Below are descriptions of internal control problems. Match the followings with each other.

Internal Control Principles:

a. Establishment of responsibility

b. Segregation of duties

c. Physical control devices

d. Documentation procedures

e. Independent internal verification

f. Human resource controls

__________ 1. The same person opens incoming mail and records the cash receipts. select a letter.

__________2. Three people handle cash sales from the same cash register drawer. select a letter.

__________3. A clothing store is experiencing a high level of inventory shortages because people try on clothing and walk out of the store without paying for the merchandise.

__________4. The person who is authorized to sign checks approves purchase orders for payment.

__________5. Some cash payments are not recorded because checks are not prenumbered.

__________6. Cash shortages are not discovered because there are no daily cash counts by supervisors.

__________7. The treasurer of the company has not taken a vacation for over 20 years.

Answers

Answer and Explanation:

The matching is as follows

1. Segregation of duties

2. Responsibility development

3. Control devices that should be displayed physically

4. Segregation of duties

5. Procedures for documentation

6. Internal vertification that to be done independently

7. Controls of human resources

By this way it should be matched

The correct pairs of internal control principles are as follows:

The same person opens incoming mail and records the cash receipts. select a letter, and The person who is authorized to sign checks approves purchase orders for payment - Segregation of duties. Thus, the correct pairs are 1-b, 2-a, 3-c, 4-b, 5-d, 6-e, 7-e.

Segregation of duties refers to the error and fraud which prevent internal control by ensuring the two parties that are responsible for the individual party for any related task.

In that condition, independent internal verification in which the cash shortages are not disclosed because they are no varied in front of the supervisors.

Therefore, the correct pairs are as follows:

1-b, 2-a, 3-c, 4-b, 5-d, 6-e, 7-e.

To know more about the Segregation of duties, visit:

https://brainly.com/question/32810908

#SPJ6

Related Questions

Answer the question on the basis of the following list of assets:1. Large-denominated ($100,000 and more) time deposits2. Noncheckable savings deposits3. Currency (coins and paper money) in circulation4. Small-denominated (less than $100,000) time deposits5. Stock certificates6. Checkable deposits7. Money market deposit accounts8. Money market mutual fund balances held by individuals9. Money market mutual fund balances held by businesses10. Currency held in bank vaultsRefer to the above list. The M2 definition of money comprises(Points : 1) items 2, 3, 4, 6, 7, 8, and 10.items 3, 4, 5, and 6.items 2, 3, 4, 6, 7, and 8.all of the items listed.

Answers

Answer: Items 2, 3, 4, 6, 7, and 8

Explanation:

The M2 definition of money includes M1 money and then some other types of instruments that are quite highly liquid and so can be converted to liquid cash quickly if needed.

M2 includes:

2. Noncheckable savings deposits

3. Currency (coins and paper money) in circulation

4. Small-denominated (less than $100,000) time deposits

6. Checkable deposits

7. Money market deposit accounts

8. Money market mutual fund balances held by individuals

Which of the following is true if you find a better rate on an external 3rd party channel within 24 hours of making a reservation through one of Marriott's direct channels?

Answers

If you find a better rate on an external 3rd party channel within 24 hours of making a reservation through one of Marriott's direct channels, the Marriott’s Best Rate Guarantee policy comes into effect.

Marriott’s Best Rate Guarantee policy is a commitment to providing the lowest rate possible. If you find a lower rate within 24 hours of booking through one of Marriott’s direct channels, Marriott will match that rate and offer an additional discount of 25%.

This policy applies to any Marriott brand including Ritz-Carlton, St. Regis, Westin, Sheraton, Aloft, and othersYou need to first book your reservation through Marriott’s direct channels like Marriott.com, the Marriott Mobile app, Marriott Bonvoy app, the Marriott Reservation Center, or directly with the hotel.

After that, you should look for lower rates on other third-party websites. If you find a lower rate within 24 hours, contact Marriott’s Customer Care team, and they will match that rate plus an additional discount of 25%.The policy does come with some terms and conditions.

The lower rate you find on the third-party website must be for the same hotel, same room type, same dates, same number of guests, same currency, and with the same booking conditions. It also excludes rates that are only available to members of certain groups or organizations, package rates that include flights, car rentals, and other amenities, and rates that are not available to the general public

For more such question on policy visit:

https://brainly.com/question/6583917

#SPJ8

A home furniture store, David's Furnishings, lowers its prices below those of

their competitors, Ada's Home Store. A price war then ensues. What must the

response of Ada's Home Store have been in order for the price war to begin?

A. Ada's Home Store started a marketing campaign against David's

Furnishings and their lower quality.

B. Ada's Home Store took David's Furnishings to court in an attempt

to make them raise their prices back up.

C. Ada's Home Store raised prices to show consumers that their

products are better.

O D. Ada's Home Store lowered prices even lower than David's

Furnishings did.

