface providing convenience for users.

What is the significance of GDS to the hoteliers?GDS is a network or platform that permits travel agencies and their clients to have access to travel data, shop for and compare hotel options and book travel. GDS platform like the other systems in similar business earns a lot of money or profit in global travel sales.

Therefore, the correct answer is as given above.

learn more about GDS: https://brainly.com/question/27905732

#SPJ1