Answers

Answer: I think its D

Explanation: because they have the power to to tax, make enforce laws, and charter banks

Related Questions

whan deciding how to invest your money which of the following is least important to know

Answers

When deciding how to invest your money, it's essential to consider several factors such as risk tolerance, investment goals, and time horizon.

However, the least important factor to know is probably the short-term market fluctuations.

Short-term market fluctuations refer to the daily ups and downs in the stock market or other investment platforms. While it can be tempting to focus on these fluctuations, they are generally not indicative of long-term performance and can lead to emotional, impulsive decisions that may not align with your investment strategy. Instead, it's more important to focus on factors that contribute to long-term growth and stability.

A sound investment strategy takes into account your risk tolerance, which is your ability and willingness to withstand potential losses. Additionally, clearly defined investment goals help you create a tailored plan that considers your specific objectives, such as saving for retirement or funding a child's education. Your time horizon, or the length of time you plan to invest, also plays a significant role in determining suitable investment options.

By prioritizing long-term factors like risk tolerance, investment goals, and time horizon, you can make more informed decisions that will ultimately lead to better financial outcomes. Remember that short-term market fluctuations can be distracting and are less important in the grand scheme of your investment journey.

For more such questions on, invest :

https://brainly.com/question/30894716

#SPJ11

3. Find the amount of tax owed: residential property valued at $162,000.00; assessed at 15%; taxed at $12.00 per hundred

dollars worth of property.

Answers

The amount of tax owed for the residential property is $29.16.

How to calculate the amount of tax owed1. Calculating the assessed value of the property by multiplying the property value by the assessment rate (expressed as a decimal):

Assessed value = Property value x Assessment rate

Assessed value = $162,000.00 x 0.15

Assessed value = $24,300.00

2. Calculate the taxable value of the property by dividing the assessed value by 100:

Taxable value = Assessed value / 100

Taxable value = $24,300.00 / 100

Taxable value = $243.00

3. Calculate the amount of tax owed by multiplying the taxable value by the tax rate:

Tax owed = Taxable value x Tax rate

Tax owed = $243.00 x ($12.00 / $100.00)

Tax owed = $29.16

Therefore, the amount of tax owed for the residential property is $29.16.

Learn more about Taxable value at https://brainly.com/question/3316916

#SPJ1

Question Content Area

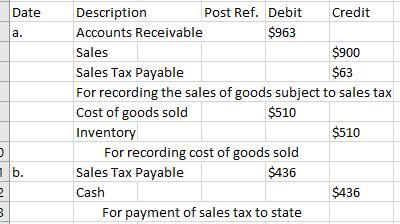

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

Answers

When the final sale in the supply chain is made, the retailer is responsible for collecting sales tax. The required journalized entries for the selected transactions involving sales tax are attached below.

The state levies a consumption tax, the so-called sales tax, on the purchase of goods and services. A standard sales tax is collected at the point of sale, collected at the store and remitted to the government.

Depending on the regulations in that country, a business may be responsible for sales taxes in that jurisdiction if it has a presence there, which can be a physical site, an employee, or an associate. The calculation of sales tax for (a) is:

Sales Tax Payable = Amount of sales× Sales Tax

= $900 × 7%

= $63

Therefore, all the selected transactions are explained with the help of the journal entries.

To learn more on sales tax, here:

https://brainly.com/question/29442509

#SPJ3

Your question is incomplete, but most probably the full question was,

Question Content Area

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

- Select -

- Select -

blank

Given the data provided in the table below, the total revenue (TR) for production at quantity (Q) level 4 equals

zero

$1.00

$15.00

$20.00

Answers

The total revenue (TR) for production at quantity (Q) level 4 , given the data on the table, is D. $ 20. 00 .

How to find Total revenue ?Total revenue refers to the total returns that a company makes when it sells a certain amount of goods or services . This amount has not been adjusted for expenses yet and is simply what is made from sales . If it is adjusted for expenses, then it becomes known as the total profit from the sale of goods and services .

The formula for the total revenue is therefore :

= Quantity of goods or products sold x Price of each unit of the good or product

At production quantity (Q) level 4, the quantity sold is 4 units and the price per unit is $5.