Answers

Answer:

d.

Explanation:

The response of Ada's Home Store has been in order for the price war to begin as Ada's Home Store lowered prices even lower than David's Furnishings did. Thus option D is correct.

What is the Price?A price refers to the amount which takes place between two individuals when performing the exchange of goods and services. This price is determined by the willingness of both parties involved in the exchange.

A price war took place when the competitors lower their prices in order to retain more customers will create conflicts in the market.

In the given case when an organization named David's Furnishings lower its prices with its competitors to begin a price war the competitors also lower their prices in order to capture the market gain effectively.

Therefore, option D is appropriate.

learn more about the price, here:

https://brainly.com/question/18117910

#SPJ5

Name the type and number of directors in spar and shoprite and what their responsibilities are/should be

Answers

The organizations such as spar and shoprite would have different types of directors. These directors are:

Executive Directors:Non-Executive DirectorsThe responsibility of directorsThe number of directors can vary widely depending on the specific company and its needs. However, it's common for large public companies to have somewhere between 7 and 15 directors, but the number can be larger or smaller.

Duty of Care: Directors must make decisions with due diligence and care, using their best judgement.

Duty of Loyalty: Directors must act in the best interests of the company and its shareholders, not for their personal gain.

Strategic Oversight: Directors approve the company's strategic plans and monitor their implementation.

Financial Oversight: Directors monitor the company's financial health and ensure the accuracy of financial reporting.

Risk Management: Directors are responsible for understanding and monitoring the major risks facing the company.

Governance: Directors establish the company's governance structures and practices, and they select, evaluate, and if necessary replace the CEO.

Read more on board of directors here: https://brainly.com/question/29359566

#SPJ1

You charge $500 on each of your two credit cards.

One is American Express with an interest rate of 15.99%.

The other is Chase Sapphire with an interest rate of

20.99%. Assuming that you are only making the minimum

payment of $25 to each of the credit card companies,

which card will you pay off first

Answers

It is advisable to pay off the Chase Sapphire card first to minimize the overall interest paid.

To determine which credit card to pay off first, we need to consider the interest rates and the minimum payment amounts. Let's calculate the interest accrued on each card and compare the total amounts.

For the American Express card with a balance of $500 and an interest rate of 15.99%, the interest accrued per month would be (15.99/100) * (500) = $79.95. With a minimum payment of $25, the remaining balance after the payment would be $500 - $25 = $475.

For the Chase Sapphire card with a balance of $500 and an interest rate of 20.99%, the interest accrued per month would be (20.99/100) * (500) = $104.95. After making the minimum payment of $25, the remaining balance would be $500 - $25 = $475.

Comparing the two cards, we see that the interest accrued on the Chase Sapphire card is higher ($104.95) compared to the American Express card ($79.95). Therefore, it is advisable to pay off the Chase Sapphire card first to minimize the overall interest paid.

For more such questions on interest

https://brainly.com/question/30500391

#SPJ8

Select the correct answer.

On May 30, 2015, XYZee Inc. paid a dividend of $10,000 to its shareholders. How will this transaction be recorded in the journal of the corporation?

A.

Cash Account (Debit) $10,000 Dividend Account (Credit) $10,000

B.

Dividend Account Debit) $10,000 Cash Account (Credit) $10,000

C.

Common Stock Account (Debit) $10,000 Cash Account Credit) $10,000

D.

Cash Account (Debit) $10,000 Common Stock Account (Credit) $10,0000

Answers

Answer:

answer is b

Explanation:

The Bildge Trust is a simple trust. Crawford is its sole beneficiary. In the current year, the trust earns $11,025 in taxable interest and $27,563 in tax-exempt interest. In addition, the trust recognizes a $1,575 long-term capital gain. The trustee charges a fee of $6,891 for the year.

a. Compute trust accounting income, where the trust agreement allocates fees andcapital gains to corpus.

b. Same as (a), except that fees are allocated to income.

Answers

Answer:

b

Explanation:

Some of the risks and pitfalls of implementing a multisource feedback include:

Stock value may drop

Negative feedback may hurt employees’ feelings

Raters may be overloaded

All of the above

Answers

A risk and pitfall of implementing a multisource feedback is that C. Raters may be overloaded .

What is multisource feedback ?Multisource feedback ( also known as 360 - degree feedback ) is a type of feedback on employees where information on those employees is gathered from multiple sources such as their colleagues, managers, and subordinates .

The major risk or pitfall with this type of feedback system is that the raters could get overwhelmed by the sheer amount of information they have to sift through from all those different sources of information on employees.

Find out more on Multisource feedback at https://brainly.com/question/14984839

#SPJ1

Use the following information to answer this question.

