Answers

Answer:

PES = -0.5 or |0.5| in absolute terms, relatively inelastic supply

Explanation:

Price (Dollars) Demand (Millions) Supply (Millions)

$60 22 14

$80 20 16

$100 18 18

$120 16 20

Calculate the price elasticity of supply when the price is $80.

In order to calculate the PES at $80, we can use either the quantity when the price is $60 or $100.

P₀ = $80

P₁ = $60

Q₀ = 16

Q₁ = 14

or

P₀ = $80

P₁ = $100

Q₀ = 16

Q₁ = 18

the answer should be the same in this case:

PES = (-2/16) / ($20/$80) = -0.125 / 0.25 = -0.5 or |0.5| in absolute terms, relatively inelastic supply

Related Questions

Which best describes how consumers may benefit from specialization?

Consumers can only purchase high-quality goods.

Consumers have more price options.

O Consumers receive more sale offers.

O Consumers find products at lower prices.

Answers

In specialization a company have produced the product at different price levels. Consumers have more price options.

What is consumer?A consumer is a person who purchases the goods and or services from the business and is also the ultimate user of the products or services. In specialization the company produces a certain product at many different levels by which they have many price options available which vary according to their customization and quality that can be offered to the consumers and hence the customer can purchase different types of a single product from a single company or Brand.

Learn more about consumer at https://brainly.com/question/14579118

#SPJ1

Calculate the Net Present Value Weather Co has recently taken over many smaller companies, which it now runs as separate divisions. One division, Thunder, has just developed a new product called Lightning and is now considering whether to put it into production. The following information is available:

(i) Costs incurred in the development of Lightning amount to $480,000.

(ii) Production of Lightning will require the purchase of new machinery at a cost of $2,400,000, payable on the first day of the new financial year. The machinery is specific to the production of Lightning and will be obsolete and valueless when production ceases. The machinery has a production life of four years and a production capacity of 30,000 units per annum.

(iii) Production costs of Lightning (at year 1 prices) are estimated as follows:

Direct material $8

Direct labour $12

Variable overheads $ 12

In addition, incremental fixed production costs (at year 1 prices), including straight-line depreciation on plant and machinery, will amount to $800,000 per annum.

(iv) The selling price of Lightning will be $80 per unit (at year 1 prices). Demand is expected to be 25,000 units per annum for the next four years.

(v) The consumer price index is expected to be at 5% per annum for the next four years and the selling price of Lightning is expected to increase at the same rate. Annual inflation rates for production costs are expected to be as follows:

Direct materials 4%

direct labour 10%

variable overheads 4%

Fixed costs 5%

(vi) The company's cost of capital in money terms is expected to be 15%. Direct materials Direct labour Variable overheads

(vii) Corporation tax is 30% and is payable one year in arrears. Tax-allowable depreciation of 25 per cent on a reducing balance is available on capital expenditure.

(viii) This investment will also require an investment in working capital of $500,000 payable at the start of the project.

This is not expected to change during the life of the investment. Unless otherwise specified, all costs and revenues should be assumed to arise at the end of each year.

The financial manager has recommended that a discounted cash flow method of project appraisal be used, but some members of the board are reluctant to do this.

Answers

Answer: Net Present Value (NPV) = -$2,400,000 + [25,000 x $80 x (1 - 0.30)]/1.15 - [$480,000 + ($800,000 x 4)]/1.15^4 + ($500,000/1.15^4)

NPV = -$2,400,000 + $1,946,739.13 - $2,719,565.22 + $385,217.39

NPV = -$1,077,608.70

Explanation:

Based on this analysis, the Lightning project has NPV of -$2,279,126.25 which is negative. Hence, the project is not economically viable and should not be pursued.

How to calculate the Net Present ValueTo calculate the net present value (NPV) of the Lightning project

Firstly, estimate the cash flows associated with the project and discount them to their present values using the company's cost of capital.

To calculate the annual cash inflows and outflows associated with the project.

The annual revenue from selling 25,000 units of Lightning at a price of $80 per unit is:

25,000 x $80 = $2,000,000

The annual production costs can be calculated as follows:

Direct material: 25,000 x $8 = $200,000

Direct labour: 25,000 x $12 = $300,000

Variable overheads: 25,000 x $12 = $300,000

Incremental fixed costs: $800,000

Total annual production costs: $1,600,000

To calculate the annual cash flow, subtract the annual production costs from the annual revenue:

Annual cash inflow: $2,000,000 - $1,600,000 = $400,000

In addition to the annual cash inflow, consider the initial investment in the project.

