Fine print contains what? A. Only stuff lawyers require B. A bunch of useless info C. Clear language designed to be easy to read D. Virtually all of the important info in an agreement. Which is it?

Answers

Answer:

D

Explanation:

A fine print is a term that refers to the business usage of the terms and the conditions.

Have important information regarding the company or the documents that are placed in the footnotes and they are essential for entering into an agreement.Hence the option D is correct.

Learn more about the Fine print contains what.

brainly.com/question/21740513.

Related Questions

Now, the CEO has provided you with a revised set of KPIs. You need to apply these KPIs toward the analysis of a proposed marketing and sales initiative to increase loyalty card memberships in neighborhoods with predominantly low-income populations, whether the populations are in rural, suburban, or city locations. The CEO wants this analysis so that she can chart the sustainability and growth of the initiative while assuring it meets standards for Corporate Social Responsibility. The CEO has provided you with several documents, available in the Supporting Materials section of this project. She wants you to use the provided Triple Bottom Line Balanced Scorecard to assess the strategic plan’s compliance with the KPIs and summarize your findings in a memo. Directions Complete the following to provide the analysis required by the CEO: Identify the financial records that indicate commitment to TBL. Outline which financial and other records marketing and sales maintains where TBL can provide data. Using the TBL scorecard, evaluate the alignment of the strategic plan with KPIs. Remember, there may be multiple outcomes of this exercise. Your focus should be to apply your understanding of the scenario and evaluate the plan accordingly. Which ideas in the plan support the KPI criteria? Cite specific ideas that meet the criteria. Explain how they meet the criteria. In your memo: Describe how the TBL data relates to the KPIs. Identify which additional TBL financial line items are needed to measure the cost for each criterion. For example, should there be a line entry for hiring temporary workers? Referring back the SWOT analyses from Project One, explain how functional considerations of individual departments contribute to financial performance.

Answers

The financial records that indicate commitment to TBL include the Profitability and Customer satisfaction.

What are the financial records and their commitment ?The following financial records indicate a commitment to TBL:

Profitability: The company's goal is to increase profits by 10% in the next year. Customer satisfaction: The company's goal is to increase customer satisfaction by 5% in the next year. Environmental sustainability: The company's goal is to reduce its environmental impact by 10% in the next year.The following financial and other records can provide data for TBL analysis:

Sales data: Sales data can be used to track the company's progress towards its goal of increasing profits.Customer satisfaction data: Customer satisfaction data can be used to track the company's progress towards its goal of increasing customer satisfaction.Environmental impact data: Environmental impact data can be used to track the company's progress towards its goal of reducing its environmental impact.The strategic plan is aligned with the KPIs in the following ways:

Profitability: The strategic plan includes a number of initiatives that are designed to increase profits, such as increasing sales and reducing costs.Customer satisfaction: The strategic plan includes a number of initiatives that are designed to increase customer satisfaction, such as improving customer service and offering loyalty programs.Environmental sustainability: The strategic plan includes a number of initiatives that are designed to reduce the company's environmental impact, such as using more sustainable materials and reducing energy consumption.The following ideas in the plan support the KPI criteria:

Increasing sales in low-income neighborhoods: This initiative will help to increase profits and customer satisfaction.Offering loyalty programs: This initiative will help to increase customer satisfaction and retention.Find out more on financial records at https://brainly.com/question/25832812

#SPJ4

The financial documents that demonstrate dedication to the Triple Bottom Line (TBL) encompass the aspects of profitability and customer satisfaction.

The CEO has introduced a revised set of Key Performance Indicators (KPIs) that requires the application of the Triple Bottom Line (TBL)

1) Balanced Scorecard to assess a marketing and sales initiative focused on increasing loyalty card memberships in low-income neighborhoods. The initiative aims to align with TBL principles and Corporate Social Responsibility (CSR) standards. The financial records indicating commitment to TBL encompass the environmental, social, and economic impacts of the business, including operational costs, revenue, taxes, fees, capital expenditures, innovation investments, and sustainability initiatives.

2) Marketing and sales maintain various financial and other records that provide data relevant to TBL. These records include customer demographics, sales revenue, marketing expenses, cost per customer acquisition, retention rate, satisfaction rate, customer lifetime value, environmental footprint (such as carbon emissions, waste reduction, and energy consumption), and social impact (like job creation, community engagement, and stakeholder involvement).