Windswept, Inc. 2017 Income Statement ($ in millions)

Net sales $9,390

Cost of goods sold 7,660

Depreciation 455

Earnings before interest and taxes $1,275

Interest paid 100

Taxable income $1,175

Taxes 411

Net income $764

Windswept, Inc. 2016 and 2017 Balance Sheets ($ in millions)

2016 2017 2016 2017

Cash $210 $240 Accounts payable $1,290 $1,335

Accounts rec. 960 860 Long-term debt 1,080 1,280

Inventory 1,750 1,665 Common stock 3,300 3,190

Total $2,920 $2,765 Retained earnings 620 870

Net fixed assets 3,370 3,910 Total assets $6,290 $6,675

Required:

What is the quick ratio for 2017?

Answers

Answer:

0.82

Explanation:

Quick ratio is computed as

= Quick assets / Current liabilities

Quick assets = cash and cash equivalents + marketable securities + Account receivables

Current liabilities = Bills payable + Accounts payable + Other short term payable

With regards to the above,

Quick assets given = Cash and accounts receivables ; account payables only for current liabilities

Quick ratio = $240 + $860 / $1,335

Quick ratio = $1,100 / $1,335

Quick ratio = 0.82

So, quick ratio for 2017 is 0.82

Sam Smith is currently employed as a mechanical engineer and is paid $65,000

per year plus benefits thatare equal to 30% of his salary. Sam wants to begin a

consulting firm and decides to leave his current job. After his first year in

business, Sam's accountant informed him that he had made $45,000 with his

consulting business. Sam also notices that he paid $6,000 for a health

insurance policy, which was his total benefit during his first year. What was

Sam's opportunity cost?

What was Sam's opportunity cost?

Answers

Sam gave up $65,000 in salary plus $19,500 in benefits or a total of $84,500.

The concept in the back of opportunity value is that the fee of 1 object is the misplaced possibility to do or eat something else; in quick, opportunity cost is the price of the following fine alternative. benefits foregone by using no longer choosing an alternative direction of motion.

Opportunity cost is the cost of the following satisfactory element you surrender whenever you decide. it's miles the lack of capacity gained from other options when one opportunity is chosen. The concept of an opportunity price became first started by John Stuart Mill. possibility price is the difference in the advantage of a preference you are forgoing compared to the advantage of the choice you're making. you may recognize opportunity fee as an estimation of the way much regret you'll sense for making one desire over every other.

Learn more about Opportunity costs here:-https://brainly.com/question/3611557

#SPJ9

categories such as education and household size represent which of the following?

a) Culture

b) Demographic

c) Benefit

d) Psychografic

Answers

Answer:

According to the case, the five kinds of share are directly relevant and can be calculated from the provided information are:

1. Authorized Capital

2. Issued Capital

3. Un-issued Capital

4. Subscribed Capital

5. Called-up Capital

Explanation:

Authorized Capital:

The authorized capital is known as the registered capital of the company, Authorized capital is the maximum amount of share that a company is authorized to issuing share to its shareholders.

In this case, the Alpha limited company registered on 5th January 2023 with the capital of 500,000 which is divided into 25,000 ordinary shares and the value of each share is Rs. 20.

Issued Capital:

The issued share capital of company is monetary value of shares which legally offers by company to its shareholders.

In this case, the Alpha limited company on 20th of January offered for sale to the public from authorized capital. The company put forward 15,000 and the value of each share is 20 Rs. Consequently, the company’s issued capital is 300,000 Rs (15,000 shares x 20 Rs.) .

Un-issued Capital:

The un-issued share capital reflects the part of authorized capital stock that the company has not yet issued to the public.

In this case, the Alpha limited company has not issued his 10,000 shares, and the value of each share is 20 Rs so its total un-issued capital is Rs. 200,000 (10,000 shares x 20 Rs.).

Subscribed Capital:

The subscribed capital is the portion of issued capital for which the public has been subscribed and the company has accepted.

In this case, the Alpha limited company on 23rd January received applications for 14,500 shares from the public which informed by company’s bank, so the subscribed capital is Rs. 290,000 (14,500 shares x 20 Rs.).

Answers

The five kinds of capital that are directly relevant are:

Authorized Capital: Rs. 500,000Issued Capital: Rs. 300,000Un-issued Capital: Rs. 200,000Subscribed Capital: Rs. 290,000Called-up Capital: Rs. 290,000What is a called-up capital?The called-up capital refers to the portion of the subscribed capital that the company has demanded and the shareholders are required to pay.

In this case, the Alpha limited company called up the entire subscribed capital of Rs. 290,000 on 25th January. Therefore, the called-up capital is also Rs. 290,000.

Summarily,

- Authorized Capital: Rs. 500,000

- Issued Capital: Rs. 300,000

- Un-issued Capital: Rs. 200,000

- Subscribed Capital: Rs. 290,000

- Called-up Capital: Rs. 290,000

learn more about capital: https://brainly.com/question/13372465

#SPJ1

The following transactions pertain to year 1, the first-year operations of Campbell Company. All inventory was started and completed during year 1. Assume that all transactions are cash transactions.