This includes the development costs of $480,000, the purchase of new machinery for $2,400,000, and the investment in working capital of $500,000. The total initial investment is:

$480,000 + $2,400,000 + $500,000 = $3,380,000

To calculate the tax-allowable depreciation on the capital expenditure, The value of the machinery after each year can be calculated as follows:

Year 1: $2,400,000 x (1 - 0.25) = $1,800,000

Year 2: $1,800,000 x (1 - 0.25) = $1,350,000

Year 3: $1,350,000 x (1 - 0.25) = $1,012,500

Year 4: $1,012,500 x (1 - 0.25) = $759,375

The tax-allowable depreciation for the first year is:

$2,400,000 - $1,800,000 = $600,000

The tax-allowable depreciation for the remaining years is calculated in the same way.

Using the information above, calculate the annual cash flows and the NPV of the project as follows:

Year 0:

Initial investment: -$3,380,000

Year 1:

Cash inflow: $400,000

Tax-allowable depreciation: $600,000 x 30% = $180,000

Tax savings: $180,000 x 30% = $54,000

Net cash flow: $400,000 - $54,000 = $346,000

Discounted cash flow: $346,000 / (1 + 15%\()^1\) = $300,870.13

Year 2:

Cash inflow: $400,000

Tax-allowable depreciation: $1,800,000 x 25% x 30% = $135,000

Tax savings: $135,000 x 30% = $40,500

Net cash flow: $400,000 - $40,500 = $359,500

Discounted cash flow: $359,500 / (1 + 15%\()^2\) = $281,880.18

Year 3:

Cash inflow: $400,000

Tax-allowable depreciation: $1,350,000 x 25% x 30% = $101,250

Tax savings: $101,250 x 30% = $30,375

Net cash flow: $400,000 - $30,375 = $369,625

Discounted cash flow: $369,625 / (1 + 15%\()^3\) = $260,775.85

Year 4:

Cash inflow: $400,000

Tax-allowable depreciation: $1,012,500 x 25% x 30% = $75,938

Tax savings: $75,938 x 30% = $22,781.40

Net cash flow: $400,000 - $22,781.40 = $377,218.60

Discounted cash flow: $377,218.60 / (1 + 15%\()^4\) = $257,347.59

Total discounted cash flow: $300,870.13 + $281,880.18 + $260,775.85 + $257,347.59 = $1,100,873.75

To calculate the NPV, subtract the initial investment from the total discounted cash flow:

NPV = $1,100,873.75 - $3,380,000 = -$2,279,126.25

Based on this analysis, the Lightning project has a negative NPV of -$2,279,126.25. Therefore, the project is not economically viable and should not be pursued.

Learn more on Present value on https://brainly.com/question/20813161

#SPJ2

A constraint on travel, when failing to obtain a visa, is known as an Answerissue.

Answers

The article is primarily made up of numbers and facts, as if this might actually solve any issues.The term "neo social movements" refers to issue-specific movements that began after the 1980s.

Which three restrictions apply to travel?According to Crawford and Godbey (1987; 1991), the model includes three types of limitations: interpersonal, intrapersonal, and structural constraints. Individuals who are alone when travelling have interpersonal limits.

Which four restrictions on travel apply?Four groups—intrapersonal, interpersonal, structural, and not a travel option—are used to group the 30 low-carbon travel restrictions.

To know more about constraint on travel visit:-

https://brainly.com/question/17156848

#SPJ1

a possible cause of favourable material price is

Answers

Question 6 of 20

What is one type of federal financial aid the Free Application for Federal

Student Aid (FAFSA) will identify for you?

OA. Pell grants

B. College Scholarship Service aid

O C. Academic merit scholarships

OD. Private loans

SUBM

Answers

The type of federal financial aid, the free application for federal student aid will identify for you is Pell grants.

What are Pell grants?The Pell Grant is a subsidy limited to students with financial needs. The Pell grants are usually awarded to undergraduate students who have not earned their first bachelor's degree, or who are enrolled in post-graduation programs. Based on your answers on the free application for federal student aid, you will get the Pell grants.

The Pell grant application process exists identical to any federal financial aid process—you require to complete the Free Application for Federal Student Aid (FAFSA). The U.S. Department of Education specifies your Pell Grant eligibility based on your answers on the FAFSA.

A Pell Grant exists money the government furnishes for students who need it to pay for college. Grants, unlike loans, do not maintain to be repaid. Eligible students acquire a specified amount each year under this program.

Therefore, option A is the right answer.

To learn more about Pell grants refer to:

https://brainly.com/question/4359286

#SPJ9

Thermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates:

Activity Cost Pool Activity Rate

Supporting direct labor $ 22 per direct labor-hour

Order processing $ 194 per order

Custom design processing $ 268 per custom design

Customer service $ 416 per customer

Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months:

Standard Model Custom Design

Number of gliders 11 3

Number of orders 1 3

Number of custom designs 0 3

Direct labor-hours per glider 29.50 31.00

Selling price per glider $ 1,825 $ 2,490

Direct materials cost per glider $ 464 $ 584

The company’s direct labor rate is $16 per hour.

