Campbell Corporation makes and sells state-of-the-art electronics products. One of its segments produces The Math Machine, an inexpensive calculator. The company’s chief accountant recently prepared the following income statement showing annual revenues and expenses associated with the segment’s operating activities. The relevant range for the production and sale of the calculators is between 35,000 and 68,000 units per year.

Revenue: (37,000 units × $9.00) $ 333,000

Unit-level variable costs:

Materials cost (37,000 × $2.00) (74,000)

Labor cost (37,000 × $1.00) (37,000)

Manufacturing overhead (37,000 × $0.70) (25,900)

Shipping and handling (37,000 × $0.34) (12,580)

Sales commissions (37,000 × $1.00) (37,000)

Contribution margin: 146,520

Fixed expenses:

Advertising costs (24,000)

Salary of production supervisor (64,000)

Allocated companywide facility-level expenses (77,000)

Net loss $ (18,480)

a. A large discount store has approached the owner of Campbell about buying 6,000 calculators. It would replace The Math Machine’s label with its own logo to avoid affecting Campbell’s existing customers. Because the offer was made directly to the owner, no sales commissions on the transaction would be involved, but the discount store is willing to pay only $5.00 per calculator. Calculate the contribution margin from the special order. Based on quantitative factors alone, should Campbell accept the special order?

b-1. Campbell has an opportunity to buy the 35,000 calculators it currently makes from a reliable competing manufacturer for $5.50 each. The product meets Campbell’s quality standards. Campbell could continue to use its own logo, advertising program, and sales force to distribute the products. Calculate the total cost for Campbell to make and buy the 35,000 calculators.

b-2. Should Campbell buy the calculators or continue to make them?

b-3. Should Campbell buy the calculators or continue to make them, if the volume of sales were increased to 68,000 units?

c. Because the calculator division is currently operating at a loss, should it be eliminated from the company’s operations? Support your answer with appropriate computations. Specifically, by what amount would the segment’s elimination increase or decrease profitability?

Answers

a. The contribution margin from the special order is $1,480. Based on quantitative factors alone, Campbell should accept the special order.

b-1. The total cost for Campbell to make and buy the 35,000 calculators is $203,900.

b-2. Campbell should buy the calculators, as it would save $41,100 compared to making them.

b-3. Campbell should still buy the calculators, as it would save $11,100 compared to making them, even with the increased sales volume.

c. Eliminating the calculator division would increase profitability by $18,480.

What is contribution margin?

a. The contribution margin from the special order would be $1.66 per unit, or $9.96 for the 6,000 units. Based on quantitative factors alone, Campbell should accept the special order as the contribution margin from the order exceeds the unit-level variable costs.

Revenue from special order: 6,000 units x $5.00 = $30,000

Unit-level variable costs:

Materials cost (6,000 x $2.00) = $12,000

Labor cost (6,000 x $1.00) = $6,000

Manufacturing overhead (6,000 x $0.70) = $4,200

Shipping and handling (6,000 x $0.34) = $2,040

Total unit-level variable costs = $24,240

Contribution margin = $30,000 - $24,240 = $5,760

Contribution margin per unit = $5,760 / 6,000 = $0.96

Contribution margin per unit after subtracting sales commissions = $0.96 - $1.00 = -$0.04

Contribution margin per unit after adding the $1.00 sales commission savings = $0.96

What is cost?

b-1. The total cost for Campbell to make 35,000 calculators is $279,480.

Materials cost (35,000 x $2.00) = $70,000

Labor cost (35,000 x $1.00) = $35,000

Manufacturing overhead (35,000 x $0.70) = $24,500

Shipping and handling (35,000 x $0.34) = $11,900

Sales commissions (35,000 x $1.00) = $35,000

Fixed expenses = $165,000

Total cost = $341,400 - $62,920 (contribution margin from 35,000 units) = $278,480

b-2. Campbell should buy the calculators for $5.50 each, as the cost to make them is higher than the cost to buy them.

b-3. If the volume of sales were increased to 68,000 units, the total cost for Campbell to make the calculators would be $536,960.