The total revenue is therefore:

= 4 x 5

= $20

Find out more on total revenue at https://brainly.com/question/16910784

#SPJ1

what are some ways the financial crisis in 2008 could've been avoided

Answers

The financial crisis in 2008 could've been avoided in some ways by Regulating the housing market, Proper regulation banks and financial institutions, Introduction of better accounting standards, Encouraging greater transparency, and Regulating credit rating agencies.

The global financial crisis of 2008 was a significant economic event that had a far-reaching impact on the worldwide economy. The crisis resulted in the collapse of numerous leading financial institutions, which led to unprecedented losses in the stock market, a decline in economic growth, and high levels of unemployment. It is commonly believed that the crisis could have been avoided if appropriate measures had been taken at the right time.

Here are some ways the financial crisis in 2008 could have been avoided:

1. Regulating the housing market: The financial crisis of 2008 originated from the housing market collapse. Banks and financial institutions had given loans to people who could not afford them, and when the housing bubble burst, a massive number of mortgages went into default. If the government had regulated the housing market more effectively, the financial institutions would not have been able to give out loans to risky borrowers, and the housing market would not have collapsed.

2. Proper regulation of banks and financial institutions: If banks and financial institutions were regulated more effectively, they would not have been able to engage in risky financial practices that led to the crisis. Regulators would have spotted the risky activities early on and would have been able to take corrective action before it was too late.

3. Introduction of better accounting standards: During the financial crisis of 2008, banks and financial institutions engaged in creative accounting practices to hide their losses. This deception made it difficult to ascertain the real situation of the banks and financial institutions, leading to a lack of confidence in the market. If better accounting standards had been introduced, this could have been avoided.

4. Encouraging greater transparency: The financial crisis of 2008 was partly caused by a lack of transparency in the market. If regulators had encouraged greater transparency, there would have been more information available to investors, which could have led to greater confidence in the market.

5. Regulating credit rating agencies: Credit rating agencies played a significant role in the financial crisis of 2008. They gave high ratings to toxic financial products, which misled investors and led to the collapse of the market. If credit rating agencies were regulated more effectively, they would not have been able to give high ratings to risky products, and the market would have been more stable.

Know more about Financial crisis here:

https://brainly.com/question/32723220

#SPJ8

Evaluate the statement "Accounting is all about numbers.". Using the definition of accounting to

justify your answer. (10 marks, maximum 250 words)

Answers

Answer:

To say "Accounting is all about numbers." is incorrect since Non- Financial or Non Qualitative information must be communicated on economic entities as well.

Explanation:

Accounting is the measurement, processing and communication of financial and non-financial information about economic entities such as business and corporations.

To say "Accounting is all about numbers." is incorrect since Non- Financial or Non Qualitative information must be communicated on economic entities as well .These Non - Financial information included the Corporate Activities which has impacts on Community (People) and the Environment (Planet).

Wally's Walleyes wants to introduce a new product that has a start-up cost of $7,800. The product has a 2-year life and will provide cash flows of $4,500 in Year 1 and $4,300 in Year 2. The required rate of return is 15 percent. Should the product be introduced? Why or why not?

Answers

The calculated NPV is negative, indicating that the present value of expected cash flows does not exceed the start-up cost of the project. In other words, the project is expected to generate a net loss.

To determine whether Wally's Walleyes should introduce the new product, we can calculate the net present value (NPV) of the project. The NPV measures the present value of expected cash flows, taking into account the required rate of return.

To calculate the NPV, we need to discount the cash flows using the required rate of return (15 percent). The formula for calculating NPV is:

NPV = Cash Flow Year 1 / (1 + Required Rate of Return)^1 + Cash Flow Year 2 / (1 + Required Rate of Return)^2 - Start-up Cost

\(NPV = $4,500 / (1 + 0.15)^1 + $4,300 / (1 + 0.15)^2 - $7,800\)

\(NPV = $4,500 / 1.15 + $4,300 / (1.15)^2 - $7,800\)

NPV = $3,913.04 + $3,537.41 - $7,800

NPV = -$350.55

For such more question on net loss:

https://brainly.com/question/28390284

#SPJ8

Suppose the government in this economy decides to decrease government purchases by $250 billion. The decrease in government purchases will lead to a decrease in income, generating an initial change in consumption equal to-$62. 5 billion. This decreases income yet again, causing a second change in consumption equal to. The total change in demand resulting from the initial change in government spending is

Answers

The total change in demand resulting from the initial decrease in government purchases of $250 billion is -$125 billion.