Required:

Using the company’s activity-based costing system, compute the customer margin of Big Sky Outfitters. (Round your intermediate calculations and final answer to the nearest whole dollar amount. Loss amounts should be entered with a minus sign.)

Answers

The total costs for Big Sky Outfitters is $6,566, The customer margin of Big Sky Outfitters is $14,123.

How to calculate the company’s activity-based costing system and the customer margin of Big Sky Outfitters.Calculating the costs for each activity:

1. Supporting direct labor:

Standard Model: 11 gliders x 29.50 direct labor-hours per glider x $16 per hour = $5,152

Custom Design: 3 gliders x 31.00 direct labor-hours per glider x $16 per hour = $1,488

2. Order processing:

Standard Model: 1 order x $194 per order = $194

Custom Design: 3 orders x $194 per order = $582

3. Custom design processing:

Custom Design: 3 custom designs x $268 per custom design = $804

4. Customer service:

Customer Service: 1 customer x $416 per customer = $416

Calculating the total costs for Big Sky Outfitters:

Total costs = Supporting direct labor + Order processing + Custom design processing + Customer service

Total costs = $5,152 + $194 + $804 + $416 = $6,566

Now, let's calculate the total revenues for Big Sky Outfitters:

Total revenues = (Number of gliders x Selling price per glider) - (Number of gliders x Direct materials cost per glider)

Total revenues = (11 x $1,825) - (11 x $464) + (3 x $2,490) - (3 x $584)

Total revenues = $20,075 - $5,104 + $7,470 - $1,752 = $20,689

Finally, let's compute the customer margin:

Customer margin = Total revenues - Total costs

Customer margin = $20,689 - $6,566 = $14,123

Therefore, the customer margin of Big Sky Outfitters is $14,123.

Learn more about customer margin at https://brainly.com/question/29389015

#SPJ1

Who collects income tax that is payable to the federal government?

Income tax that is payable to the federal government is collected by the

.

Answers

The income tax that is payable to the federal government is collected by the Internal Revenue Service.

What is Tax?When the government of a nation collects money from its residents as a tax, it is used to fund various aspects of the nation's growth, such as the construction of hospitals, roads, temples and transit systems,

Taxes on individual income, payroll, and corporate income are the three main ways that the federal government receives its revenue. Individuals' wages and salaries as well as investment and other income are subject to income taxes.

Learn more about tax, here:

https://brainly.com/question/16423331

#SPJ1

The types of resources needed by a business are financial, physical, and labor resources.

a) true

b) false

Answers

Answer:

a. True

Explanation:

The above is true because financial resources are needed to enable a business meet up with its daily activities in terms of funding. Also, physical resources are buildings, machineries and assets in general which are required to carry a business daily operations. The labor resources, which is the most important resources are the workforce that carry out the day to day operations of a business.

identify an advantage of having strategic plans made by a firm at all levels.

Answers

The business environment, the state of the economy, market potential, and competitor behavior are all taken into account by strategic plans.

What is in a strategic plan for firm planning?Taking into account both internal and external variables, a strategic plan evaluates the business's existing environment. Long-term objectives and targets are listed, along with the plans that will be used to attain them, in the paper. Or to put it another way, a business plan details a specific new project or an established business.

In strategic management, how does the corporate environment appear?It is speaking of the commercial setting. "The totality of all the forces, factors, and institutions that are external to and beyond the control of a particular corporate organization but that have a significant influence on the operation and development of such firms."

Learn more about strategic plans: https://brainly.com/question/28332092

#SPJ4

When a company issues 37,000 shares of par value common stock for $10 per share, the journal entry for this issuance would include

Answers

Explanation:

Given a par value of $ 1 , and an issue price of $ 10 , the shares were issued at a premium of ( 10 -1 = ) $ 9 . Therefore , the journal entry are as follows . Debit Cash Account ( 37,000 * $ 10 ) = $ 370,000 Credit Common Stock Account ( 37,000 * $ 1 ) = $ 37,000 Credit Share Premium Account ( 37,000 * $ 9 ) = $ 333,000 .

I search it.

Suppose for the year 2015, Speedy Chef, a fast food restaurant, had a Gross Profit of $1,281,648. Speedy Chef had the following expenses:

Cost of Goods Sold $1,251,167

Selling Expense $70,578

Rent Expense $156,941

Utilities Expense $73,994

Insurance Expense $35,148

Wages $505,245

General & Administrative $24,358

Miscellaneous $32,968

Interest Expense $4,059

Income Tax Expense $60,596

What would Speedy Chef's Income Before Taxes be for 2015?

Answers

The Speedy Chef's Income Before Taxes for 2015 is -$873,406.