Acquired $4,700 cash by issuing common stock.

Paid $630 for materials used to produce inventory.

Paid $1,940 to production workers.

Paid $1,210 rental fee for production equipment.

Paid $120 to administrative employees.

Paid $116 rental fee for administrative office equipment.

Produced 360 units of inventory of which 260 units were sold at a price of $13 each.

RequiredPrepare an income statement and a balance sheet in accordance with GAAP.

Answers

Answer:

a. In the income statement, Net Income = $414

b. In the balance sheet, Total assets = Total equities and liabilities = $5,114.

Explanation:

Note: See the attached excel file for the income statement and a balance sheet.

An income statement prepared in accordance with the generally accepted accounting principles (GAAP) records income when they are earned and expenses when they are uncured.

A balance sheet prepared in accordance with the generally accepted accounting principles (GAAP) shows assets in order of liquidity. In the prepared balance sheet, current asset starting with the ending cash balance which is the most liquid asset asset is shown first followed by others in there order of liquidity.

The fact that Total assets = Total equities and liabilities = $5,114 in the attached excel file shows the balance sheet is accurately prepared.

In the attached excel file, we have:

Sales revenues = Units sold * Unit price = 260 * $13 = $3,380

Ending finished goods Inventory = Total cost of production * ((Units produced - Units sold) / Units produced) = $3,780 * ((360 - 260) / 360) = (100/360)) = $1,050

Below the income statement and the balance sheet in the attached excel file, there is a working that shows the ending cash balance of $4,064.

While Peloton’s stationary bike and treadmill have been successful, companies need to continuously innovate to have long-term success (e.g., Apple didn’t just release the first iPhone and ride off into the sunset of permanent success). What types of innovations can Peloton pursue to ensure long-term revenue?

Answers

New product lines: While Peloton's stationary bike and treadmill have been successful, the company can consider expanding its product lines to include other types of fitness equipment, such as rowing machines, ellipticals, or strength training equipment.

Digital content expansion: Peloton has a library of on-demand fitness classes and live classes. The company can consider expanding its digital content offerings beyond fitness classes to include wellness and nutrition content, or even streaming content from other providers.

Partnerships and collaborations: Peloton can form partnerships and collaborations with other companies to expand its offerings and reach new customers. For example, Peloton has partnered with Beyoncé to offer a series of themed workouts.

International expansion: While Peloton has made inroads in international markets, there is still significant potential for growth. The company can consider expanding into new markets, tailoring its products and services to meet the unique needs of each market.

Technology advancements: Peloton can pursue technological innovations that enhance the user experience, such as virtual reality integration, personalized AI training, or machine learning-based performance tracking.

By pursuing these types of innovations, Peloton can ensure long-term revenue growth and continued success.

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:

Selling price

Units in beginning inventory

Units produced

Units sold

Units in ending inventory

Variable costs per unit:

Direct materials

Direct labor

Variable manufacturing overhead

Variable selling and administrative expense

Fixed costs:

Fixed manufacturing overhead

Fixed selling and administrative expense

The total gross margin for the month under absorption costing is:

$

$

$

$

143

e

2,820

2,770

50

47

23

14

11

$95,880

$19,390

Answers

The total gross margin for the month under absorption costing is $16,120.

What is the total gross margin?Total variable cost per unit:

Direct materials cost per unit = $44Direct labor cost per unit = $19Variable manufacturing overhead per unit = $13Variable selling and administrative expenses per unit = $12Total variable cost per unit:

= Direct materials cost per unit + Direct labor cost per unit + Variable manufacturing overhead per unit + Variable selling and administrative expenses per unit

= $44 + $19 + $13 + $12

= $88

Total fixed costs:

Fixed manufacturing overhead = $85,260Fixed selling and administrative expenses = $16,440Total fixed costs:

Fixed manufacturing overhead + Fixed selling and administrative expenses

= $85,260 + $16,440

= $101,700

Total gross margin:

= (Selling price per unit - Total variable cost per unit) * Units sold - Total fixed costs

= ($131 - $88) * 2,740 - $101,700

= $43 * 2,740 - $101,700

= $117,820 - $101,700

= $16,120.