3) The evaluation of the strategic plan's alignment with KPIs using the TBL scorecard considers the economic, social, and environmental dimensions. Each dimension assesses the initiative's impact on financial performance, stakeholders, and the natural environment. The strengths and weaknesses of the initiative are identified, and recommendations for improvement are provided.

4) The plan includes ideas that support the KPI criteria, such as providing discounts and free samples to low-income customers, hiring local staff, and partnering with community organizations. These ideas contribute to economic benefits through increased revenue and profit, social benefits by improving customer engagement and satisfaction, and environmental benefits by reducing waste and emissions.

5) In the memo, the TBL data is described as providing a framework for evaluating the initiative's impact on the economic, social, and environmental dimensions. The data informs decision-making and measures the success of the initiative.

6) Additional TBL financial line items needed to measure costs for each criterion may include marketing, advertising, promotions, customer acquisition, retention, and loyalty program costs. Comparing the total cost of the initiative to generated revenue and its economic impact is crucial.

7) Functional considerations of individual departments contribute to financial performance by optimizing resources, technology, personnel, and operational procedures. Leveraging strengths, addressing weaknesses, exploring opportunities, and mitigating threats enhance the efficiency and effectiveness of the initiative.

Learn more about Financial Records from the given link:

https://brainly.com/question/10677328

#SPJ11

terrance, age 47, withdrew $22,000 from an employer-sponsored qualified retirement plan to pay for a new rv. compute the tax cost (and premature withdrawal penalty, if applicable) of the withdrawal if terrance has a 37% marginal tax rate on ordinary income. Tax Cost is_____?

Answers

If terrance, age 47, withdrew $22,000 from an employer-sponsored qualified retirement plan to pay for a new rv. The tax cost is: $10,340.

How to find the tax cost?Using this formula to find the tax cost

Tax cost=(Amount withdrew × Marginal tax)+ Premature withdrawal penalty

Let plug in the formula

Tax cost=x ($22,000 × 37%) + $2,200

Tax cost=$8,140+$2,200

Tax cost=$10,340

Therefore the tax cost is is the amount of $10,340.

Learn more about tax cost here:https://brainly.com/question/16907879

#SPJ1

Explain why having a good accountant is important for a large business. What does an accountant do? Do some research to find out. What might happen to a business if they did not have an accountant?

Answers

Answer:

Having a good accountant if you own a large business is important because any mistakes could be detrimental in the long run and upset clients.An accountant takes care of all finances, If a business did not have an accountant it would most likely take a turn for the worst.

-Hope i helped :D

How do your parent(s) or guardian(s) and your own spending and saving habits

compare and contrast from one another? Write the similarities and differences.

Answers

Answer:

I spend more than them ngl lol dead

Explanation:

My parents are the ones who pay for the gas, bills, buying groceries, and other necessities using the money that they earn. I save all the money I earn from my job and seldom buy stuff compared to my parents. The few purchases I made were not necessary for me to survive, but I really wanted it. My parents and I always consider the price of something before we buy it so as to not waste money. Also, we always try to save up some of our money as well.

Typically, firms start exporting to a country via an agent, later establish a sales subsidiary, and eventually, in some cases, begin production in the host country. True or False.

Answers

The statement "Typically, firms start exporting to a country via an agent, later establish a sales subsidiary, and eventually, in some cases, begin production in the host country" is true.

Why do firms establish sales subsidiary?Firms establish sales subsidiary to develop their business, to create new markets, to maintain or increase their market share, and to increase their profits in the host country.

The firms can start exporting to a country via an agent to get started with sales in a new location.

By utilizing an agent, the firm can avoid most of the risks associated with exporting.

The process of exporting via an agent will help a firm to learn about the market in the host country, the import regulations, the local customers, and the competition.

After gaining experience and a better understanding of the market, the firm may choose to establish a sales subsidiary in the host country.

To know more about maintain or increase refer here

https://brainly.com/question/29809410#

#SPJ11

select the agency or method (direct) that is used to collect royalties for a mechanical license. a. a public performance organization (ascap), (b.m.i.), (gmr), or (s.e.s.a.c.) b. the harry fox agency (h.f.a.) c. the william morris agency the mechanical licensing collective (m.l.c.) d. sound exchange the recording industry association of america (r.i.a.a.) e. no representation organization/license must be acquired with direct negotiations.