Materials cost (68,000 x $2.00) = $136,000

Labor cost (68,000 x $1.00) = $68,000

Manufacturing overhead (68,000 x $0.70) = $47,600

Shipping and handling (68,000 x $0.34) = $23,120

Sales commissions (68,000 x $1.00) = $68,000

Fixed expenses = $165,000

Total cost = $508,720 - $299,040 (contribution margin from 68,000 units) = $209,680

What is profitability?

c. The segment's elimination would increase profitability by $18,480. However, qualitative factors such as the potential impact on the company's reputation and employee morale should also be considered.

Net loss from segment = $18,480

Elimination of fixed expenses = $165,000

Increase in profitability = $146,520

To know more about contribution margin, visit:

https://brainly.com/question/29534784

#SPJ1

Related Questions

An employee:

works for someone else

O takes the risk of a business venture

sets financial goals for the business

sets nonfinancial goals for a business

Answers

Answer:

works for someone else

Explanation:

An employee is someone hired to offer labor services to their employers. The employers may be an individual, a private organization, or the governments. Employees earn wages, salaries, and other benefits provided by the employer in exchange for their labor services.

Employees do not assume any risks as the business owners do. Their role is to fulfill their mandate as instructed by the employers. Employees assist the employer in accomplishing their business vision.

Assume that the hypothetical economy of Econoland has 10 workers in year 1, each working 2,000 hours per year (50 weeks at 40

hours per week). The total input of labor is 20,000 hours. Productivity (average real output per hour of work) is $10 per worker.

Instructions: In parts a and b, enter your answers as a whole number. In part c, round your answer to 2 decimal places.

a. What is real GDP in Econoland?

$

b. Suppose work hours rise by 1 percent to 20,200 hours per year and labor productivity rises by 4 percent to $10.40. In year 2, what

will be Econoland's real GDP?

$

c. Between year 1 and year 2, what will be Econoland's rate of economic growth?

percent

Answers

In year one, the Econoland economy has 10 workers, each working 2,000 hours per year (50 weeks at 40 hours per week).

a. $200,000

b. $210,080

c. 5.04 percent

What is GDP?Gross domestic product (GDP) is a monetary measure of the market value of all final goods and services produced and sold by countries during a specific time period. Because of its complex and subjective nature, this measure is frequently revised before being considered a reliable indicator. The gross domestic product (GDP) is the monetary value of all finished goods and services produced within a country during a given time period.GDP provides an economic snapshot of a country and is used to estimate the size of an economy and its growth rate. GDP can be calculated in three ways: through expenditures, production, or income. Gross domestic product, or GDP, is a metric used to assess the health of a country's economy.To learn more about GDP, refer to:

https://brainly.com/question/1383956

#SPJ9

1. Deirdre has one hour this afternoon in which she can either practice the piano for the upcoming school concert, work at

the library for $7 per hour, or babysit her neighbor's son for $10 per hour. Deirdre chooses to practice the piano, but

if she hadn't chosen to practice the piano, she would have chosen to babysit over working at the library. What is the

opportunity cost of Deirdre's decisions

A. The value gained from practicing the piano for an hour.

B. The value of babysitting her neighbor's son for an hour.

C. The value of working at the library for an hour.

D. The value of babysitting her neighbor's son and working at the library for an hour.

Answers

Answer:

The correct answer is B) The value of taking care of her neighbours son for 60 minutes.

Explanation:

Opportunity Cost belongs more in the parlance of microeconomics and is used to describe the idea that one cannot have everything all the time. There are alternative ends competing for limited means. In order words, when we decide to take a course of action, in the hope of achieving a thing or getting a reward, there is always another benefit forgone.

So knowing that there is an opportunity that was foregone helps the microeconomist to think carefully about what they want to achieve using the limited resources at their disposal.

Further simplified, if I have $5 dollars to spend, and that amount can purchase either a cupcake or a cup of ice cream, the one I chose to buy becomes the opportunity taken, whilst the alternative forgone is the opportunity cost.

Therefore, the cost of an item is not just the amount of money for which it was purchased, but all other alternatives with which the same amount could have been purchased.

In the question above, Deidre would have chosen to babysit her neighbor's son. That to her is the next best use of her time, and therefore the opportunity cost. According to the question, she wouldn't have worked in the library even if she had nothing else to do. Hence, that does not pass as opportunity cost.

