HELP!!!!!!Match the job role with the job title.

Evaluate student

applications for

financial aid.

Review financial records

of large businesses

and corporations.

Gather evidence and

prepare for court.

Review policies and grant

funds to students in need.

Conduct research

that is pertinent

to a criminal case.

Review tax documents

and returns for errors

and inaccuracies.

Internal Revenue Investigator

Federal Aid Coordinator

Paralegal

Answers

Answer:

Internal revenue investigator: Review Tax Documents, Review financial records.

Federal Aid Coordinator: Evaluate Student Applications, Review policies and grant funds.

Paralegal: Conduct research that is pertinant to a criminal case, gather evidence and prepare for court

Explanation:

Answer:

answer down below

Explanation:

Related Questions

Privacy laws include governing what

Answers

Jermaine is thinking about attending college. However, he knows that he could get a jot right out of high school making about $18,000 a year. He could also work part time while attending four years of college and make $7,000 a year. Assuming grants will pay for his college, how long will it take Jermaine to recover his lost wages if he chooses to to college and will make $40,000 a year with his degree?

Answers

It would take Jermaine approximately 1.1 years after completing college to recover his lost wages if he chooses to attend college and earns $40,000 per year with his degree.

If Jermaine chooses to attend college, he will forego four years of potential earnings, as he could have made $18,000 per year working right out of high school.

However, if he decides to work part-time during college, he can still earn $7,000 per year. This means that each year, he would miss out on $18,000 - $7,000 = $11,000 in potential income.

Assuming grants cover his college expenses, upon graduating, Jermaine would start earning $40,000 per year with his degree. To calculate the time it would take for him to recover his lost wages, we divide the total lost income by his yearly salary after graduation.

The total lost income over four years of college is $11,000 x 4 = $44,000. To recover this amount, Jermaine needs to earn $44,000 / $40,000 = 1.1 years after graduation.

Therefore, it would take Jermaine approximately 1.1 years after completing college to recover his lost wages if he chooses to attend college and earns $40,000 per year with his degree.

For more such questions on wages

https://brainly.com/question/27888413

#SPJ11

if erik is indifferent about these three investment options, and he thinks that they are worth the same to him. therefore, which of the following statements is true about erik?

a. He is risk-neutral. b. He is risk-averse. c. He is risk-loving. d. None of the above

Answers

Based on Erik's indifference towards the three investment options and considering them equally valuable, the statement "He is risk-neutral" is true.

Erik's indifference towards the three investment options suggests that he assigns equal value to each option. In this context, being risk-neutral means that Erik does not have a preference for one investment option over another based on their potential risks or returns. He is indifferent to the level of risk associated with each option and is solely focused on their overall worth.

Being risk-neutral implies that Erik's decision-making is not influenced by the level of risk involved. He is willing to accept any level of risk as long as the options are valued the same. This attitude indicates a neutral stance towards risk, as Erik's decision-making is solely based on the perceived value of the investments rather than their associated risks.

Therefore, among the given options, the statement "He is risk-neutral" accurately characterizes Erik's attitude towards the investment options.

Learn more about investment here:

https://brainly.com/question/29547577

#SPJ11

What conditions would affect how much people would use your business?

The business is and Ice Cream Shop.

Answers

Answer:

restaurant

like pandemic all small restaurant is closed the business is bankcrap

harmful substances which contaminate water are collectively called

Answers

Answer:

Ground Water Contamination

Explanation:

I'll be honest I'm not 100% sure.

How have tariff rates for manufactured goods been affected by the global efforts of gatt?

Answers

Global efforts to reduce tariff rates for manufactured goods have been an important part of the General Agreement on Tariffs and Trade (GATT).

Tariff rates for manufactured goods have been declining significantly since the establishment of GATT in 1947, and this trend has continued in recent years.

For example, the World Trade Organization has reported that the tariff rate for manufactured goods in the US has decreased from approximately 10% in the late 1940s to less than 1% in 2020. Similarly, tariff rates for manufactured goods in the EU have fallen from around 15% in the late 1940s to less than 4% in 2020.

These tariff reductions have helped to promote global economic growth and development, as they have reduced the cost of imported goods, making them more accessible to consumers.

In addition, these tariff reductions have increased competition among countries, making it easier for countries to access the global market, and allowing for the efficient transfer of goods and services around the world.