Answers

The correct answer is option B, The Harry Fox Agency (HFA). HFA is an organization that helps to secure and administer mechanical licenses for the reproduction of copyrighted works.

It works directly with copyright owners and publishers to collect royalties for mechanical licenses, and acts as a middleman between the two parties to ensure that the copyright owners are paid properly for the usage of their works. HFA also works with digital service providers to help them acquire the proper mechanical licenses for their content. In addition, it provides services for registration and tracking of copyrighted works and royalty payments. The other options listed in the question are all organizations that provide services related to public performance, such as collecting performance royalties from radio, TV, clubs, etc. They are not responsible for mechanical licenses.

For more questions on licenses

https://brainly.com/question/10719460

#SPJ11

payments to tax-deferred pension and retirement savings plans True or false?

Answers

True, payments to tax-deferred pension and retirement savings plans are tax-deductible.

Payments made to tax-deferred pension and retirement savings plans are generally tax-deductible. These plans, such as 401(k) plans, Individual Retirement Accounts (IRAs), and other similar programs, offer individuals the opportunity to contribute a portion of their income towards retirement savings on a pre-tax basis.

The tax-deductible nature of these contributions means that individuals can reduce their taxable income by the amount they contribute to these plans. By deducting the contributions from their taxable income, individuals can potentially lower their overall tax liability for the year.

For example, if an individual earns $50,000 per year and contributes $5,000 to a tax-deferred retirement plan, their taxable income for that year would be reduced to $45,000. This reduction in taxable income can result in a lower tax bill, as the individual is only taxed on the remaining $45,000.

However, it's important to note that taxes on these contributions are deferred, not eliminated. When individuals withdraw funds from these tax-deferred retirement plans during their retirement years, the withdrawals are then subject to income tax at the applicable tax rates.

Payments to tax-deferred pension and retirement savings plans are indeed tax-deductible. This feature allows individuals to lower their taxable income and potentially reduce their overall tax liability during their working years. It's important to consult with a tax advisor or financial professional to understand the specific rules and limitations associated with different retirement savings plans and their tax implications.

To know more about payments , visit

https://brainly.com/question/28424760

#SPJ11

EXPLAIN THE FOLLOWING SITUATION BASED FROM YOUR OBSERVATION.

A. FAMILY LIFE

B.PEACE AND ORDER

C.ENVIRONMENTAL CONDITION

D.POLITICS

E.ECONOMY

F. HEALTH

G. JOBS AND EMPLOYMENT

Answers

Answer:

Explanation:

A. Family life refers to the relationships and dynamics within a family. It includes factors such as communication, love and support, discipline, and responsibilities within the family.

B. Peace and order refers to the level of stability, security, and safety within a community or society. It is maintained through laws, law enforcement, and social norms.

C. Environmental condition refers to the state of the natural surroundings, including air quality, water quality, and the presence of natural resources. It also includes the impact of human activities on the environment.

D. Politics refers to the systems and processes by which a society is governed, including the formation and exercise of power, decision-making, and the distribution of resources.

E. Economy refers to the production, distribution, and consumption of goods and services within a society. It includes factors such as employment, trade, and the level of wealth within a society.

F. Health refers to the physical and mental well-being of individuals and communities. It includes factors such as access to healthcare, nutrition, and hygiene.

G. Jobs and employment refer to the availability and conditions of work within a society. It includes factors such as the unemployment rate, the types of jobs available, and the wages and benefits offered by employers.

Malcolm has decided that he wants to open up his own law practice. The time has come to establish prices for his services. Due to his extensive experience and legal background, he believes that his fees should not relate directly to the time or effort spent on specific cases. Now that Malcolm has chosen the pricing strategy he wants to use, what is his next step

Answers

Answer:

determining the final price

Explanation:

In the given scenario Malcolm wants to use a pricing strategy that relies on his extensive experience and legal background rather than on time or effort spent on cases.

So he is promoting a higher quality of legal representation compared to other firms.

The next step in his pricing strategy will be to set the final price he wants to.offer his services.

This should be done by taking note of other law firms operating in the same community. A price that is too high will drive customers to competitors.