Opportunity cost must be an alternative choice and is very subjective.

Cheers!

two ways in which best bank can adapt to the challenges of the macro environment

Answers

Answer:

Mergers or Information Management

Explanation:

Mergers-In order to respond to certain challenges, businesses may choose to merge with another business. The new business will have a larger market share than either of the original businesses did.

Information management -All changes lead to new information that needs to be distributed to all the relevant parties.

Information must be managed efficiently and a system must be in place so that the relevant staff can easily access it.

Information must be protected and kept secure to protect the company's intellectual property.

Using the appropriate tool from the Accountant Tools menu, which 4 of the following can be batch reclassified in QuickBooks Online Accountant?

Classes

Customers

Products and Services

Locations

Tax Code

Answers

The Batch Reclassify Transactions tool in QuickBooks Online Accountant provides a streamlined and efficient way to reclassify these four items.

In QuickBooks Online Accountant, the "Batch Reclassify Transactions" tool can be used to reclassify the following four items:

1. Classes: The Batch Reclassify Transactions tool allows you to reclassify transactions based on their assigned classes. You can select a range of transactions and update the class assignment in bulk, which is useful for correcting any misclassifications or for making changes to your class structure.

2. Customers: With the Batch Reclassify Transactions tool, you can also reclassify transactions based on the customer associated with them. This is helpful when you need to make changes to the customer assignments for a group of transactions, ensuring accurate reporting and tracking of sales and expenses.

3. Products and Services: The Batch Reclassify Transactions tool enables you to reclassify transactions based on the products and services involved. By selecting a range of transactions, you can update the product or service assignment in bulk, allowing you to correct any misclassifications or make changes to your product and service categorizations.

4. Tax Code: The Batch Reclassify Transactions tool can be used to reclassify transactions based on their assigned tax codes. This feature is particularly useful when there are changes to tax regulations or when transactions have been mistakenly assigned incorrect tax codes. By selecting the transactions and updating their tax code in bulk, you can ensure accurate tax reporting and compliance.

The Batch Reclassify Transactions tool in QuickBooks Online Accountant provides a streamlined and efficient way to reclassify these four items, helping to maintain accurate financial records and ensure proper reporting and analysis of your business's data.

for more questions on tool

https://brainly.com/question/30624816

#SPJ8

5. Would most standard bank accounts work for Janet based on her banking needs? Why or why not?

Answers

Answer:

A lot of information is missing, so I looked for it:

Before meeting, Ana asked Janet to create a list of how she intended to use her account. Janet’s list included:

She had started to take on assorted jobs including babysitting and tutoring and wanted a place to “park her cash.” She wants to start saving for college and thinks that having a bank account will keep her from spending all the money that she earns (which she currently does). She wants to be able to access her money when she needs it. She generally is averse to carrying lots of cash around and envisions that she will be using her debit card at her favorite stores and also may need to take out cash from an ATM when she goes out to eat with her friends. She needs to track her account balances on her mobile phone. She likes to know where she stands at all times when it comes to her financial situation.Janet's first need, to have somewhere to park her cash, should be easily satisfied by most checking and savings accounts.

A savings account would be better to keep Janet from spending too much of her cash (second need).

If Janet wants to use frequently use a debit card (third need), then she will probably need a checking account.

Both checking and savings accounts satisfy the fourth need (online banking).

Personally, I believe a checking account will suit Janet.

The question then offers 3 different options for checking accounts, and if I were Janet, I would choose the online bank. It includes $0 fees, low monthly balance, and free ATM withdrawals (ATMs from other banks).

Answer:

Are any of the three options a bad choice for Janet? Explain your answer.

Explanation: Do online banks have ATMs? If so, where are they located? Do I have to pay a fee each time? That ATM access. A good online bank will be part of an ATM network, like Allpoint or MoneyPass, with thousands of fee-free machines nationwide. If you need to withdraw cash from a non-network machine, some online banks will also reimburse any fees the ATM owner charges. Security.

That How can you prevent the need for it? Overdraft protection means that if you do not have enough money in your account to meet the banks required amount, then your bank will cover it. You can prevent it by keeping track of your checking account balance.