The following are the operating expenses for Speedy Chef for the year 2015:Cost of Goods Sold $1,251,167Selling Expense $70,578Rent Expense $156,941 Utilities Expense $73,994Insurance Expense $35,148Wages $505,245General & Administrative $24,358Miscellaneous $32,968Interest Expense $4,059Income Tax Expense $60,596.

The formula to determine the Income Before Taxes (IBT) of Speedy Chef for 2015 is given below:Income Before Taxes (IBT) = Gross Profit - Total Operating ExpensesTotal Operating Expenses = Cost of Goods Sold + Selling Expense + Rent Expense + Utilities Expense + Insurance Expense + Wages + General & Administrative + Miscellaneous + Interest Expense + Income Tax Expense.Substitute the given values,Income Before Taxes (IBT) = Gross Profit - Total Operating Expenses = $1,281,648 - $2,155,054 = -$873,406.

For more such questions Taxes,Click on

https://brainly.com/question/28798067

#SPJ8

Wally's Walleyes wants to introduce a new product that has a start-up cost of $7,800. The product has a 2-year life and will provide cash flows of $4,500 in Year 1 and $4,300 in Year 2. The required rate of return is 15 percent. Should the product be introduced? Why or why not?

Answers

The calculated NPV is negative, indicating that the present value of expected cash flows does not exceed the start-up cost of the project. In other words, the project is expected to generate a net loss.

To determine whether Wally's Walleyes should introduce the new product, we can calculate the net present value (NPV) of the project. The NPV measures the present value of expected cash flows, taking into account the required rate of return.

To calculate the NPV, we need to discount the cash flows using the required rate of return (15 percent). The formula for calculating NPV is:

NPV = Cash Flow Year 1 / (1 + Required Rate of Return)^1 + Cash Flow Year 2 / (1 + Required Rate of Return)^2 - Start-up Cost

\(NPV = $4,500 / (1 + 0.15)^1 + $4,300 / (1 + 0.15)^2 - $7,800\)

\(NPV = $4,500 / 1.15 + $4,300 / (1.15)^2 - $7,800\)

NPV = $3,913.04 + $3,537.41 - $7,800

NPV = -$350.55

For such more question on net loss:

https://brainly.com/question/28390284

#SPJ8

Which of these clauses is most likely not in Freeman's collective bargaining agreement?

Answers

The clause that is not most likely in Freeman Audio-Visual's collective bargaining agreement is A) individual rights.

What are individual rights?According to popular definitions, individual rights refer to the rights that an individual requires to pursue their lives and attain goals without interference, either from another individual or the government.

What is a collective bargaining agreement?A collective bargaining agreement is a labor union agreement reached between workers and an organization based on negotiated work conditions.

The collective bargaining agreement also contains the interpretation and enforcement of the collective agreement and the resolution of the ensuing conflicts.

Question Completion with Answer Options:Labor unions are organizations of employees formed to protect and advance their members’ interests by bargaining with management over job-related issues. The goal of this video case is to apply your knowledge of labor relations theory to Freeman Audio-Visual, which heavily utilizes labor unions.

A) individual rights

B) wage component

C) grievance procedure

D) tiered Benefits

E) security.

Thus, the clause that is not most likely in Freeman Audio-Visual's collective bargaining agreement is A) individual rights.

Learn more about collective bargaining agreements at https://brainly.com/question/11819753

The Freeman's collective bargaining agreement was the labor union agreement for the negotiation of working condition. The clause not included in the agreement is individual's rights.

What are the clauses involved in the Freeman's collective bargaining agreement?The labor union collectively bargained with the organization for the negotiation to acquire the better working conditions.

The clause that were includes were not involved with the individual rights of the living for the labor. The clauses include are:

Wage componentGrievance procedureTiered BenefitsSecurityTherefore, the clause not included in the Freeman's collective bargaining agreement was the individual's right.

Learn more about collective bargaining agreement, here:

https://brainly.com/question/7774409

Sariah sets challenging sales targets for her team.

Answers

"Sariah sets lofty sales targets for her team" is an example of planning.

What is Planning?Thinking about the steps necessary to accomplish a goal is the process of planning. Foresight, the fundamental ability for mental time travel, is the foundation of planning.

The ability to plan ahead and exhibit foresight is assumed to have evolved early in the course of human evolution.

An essential characteristic of intelligent conduct is planning.

It entails applying logic and creativity to visualize both the desired outcome and the processes required to get there.

Planning's relationship to forecasting is a crucial factor.

Planning envisions what the future may look like while forecasting attempts to anticipate what it will look like.

"Sariah sets ambitious sales targets for her team" is an example of planning.

Therefore, "Sariah sets lofty sales targets for her team" is an example of planning.

Know more about Planning here:

https://brainly.com/question/25453419

#SPJ1

Correct question:

"Sariah sets challenging sales targets for her team" is an example of ____.