This is due to the multiplier effect, which is the effect of a change in spending or income on the total amount of spending or income in the economy.

When the government decreases its purchases, there is an initial decrease in income of $62.5 billion, which decreases consumption by the same amount. This then leads to a further decrease in income, leading to a second change in consumption of an additional -$62.5 billion. The total change in demand resulting from the initial decrease in government spending is therefore -$125 billion.

Learn more about government purchases at: https://brainly.com/question/25125137

#SPJ11

You and 11 coworkers just won $16 million ($ 1,333,333,33 each) from the state lottery. what is the present value of your prize before taxes if you request the 'up-front cash' option?

The present value of your prize before taxes if you request the 'up-front cash' option is $.

Answers

Based on the amount that you won and the return earned by the state lottery, the present value of the "up-front cash" is $715,450.96

What is the present value?Over 17 years, the amount per year is:

= 1,333,333.33 / 7

= $78,431.37

This amount is the same every year so the present value will be that of an annuity.

The present value is:

= Annuity amount x present value interest factor of annuity, 17 years, 8%

= 78,431.37 x 9.122

= $715,451.96

Missing part of question:

Assuming you cach receive your share over 17 years and that the state lottery earns a 8 percent retum on its funds,

Find out more on the present value of an annuity at https://brainly.com/question/25792915

#SPJ1

The rule in Garner v. Murray deals with

Answers

Answer:

In the event of the insolvency of a partner any losses should be shared in the ratio of the last agreed capital balances before the dissolution took place. This is known as the Garner v Murray rule.

Which of the following forms of argumentation is not commonly used in aesthetic reasoning?

Analogy

Statistical syllogism

Definition

Answers

In aesthetic reasoning, the form of argumentation that is not commonly used is Option B. Statistical syllogism.

Aesthetic reasoning focuses on the subjective and qualitative aspects of art, beauty, and expression. It involves analyzing and evaluating the aesthetic qualities and experiences associated with a particular artwork, object, or concept. In this context, arguments are often based on personal preferences, individual interpretations, and emotional responses rather than empirical data or statistical evidence.

A. Analogy is a form of argumentation commonly used in aesthetic reasoning. It involves comparing similarities between different objects, experiences, or concepts to support a particular aesthetic judgment or interpretation. By drawing parallels and making connections, analogy helps to explain and communicate aesthetic qualities, associations, or meanings.

C. Definition is another form of argumentation frequently used in aesthetic reasoning. It involves providing clear and precise explanations of key terms, concepts, or aesthetic categories to facilitate understanding and analysis. By defining terms such as beauty, harmony, or expression, individuals can establish a framework for discussing and evaluating aesthetic qualities.

However, statistical syllogism, which relies on statistical data and generalizations, is not commonly used in aesthetic reasoning. Aesthetic judgments are typically subjective and personal, based on individual experiences and perceptions. Statistics and generalizations may not adequately capture the nuances, complexities, and subjective nature of aesthetic experiences.

In summary, while analogy and definition are commonly used in aesthetic reasoning, the statistical syllogism is not typically employed due to the subjective nature of aesthetic judgments. Therefore, the correct option is B.

The question was incomplete, Find the full content below:

Which of the following forms of argumentation is not commonly used in aesthetic reasoning?

A. Analogy

B. Statistical syllogism

C. Definition

Know more about Analogy here:

https://brainly.com/question/31569248

#SPJ8

Research cyber espionage case and briefly describe it (provide a link to your website source

Answers

The primary goal of cyber espionage is to gather private or confidential data, trade secrets, or other kinds of intellectual property that the attacker can use.

What is cyber espionage?Cyber espionage is a type of cyber attack that involves the theft of sensitive information or intellectual property from a target entity, such as a government agency, business, or individual. It involves the use of sophisticated hacking techniques, malware, and other cyber tools to gain unauthorized access to a victim's computer network or other digital systems. The objective of cyber espionage is often to obtain valuable information, trade secrets, or political or military intelligence that can be used for financial gain or to advance the interests of a foreign government. Cyber espionage can have serious consequences, including economic damage, reputational harm, and national security risks. As such, it is a major concern for businesses, governments, and individuals alike.