To learn more about tariff , click here:

https://brainly.com/question/29775921

#SPJ4

How did the United States arrive at its current occupational-safety-and-health laws?

A. joyfully, with parades and celebrations, the way we celebrated the end of World War II

B. quickly, as an idea whose time had come and about which no reasonable person could voice an objection

C. secretly, in the middle of the night on a holiday, since supporters knew it would be extremely unpopular

B. slowly, after over 100 years of small steps, backslides, and back-and-forth between business interests and representatives for workers

Answers

Answer:

B. slowly, after over 100 years of small steps, backslides, and back-and-forth between business interests and representatives for workers

Explanation:

Before 1970, America was experiencing a sharp increase in the number of occupational injuries and illnesses. Both the injuries and illnesses were becoming more severe, which lead to increased death and disabilities due to work-related issues.

The OSHA act was passed in 1970. Prior to that, the responsibilities for developing workplace safety and health regulations were under the ministry of labor. Activities and lawmakers felt that the existing structure give not give enough weight to workers plight. Employees were left at the mercy of their employers.

After intensive lobbying in the senate, the OSHA act was signed into law in 1970 by president Richard M. Nixon. The law aimed to promote safety and ensure safer working conditions for all workers, notwithstanding their job or industry.

Companies go through different phases to reach product/market fit. These phases are the

A: idea stage, the prototype stage, the launch stage, the traction stage, the monetization stage, and the growth stage.

B: idea stage, the prototype stage, the launch stage, the traction stage, and the growth stage.

C: the prototype stage, the launch stage, the traction stage, the monetization stage, and the growth stage.

D: idea stage, the traction stage, the monetization stage, and the growth stage.

Answers

These phases are the idea stage, the prototype stage, the launch stage, the traction stage, the monetization stage, and the growth stage. Thus, option A is correct.

What is a Company?An organization that produces goods or services and markets them to consumers in order to make money is referred to as a company.

The connection between such a company's Unit Economies as well as Net Profitability can be used as an example of the developmental process of a company looking for Product Attributes. Whenever a company finds a solution to an issue that aligns with the demands of the existing markets and for which customers are prepared to pay for a good or commodity.

Therefore, option A is the correct option.

Learn more about Company, here:

https://brainly.com/question/27238641

#SPJ1

For each example, identify the most appropriate CTSO. 1. Ann wants to be a manager who directs the work of others: 2.Teresa wants to have a career that emphasizes mathematics: 3.Justin wants to have a career in nursing: 4.Howard wants to have a career focused on the education of

Answers

Answer:

Ann: DECA

Teresa: TSA

Justin: HOSA

Howard: FEA

Explanation:

Answer: DECA your welome if i did spell it wrong sorry bout that im am a horrible speller

Assume that a parent company increases its ownership in a subsidiary from 55% to 75% through the purchase of additional shares of the subsidiary’s outstanding stock from noncontrolling shareholders for a purchase price of $198,000. Prior to this transaction, the noncontrolling interest reports a balance of $1,620,000 on that date. Prepare the journal entry by the parent to record the purchase.

Description Debit Credit AnswerAPICCashCommon stockEquity incomeEquity investmentGoodwillNet income attributable to noncontrolling interestNoncontrolling interestRetained earnings

AnswerAPICCashCommon stockEquity incomeEquity investmentGoodwillNet income attributable to noncontrolling interestNoncontrolling interestRetained earnings

cash

Answers

Based on the information provided, the journal entry to record the purchase of additional shares by the parent company.

Description Debit Credit Equity investment $198,000

Cash $198,000 Explanation: The parent company increases its equity investment in the subsidiary by $198,000, representing the purchase price of the additional shares.

The parent company pays cash of $198,000 for the purchase. Note: The journal entry only reflects the transaction related to the purchase of additional shares. Any subsequent adjustments or effects on other accounts may require additional journal entries or adjustments.

To know more about the parent company:- https://brainly.com/question/30763544

#SPJ11

how do imagination and creativity helps in innovating product?

Answers

Megamalls Inc. is known for its ability to create "retail experiences" for customers visiting any one of its six malls in major Canadian cities, with each mall bring in the 80-120 store range. To further its reputation, Megamalls specially selects its qualifying tenant stores for a particular mix of goods and services it feels will create the greatest customer draw. Moreover, it draws up tenant contracts to ensure that retail offerings are in accordance with its wishes. Recently, one chain of stores with tenancies in each of six Magemalls began changing its own details image by altering its line of goods and marketing tactics. Megamalls feels that this is in contravention of the tenant contract.