During April, the first production department of a process manufacturing system completed its work on 305,000 units of a product and transferred them to the next department. Of these transferred units, 61,000 were in process in the production department at the beginning of April and 244,000 were started and completed in April. April's beginning inventory units were 65% complete with respect to materials and 35% complete with respect to conversion. At the end of April, 83,000 additional units were in process in the production department and were 85% complete with respect to materials and 35% complete with respect to conversion.

The production department had $779 288 of direct materials and $659,797 of conversion costs charged to it during April. Also, its April beginning inventory of $163,740 consists of $122,032 of direct materials cost and $41708 of conversion costs.

Required:

a. Compute the direct materials cost per equivalent unit for April.

b. Compute the conversion cost per equivalent unit for April.

c. Using the weighted average method, assign April's costs to the department's output-specifically, its units transferred to the next department and its ending work in process inventory.

Answers

Answer:

b. Compute the conversion cost per equivalent unit for April.

Explanation:

i think thats the answer sorry if im wrong but if im right may i get brainlest?

Rent of $1,000 per month is paid for the next twelve months on October 1st, 1988. As a result of this transaction:

X: 1988 net income will decrease by $3,000

Y: 1988 equity will increase by $12,000

A. X

B. Y

C. Both

D. Neither

Answers

Answer:

the answer would be Neither

Alfred E. Old and Beulah A. Crane, each age 42, married on September 7,2017. Alfred and Beulah will file a joint return for 2019. Alfred's Social Security number is 111-11-1109. Beulah's Social Security number is 123-45-6780, and she adopted "Old" as her married name. They live at 211 Brickstone Drive, Atlanta, GA 30304. Alfred was divorce from Sarah Old in March 2016. Under the divorce agreement, Alfred is to pay Sarah $1,250 per month for the next 10 years or until Sarah's death, whichever occurs first. Alfred pays Sarah $15,000 in 2019. In addition, in January 2019, Alfred pays Sarah $50,000, which is designated as being for her share of the marital property. Also, Alfred is responsible for all prior years' income taxes. Sarah's Social Security number is 123-45-6788. Alfred's salary for 2019 is $150,000. He is an executive working for Cherry.Inc. (Federal I.D. No. 98-7654321). As part of his compensation package, Cherry provides him with group term life insurance equal to twice his annual salary. His employer withheld $24,900 for Federal income taxes and $8,000 for state income taxes. The proper amounts were withheld for FICA taxes. Beulah recently graduated from law school and is employed by Legal Aid Society.Inc. (Federal I.D. No. 11-1111111), as a public defender. She receives salary of $42,000 in 2019. Her employer withheld $7,500 for Federal income taxes and $2,400 for state income taxes. The proper amounts were withheld for FICA taxes. Alfred and Beulah had interest income of $500. They received $1,900 refund on their 2018 state income taxes. They claimed the standard deduction on their 2018 Federal income tax return. Alfred and Beulah pay $4,500 interest and $1,450 property taxes on their personal residence in 2019. Their charitable contributions total $2,400 (all to their church). They paid sales taxes of $1,400, for which they maintain the receipts. Alfred and Beulah have never owned or used any virtual currency, and they do not want to contribute to the Presidential Election Campaign. Compute the Old's net tax payable (or refund due) for 2019. Suggested software: ProConnect Tax Online

Answers

To compute the Olds' net tax payable (or refund due) for 2019, we need to gather all the relevant information and calculate their taxable income, apply the appropriate tax rates, deductions, and credits. Since the tax calculation involves various factors and tax laws, it would be best to use tax software such as ProConnect Tax Online or consult with a tax professional. The software will streamline the process and ensure accurate calculations based on the specific tax laws and regulations applicable to the Olds' situation.

What is the best definition of elasticity in economics? Elasticity of supply measures how the amount of a good changes when the producer hires more employees. Elasticity of supply measures how the amount of a good changes when the producer uses new materials. Elasticity of demand measures how the amount of a good changes when its price goes up or down. Elasticity of demand measures how the amount of a good changes when its distribution expands.

Answers

Answer:

Elasticity of demand measures how the amount of a good changes when its price goes up or down.