A retailer prices an article at 50% above the cost price and reduce it by 30%. What is the percentage profit profit does now make

Answers

Answer:

What has many teeth but cannot bite.?

Which document must a developer of more than 20 new residential condo units give to prospective buyers?

Answers

Answer:

a Prospectus

Explanation:

The Prospectus is the name of the document that is required to be issued out by a developer when there are 20 new residential condo units up for sales.

This document contains information written in the condominium documents, and after it has been filled, it is usually submitted to the Division of Florida Condominiums, Timeshares, and Mobile Homes.

Sales 101 teaches you to: Always just answer the question the customer has Never try to get more information about what the customer needs Always answer a question with another question Never look the customer in the eye

Answers

Answer:

I think it's A) Always just answer the question the customer has.

Explanation:

I know it's not D) "Never look the customer in the eye."

I don't think it's C) "Always answer a question with another question" that just seems like it would be confusing for the customer.

And I don't think it's B) "Never try to get more information about what the customer needs" because part of you're job as a salesman is find out what the customer needs.

So that leaves answer choice A

Advise business on the role of intermediaries in the distribution process.

Answers

Intermediaries, in business and marketing, are those that act as a middleman between the producer and the consumer. The role of intermediaries in the distribution process of goods and services is to ensure that products and services are moved from the producer to the consumers.

There are several types of intermediaries in the distribution process, including wholesalers, retailers, agents, and brokers. They play a crucial role in the distribution process in the following ways:

Assist in Sorting and Selection: Intermediaries help producers to sort and select their products, which saves time and money for producers.Assist in Breaking Bulk: Intermediaries buy goods in large quantities from producers and then break them into smaller quantities. This makes it possible for producers to sell their products in smaller quantities, making it possible for consumers to afford them.Helps in Transporting Goods: Intermediaries help in transporting products from producers to consumers by offering transportation services at lower costs. They also assist in the warehousing of goods, which helps in the storage and protection of goods.Assist in Financing: Intermediaries play an important role in financing. They buy goods from producers, hold them, and then sell them to consumers. This helps to reduce the risk of loss for producers by providing cash up front for goods sold. They also offer credit facilities to consumers, which makes it possible for them to buy goods without having to pay cash upfront.Help in Providing Information: Intermediaries help to provide information about products and services to consumers, making it easier for them to make informed decisions. They also help to provide feedback to producers about the quality of their products and services.For more such questions on marketing

https://brainly.com/question/25369230

#SPJ8

Use the above Cash account to determine (a) cash flows used by investing activities and (b) cash flows provided by financing activities.

Answers

Add your dividends paid to the repurchase of debt and equity to determine your cash flow from financing activities. Next, deduct the sum from cash inflows from issuing equity or debt to arrive at your cash flow from financing activities. Likewise, a cash flow statement contains these.

How do you calculate cash provided by investing activities?The cash flow statement of a business shows the cash flow from investments. Any inflows or outflows of money from long-term investments made by a company are included in cash flow from investing activities. The amount of cash and cash equivalents entering and leaving a company is shown on the cash flow statement.

A company's cash flow statement includes a section called cash flow from financing activities (CFF), which details the net cash flows used to finance the business. Transactions involving equity, debt, and dividends are all examples of financing activities.

Learn more about investing activities here:

https://brainly.com/question/14122060

#SPJ1

On December 1, Year 1, Childe Company purchased $100,000 of bonds issued by Paperman Company at face value. The bonds mature in ten years. Childe’s intent was to keep the bonds available to sell when cash needs arise in future years. The fair value of those bonds increased to $102,000 on December 31, Year 1. Which of the following statements are correct with regards to this investment? (Select all that apply.) Check All That Apply The bonds should be reported among assets in the balance sheet at December 31, Year 1. The bonds should be reported among assets in the balance sheet at December 31, Year 1. The bonds should be reported at their fair value of $102,000 in the balance sheet. The bonds should be reported at their fair value of $102,000 in the balance sheet. An unrealized holding gain of $2,000 should be included in net income for Year 1. An unrealized holding gain of $2,000 should be included in net income for Year 1. An unrealized gain of $2,000 should be included in other comprehensive income for Year 1.