What remedy or remedies should Megamalls seek and why?

You will have the opportunity to discuss some remedies available for the breach of contract by one party.

Answers

Megamalls Inc. should start by reviewing the tenant contract, communicating their concerns with the chain of stores, and attempting mediation or negotiation.

In this scenario, Megamalls Inc. believes that a chain of stores with tenancies in each of its six malls is breaching the tenant contract by altering its line of goods and marketing tactics. To address this breach, Megamalls can seek the following remedies:

1. Review the tenant contract: The first step for Megamalls is to carefully review the tenant contract to confirm whether the chain of stores' actions indeed contravene the agreed-upon terms. This will provide a clear understanding of the specific obligations and rights of both parties.

2. Communication with the chain of stores: Megamalls should initiate a conversation with the chain of stores to discuss the issue. They can outline their concerns and provide evidence supporting their belief that the stores' changes violate the contract. Open and honest communication may help resolve the issue without the need for further legal action.

3. Mediation or negotiation: If the initial communication does not lead to a resolution, Megamalls can suggest mediation or negotiation. This involves engaging a neutral third party who can facilitate a discussion between Megamalls and the chain of stores to find a mutually agreeable solution. Mediation or negotiation allows both parties to express their concerns and explore potential compromises.

4. Legal action: If the breach of contract persists and other remedies fail, Megamalls may need to pursue legal action. They can consult with an attorney specializing in contract law to assess the strength of their case and determine the appropriate legal steps to take. Legal action may involve filing a lawsuit against the chain of stores seeking remedies such as specific performance (forcing the chain to comply with the contract) or damages (monetary compensation for the breach).

In conclusion, Megamalls Inc. should start by reviewing the tenant contract, communicating their concerns with the chain of stores, and attempting mediation or negotiation. If these measures do not resolve the issue, legal action may be necessary to enforce the terms of the contract.

To know more about marketing visit:

https://brainly.com/question/27155256

#SPJ11

You are an American, working for a US hospital. The hospital sells services to a French hospital. Given a depreciation of the Euro, your French subsidiary (the one that receives the revenues from the French Hospital) received a lesser income last year, although a clause in your contract stipulates adjustment payment in US dollars. Therefore, your subsidiary has a balance sheet loss, although your consolidated global result is positive. This type of foreign exchange risk is known as:

Answers

Answer:

translation exposure

Explanation:

Translation exposure is also known as translation risk. In this type of risk, the value of a company's assets, equities, income, or liabilities change due to changes in the exchange rate,

French subsidiary received a lesser income last year, although payment will be adjusted in US dollars as per the contract.

Due to this, the subsidiary has a balance sheet loss, although the consolidated global result is positive.

This type of foreign exchange risk is known as translation exposure.

Name three types of financial payment methods for labour services.

Answers

1. Checks

2. Electronic bank transfers (direct deposit)

3. Pre-paid debit cards

Which documents are generally finished and approved before a project begins? (select three.)

Answers

Project plan, budget plan, and resource allocation are the three documents that are generally finished and approved before a project starts.

It generally requires that the documents containing the project plan, budget plan, and resource allocation details are finished and approved before a team begins a project. These documents provide the baseline to successfully complete the project according to its defined plan, budget, and allocated resources.

The project plan document provides a proper plan to ensure the successful completion of a project. The document gives clarity on the responsibilities of team members; defines the scope of the project; lists the processes and procedures involved; identifies the expected outcomes.

The budget plan document contains detailed information about the expenditures and expected revenues associated with the project. This document helps to estimate and track the expenses of the project.

The resource allocation document provides details about equipment/tools, manpower, office space, the time required, and the other facilities needed for accomplishing the various tasks of the project. This document is essential for ensuring teams have adequate access to the resources needed to finish the project effectively.

The complete question is given below:

" Which documents are generally finished and approved before a project begins?

Project PlanProject BudgetResource allocationClosure document "You can learn more about project documentation at

https://brainly.com/question/27364325

#SPJ4

Compare these costs.

48 paper plates for $2.99

75 paper plates for $3.99

Answers

Answer:

the $3.99 one cost less per unit

Explanation:

the $2.99 = $0.06 per unit

the $3.99 = $0.05 per unit

which of the following relates most directly to the law of diminishing marginal utility? group of answer choices after watching two football games, terry decides to play golf rather than watch a third game. a sports fan enjoys watching monday night football rather than going to the theater. two carpenters build their own house rather than hiring a contractor. a musician receives the biggest ovation of the evening after playing the final work of a recital.