Explanation:

bruh

Answer:

so its c

Explanation:

NEED HELP ASAP

You find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2019 and the bond has a par value of $1,000. Rate Maturity Mo/Yr Bid Asked Chg Ask Yld ?? May 24 103.4690 103.5418 +.3093 6.119 5.524 May 29 104.5030 104.6487 +.4365 ?? 6.193 May 39 ?? ?? +.5483 4.151 In the above table, find the Treasury bond that matures in May 2029. What is your yield to maturity if you buy this bond? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Answers

Answer:

4.93%

Explanation:

For computing the yield to maturity we need to apply the RATE formula i.e to be shown in the attachment below:

Provided that,

Present value = $1,046.487

Future value or Face value = $1,000

PMT = 1,000 × 5.524% ÷ 2 = $27.62

NPER = 10 years × 2 = 20 years

The 10 years is come from

= May 2029 - May 2019

= 10 years

The formula is shown below:

= Rate(NPER;PMT;-PV;FV;type)

The present value come in negative

So, after applying the above formula,

The yield to maturity is

= 2.46% × 2

= 4.93%

Differentiate a regular savings account from a CD, a money market fund, and a money market deposit account.

Answers

Savings accounts, money market accounts, and CDs all have different interest rates, limits, benefits, fees, and risk levels. Furthermore, a savings or money market account may be appropriate for short-term savings, whilst a CD is better suited for long-term savings.

Savings accounts, money market accounts, and CDs are all viable options for putting money aside and seeing it grow. These three types of accounts are similar in appearance, yet they function differently and may serve different purposes.

CDs are deposit accounts similar to savings and money market accounts that are offered from banks and credit unions. Both money market funds and CDs provide higher interest rates than ordinary savings accounts.

To learn more on savings account, here:

https://brainly.com/question/3970927

#SPJ1

Cotton On Ltd. currently has the following capital structure: Debt: $3,500,000 par value of outstanding bond that pays annually 10% coupon rate with an annual before-tax yield to maturity of 12%. The bond issue has face value of $1,000 and will mature in 20 years.

Answers

Answer and Explanation:

This question is incomplete. Kindly find the incomplete question here

Ordinary shares: $5,500,000 book value of outstanding ordinary shares. Nominal value of each share is $100. The firm plan just paid a $8.50 dividend per share. The firm is maintaining 4% annual growth rate in dividends, which is expected to continue indefinitely.

Preferred shares: 45,000 outstanding preferred shares with face value of $100, paying fixed dividend rate of 12%

The firm's marginal tax rate is 30%.

Required:

a) Calculate the current price of the corporate bond?

b)Calculate the current price of the ordinary share if the average return of the shares in the same industry is 9%?

c) Calculate the current price of the preferred share if the average return of the shares in the same industry is 10%

The computation is shown below:

a. For the current price of the corporate bond

Before that first we have to determine the after tax yield to maturity i.e

After tax YTM = Before tax YTM × (1 - tax rate)

= 12% × ( 1 - 30%)

= 12% × (1 - 0.3)

= 12% × (0.7)

= 8.4%

Now

Price of bond = Interest × PVIFA(YTM%,n) + Redemption value × PVIF(YTM%,n)

Interest = 1000 × 10% = $100

YTM% = 8.4%

n = 20

PVIFA(YTM%,n) = [1 - (1 ÷ (1 + r)^n ÷ r ]

PVIFA(8.4%,20) = [1 - (1 ÷ (1 + 8.4%)^20 ÷ 8.4%]

= [1 - (1 ÷ (1 + 0.084)^20 ÷ 0.084]

= [1-(1 ÷ (1.084)^20 ÷ 0.084]

= [1 - 0.1993 ÷ 0.084]

= 0.8007 ÷ 0.084

= 9.5327

PVIF(8.4%,20) = 1 ÷ (1 + 8.4%)^20

= 1 ÷ (1.084)^20

= 0.19926

So, the price of bond is

= $100 × 9.5327 + $1000 × 0.19926

= $953.27 + $199.26

= $1,152.52

b)Price of stock = Dividend of next year ÷ (Required rate of return - growth rate )

where,

Growth rate = 4%

Required rate of return = 9%

The Dividend of next year = Dividend paid × (1 + growth rate)

= 8.50 × (1 + 4%)

= 8.50 × (1 + 0.04)

= 8.50 × (1.04)

= $8.84

Thus the price of the stock is

= $8.84 ÷ (9% - 4%)

= $8.84 ÷ 5%

= $176.80

c) Price of preference shares is

= Dividend ÷ Required rate of return

where,

Dividend = 100 × 12% = $12

And, the Required rate of return = 10%

So, the price of preference shares is

= 12 ÷ 10%

= $120

Estate has an ROI of 16% based on revenues of $400,000. the residual income is $14,000 and the investment turnover is 2. what is the hurdle rate? With Explanation

Answers

If Estate has an ROI of 16% based on revenues of $400,000. the residual income is $14,000 and the investment turnover is 2. The hurdle rate is 9%.

How to find hurdle rate?First step is to find the investment turnover using this formula

Investment turnover=Sales/invested capital

Investment turnover = ($14,000 / $400,000) × 2

Investment turnover = 0.035 × 2

Investment turnover =0.07

Second step is to find the hurdle rate using this formula

Hurdle rate = ROI - Investment turnover

Hurdle rate = 0.16 - 0.07

Hurdle rate = 0.09× 100

Hurdle rate = 9%

Therefore the hurdle rate is 9%.