Read more about gross margin

brainly.com/question/28390697

#SPJ1

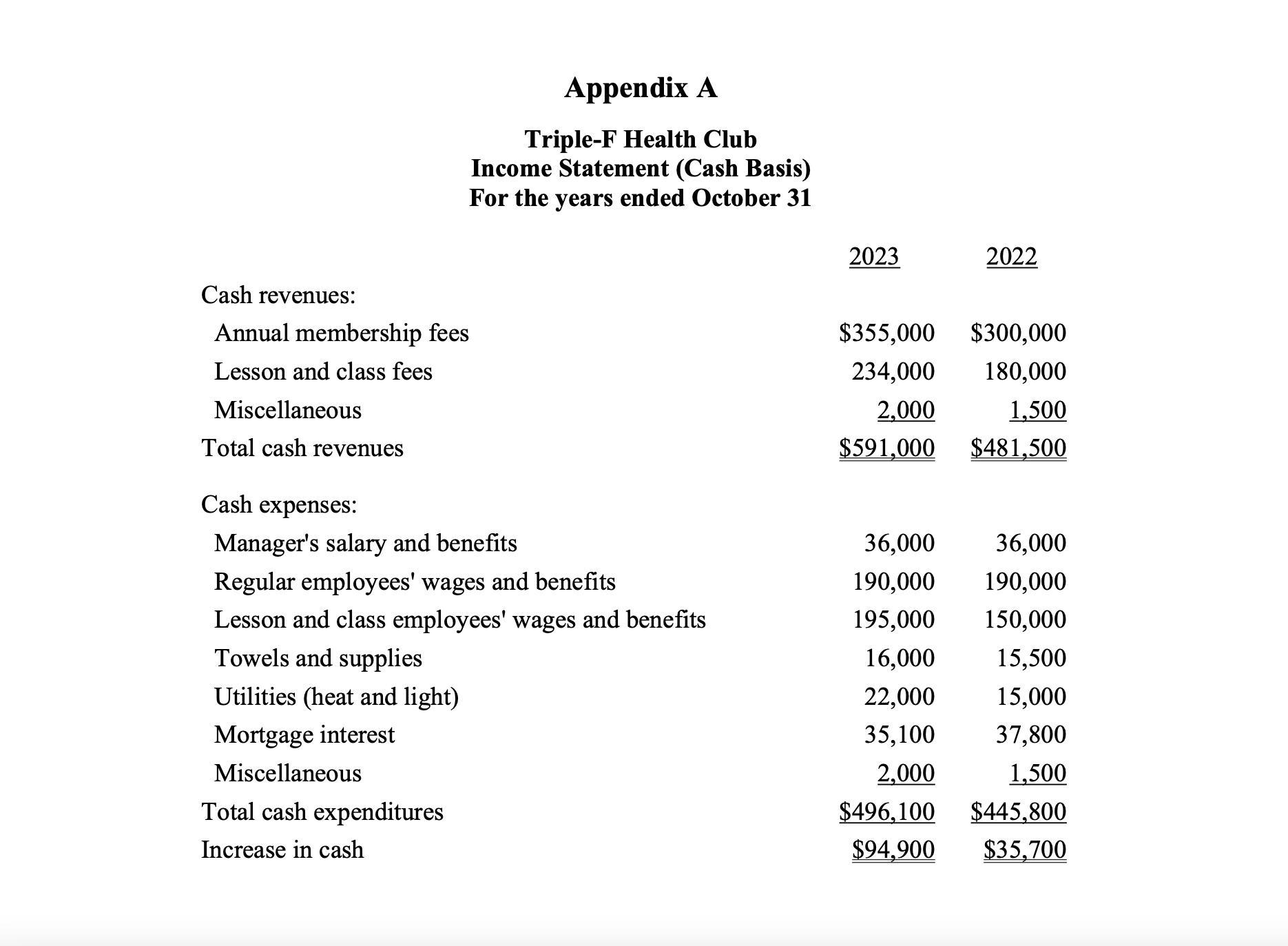

Triple-F Health Club (Family, Fitness, and Fun) is a not-for-profit family-oriented health club. The club's board of directors is developing plans to acquire more equipment and to expand club facilities. The board plans to purchase about $25,000 of new equipment each year and wants to establish a fund to purchase the adjoining property in four or five years. The adjoining property has a market value of about $300,000.

The club manager, Jane Crowe, is concerned that the board has unrealistic goals in light of the club's recent financial performance. She has sought the help of a club member with an accounting background to assist her in preparing a report to the board supporting her concerns.

Jane would like you to prepare a cash budget for 2024 for the Triple-H Health Club and explain any operating problems that this budget discloses for the Triple-H Health Club. Is Jane Crowe's concern that the board's goals are unrealistic justified?

Answers

The Triple-H Health Club may face operational issues in 2024, based on the cash budget. There is a $5,000 cash shortfall as a result of the anticipated cash outflows exceeding the anticipated cash inflows.

What is Cash Outflow?Any cash payments or expenditures made by a person or organization, such as purchasing inventory, paying salaries, or purchasing equipment, are referred to as cash outflow.