When making decisions, managers often must decide between doing what is beneficial for the firm in the short term, and what is beneficial for both the firm and society in the long term. To address this conflict, a firm must

Answers

When making decisions, managers are often faced with a conflict between what is beneficial for the firm in the short-term and what is beneficial for both the firm and society in the long-term.

This conflict arises because the actions that benefit the firm in the short-term may not necessarily align with the interests of society as a whole, which can lead to negative consequences for both the company and society in the long-term.

To address this conflict, a firm must adopt a long-term orientation and consider the broader social and environmental impacts of its decisions. This means looking beyond immediate financial gains and recognizing that actions taken today can have far-reaching implications for the company's reputation, customer loyalty, employee morale, and overall sustainability.

Firms that prioritize social responsibility and sustainable business practices are more likely to build strong relationships with stakeholders, including customers, employees, investors, and regulators. They are also better equipped to weather economic downturns and other disruptions, as they have diversified their risk and invested in building resilient supply chains and communities.

Ultimately, the key to addressing the conflict between short-term gains and long-term benefits is a commitment to corporate social responsibility (CSR) and sustainable business practices. By prioritizing the needs of society and the environment alongside those of shareholders, firms can create value for all stakeholders over the long-term, ensuring their continued success and impact.

learn more about managers here

https://brainly.com/question/32150882

#SPJ11

Step 3: Creating a Balanced Family Budget

a) Search for a "family budget estimator" and calculate the monthly expenses for a family living

in your city.

Insert a screenshot of the calculator you used, as well as all of the information you entered

into it. If you are unable to insert a screenshot, then list the information below. (10 points)

b) State the minimum monthly income and hourly wage per worker needed to cover monthly

expenses for the family you used in part a. Then, explain how to calculate the hourly wage

Show we’re u found your information

Answers

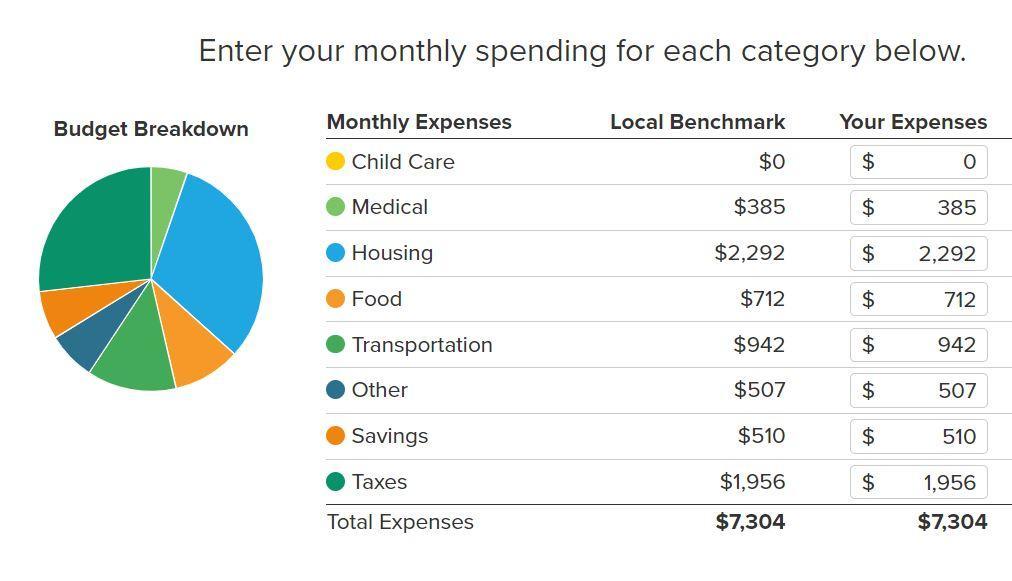

The family budget calculator use is attached accordingly. See relevant definition below.

What is the minimum monthly income and hourly wage per worker required to cover the monthly expenses indicated in the budget?The total budget indicated is $7,304. Hence to cover for the above expenses, one would need to work for at least 8 hours per day, and 5 days a week at the minimum income wage of $50 dollars/Hour.

This translates to:

50 x 8 x 20

= $8,000

What exactly is a family budget?A family budget is a plan for your household's incoming and outgoing funds for a specific time period, such as a month or year.