Answers

The option that relates most directly to the law of diminishing marginal utility is "after watching two football games, Terry decides to play golf rather than watch a third game." Option A

What is the law of diminishing marginal utility about?The law of diminishing marginal utility states that as a person consumes more of a good or service, the additional satisfaction or utility that they receive from each additional unit of the good or service decreases.

In this case, Terry's decision to switch from watching football to playing golf suggests that the utility or satisfaction he derived from watching the third football game was lower than the utility or satisfaction he expected to receive from playing golf.

Hence, this decision reflects the idea that the additional utility derived from each additional football game is decreasing.

Learn more about diminishing marginal utility from

https://brainly.com/question/28024304

#SPJ1

Required information Problem 9-46 (LO 9-1, LO 9-2) (Algo) [The following information applies to the questions displayed below) Michelle operates several food trucks. Indicate the amount (if any) that she can deduct as an ordinary and necessary business deduction in each of the following situations. (Leave no answers blank. Enter zero if applicable.)

Problem 9-46 Part-d (Algo) d. Michelle realized a $1,275 loss when she sold one of her food trucks to her father, a related party Deductible amount Previous question Ne

Answers

In the given situation, Michelle realized a $1,275 loss when she sold one of her food trucks to her father, a related party. The deductible amount in this case would be zero.

When selling an asset to a related party, the transaction is subject to special tax rules to prevent the abuse of tax deductions. Generally, losses on sales or transfers of property to related parties are disallowed for tax purposes. Therefore, Michelle would not be able to deduct the $1,275 loss on the sale of the food truck to her father as an ordinary and necessary business deduction. To determine the deductible amount, it is necessary to consult the tax laws and regulations of the relevant jurisdiction. These rules may consider factors such as the nature of the transaction, the relationship between the parties, and any specific restrictions on related party transactions.

learn more about loss here:

https://brainly.com/question/32457648

#SPJ11

Allie forms Broadbill Corporation by transferring land (basis of $125,000, fair market value of $775,000), which is subject to a mortgage of $375,000. One month prior to incorporating Btroadbill, Allie borrows $100,000 for personal reasons and gives the lender a second mortgage on the land. Broadbill Corporation issues stock worth $300,000 to Allie and assumes the mortgages on the land.a. What are the tax consequences to Allie and to Broadbill Corporation?b. How would the tax consequences to Allie differ if she had not borrowed the $100,000?

Answers

a. When Allie transfers land with a basis of $125,000 and a fair market value of $775,000 to Broadbill Corporation, she realizes a gain of $650,000 ($775,000 - $125,000).

The gain is recognized for tax purposes, and Allie will have to pay capital gains tax on the amount of the gain.Allie's basis in the stock received from Broadbill Corporation is $300,000, which is equal to the fair market value of the stock. Broadbill Corporation assumes the mortgages on the land, which are not considered taxable events. However, Allie may be subject to tax on the personal loan of $100,000, depending on the terms of the loan.b. If Allie had not borrowed the $100,000, her tax consequences would have been the same as in part (a), with the exception of the tax treatment of the personal loan. Without the personal loan, there would be no second mortgage on the land, and Allie would not have to worry about the tax implications of borrowing the $100,000.

To learn more about market value click the link below:

brainly.com/question/16359101

#SPJ1

The Security Classification Guide (SCG) states: The dates of the training exercise are Secret. The new document states: (S) The training exercise runs Monday through Friday and occurs every June based on trainer availability. The only trainer currently certified is running other exercises the first three weeks in June. What concept was used to determine the derivative classification of the new document?

Answers

The concept used to determine the derivative classification of the new document is "need-to-know."

The concept of "need-to-know" is a fundamental principle in information security and classification. It states that individuals should have access to classified information only if they have a legitimate need for that information to perform their duties or responsibilities. In this case, the Security Classification Guide (SCG) has classified the dates of the training exercise as Secret, indicating that access to this specific information is restricted to individuals with a need-to-know. The new document, while providing some information about the training exercise, does not disclose the specific dates, ensuring that the derivative classification aligns with the principle of "need-to-know."

To know more about Security Classification Guide here: brainly.com/question/28222508

#SPJ11

What Is NOT one of the three primary resources that farnilies have to reach financlal goals?