To prepare a cash budget for 2024, we need to estimate the club's cash inflows and outflows for that year. Here is a potential cash budget for Triple-H Health Club for 2024:

Cash Inflows:

Membership fees: $200,000

Donations: $20,000

Total Cash Inflows: $220,000

Cash Outflows:

Equipment purchases: $25,000

Rent: $60,000

Salaries and wages: $100,000

Utilities: $12,000

Insurance: $10,000

Maintenance and repairs: $8,000

Total Cash Outflows: $215,000

Net Cash Inflows: $5,000

This cash budget indicates that the club is expecting a net cash inflow of $5,000 in 2024, which is a positive sign. However, the budget also shows that the club has relatively high fixed costs in the form of rent, salaries, and wages, which could pose challenges if the club's revenue falls short of expectations.

To know more about Cash Outflow, visit:

brainly.com/question/23453537

#SPJ1

What steps should Shana take to meet the needs of the company’s sales representatives?

Answers

In the template’s Slide Master tab, select Insert Layout, name the layout, and insert a placeholder. Thus, option C is correct.

Using a computer program, Shana aids the salespeople of the organization in creating presentations for customers will be with the help of a placeholder will be her job role.

Select the sort of filler you wish to add by clicking the Include Placeholder button on the Slide Master tab. Drag the mouse to create the placeholder at the desired area on the slide template. Placeholders may be added to any number.

Therefore, option C is correct.

Learn more about Slide Master, here:

https://brainly.com/question/7868891

#SPJ1

The question is incomplete, Complete question probably will be is:

Shana works for a company that makes industrial kitchen equipment that is sold to cafeterias and restaurants. She helps the company’s sales representatives create presentations for clients. They regularly use a custom PowerPoint template to craft their pitches. The sales reps have asked for a slide that will allow them to add a diagram showing the benefits of the equipment they sell.

What steps should Shana take to meet the needs of the company’s sales representatives?

Insert a slide for a diagram each time a sales rep needs to create a new presentation.

In the template’s Slide Master tab, use Master Layout to pick a placeholder for a diagram.

In the template’s Slide Master tab, select Insert Layout, name the layout, and insert a placeholder.

Save a brand-new presentation using the template, select Insert, and choose Charts from the Illustrations command group.

E10.13 (LO 1, 3) (Entries for Acquisition of Assets) Presented below is information related to Zonker Company. 1. On July 6, Zonker Company acquired the plant assets of Doonesbury Company, which had discontinued operations. The appraised value of the property is: Land Buildings Equipment $400,000 1,200,000 800,000 Total $2,400,000 Zonker Company gave 12,500 shares of its $100 par value common stock in exchange. The stock had a market price of $168 per share on the date of the purchase of the property. 2. Zonker Company expended the following amounts in cash between July 6 and December 15, the date when it first occupied the building. Repairs to building Construction of bases for equipment to be installed later Driveways and parking lots Remodeling of office space in building, including new partitions and walls Special assessment by city on land $105,000 135,000 122,000 161,000 18,000 3. On December 20, the company paid cash for equipment, $260,000, subject to a 2% cash discount, and freight on equipment of $10,500. Instructions Prepare entries on the books of Zonker Company for these transactions.

Answers

Answer:

See below

Explanation:

1. Journal entry

Land Dr $350,000

Building Dr $1,050,000

Machinery and equipment Dr $700,000

........................ To Common stock Cr $1,250,000

(12,500 × $100)

.......................To Paid in capital in excess of par Cr $850,000

($2,100,000 - $1,250,000)

Workings

Cost of plant is $168 × 12,500 = $2,100,000

2. Journal entry

Building Dr $266,000

($105,000 + $161,000)

Machinery and equipment Dr $135,000

Land improvements Dr $122,000

Land Dr $18,000

..............................................To Cash a/c Cr $541,000

3. Journal entry

Machinery and equipment Dr $255,500

..........................................To cash a/c Cr $255,500

Working

($10,500 + $245,000 which is 98% of $250,000)

Assume Canada can either produce three bushels of barley or six bushels of hay in a set period of time, and China can produce either two bushels of barley or three bushels of hay in a set period of time. Which nation has a comparative advantage in producing hay

Answers

Answer:

Explanation:

Abcdefg

For most consumers, term life insurance is considered to be the:

O worst option

O same cost as term

O most expensive

O best value

Answers

For most consumers, the term life insurance is considered to be worst option.

What is a term life insurance?A sort of death benefit that pays the policyholder's heirs over a predetermined length of time is term life insurance, commonly referred to as pure life insurance. The owner of the term life insurance policy has three options after the term has ended: renewing it for a new term, changing it to permanent protection, or letting the policy lapse. The premium for term life insurance is established by the insurance provider based on the value of the policy (the payout amount), as well as your age, gender, and general health. A medical examination could be necessary in several situations. Your driving history, current medications, whether you smoke, your work, your hobbies, and your family history may all be requested by the insurance provider.

To learn more about insurance, visit:

https://brainly.com/question/24034584

#SPJ1

Responding to an email message in an angry, emotional tone is:

A) Spamming, which is unacceptable.