To learn more about network, visit:

https://brainly.com/question/30155190

#SPJ1

In late 2022, P&S Corp sells product to a client who, instead of paying cash, signs a non-interest-bearing note promising to pay in three years. This amount is based on a 6% interest rate, resulting in the present value of the note being $150,000. How much sales revenue will be recorded for this sale in 2022?

Answers

Zero interest bearing notes are debt obligations that have been issued by a company but have no dividend yield associated with them.

What is a non-interest-bearing note ?The issuing corporation is not compelled to continue paying interest to investors after the issuance of such securities. These are also referred to as zero-coupon bonds.

Because they are not subject to periodic interest, the corporation issues zero interest bearing notes at a significant discount to their face value. These securities also have a fixed maturity length. Every time the notes mature, the company is required to give the investors their full face value back.

Hence the amount of sale will be recognized

= $150000/1.06^(4)

= $ 1,18,841

Learn more about a non-interest-bearing note here

https://brainly.com/question/28813025

#SPJ1

Your reading material illustrates a typical example of what happens if you pay just the minimum monthly payment every month on a credit card balance, In this example, approximately how long will it take to pay off the original dept completely?

Answers

Answer: Most credit cards only require you to make a minimum payment each month, which is typically a fixed amount, often $20 to $25, or a percentage of your balance, usually 1 to 3 percent. Paying the minimum is tempting, especially if your budget is tight. But the less you pay now, the more you’ll pay later.

Carrying a credit card balance not only means you’ll be in debt longer, but it also means you can rack up massive amounts of interest, thanks to exorbitant, oftentimes double-digit interest rates.

Explanation:

To give you an idea of just how costly it can be to pay only the minimum on your credit card, personal finance site NerdWallet crunched the numbers and determined the interest costs of paying off debt. It assumed credit card debt of $6,081, which is what the average household with revolving credit card debt owes, and an interest rate of 14.99 percent.

se the following financial statements and additional information.

AUSTIN INCORPORATED

Comparative Balance Sheets

June 30, 2019 and 2018

2019 2018

Assets

Cash $ 94,300 $ 39,400

Accounts receivable, net 81,000 63,000

Inventory 68,000 94,000

Prepaid expenses 5,600 7,000

Total current assets 248,900 203,400

Equipment 176,000 163,000

Accumulated depreciation—Equipment (45,000) (15,000)

Total assets $ 379,900 $ 351,400

Liabilities and Equity

Accounts payable $ 31,000 $ 38,000

Wages payable 6,000 16,000

Income taxes payable 4,900 5,400

Total current liabilities 41,900 59,400

Notes payable (long term) 40,000 80,000

Total liabilities 81,900 139,400

Equity

Common stock, $5 par value 240,000 170,000

Retained earnings 58,000 42,000

Total liabilities and equity $ 379,900 $ 351,400

AUSTIN INCORPORATED

Income Statement

For Year Ended June 30, 2019

Sales $ 922,000

Cost of goods sold 564,000

Gross profit 358,000

Operating expenses

Depreciation expense $ 75,000

Other expenses 91,000

Total operating expenses $ 166,000

192,000

Other gains (losses)

Gain on sale of equipment 4,900

Income before taxes 196,900

Income taxes expense 60,270

Net income $ 136,630

Additional Information

A $40,000 note payable is retired at its $40,000 carrying (book) value in exchange for cash.

The only changes affecting retained earnings are net income and cash dividends paid.

New equipment is acquired for $74,000 cash.

Received cash for the sale of equipment that had cost $61,000, yielding a $4,900 gain.

Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement.

All purchases and sales of inventory are on credit.

Using the income statement, the comparative balance sheet, and the additional information given above, reconstruct the entries for the summarized activity of the current fiscal year. Upon completion, the trial balance tab should agree with the June 30, 2019 balances.

1 Reconstruct the journal entry for cash receipts from customers, incorporating the change in the related balance sheet account(s), if any.

2 Reconstruct the journal entry for cash payments for inventory, incorporating the change in the related balance sheet account(s), if any.