What is the definition of a Family Budget Calculator?The Family Budget Calculator calculates the amount of money required for a family to maintain a modest but decent level of life.

The budgets project community-specific expenses for ten different family types (one or two adults with zero to four children) across all counties and metro regions in the United States.

Learn more about Family Budget Calculator:

https://brainly.com/question/9621657

#SPJ1

In which type of economy is a business owner most likely to benefit from free enterprise?

Answers

hope this helps

Answer:

Sole proprietorship

Explanation:

I’m not 100% sure but it’s a sole individual business

Sarah started working this year. She is single with no children and hasn't earned much money. Money has been taken out of each paycheck for federal taxes. To see if she gets a refund from the IRS, what should Sarah do?

Answers

In United states, the Form 1040 are used by U.S. taxpayers to file an annual income tax return, hence, it should be filled by Sarah to gets a refund from the IRS, if there is any.

What is a tax refund?This refers to the reimbursement made to the taxpayers who have overpaid their taxes often due to having employers withholding too much from paychecks.

An example of an Income tax refund is when the excess tax paid by the taxpayer is refunded back by the Income Tax Department. E.g. Tax payable = $10,000 but paid $15,000, the tax return will equals $5,000.

Here, the case is different because there are no excess tax remittance, hence, the claim for tax refund is baseless.

Read more about tax refund

brainly.com/question/25849488

#SPJ1

in voluntary exchange, if the seller of a product gains, group of answer choices the buyer will generally lose an amount greater than the gain to the seller. the buyer must lose an amount equal to what the seller gains. someone else must lose an equal amount. the buyer must also gain; mutual gain provides the foundation for exchange.

Answers

In voluntary exchange, if the seller of a product gains the buyer must also gain.

The foundation of modern mainstream economics is the idea of voluntary exchange, which is a key tenet of classical and neoclassical economics. That is, neoclassical economists presume that voluntary exchange occurs when they think about the universe.

Based on this premise, neoclassical economics goes on to draw a number of significant conclusions, including the efficiency of market activity, the net benefits of free trade, and the fact that economic agents benefit from participating in markets freely. Notably, neoclassical economists reject the Marxist notion of labor exploitation as a possibility within neo classically defined capitalism because they base their theories on the assumption of voluntary exchange.

Learn more about voluntary exchange at

https://brainly.com/question/18108423?referrer=searchResults

#SPJ4

If a salesperson sells 34 pairs of jeans, 126 t-shirts, and 40 jackets, what fraction of the total number of items sold do the jackets represent? Reduce the fraction.

Answers

Answer:

1/5

Explanation:

34 + 126 + 40 = 200

40 jackets so 40/200

40/200 = 1/5 or one fifth

An increase in the price level will cause a ______________ the aggregate demand curve.

Answers

An expansion in the value level will cause a movement up along the aggregate demand curve.

The option (A) is correct.

As per the standard aggregate demand-aggregate supply (AD-AS) model, the total interest bend addresses the connection between the general cost level and the amount of genuine Gross domestic product requested in an economy. The total interest bend has a descending slant, demonstrating a reverse connection between the cost level and the amount of genuine Gross domestic product requested.

At the point when the cost level increments, it lessens the buying force of purchasers and builds the expense of creation for firms. Thus, the amount of genuine Gross domestic product requested diminishes, and there is a development up along the total interest bends to a lower level of result and consumption.

Learn more about aggregate demand curve:

https://brainly.com/question/31260219

#SPJ4

This question is not complete, Here I am attaching the complete question:

An increase in the price level will cause a ______________ the aggregate demand curve.

(A) movement up along

(B) rightward shift of

(C) leftward shift of

Consider the following data: The money supply in $2trillion, the price level equals 2, and real GDP is $5 trillion in base-year dollars. What is the income velocity of money?

Answers

The money supply is $2 trillion, the price level equals 2, and the real GDP is $5 trillion in base-year dollars. The income velocity of money is 5.