A.Education

B.Energy

C.Time

D.Money

Answers

Answer:

I think it would be education

Explanation:

Answer: A. Education

Explanation:

(Related to Checkpoint 9.2) (Yield to maturity) Abner Corporation's bonds mature in 16 years and pay 12 percent interest annually. If you purchase the bonds for $1,050, what is your yield to maturity? Your yield to maturity on the Abner bonds is %. (Round to two decimal places.) (Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation) The 8-year $1,000 par bonds of Vail Inc. pay 15 percent interest. The market's required yield to maturity on a comparable-risk bond is 12 percent. The current market price for the bond is $1,070. a. Determine the yield to maturity. b. What is the value of the bonds to you given the yield to maturity on a comparable-risk bond? c. Should you purchase the bond at the current market price? a. What is your yield to maturity on the Vail bonds given the current market price of the bonds? % (Round to two decimal places.) (Related to Checkpoint 9.2) (Yield to maturity) The Saleemi Corporation's $1,000 bonds pay 8 percent interest annually and have 8 years until maturity. You can purchase the bond for $865. a. What is the yield to maturity on this bond? b. Should you purchase the bond if the yield to maturity on a comparable-risk bond is 9 percent? a. The yield to maturity on the Saleemi bonds is \%. (Round to two decimal places.)

Answers

Checkpoint 9.2: The yield to maturity on Abner Corporation's bonds, with a 12% annual interest rate and 16-year maturity, purchased for $1,050, is approximately 9.71%. Checkpoint 9.3: The yield to maturity on Vail Inc.'s bonds, with a 15% interest rate and 8-year maturity, based on the current market price of $1,070, is approximately 9.86%. The value of the bonds given a comparable-risk yield to maturity of 12% needs to be calculated to determine whether purchasing them at the current market price is advisable.

Checkpoint 9.2:

To calculate the yield to maturity for Abner Corporation's bonds, we need to use the present value formula and solve for the yield. The formula is:

PV = C/(1 + r)¹ + C/(1 + r)² + ... + C/(1 + r)ⁿ + M/(1 + r)ⁿ

Where:

PV = Present value of the bonds ($1,050)

C = Annual interest payment ($1,050 * 12% = $126)

r = Yield to maturity (unknown)

n = Number of years to maturity (16)

M = Maturity value ($1,000)

By substituting the values into the formula, we can solve for r:

1,050 = 126/(1 + r)¹+ 126/(1 + r)² + ... + 126/(1 + r)¹⁶ + 1,000/(1 + r)¹⁶

To find the yield to maturity, you can use financial calculators or Excel's RATE function. The yield to maturity on the Abner bonds is approximately 9.71%.

Checkpoint 9.3:

a. To determine the yield to maturity for Vail Inc.'s bonds, we can use the same present value formula as above:

PV = C/(1 + r)¹ + C/(1 + r)² + ... + C/(1 + r)ⁿ + M/(1 + r)ⁿ

Where:

PV = Current market price of the bonds ($1,070)

C = Annual interest payment ($1,000 * 15% = $150)

r = Yield to maturity (unknown)

n = Number of years to maturity (8)

M = Maturity value ($1,000)

By substituting the values into the formula, we can solve for r:

1,070 = 150/(1 + r)¹ + 150/(1 + r)² + ... + 150/(1 + r)⁸ + 1,000/(1 + r)⁸

To find the yield to maturity, you can use financial calculators or Excel's RATE function. The yield to maturity on the Vail bonds given the current market price is approximately 9.86%.

b. To calculate the value of the Vail bonds given the yield to maturity on a comparable-risk bond, we can use the present value formula again. However, this time, the yield to maturity will be 12% (the market's required yield).

PV = C/(1 + r)¹ + C/(1 + r)² + ... + C/(1 + r)ⁿ + M/(1 + r)ⁿ

Where:

PV = Value of the bonds based on the yield to maturity on a comparable-risk bond

C = Annual interest payment ($1,000 * 15% = $150)

r = Yield to maturity on a comparable-risk bond (12%)

n = Number of years to maturity (8)

M = Maturity value ($1,000)

By substituting the values into the formula, we can solve for PV:

PV = 150/(1 + 12%)¹ + 150/(1 + 12%)² + ... + 150/(1 + 12%)⁸ + 1,000/(1 + 12%)⁸

Calculating this will give you the value of the bonds based on the yield to maturity on a comparable-risk bond.

c. To determine whether you should purchase the bond at the current market price, compare the calculated value from part (b) to the current market price. If the calculated value is higher than the market price ($1,070), then it may be a good investment. If the calculated value is lower than the market price, it may not be a good investment.