3 Reconstruct the journal entry for depreciation expense, incorporating the change in the related balance sheet account(s), if any.

4 Reconstruct the journal entry for cash paid for operating expenses, incorporating the change in the related balance sheet account(s), if any.

5 Reconstruct the journal entry for the sale of equipment at a gain, incorporating the change in the related balance sheet account(s), if any.

6 Reconstruct the journal entry for income taxes expense, incorporating the change in the related balance sheet account(s), if any.

7 Reconstruct the entry to record the retirement of the $40,000 note payable at its $40,000 carrying (book) value in exchange for cash.

8 Reconstruct the entry for the purchase of new equipment.

9 Reconstruct the entry for the issuance of common stock.

10 Close all revenue and gain accounts to income summary.

11 Close all expense accounts to income summary.

12 Close Income Summary to Retained Earnings.

13 Reconstruct the journal entry for cash dividends paid.

Answers

Answer:

explain down

Explanation:

A specialty journal records special events or transactions related to the particular journal. There are mainly four kinds of specialty journals – Sales journal, Cash receipts journal, Purchases journal

, and Cash disbursements journal. The company can have more specialty journals depending on its needs and type of transactions, but the above four journals contain the bulk of accounting activities.

All other transactions not entered in a specialty journal account for in a General Journal. It can have the following types of transactions:

Accounts receivables

Accounts payable

Equipment

Accumulated depreciation

Expenses

Interest income

and expenses, etc.

Table of contents

What is General Journal?

General Journal Accounting

General Journal Format

General Journal Examples

Flow Process

Uses

Technological Advances

Conclusion

General Journal Video

Recommended Articles

leearning task 1 give the examples of technology

Answers

Technology continues to evolve and shape our lives, transforming industries, and opening up new possibilities for innovation and growth.

Technology encompasses a wide range of tools, systems, and applications that are designed to improve efficiency, productivity, and communication in various fields. Here are some examples of technology in different areas:

1. Information Technology (IT): Examples include computers, laptops, servers, networking equipment, software applications, operating systems, databases, cloud computing, cybersecurity systems, and data storage devices.

2. Communication Technology: Examples include smartphones, landline phones, video conferencing systems, email platforms, instant messaging applications, social media platforms, VoIP (Voice over Internet Protocol) systems, and telecommunications infrastructure.

3. Transportation Technology: Examples include automobiles, airplanes, trains, ships, electric vehicles, GPS navigation systems, traffic management systems, logistics and supply chain software, and autonomous vehicles.

4. Medical Technology: Examples include medical imaging devices (X-rays, MRI machines, CT scanners), electronic health records (EHR) systems, robotic surgery systems, telemedicine platforms, wearable health monitoring devices, and medical research equipment.

5. Educational Technology: Examples include interactive whiteboards, online learning platforms, educational software, e-books, virtual reality (VR) and augmented reality (AR) tools for learning, student management systems, and distance learning platforms.

6. Renewable Energy Technology: Examples include solar panels, wind turbines, hydroelectric power systems, geothermal energy systems, biomass energy systems, energy storage solutions, and smart grid technologies.

7. Agricultural Technology: Examples include precision farming tools, automated irrigation systems, drones for crop monitoring, livestock tracking systems, genetic engineering and biotechnology in agriculture, and farm management software.

8. Entertainment Technology: Examples include streaming services, gaming consoles, virtual reality (VR) headsets, smart TVs, home theater systems, digital music players, and video editing software.

9. Financial Technology (Fintech): Examples include mobile banking apps, digital payment platforms, cryptocurrency systems, robo-advisors, online lending platforms, and blockchain technology.

10. Manufacturing Technology: Examples include robotics and automation systems, 3D printers, CNC machines, computer-aided design (CAD) software, inventory management systems, and quality control systems.

These are just a few examples of the vast array of technologies that exist today. Technology continues to evolve and shape our lives, transforming industries, and opening up new possibilities for innovation and growth.

for more such question on Technology visit

https://brainly.com/question/31601168

#SPJ8

Compute 2018 taxable income in each of the following independent situations.

a. Drew and Meg, ages 40 and 41, respectively, are married and file a joint return. In addition to four dependent children, they have AGI of $125,000 and itemized deductions of $27,000.

b. Sybil, age 40, is single and supports her dependent parents who live with her, as well as her grandfather who is in a nursing home. She has AGI of $80,000 and itemized deductions of $8,000.

c. Scott, age 49, is a surviving spouse. His household includes two unmarried stepsons who qualify as his dependents. He has AGI of $75,000 and itemized deductions of $10,100.