Learn more about hurdle rate here:https://brainly.com/question/29570213?

#SPJ1

604 | Business Statistics 10. If 2A + B = 12 -3 [13 22] and 3A - 4B 7 [2, 10]. 21 11 604 | Business Statistics 10. If 2A + B = 12 -3 [ 13 22 ] and 3A - 4B 7 [ 2 , 10 ] . 21 11

Answers

2A + B = 12 -3 [1,

3 22] ,3A-4B

5A+z5B

How does an employee know how much their paycheck is going to be?

pls help me

Answers

Answer:

There supposed to be given that info when applying for the job or in meeting! hope it helped :))

Apply concepts suppose a friend is trying to decide whether to purchase a car. Use what you know about opportunity cost to help your friend arrived at a wise decision.

Answers

Answer:

see below

Explanation:

Opportunity cost refers to the forfeited benefits as a result of preferring one option over others. When deciding between several choices, one has to weigh the gains associated with each option.

When a choice is made, one foregoes the benefits from the options not preferred. The friend needs money to buy a car. Naturally, they have several options to spend that money other than buying a car. For example, they can invest in stocks, take a holiday, or buy a house. All the alternatives have their uniques benefits. If they buy a car, they forego the advantages of the other options. Opportunity cost is measured as the benefits of the next best alternative

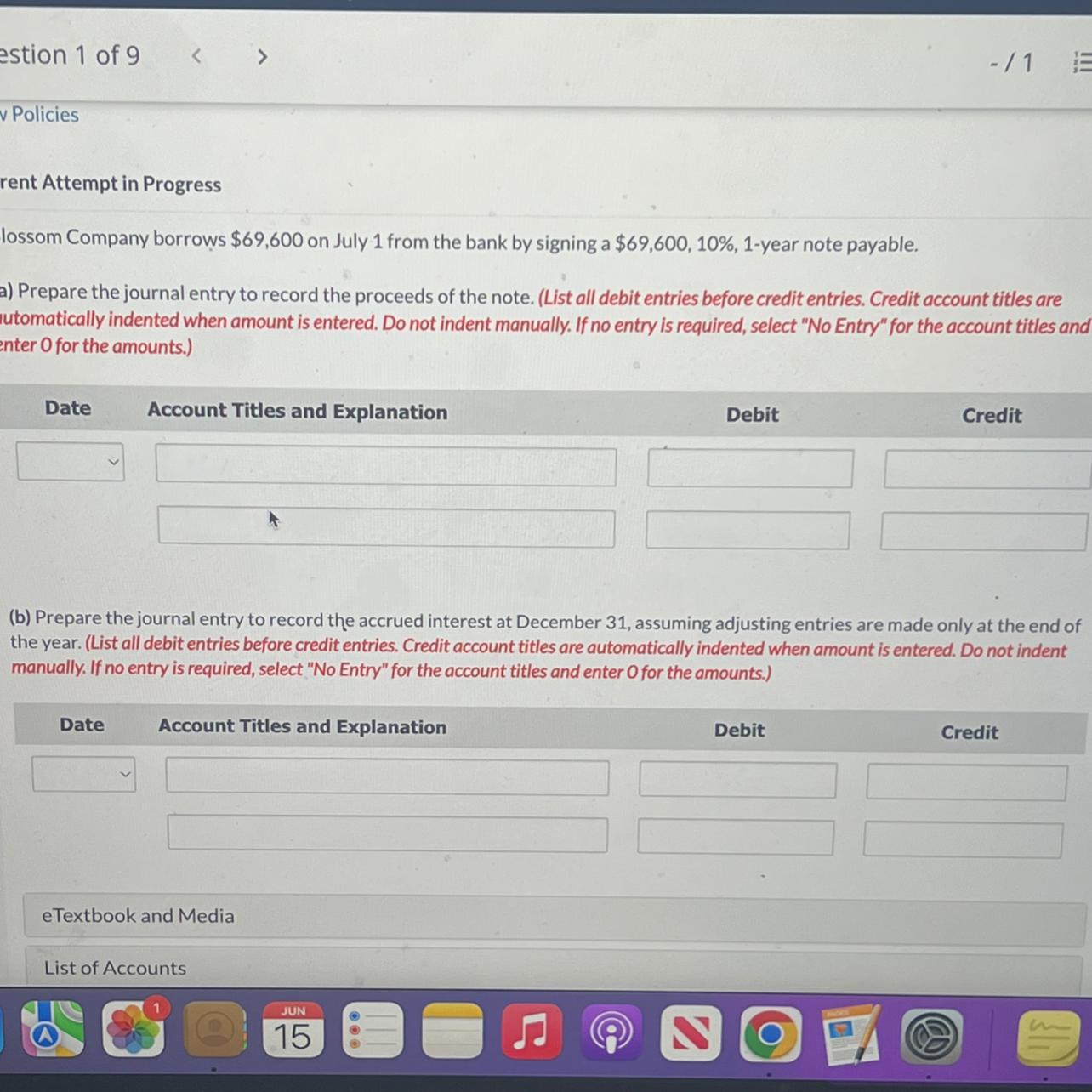

Blossom Company borrows $69,600 on July 1 from the bank by signing a $69,600, 10%, 1-year note payable.