Answers

Answer: A- The bonds should be reported among assets in the balance sheet at December 31, Year 1.

B- The bonds should be reported at their fair value of $102,000 in the balance sheet.

D- An unrealized gain of $2,000 should be included in other comprehensive income for Year 1.

Explanation:

Managing risks refers to identifying any possible

process for

and evaluating risks.

events and taking steps to reduce them. Risk management is a continuous

Reset

Next

Answers

Answer:

Uncertain is the first blank and identifying is the second blank

Explanation:

I searched it on a business management website and it worked for Plato

help it’s due tomarrow

Jot down ideas for a promotional mix for the three scenarios (at the bottom). Create a

quick promotional mix. Include specific and creative tactics needed to promote the

event, company or product. Be sure to include at least one tactic for each element of

the mix:

• advertising

• public relations

• sales promotions

• personal selling

Possible tactics include: Slogans, Billboards, Free Samples, Sponsorships, Commercials,

Contests, Telemarketing, Trade Shows, Sweepstakes, Press Kits, Coupons or Loyalty

Programs. You are NOT limited to this list.

Create a Microsoft® PowerPoint describing your promotional mix and each tactic.

Briefly explain why you selected the elements you choose.

SCENARIOS

• A charity carnival raising funds and supplies for a homeless shelter

• A non-profit children's agency

• Season tickets to a women's college basketball team

Answers

Answer:

hun you're going to have to do this on your own

You decide to decrease the price of your product to increase total sales revenue, because you believe your product's demand is

A) perfectly inelastic

B) unit elastic

C) price elastic

D) price inelastic

Answers

Answer:

C) price elastic.

Explanation:

Dhrish has flown into Chicago for work. He needs a place to eat dinner and hasn’t had time to research local restaurants. Dhrish calls the concierge desk at his hotel and asks for a few recommendations. After settling on one close by, Dhrish thanks the concierge and hangs up the phone. Identify all of the relevant characteristics for this service product experience:

Answers

The relevant characteristics of this service product experience were intangible and simultaneous production and consumption.

What is Service?Services are referred to as a type of goods that is offered to someone in terms of facilities like the one received in a restaurant or shopping mall. It is a type of commodity or product that is intangible in nature, one can only feel it.

In this case, Dhrish call the help desk in the hotel and take suggestions from them via phone call which reflects intangible service as he did not see it just felt it.

Services are said to be simultaneous production and consumption as services are consumed at the time when they are produced like Dhrish receives information through the help desk and made decisions.

Learn more about service, here:

https://brainly.com/question/15862930

#SPJ1

QUESTION 2 of 10: A sports franchise posted a video which resulted in viewers purchasing 60,000 team shirts. This was 20% of viewers of the post. How many views did they get?

Answers

Answer:

300,000

Explanation:

60,000=20%

10%= 60,000÷2

= 30,000

100%= 30,000x10

=300,000

In North American professional sports leagues, there are a set number of franchises that each field one team. The franchises have exclusive territorial rights that typically encompass huge metropolitan regions, preventing them from having any local competitors.

What sports franchise posted a video, resulted in viewers?In addition to the possibility for capital growth over time and the prestige of owning a professional sports franchise, there are additional advantages, like certain tax advantages.

The value of professional sports franchises is in the billions of dollars. The value of a franchise is influenced by ticket sales, merchandise, broadcast rights, and marketing agreements.

A potential estate planning tool, the capacity to run a multi-generational family business, and the chance to engage in diverse activities.

Therefore, 300,000 views they get.

Learn more about sports franchise here:

https://brainly.com/question/29236547

#SPJ6

br.uh + meme =jhhbn b bbv v

Answers

Answer:

jhcv njkdqevjkqefvhuiqevhihuerfihuer thank i guess and we have the same name

Explanation:

The awnser to your question is meme

c) “Shadow price is the increase in value created by having one additional unit of a limiting resource at original cost”. Provide a comprehensive real world example of where a shadow price can be calculated with multiple limiting factors and with more than one product. Your answer should be in a form of a short case study roughly 4 or 5 sentences. (5 marks)

Answers

A real world example of shadow pricing would be in a case where a manufacturer produces two product A and B with 2 input such as raw materials and labor.