To calculate the income velocity of money, you can use the equation:

Income Velocity of Money = Nominal GDP / Money Supply

Given the data:

Money Supply = $2 trillion

Price Level = 2

Real GDP (Base-year dollars) = $5 trillion

To calculate the Nominal GDP, we multiply the Price Level by the Real GDP:

Nominal GDP = Price Level * Real GDP

Nominal GDP = 2 * $5 trillion

Nominal GDP = $10 trillion

Now, we can calculate the income velocity of money:

Income Velocity of Money = Nominal GDP / Money Supply

Income Velocity of Money = $10 trillion / $2 trillion

Income Velocity of Money = 5

Therefore, the income velocity of money in this scenario is 5.

Learn more about Money supply: https://brainly.com/question/3625390

#SPJ11

refer to table 17-8. if player b chooses right, player A should choose

a.

Up and earn a payoff of 1.

b.

Middle and earn a payoff of 5.

c.

Middle and earn a payoff of 7.

d.

Down and earn a payoff of 4.

Answers

Table 17-8 represents a two-player game with Player A and Player B. If Player B chooses the right option, Player A should choose the Middle option, with a payoff of 7. The Correct option is B

This is the option that yields the highest payoff for Player A when Player B chooses the right option. The payoff matrix shows that if Player A chooses the Middle option, they will earn 7, which is higher than the payoff of 5 for the Middle option and 4 for the Down option.

The Up option offers the lowest payoff of 1, which is not a desirable choice for Player A. Therefore, to maximize their payoff, Player A should choose the Middle option.

Learn more about highest payoff

https://brainly.com/question/31850503

#SPJ4

The boss at your company wants a way to block certain websites from employees. as the sole it professional at the company, what can you set up to help with this request?

Answers

Explanation:

1. You can set up awards to people who heed to the request.

2. You can meet the owner of the websites to restrict certain people from the website and you can make a deal with them.

quality assurance programs have been successful in many manufacturing environments because they increase workers’ autonomy over the work process.

Answers

False. It has been less successful because the employees have no control over the process.

What are Quality Assurance programs?

Quality Assurance (QA) programs are processes used to ensure that products and services meet certain standards of quality. Quality assurance programs involve implementing specific quality assurance activities, such as creating quality standards, inspecting products, and testing services. Quality assurance programs are part of an overall quality management system that helps organizations ensure that their products or services meet customer requirements.

What do you mean by Autonomy?

Autonomy is the ability to think and act independently. It is the freedom to make decisions without external influence, to act without having to rely on someone else, and to take responsibility for one's own actions. Autonomy can also refer to self-governance, or the ability to make decisions without the need for guidance or approval from others.

To know more about Quality Assurance (QA) programs,

https://brainly.com/question/13876752

#SPJ1

Look for _____ in research information showing preferential treatment or consideration regardless of legitimate reasoning.

credibility

relevance

bias

additional sources

Answers

Answer:

bias

Explanation:

bias is the true anwer

(e) Choose the gerund form of the verb from the following.

(1) swim (ii) swimmer (ii) swam

(iv) swimming

Answers

Answer:

I believe the answer is swimming. I apologize if it is not. I hope this helped a little.

The Human Resources Director of a large corporation wishes to develop an employee benefits package and decides to select 500 employees from a list of all (N=40,000) workers in order to study their preferences for the various components of a potential package. All the employees in the corporation constitute the A) a statistic. B) a population. C) a sample. D) a parameter. 2) The Human Resources Director of a large corporation wishes to develop an employee benefits package and decides to select 500 employees from a list of all (N=40,000) workers in order to study their preferences for the various components of a potential package. The 500 employees who will participate in this study constitute the A) a statistic. B) a population. C) a sample. D) a parameter. 3) The Human Resources Director of a large corporation wishes to develop an employee benefits package and decides to select 500 employees from a list of all (N=40,000) workers in order to study their preferences for the various components of a potential package. The Director will use the data from the sample to compute A) a statistic. B) a population. C) a sample. D) a parameter. 4) The Human Resources Director of a large corporation wishes to develop an employee benefits package and decides to select 500 employees from a list of all (N=40,000) workers in order to study their preferences for the various components of a potential package. Information obtained from the sample will be used to draw conclusions about the true population A) a statistic. B) a population. C) a sample. D) a parameter. 5) The Human Resources Director of a large corporation wishes to develop an employee benefits package and decides to select 500 employees from a list of all (N=40,000) workers in order to study their preferences for the various components of a potential package. In this study, methods involving the collection, presentation, and characterization of the data are called A) descriptive statistics. B) inferential statistics. C) a parameter. D) a statistic 6) The Human Resources Director of a large corporation wishes to develop an employee benefits package and decides to select 500 employees from a list of all (N=40,000) workers in order to study their preferences for the various components of a potential package. In this study, methods that result in decisions concerning population characteristics based only on the sample results are called A) descriptive statistics. B) inferential statistics. C) a parameter. D) a statistic

Answers

1) C) a sample.