(A) prepare the journal entry to record the proceeds of the note.

(B) Prepare the journal entry to record accrued interest at December 31, assuming adjusting entries are made only at the end of the year.

Answers

To record the proceeds of the note, the following journal entry is made:

Date | Account | Debit | Credit

July 1 | Cash | $69,600 |

| Notes Payable | | $69,600

What is the journal entry to record the proceeds of the note?The company received $69,600 in cash, which is recorded as a debit to the Cash account. The company incurred a liability by borrowing the money, which is recorded as a credit to the Notes Payable account.

To record accrued interest at December 31, the following journal entry is made:

Date | Account | Debit | Credit

December 31 | Interest Expense | $6,960 |

| Interest Payable | | $6,960

Read more about journal entry

brainly.com/question/28390337

#SPJ1

A new app was released providing consumers with digital coupons for products the consumer indicates they frequently purchase. The app gives different users coupons with different values and shares purchasing as well as demographic information with the product manufacturer. Under what circumstances would the information sharing with product manufacturers be ethical?

Answers

The circumstances that the information would be sharing with product manufacturers be ethical when new app was released providing consumers with digital coupons for products the consumer indicates they frequently purchase is if the app's terms of service indicated who they would be sharing information with and what information would be shared.

What is ethics?Ethics can be described as the moral principles which is been set so as to able to govern a person's behaviour as well as to be able to conduct an activity.

It should be noted that every organization that want to be successful must have the ethics which is the guiding principle that will guide their member of the organization as well as the way they carry out their function in the organization.

In conclusion, in dealing with the app as described in the question then the ethics require that app's terms of service must be followed.

Therefore, the first option is correct.

Read more about ethics at:

https://brainly.com/question/24606527

#SPJ1

Check the missing options:

if the app's terms of service indicated that different users would receive different discount values This scenario is never ethical. if the app ensured that their targeting was not discriminatory based on race, ethnicity, gender, age, or disability if the app's terms of service indicated who they would be sharing information with and what information would be shared

If the economy is in an expansionary period, appropriate policies to pursue may include: Group of answer choices an income tax cut that shifts the AD curve to the right. consumer investment incentives that shift the AD curve to the right business investment incentives that shift the AD curve to the left. a reduction in government spending that shifts the AD curve to the left.

Answers

Answer:

curve to the right business investment incentives

The result of your Monte Carlo simulation for the Present Worth of a project is a normal distribution with a mean of $575,234 and a standard deviation of $10,245. If your boss tells you that in order to be successful, the Present Worth needs to exceed $560,000. What is the chance that the project will NOT succeed

Answers

Answer:

6.85%

Explanation:

Mean = 575,234

Standard deviation = 10,245

Project will be successful when PV > 560,000

For not getting success, PV < 560,000

P (X < 560,000) = P (Z < (560,000-575,234)/10,245)

P (X < 560,000) = P (Z < -1.48697)

P (X < 560,000) = 0.0685

P (X < 560,000) = 6.85%

Therefore, the chance that the project will NOT succeed is 6.85%

A firm has a P/E ratio of 12 and a ROE of 13% and a market to book value of what?

Answers

Answer:

1.56

Explanation:

Calculation for the market-to-book value

First step is to calculate for the P/E ratio

P/E ratio=1/12

P/E ratio= 0.0833

Now let find the market-to-book value using this formula

Market-to-book value = ROE percentage/P/E ratio

Let plug in the formula

Market-to-book value=0.13/0.0833

Market-to-book value= 1.56

Therefore the Market-to-book value will be 1.56

The market to book value is 1.56.

The calculation is as follows:

ROE = Net income ÷ Book Value of shareholders equity

P/E = (Price per share ) ÷ (EPS per share)

or P/E = Market Capitalization ÷ Net Income

So,

12 = Price ÷ Net Income

Price = 12 Net Income-------------Equation 1

Now

0.13 = Net Income ÷ Book Value of shareholders equity

Book Value = Net Income ÷ 0.13----------------Equation 2

Now

Market/ Book Value = 12 Net Income ÷ Net Income/0.13

= 12 × 0.13

= 1.56

Learn more; https://brainly.com/question/17429689?referrer=searchResults