How is this so?Two products (A & B) are produced through the use of two primary resources: labor & raw materials. To produce one unit of product A, we require roughly an hour's worth (60 minutes) of work time from our available pool.

Also, approximately two pounds worth of our current stockpile must be incorporated into each instance as well. Comparatively speaking, producing one unit from group B takes almost three times that much effort (3 hours' time), but only requires about half as much by weight (a single pound).

Our maximum allowance stands at exactly 60 work-hours across all levels plus another hundred pounds maximum in terms concerning these earthly elements - with that established pricing amounts to a flat rate where five dollars buys us one metric pound whereas ten dollars goes towards hourly wages; so what is their shadow price?

When dealing with limited input availability, the optimal allocation of resources and production process optimization can be achieved using shadow prices. In this regard, it has been determined that labor's shadow price stands at $10 per hour while the shadow price for raw materials is set at $5 per pound.

Learn more about Shadow pricing:

https://brainly.com/question/30695369

#SPJ1

why do monopolistic firms exhibit excess capacity?

Answers

Answer:

Excess capacity under monopolistic competition is caused by product differentiation that leads to product variety and quality, which is beneficial to consumers. Consumers generally do not prefer homogenous products. Technically, excess capacity increases consumer satisfaction.

Explanation:

(hope this helps)

f the inflation rate was 2.60% and the nominal interest rate was 8.00% over the last year, what was the real rate of interest over the last year? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. Round intermediate calculations to four decimal places.

Answers

If the inflation rate was 2.60% and the nominal interest rate was 8.00% over the last year, the real rate of interest over the last year was 5.40%.

How to solve for the real rate of interestTo calculate the real rate of interest, we need to subtract the inflation rate from the nominal interest rate.

Real interest rate = Nominal interest rate - Inflation rate

Real interest rate = 8.00% - 2.60%

Real interest rate = 5.40%

Therefore, the real rate of interest over the last year was 5.40%.

Read more on interest here:https://brainly.com/question/25793394

#SPJ1

For each statement about Direct Competition and Indirect Competition,

choose True or False.

Indirect Competition is a

business whose services are

different from yours but

satisfy the same need.

All Companies that sell

goods and services are

Indirect Competitors.

When your target audience

buys products from a

competitor instead from

you, that is Indirect

Competition.

Direct Competition is a

company that offers

the same thing you

offer.

1. True

2. False

Answers

Answer:

Explanation:

1) Indirect Competition is a business whose services are different from yours but satisfy the same need.

True

2) All Companies that sell goods and services are Indirect Competitors.

False

3) When your target audience buys products from a competitor instead from you, that is Indirect Competition.

False

4) Direct Competition is a company that offers the same thing you offer.

True

Lehman Dairy leases its milking equipment from Chavez Finance Company under the following lease terms.

⦁ The lease term is 10 years, noncancelable, and requires equal rental payments due at the beginning of each year starting January 1, 2025.

⦁ The equipment has a fair value of $415,000, and cost Chavez $325,000 at the inception of the lease (January 1, 2025).

⦁ The estimated economic life of the equipment is 15 years.

⦁ The lease contains no renewable options, and the equipment reverts to Chavez Finance Company upon termination of the lease.

⦁ Lehman Dairy’s incremental borrowing rate is 10% per year. The Chavez’s implicit rate is 8% and is unknown to Lehman Dairy.

⦁ Collectability of the payments is reasonably predictable, and there are no important uncertainties surrounding the costs yet to be incurred by the lessor.

Instructions:

⦁ Calculate the payments that Chavez requires to recover the $415,000 fair value?

⦁ Present the lessor and lessee journal entries for the first two years.

⦁ If Lehman was able to negotiate the lease payments to $51,000 per year, starting on January 1, 2025, how would this change this lease and journal entries?

Answers

To recover the fair value of the equipment over the 10-year lease term, Chavez Finance Company requires $57,703.73 in annual rental payments.

What is the difference between an annuity and an ordinary annuity?An annuity due is one that has a payment due at the start of the payment interval. An ordinary annuity, on the other hand, pays at the end of the period.