2) C) a sample.

3) A) a statistic.

4) B) a population.

5) A) descriptive statistics.

6) B) inferential statistics.

1) In the given scenario, all the employees in the corporation constitute the population. However, the Human Resources Director selects a subset of 500 employees from the entire population. This selected subset represents a smaller group taken from the larger population, which is known as a sample.

2) The 500 employees who will participate in the study represent a specific group chosen from the entire population. Since they constitute a subset of the population, they are considered a sample.

3) The Director will use the data collected from the sample of 500 employees to compute various measures and statistics, such as averages, proportions, or other numerical summaries. These computed values are specific to the sample and are known as statistics.

4) The information obtained from the sample of 500 employees will be used to draw conclusions or make inferences about the entire population of workers in the corporation. Therefore, the focus is on making statements about the true population characteristics, which makes it a population.

5) In this study, the methods used for collecting, presenting, and summarizing the data gathered from the sample of 500 employees are referred to as descriptive statistics. Descriptive statistics involve techniques such as calculating averages, creating charts or graphs, and summarizing the data to provide a clear understanding of the sample.

6) The methods that result in making decisions or drawing conclusions about the population characteristics based on the results obtained from the sample are known as inferential statistics. Inferential statistics involve using sample data to make inferences or generalizations about the larger population. These techniques allow us to estimate parameters, test hypotheses, and make predictions about the population based on the information obtained from the sample.

Learn more about descriptive statistics.

brainly.com/question/33359367

#SPJ11

A downward sloping demand curve can be explained by i. diminishing marginal utility. ii. diminishing marginal returns. iii. the substitution effect. iv. the income effect.

Answers

A downward sloping demand curve can be explained by i. diminishing marginal utility, iii. the substitution effect, and iv. the income effect.

A downward sloping demand curve can be explained by i. diminishing marginal utility, iii. the substitution effect, and iv. the income effect.

1. Diminishing marginal utility: This refers to the idea that as a consumer consumes more of a good, the additional satisfaction (or utility) they gain from each additional unit decreases. This causes the demand curve to slope downward because consumers are less willing to pay a high price for additional units of the good.

2. Substitution effect: As the price of a good increases, consumers may choose to substitute it with other similar goods that are relatively less expensive. This causes the demand curve to slope downward because an increase in price results in a decrease in the quantity demanded as consumers switch to alternative products.

3. Income effect: When the price of a good decreases, consumers' real income effectively increases (since they can now purchase more of the good with the same amount of money). As a result, consumers may choose to buy more of the good, causing the demand curve to slope downward as lower prices lead to an increase in the quantity demanded.

Note that option ii. diminishing marginal returns is not relevant to the demand curve, as it refers to the production side of the economy (i.e., how output changes as additional units of input are used in production).

To know more about downward sloping demand curve

visit:

https://brainly.com/question/29749119

#SPJ11

An S corporation does not recognize a loss when distributing assets that are worth less than their basis. a) True b) False.

Answers

b) False. An S corporation does recognize a loss when distributing assets that are worth less than their basis.

When an S corporation distributes assets with a fair market value lower than their adjusted basis, it results in a loss for the corporation. This loss can be recognized and used to offset other income or gains of the S corporation, reducing its taxable income. It is important to note that shareholders of the S corporation may have limitations on deducting the loss on their personal tax returns. Loss refers to a financial outcome where the expenses or costs incurred by an individual, business, or entity exceed the revenue or income generated. It represents a negative result in terms of financial performance. Losses can occur in various contexts, such as in business operations, investments, or personal finances. In business, losses can result from factors such as low sales, high expenses, inefficient operations, or unfavorable market conditions. They can impact profitability and financial stability, and businesses often aim to minimize or mitigate losses through strategic planning, cost control, and risk management.

Learn more about loss here:

https://brainly.com/question/32732940

#SPJ11

True or False: When land with an old building is purchased as a future building site, the cost of removing the old building is part of the cost of the new building.