Answers

Answer:

b

Explanation:

Most of the assets were bought a long

time ago and would worth much more

than the books show today.

What is the accounting principle?

Answers

Answer:

Historical cost principle

Explanation:

Assets must be recorded at cost value, not market value. When you record an asset, you cannot change its value every period, you have to keep using the historical value. This is why we use a separate account to record accumulated depreciation of assets, so that the purchase cost is always constant, but the net carrying value will vary depending on depreciation expense.

Market value changes and can be very volatile. Imagine a house, whose initial value was $300,000, then it increased to $500,000 but the market went down and its value was $350,000. It would be a mess to change the value and pay capital gains taxes, or then report a loss.

STEP 1 1. Explain the five basic costs curves that SEGAO Bricks will experience. ert MC =MR

Answers

The five basic cost curves that SEGAO Bricks will experience are:

1. Total Cost (TC) Curve: The total cost curve represents the relationship between the total cost of production and the quantity of output produced. It shows how the total cost changes as the level of production changes.

2. Marginal Cost (MC) Curve: The marginal cost curve represents the additional cost incurred by producing one more unit of output. It shows how the cost of producing each additional unit changes as the quantity of output increases. The marginal cost curve is derived from the change in total cost divided by the change in quantity.

3. Average Total Cost (ATC) Curve: The average total cost curve represents the average cost per unit of output. It is calculated by dividing the total cost by the quantity of output. The average total cost curve shows how the average cost changes as the level of production increases.

4. Average Variable Cost (AVC) Curve: The average variable cost curve represents the variable cost per unit of output. It is calculated by dividing the variable cost by the quantity of output. The average variable cost curve shows how the variable cost per unit changes as the level of production increases.

5. Average Fixed Cost (AFC) Curve: The average fixed cost curve represents the fixed cost per unit of output. It is calculated by dividing the fixed cost by the quantity of output. The average fixed cost curve shows how the fixed cost per unit changes as the level of production increases.

The equation MC = MR represents the condition for profit maximization in a perfectly competitive market. It states that a firm should produce at the quantity where the marginal cost (MC) equals the marginal revenue (MR). This ensures that the firm is maximizing its profit by producing the optimal quantity of output at which the additional revenue generated by producing one more unit (MR) is equal to the additional cost incurred (MC).

What is the residual income(loss) if a company has sales of $205,000, cost of goods sold of $115,000, operating expenses of $40,000, average invested assets of $915,000, and hurdle rate of 12.75 percent?

Answers

Answer:

Following are the solution to this question:

Explanation:

value Amount

Sale \(\$ 205,000\)

The less cost of product sol \(\$115,000\)

The less operate expenses \(\$40,000\)

Earning \(= \$205,000- \$115,000 - \$40,000 = \$ 50,000\)

Average funds invested \(\$915,000\)

Investment return \(= \frac{ \$50,000}{\$915,000} \times 100 = 5.464 \%\)

Required Income \(= \$ 915,000\times 12.75\% = \$ 116,662.5\)

Residual Income (Loss) \(= \$50,000 - \$116,662.5 = (\$66,662.5)\)

PLEASE HELP. I NEED TO FINISH THIS TODAY OR IM GROUNDED

Answers

Beginning to invest early for retirement is beneficial because it allows you to take advantage of the power of compounding returns.

What is beneficial?Beneficial means something that is helpful or advantageous. In general, it refers to something that is good or has a positive effect. For example, good health is beneficial, as it can help us live longer and happier lives. Exercise is also beneficial, as it can keep us strong and help us stay in shape. Education is also beneficial, as it can open doors to new opportunities, help us gain knowledge and skills, and provide us with a better future.