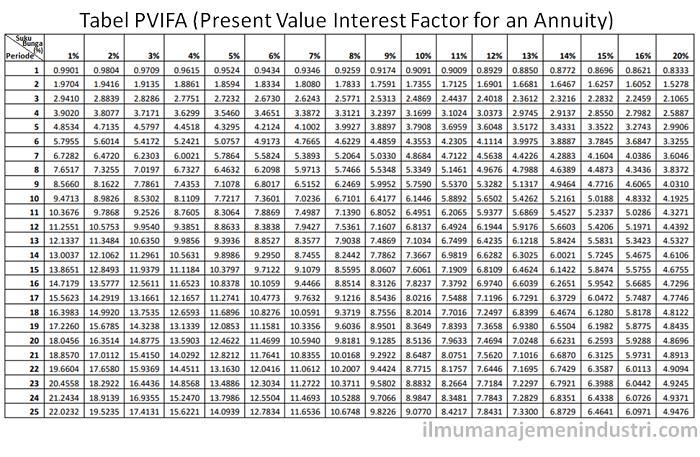

To calculate the payments that Chavez requires to recover the $415,000 fair value, we need to use the present value formula for an ordinary annuity.

PV = Payment x [1 - (1 + r)^-n] / r

Where:

PV = Present value of the lease payments

Payment = Equal annual rental payment

r = Discount rate

n = Number of periods

In this case, the present value of the lease payments should be equal to the fair value of the equipment, which is $415,000. The discount rate is the implicit rate of 8%, which is known to Chavez Finance Company but not to Lehman Dairy. The number of periods is 10 since the lease term is 10 years, and there are equal rental payments due at the beginning of each year.

Plugging in the values, we get:

$415,000 = Payment x [1 - (1 + 0.08)^-10] / 0.08

Simplifying the equation, we get:

Payment = $57,703.73

Therefore, Chavez Finance Company requires equal annual rental payments of $57,703.73 to recover the fair value of the equipment over the 10-year lease term.

Learn more about an annuity and an ordinary annuity here:

https://brainly.com/question/13369387

#SPJ9

Esquire Company needs to acquire a molding machine to be used in its manufacturing process. Two types of machines that would be appropriate are presently on the market. The company has determined the following

Machine A could be purchased for $27,000. It will last 10 years with annual maintenance costs of $900 per year. After 10 years the machine can be sold for $2,835.

Machine B could be purchased for $22,500. It also will last 10 years and will require maintenance costs of $3,600 in year three, $4,500 in year six, and $5,400 in year eight. After 10 years, the machine will have no salvage value.

Required: Assume an interest rate of 8% properly reflects the time value of money in this situation and that maintenance costs are paid at the end of each year. Calculate the present value of Machine A & Machine B. Which machine Esquire should purchase?

Answers

Answer: Esquire should purchase Machine B because it has a lower present value.

Explanation:

Present value cost of Machine A:

= Initial investment + Present value of costs - Present value of sales amount

Present value of cost = 900 * Present value annuity factor, 10 years, 8%

= 900 * 6.7101

= $6,039

Present value of sales amount = 2,835 / (1 + 8%)¹⁰

= $1,313.15

Present value cost = 27,000 + 6,039 - 1,313.15

= $31,725.85

Present value of Machine B:

= 22,500 + 3,600 / 1.08³ + 4,500 / 1.08⁶ + 5,400 / 1.08⁸

= 30,198.18

Esquire should purchase Machine B

A project that will last for 10 years is expected to have equal annual cash flows of $103,900. If the required return is 8.4 percent, what maximum initial investment would make the project acceptable? Multiple Choice $638,392.96 $595,833.43 $1,534,047.75 $655,213.49 $684,772.10

Answers

Answer:

PV= $684,772.1

Explanation:

Giving the following information:

A project that will last for 10 years is expected to have equal annual cash flows of $103,900. If the required return is 8.4 percent.

First, we need to calculate the future value of the cash flows:

FV= {A*[(1+i)^n-1]}/i

A= annual cash flow

FV= {103,900*[(1.084^10) - 1]} / 0.084

FV= $1,534,047.75

Now, we can determine the present value:

PV= FV/(1+i)^n

PV= 1,534,047.75 / (1.084^10)

PV= $684,772.1

Complete this question by entering your answers in the tabs below.