Answers

False, when land with an old building is purchased as a future building site, the cost of removing the old building is not a part of the cost of the new building.

In cost accounting usually, the price of demolishing the old building is counted separately from the price of building a new one. This is due to the fact that the expense of demolishing the old structure is typically incurred prior to beginning new construction.

The price of demolishing the old structure may also include costs for clearing the site of debris and preparing it for construction. The majority of the time, these expenses are thought of as being part of the site development costs, which are distinct from the construction costs.

Costs associated with utility connections, grading, and excavation can also be included in site development costs. The cost of constructing the new building can then be estimated based on the design and specifications of the building after the site has been cleared and prepared. This price usually includes labor, materials, and any fees or permits required.

Learn more about cost accounting at:

https://brainly.com/question/27960900

#SPJ4

Suppose General Electric payed its line workers $12 per hour

Answers

The relevant answers with regard to real wages are as follows:

A) $10.08

B) 10.89

C) 19.05. See explanation below.

What is the computation justifying the above results?[A]

Recall that Real Wages are computed as follows;

Real Wages = (Nominal Wage/CPI in the Given Year) x CPI in the base year

12 = (N/84) x 100

= 10.08

[B]

The formula for real wage still stands:

Hence,

12 x 1.08 = (N/84) x 100

= 10.89

One thing to keep in mind is that the percentage rise in real wages is always equal to the percentage increase in nominal wages. The same may be demonstrated with other values.

[C]

It is to be noted that the real wage is pegged at $12 which is same from the prior year.

Hence, percentage increase = 0

But because $12 is Nominal in the incumbent year,

[(12 - 10.08)/10.08] x 100

= 92/10.08

= 19.05

What is real wages?Real wages are earnings adjusted for inflation, or pay expressed in terms of the quantity of goods and services that may be purchased. In contrast to nominal wages or unadjusted wages, this word is used.

Learn more about real wages:

https://brainly.com/question/22683172

#SPJ1

Full Question:

Suppose General Electric paid its line workers $12 per hour in 2015 when the Consumer Price Index was 100. Suppose that deflation occurred and the aggregate price level fell to 84 in 2016. Instructions: Round your answers to two decimal places. a. GE needed to pay its workers $ in 2016 in order to keep the real wage fixed at $12. b. GE needed to pay its workers $ in 2016 if it wanted to increase the real wage by 8 percent. c. If GE kept the wage fixed at $12 per hour in 2016, in real terms, its workers got a % increase in wages.

When Elaine accepted a position with Cannon Corporation in Dallas, Texas, she felt uneasy. She was new to the area and new to this company. However, she was pleased that her new job offered her the opportunity to play on the company volleyball team. She quickly made new friends and, through her new friends, learned about the city. Apparently, her new job satisfies Elaine's ________ needs.

A. physiological

B. esteem

C. social

D. self-actualization

Answers

Answer:

Social needs

Explanation:

In simple words, After physiological and safety requirements have been met, social needs refer to the need to form relationships with others. Because our interactions with everyone assist us minimize emotional problems such as sadness or worry, Maslow regarded the social stage to be an essential element of psychological development.

Thus, from the above we can conclude that the correct option is C.

what is the main distinguishing factor between accountants and bookkeepers?

Answers

The main distinguishing factor between accountants and bookkeepers is the level of education, training, and expertise required for their respective roles.

Bookkeepers are responsible for recording and maintaining the financial transactions of a business or organization.

This typically involves tasks such as recording daily transactions, reconciling bank accounts, and generating basic financial reports.

Bookkeepers are generally not involved in the analysis or interpretation of financial data, and their work is primarily focused on ensuring accurate recordkeeping.

Accountants, on the other hand, are trained professionals who have a more comprehensive understanding of financial reporting and analysis.

They may perform some of the same tasks as bookkeepers, such as preparing financial statements and reconciling accounts, but they also provide more in-depth financial analysis and advice.

Accountants are responsible for interpreting financial data and using it to provide guidance to businesses or organizations. They may also be involved in tax planning and preparation, auditing, and other financial management tasks.

Read more about accountants and bookkeepers.

https://brainly.com/question/31229157

#SPJ11

just say sum and ill give you alot of points⇒⇒⇒⇒