B) Phishing, which is acceptable.

C) Flaming, which is unacceptable.

D) Replying, which is acceptable.

Answers

Answer:

C

Explanation:

Spamming would not make sense in this situation. Phising is illegal. Finally replying is acceptable as long as its kept business formal with whom the email may inquire to.

Answer:

c

Explanation:

it is the only appropriate awnser

Theodosia was laid off from her last job. What should she put on her next application as her reason for leaving that job?

O No prior employment experience

O Currently employed

O Fired

O Downsizing

Answers

Answer:

O Downsizing

Explanation:

A lay off happens when the employer has closed down, has changed locations, or when there is not sufficient work for all the employees. A layoff is not caused by an employee's fault.

Downsizing refers to scaling down of operation. When a company downsizes, some of the employees will be laid off. Theodosia should mention she was laid off in her next application. The potential employer will realize that she wasn't at fault at her previous workplace.

Cougar Athletics is soliciting bids on a 3-year contract to produce 5,000 t-shirts per year to be given away at athletic events. You have decided to bid on the contract. It will cost you $4 per shirt in variable costs (buying plain t-shirts and paying an employee to imprint them) and $8,000 per year in fixed costs. A t-shirt printing machine will cost $17,500. The machine will be depreciated to zero over its 3-year life and it will not have any salvage value. There are no net working capital implications for the project. If your tax rate is 21% and your required return on this project is 12%, how much would you bid for the contract? State your answer as the annual sales amount (to 2 decimal places, $XX,XXX.XX), not the per-unit price. Write up your solutions by hand and email them to me after the exam (do NOT send a spreadsheet).

Answers

Answer:

$7.1345 per shirt

Explanation:

depreciation expense per year = $17,500 / 3 = $5,833

initial outlay = -$17,500

cash flow year 1 = [(5,000X - $20,000 - $8,000 - $5,833.33) x 0.79] + $5,833.33 = 3,950X - $20,895

cash flow year 2 = [(5,000X - $20,000 - $8,000 - $5,833.33) x 0.79] + $5,833.33 = 3,950X - $20,895

cash flow year 3 = [(5,000X - $20,000 - $8,000 - $5,833.33) x 0.79] + $5,833.33 = 3,950X - $20,895

$17,500 = (3,950X - $20,895)/1.12 + (3,950X - $20,895)/1.12² + (3,950X - $20,895)/1.12³

$17,500 = 3,526.79X - $18,656.25 + 3,148.92X - $16,657.37 + 2,811.53X - $14,872.65

$17,500 = 9,487.24X - $50,186.27

$67,686.27 = 9,487.24X

X = $67,686.27 / 9,487.24 = $7.1345 per shirt

Which franchise model do automobile dealerships usually follow?

(plato)

Answers

Product distribution franchises meaning: Distribution Franchise, these product-driven franchises are where the franchisee distributes the parent company products and some related services. The parent company provides the use of its branded trademark, but not typically an entire system for running a business.

5 outs. She packs one for her lunch almost every day. A co-worker sees Saanvi enjoying her lunch and asks her if she cooked the sprouts before assembling her pita. Since Saanvi’s lunch is designed to be eaten cold, she is confused. Which BEST explains the reason for her co-worker’s inquiry? A. The co-worker has mistaken the sprouts for iceberg lettuce. B. The sprouts might smell rancid if they are not cooked first. C. The sprouts may have invisible pathogens on them. D. Cooking the sprouts will change their taste and texture.

Answers

Answer:

D. Cooking the sprouts will change their taste and texture.

Explanation:

SBA a business from any of the THREE sectors and conduct a research using newspaper clips, business articles, any business magazines, News 24 and a other business websites to answer the following Research (Part A) for your Select a business business questions. (Collect FIVE resources) must be NB After choosing the sector you able to motivate your answer then provide picture/ newspaper article of the business -You must identify challenges experienced by the business and classify those challenges according to the three Business Environments and state the extent of control.