To know more about yield to maturity:

https://brainly.com/question/26376004

#SPJ4

the logistics process of recycling or disposing of returns from customers or from resellers is known as

Answers

The logistics process of recycling or disposing of returns from customers or from resellers is known as reverse logistics.

What is the reverse logistics process?Reverse logistics, as it is commonly known, is the movement of commodities away from their usual final location in order to increase their value or ensure correct disposal. The management and sale of excess inventory or raw materials, as well as the delivery of rented machinery, equipment, and other hardware back to the leasing company, are all included in reverse logistics. Another name for it is returned.

Every e-commerce fulfillment operation needs management to be successful. An order's return procedure is known as reverse logistics. Moving the product back to its place of origin once it leaves the client is known as this process. Reverse logistics, in essence, is the handling or process of an item after the initial sale.

To learn more about reverse logistics, visit:

https://brainly.com/question/15888400

#SPJ4

Pick two of your favorite products or services. These can be shoes, clothes, music, vehicles, technology, cleaning products, hobby supplies--literally anything legal--as long as they have a public website. Please compare and contrast the following about your two chosen firms that produce your favorite products/services:

What type of firm/industry is it? What do they provide to customers?

What CSR initiatives/programs does each firm have?

Does the firm’s CSR initiatives align with the type of industry and the products/services it provides? Why or why not?

Is the firm focusing on the issues/stakeholders that it should be? Why or why not?

Your initial post should be a minimum of 450 words.

Answers

My favorite products are the iPhone and Adidas shoes. Apple is a tech giant that designs and develops hardware and software products for its customers worldwide. On the other hand, Adidas is a multinational corporation that designs and manufactures shoes, clothing, and accessories.

Both Apple and Adidas have established their Corporate Social Responsibility (CSR) programs to promote sustainability and social responsibility in the communities they serve. Apple has a CSR program known as the Supplier Responsibility Program (SRP), which focuses on ensuring the well-being and safety of employees working in their supply chains. Adidas has its CSR program known as the Better Cotton Initiative (BCI), which works towards making cotton more sustainable. The company also focuses on improving working conditions in its supplier factories.Both firms have aligned their CSR initiatives with the type of industry and the products/services they provide. Apple's SRP program aims to ensure that suppliers uphold the same high standards as the company itself, which aligns with the tech industry's core values. Similarly, Adidas' BCI program is aligned with its core values of environmental sustainability and social responsibility.Both firms have also been focusing on the issues/stakeholders that they should. Apple has been focusing on improving employee working conditions and reducing the environmental impact of their operations. Similarly, Adidas has been working towards promoting sustainable practices, fair labor practices, and reducing waste in the supply chain.

In conclusion, Apple and Adidas have established CSR initiatives that promote sustainability and social responsibility. Both firms have aligned their CSR initiatives with their core values and the type of industry and the products/services they provide. Additionally, both firms have been focusing on the issues/stakeholders they should by promoting sustainable practices, fair labor practices, and reducing waste in their supply chains. Overall, these CSR initiatives demonstrate the firms' commitment to creating a better world for future generations.

To learn more about Corporate Social Responsibility (CSR) click:

brainly.com/question/8003335

#SPJ11

when the blank account decreases, it means the company paid less cash for insurance than it recorded as insurance expense.

Answers

When the blank account decreases, it means the company paid less cash for insurance than it recorded as insurance expense.

The blank account in this statement refers to the insurance payable or accounts payable account. This account represents the amount owed by the company to the insurance provider for insurance coverage.

If the blank account decreases, it indicates that the company has made a cash payment to the insurance provider, reducing the outstanding balance of the insurance payable. This situation arises when the company pays less cash for insurance than it initially recorded as insurance expense in its financial records.

The insurance expense is recorded based on accrual accounting principles, where expenses are recognized in the period they are incurred, regardless of when the cash payment is made. Therefore, if the actual cash payment for insurance is less than the recorded insurance expense, it creates a difference between the two amounts, resulting in a decrease in the insurance payable account.

This discrepancy could occur due to factors such as insurance premium discounts, adjustments in coverage, or timing differences between the recording of expenses and the actual cash outflows.