Compounding returns means that the longer you leave your money in an investment, the more it will grow. This is because the returns are reinvested and compounded or multiplied over time. As you invest earlier in life, you will have more time for your money to grow and benefit from compounding returns. Additionally, taxes are generally lower on investments made by younger investors, and investing at a young age can also help to raise your credit score. Finally, younger people often have fewer expenses, making it easier to invest and set money aside for retirement.

To learn more about beneficial

https://brainly.com/question/28712888

#SPJ1

Allied Paper Products, Inc., offers a restricted stock award plan to its vice presidents. On January 1, 2021, the company granted 20 million of its $1 par common shares, subject to forfeiture if employment is terminated within two years. The common shares have a market price of $7 per share on the grant date. Required: 1. Determine the total compensation cost pertaining to the restricted shares. 2. Prepare the appropriate journal entries related to the restricted stock through December 31, 2022.

Answers

Answer:

See below

Explanation:

1. Total compensation pertaining to the restricted shares

= Fair value per share × Shares granted

= $7 × 20,000,000

= $140,000,000

Therefore, the total compensation cost pertaining to the restricted shares is $140,000,000

2. Journal entries as at December 31, 2021 (in million dollars)

Dr Compensation expense ($140,000,000 ÷ 2 years) $70

Cr Paid- in capital - restricted stock $70

Journal entries as at December 31, 2022 (in million dollars)

Dr Compensation expense ($140,000,000 ÷ 2 years) $70

Cr Paid in capital - restricted stock $70

Dr Paid in capital restricted stock $140

Cr Common stock (20 million shares × $1 par) $20

Cr Paid in capital in excess of par (remainder) $120

what are the unethical practices being perpetrated of calling a executive of another business

Answers

The unethical practices being perpetrated of calling an executive of another business are

Unauthorized solicitationHarassment sensitive informationWithout their permission, making unsolicited calls to executives can be viewed as an invasion of their privacy and a transgression of their personal and professional boundaries.

Contacting an executive repeatedly or persistently despite their blatant disinterest or request to stop can be construed as harassment and be upsetting or disruptive to their work.

It is unethical and might be regarded as a violation of trust to try to coerce or trick an executive into divulging sensitive or confidential information.

Learn more about unethical practices, here:

https://brainly.com/question/30094339

#SPJ1

because most businesses dont have a one-size-fits-all aproach, what do you need to do?

Answers

Answer:

Add your creativity to the existing problem and make it unique for it to suit others.

(Y²R²C²i²x²k²j²e²s²b²)where "land and water are intimately intertwinned, constantly shifting, and with the pressures of population, increasingly valuable in its rarity."find all things

Answers

Land and water are intimately intertwined, constantly shifting, and with the pressures of population, increasingly valuable in its rarity to the significance and interconnectedness of land and water resources.

Here's an explanation of the terms used:

Land refers to the Earth's solid surface, which includes continents, islands, and various forms of topography. Water is the liquid component of the Earth's surface, and it includes oceans, rivers, lakes, and groundwater. Intimately Intertwined: The statement emphasises how land and water are inextricably linked and interdependent. They interact and impact one another in a variety of ways. Constant Change: Both land and water are constantly changing and moving. Population Pressures: As the world's population grows, so does the demand for land and water. Rarity and Increasing Value: The rarity of land and water resources relates to their limited availability as well as the growing appreciation for their value.For such more question on population:

https://brainly.com/question/30224379

#SPJ8

If you had a million dollars what would you buy and why? 2 sentences please!!

Answers

Service providers like cable companies have tiered pricing and also charge their customers according to a schedule of fees. Sometimes customers are able to negotiate for a lower price by getting fees or service charges waived for a certain amount of time if they contact customer service and threaten to cancel their service. The flexibility on the part of service providers is an attempt to practice:_________

Answers

The flexibility on the part of service providers is an attempt to practice Perfect Price discrimination.

A Price discrimination is a pricing strategy that tends to charges consumers different prices for similar goods or services.

Here, because of the customer negotiate for a lower price with threat to cancel the service if not agreed encourages price discrimination because the firm will not want to lose customer.

Therefore, the flexibility on the part of service providers is an attempt to practice Perfect Price discrimination.

Read more about Price discrimination:

brainly.com/question/17272240

Which of the following is true?