Answers

Selecting a business from one of the three sectors, conducting research using newspaper clips, business articles, any business magazines, News 24, and other business websites to answer research (Part A) questions. This article will discuss the challenges faced by the business and classify them based on the three business environments. The business selected for this research is Sasol, which belongs to the primary sector. Sasol is an integrated energy and chemicals firm with operations in over 30 countries and more than 30,000 employees. It mines coal and convert it into synthetic fuels and chemical feedstock. Sasol operates in a challenging environment, and it faces many challenges. However, in this research, we will discuss the most important challenges faced by Sasol. The following are the difficulties Sasol faces: Environmental challenges: Sasol is a large company, and it emits greenhouse gases, which affect the environment. Furthermore, environmental regulations have become more stringent, which is a significant challenge for the company. Sasol must adhere to environmental regulations, which will impact its operations. Sasol must also protect its reputation, which is critical to its success. Sasol should be proactive in responding to environmental challenges by investing in renewable energy and ensuring that it adheres to environmental regulations. Economic challenges: Sasol faces economic challenges, including fluctuating oil prices, currency volatility, and rising operating costs. These issues are beyond the company's control, and they can have a significant impact on Sasol's financial performance. Sasol must adapt to economic changes by diversifying its revenue streams and improving its operational efficiency. Social challenges: Sasol faces social challenges such as workforce diversity, employee engagement, and community relations. Sasol must address these challenges by fostering a diverse and inclusive culture, promoting employee engagement, and engaging with the community. Sasol must also ensure that its business practices align with the expectations of its stakeholders, including customers, employees, and investors. In conclusion, Sasol faces many challenges, which can be classified into three categories: environmental, economic, and social. Sasol has limited control over some of these challenges, but it must be proactive in responding to them to ensure its long-term success.

A business that you can select for this analysis is the importation of cars into a country. Some challenges that may affect the importation of cars include import duties and trade agreements between nations.

What are business challenges?Business challenges refer to those problems that are encountered by entrepreneurs who want to go into any area of trade. For those into the importation of cars and other such items, excessive import duties might be limiting to them.

They may also experieice trade agreements sbetween nations and rising forex that amy not be favorable for trade.

Learn more about business challenges here:

https://brainly.com/question/30820313

#SPJ1

commenced business with investment Rs 500000

Purchased good from hari Rs 10000

sold

goods to shyam Rs 15000

lach received from shyam Rs 15000

House rent received

from

tenant Rs 10000

Commission Paid Rs 5000

Regeired: Accounting equation

y

Answers

I'm also stuck on the same question

Complete Part 1 of the assignment by g

iving three examples of your workplace strengths and explaining each with one or two paragraphs for each strength.

Please help

Answers

Three examples of my workplace strengths are adaptability, collaboration, and initiative.

What are workplace strengths?Workplace strengths consist of the skills, abilities, and personal attributes that one brings to one's job that enables the person to perform well in his/her role.

Examples are:

Adaptability, which means being able to adjust to changing circumstances.

When one is adaptable, he is creative and ready to come up with solutions to unexpected problems, be it in a new project, a new team, or a new way of doing things.

Collaboration refers to being able to work well with others, share ideas, and have strong relationships.

Collaborators are not afraid to listen to other people's perspectives and are always willing to compromise to find the best solution.

Initiative is another of my strength in the workplace. Being initiative allows me to identify problems and come up with solutions.

It also enables me to be unafraid of taking risks and to try new ways to make a positive impact on the organization.

Learn more about skills at brainly.com/question/26061350

#SPJ1

Which taxpayer is most likely to benefit by itemizing deductions on their 2021 return? None of these individuals are blind. Colin (32). He has no dependents and will use the single filing status. His allowable itemized deductions are $13,650. Donald (69). He has no dependents and will use the single filing status. His allowable itemized deductions are $13,800. Janelle (65). She is unmarried and will use the head of household filing status. She has one dependent. Her allowable itemized deductions are $19,500. Trevon (28). He is married and filing a joint return with his wife, Courtney (27). They have no dependents, and their allowable itemized deductions are $24,600.

Answers

a) Age of Garcia:68 years old She is single and can claim a standard deduction of 12400 dollars. In this particular instance, Garcia is over 65 years old, so the $1650 increase in the standard deduction is applicable.

Gracia will benefit from the standard deduction because it is greater than the itemized deduction, which is equal to 12400 times 1300, or 14050 dollars.

b) Age of Connor:31 Because he is single, he can claim a standard deduction of $12,400.

Because the itemized deduction is $13585, claiming it is advantageous for Connor because it is greater than the standard deduction.

c) Marietta, 35 years old, is unmarried and the head of the household. As a result, she is eligible for the standard deduction, which is 1865 dollars. The standard deduction for a dependent is 4300 dollars; the itemized deduction is 19300 dollars. As a result, Marietta is better off claiming the standard deduction than the itemized deduction. d) Tyrone, 35 years old28 years of age, married: married Filing jointly with spouse The standard deduction for married filers is $24880, while the itemized deduction is $23980. As a result, claiming the standard deduction is advantageous for Tyrone because it is greater than the itemized deduction.

The answer is:In the 2020 return, only Connor will benefit from itemizing deductions.

To learn more about standard deduction here

https://brainly.com/question/3158031

#SPJ1

What is the source of funds for transactions completed with debit cards

Answers

Answer:

The cardholder checking account

Explanation:

A debit card facilitates remote access to a customer's funds held in a checking account. The cardholder can make payments for goods and services using the money in their account through the debit card. Therefore, every debit card transaction reduces the customer's bank balance immediately. Should the customer have insufficient funds in their account, the payment will fail.

Answer:

Explanation:bank account