Req 1Req 2Req 3 to 5Req 6

Prepare a contribution format income statement.

Todrick Company

Contribution Format Income Statement

Sales $480,000

Variable expenses:

Cost of goods sold $16,000

Selling expense 24,000

Administrative expense 40,000

80,000

Contribution margin 96,000

Fixed expenses:

Administrative expense $19,200

Selling expense

19,200

Net operating income $28,800

Req 1Req 2

Answers

The necessary entry to illustrate the information is written below.

How to depict the entriesOne of a company's financial accounts, the income statement or profit and loss account, lists the company's receipts and outgoings for a specific time period.

Sales $ 480,000

Variable Expenses

COGS $ 336,000

Selling Expenses $ 24,000

Admin Expenses $ 24,000

$ 384,000

Contribution Margin $ 96,000

Selling Expenses $ 48,000

Admin Expenses $ 19,200

$ 67,200

Net Income $ 28,800

Sales $ 480,000

Variable Expenses

COGS $ 336,000

$ 336,000

Gross Margin $ 144,000

Selling Expenses $ 72,000

Admin Expenses $ 43,200

$ 115,200

Net Income $ 28,800

Learn more about contribution on:

https://brainly.com/question/14852051

#SPJ1

A source document should always do which of the following?

A. Be printed on paper

B. Record the date of the transaction

C. Bear an authorized

D. Include a number that can be used for recording

Answers

Answer:

Record the date of transaction

Explanation:

Unscramble the vocabulary word from Chapter 18: genrocis

Answers

The vocabulary word from Unscramble term genrocis is Cosigner.

With the help of a word unscrambler, you may input all the letters you have in your possession, and the tool will reorganize them to show all conceivable word combinations. Some might be concerned that this is a cheating method.

When a borrower fails not to repay a loan as promised, a co-signer agrees to be held accountable for the debt. If you want to buy a big item, like a car, but you can't get a loan on your own, you could consider getting a co-signer. Cosigner is a person responsible for payment of the loan if you do not pay as promised.

Learn more about Cosigner here:

https://brainly.com/question/31237415

#SPJ1

If the amount of gasoline purchased per car at a large service station has a population of $15 and a population standard deviation of$4 then 99.73% of all cars will purchase between $3 and $27

Answers

The range between $3 and $27 is three standard deviations away from the mean.

Since we know that 99.73% of the data falls within three standard deviations of the mean, we can estimate that 99.73% of all cars will purchase gasoline between $3 and $27.

According to the given information, the population mean is $15, and the population standard deviation is $4.

This means that 99.73% of all cars will purchase gasoline within three standard deviations of the mean, using the empirical rule.

Therefore, we can use the empirical rule to estimate the percentage of cars that will purchase gasoline between $3 and $27.

The empirical rule is also known as the 68-95-99.7 rule, which states that:Approximately 68% of the data falls within one standard deviation of the meanApproximately 95% of the data falls within two standard deviations of the meanApproximately 99.7% of the data falls within three standard deviations of the mean.

To find the number of standard deviations that correspond to $3 and $27, we need to calculate the z-scores.

The z-score formula is given as:z = (x - μ) / σwhere z is the standard score, x is the value of the variable, μ is the population mean, and σ is the population standard deviation.

To find the z-score for $3, we plug in the values:z = (3 - 15) / 4z = -3To find the z-score for $27, we plug in the values:z = (27 - 15) / 4z = 3.

For more such questions on standard deviation

https://brainly.com/question/29435572

#SPJ8

If Ford Motor Company builds a new auto plant in South Africa this is considered to be

Answers

Group of options omitted and they are

a) brownfield investment only

b) brownfield and horizontal investment

c) greenfield and horizontal investment

d) greenfield and vertical investmen

Answer:c) greenfield and horizontal investment

Explanation:

A green-field investment is foreign direct investment whereby a parent company establishes a new subsidiary in a different or foreign country, starting its operations from the scratch, ie building the establishment from ground up and not buying an already existing plant or structure..

By horizontal direct investment , it means that the investor establishes the same type of operation in a different country as it operates in its home country, for example, Ford Motor Company based in the United States building a new auto plant in South Africa.