A. None of the above is true.

B. Free trade areas and customs unions do not conflict with either the most- favoured-nation or national treatment principles of the GATT. C .Free trade areas and customs unions are a violation of the most-favoured-nation principle, but were permitted by the contracting parties to the GATT so long as they created trade.

D. Free trade areas and customs unions are a violation of the national treatment principle, but were permitted by the contracting parties to the GATT so long as they created trade.

Answers

Answer:

C.

Explanation:

In the context of the General Agreement on Tariffs and Trade (GATT), free trade areas and customs unions were seen as exceptions to the most-favored-nation (MFN) principle, which states that countries should not discriminate between their trading partners. Free trade areas and customs unions involve preferential treatment among member countries, which goes against the MFN principle.

However, the contracting parties to the GATT allowed for the creation of free trade areas and customs unions as long as they promoted trade and economic integration among member countries. These exceptions were made in recognition of the potential benefits that such arrangements could bring.

Therefore, option C accurately describes the stance on free trade areas and customs unions in relation to the GATT.

b) Find the standard deviation and the coefficient of variation of the following data. 25 Marks Interval Frequency Interval Frequency 3.00-3.25 6 4.00-4.25 47 3.25-3.50 19 4.25-4.50 29 3.50-3.75 35 4.50-4.75 15 3.75-4.00 44 4.75-5.00 5

Answers

The standard deviation is 0.4182 and the coefficient of variation is 10.5%.

Given the following data Interval Frequency 3.00-3.25 64.00-4.25 473.25-3.50 194.25-4.50 293.50-3.75 354.50-4.75 153.75-4.00 445.00-4.75 5 The formula for finding the standard deviation is:\($$ \sigma =\sqrt{ \frac{\sum f(x-\overline{x})^2}{N}} $$\)

The table below shows the calculation; Interval \($X$ Midpoint ($X_i$)\) Frequency \(($f$) $x-\bar{x}$ $f(x-\bar{x})$ $(x-\bar{x})^2$ $f(x-\bar{x})^2\)

$3.00-3.25 3.125 6 -0.725 -4.35 0.525625 3.153.25-3.50 3.375 19 -0.475 -9.025 0.225625 4.279.50-3.75 3.625 35 -0.225 -7.875 0.050625 1.773.75-4.00 3.875 44 0.025 1.1 0.000625 0.274.00-4.25 4.125 47 0.275 12.925 0.075625 3.554.25-4.50 4.375 29 0.525 15.225 0.275625 7.994.50-4.75 4.625 15 0.775 11.625 0.600625 9.01.75-4.00 4.875 5 1.025 5.125 1.050625 5.25 \($\sum f=200$ $\sum f(x-\bar{x})= 3.15$ $\sum f(x-\bar{x})^2= 35.01$\)

The variance is: \($ \sigma^2 =\frac{\sum f(x-\overline{x})^2}{N} $$\sigma^2=\frac{35.01}{200}=0.1751$\)

Therefore, the standard deviation is: \($$ \sigma=\sqrt{ \sigma^2} $$$ \sigma=\sqrt{ 0.1751}=0.4182$\)

The formula for finding the coefficient of variation is:$$ C.V = \(\frac{\sigma}{\overline{x}} \times 100\% $$\)

The coefficient of variation is:$$ C.V = \(\frac{0.4182}{3.985} \times 100\% $$$C.V = 10.5\%$\)

Therefore, the standard deviation is 0.4182 and the coefficient of variation is 10.5%.

For more such questions on standard deviation

https://brainly.com/question/475676

#SPJ8

operations management course concept

Answers

The operations management course concept refers to the systematic design, direction, and control of the processes that transform inputs such as raw materials, energy, and labor into outputs such as goods and services that satisfy customer needs.

This management process includes inventory management, scheduling, supply chain management, quality control, and more. The goal of operations management is to create efficient processes that maximize productivity while minimizing costs.

Students taking an operations management course learn about these concepts and how to apply them to real-world situations in various industries. They also study topics like process design, project management, lean principles, and decision-making models.

The course is usually offered as a part of business administration, engineering, or industrial technology programs. Graduates of the course may go on to careers as operations managers, logistics managers, supply chain analysts, process improvement specialists, or manufacturing engineers, depending on their areas of focus and interests.

For more questions on: customer

https://brainly.com/question/15096946

#SPJ8