A decrease in the blank account signifies that the company paid less cash for insurance than it recorded as insurance expense, highlighting a difference between the recorded expenses and the actual cash payments made for insurance coverage.

To know more about insurance, visit:

brainly.com/question/30291521

#SPJ11

List the sourcesvof obtaining inform related to foriegn employment ..

Answers

Answer:

not having any idea.........

Explanation:

⚘ Correction :List the sources of obtaining information related to foreign employment.⚘ Answer :Different sources of information are available for foreign employment. The institutions and individuals involved in foreign employment - related work and their web sites and training institutions and their publications provide information on foreign employment. Some of the sources of obtaining information related to foreign employment are mentioned below with description :

✎ Noticeboards : Manpower companies put vacancy announcement notice on the noticeboards as demanded by foreign employers. The following details are included in the demand paper and the same are stated in the notice.

Name of a countryName of companyNumber of vacancyMinimum qualificationMonthly salaryContract periodFacilitiesRequired skills✎ Booklets : Information can be obtained from booklets published by concerned authorities and institutions. Required skills , qualification , training , ability , post etc. are published in the booklets.

✎ Institutions or individuals involved in foreign employment : Foreign employment may directly contact the government offices to demand required workers. Therefore , we can contact such offices to obtain information.

✎ Publication of training institutions : Publications of training institutions , which provide employment - oriented training can be reliable sources of information for foreign employment.

✎ Web sites : Web sites of employers are reliable sources of information for foreign employment. Interested candidates can apply for the job through the Internet or web sites. Physical contact is not necessary for selection procedures.

✎ Newspapers and magazines : Newspapers are very popular means of communication. They are published daily , weekly , fortnightly and monthly basis. Notices on foreign employment are published in such newspapers and magazines. Clear details are included in the notices .

✎ Radio , F.M and Television : Radio , F.M and television disseminate information immediately to public. These are very popular and important means of communication. They broadcast different entertaining programmes , news , information etc. They also broadcast information on foreign employment.

✎ Public relation : Public relation is another source of information on foreign employment. We can obtain information through individuals , symposiums , meetings , interaction programmes etc.

Hope I helped !

Have a wonderful time ! ツ

~\( \sf{TheAnimeGirl}\)

Analyze (10 points)

Analyze different examples of communication in the workplace.

1. First look at how email should and should not be used in the workplace.

a) You need to share information summarizing last week's sales department meeting

with all the departments in your company. Would email be a good choice for this

interdepartmental communication? Why or why not? (1 point)

Answers

Workplace communications may occur between varying levels of management, from front-line workers to top-level executives. Some of the most common forms of workplace communication include video conferencing, meetings, email, text messages, and phone calls.

What is workplace communication ?Verbal, bodily, phone, and written communication are the four primary forms of business communication. You always have to deal with at least one at some point throughout the workweek. Being able to communicate effectively in these environments can be one of the most sensitive abilities a worker can acquire.

Making connections with other members of your team and fostering an inclusive environment are key to effective workplace communication. It's about communicating in a way that helps your team advance and reach its objectives.

Learn more about Workplace communication here:

https://brainly.com/question/28499813

#SPJ1

2. What does AOC stand for?

d. Area of Concentration

c. Area of Careers

b. Awareness of Careers

na Awareness of College

Answers

Answer:

The answer is D. Area of Concentration

Explanation:

Area of concentration (AOC) must be listed along with a skill identifier (if applicable) and listed as the primary specialty.

An architect’s functions may include which of the following? (SELECT ALL THAT APPLY.)

-planning and designing houses, commercial buildings, and other structures

-ensuring worksite safety

-collaborating with engineers

-acting as a construction manager and supervising contractors

Answers

Answer:

the answer is planning, ensuring, and acting

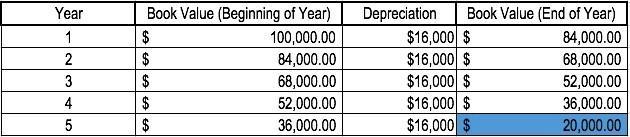

Use the sum-of-year depreciation method to calculate the depreciation for the

following scenario. Company XYZ bought a new machine for $100,000 and

expects the machine will last for 10 years.

Answers

Answer:

20%

Explanation:

How to Calculate Straight Line Depreciation

The straight line calculation steps are:

Determine the cost of the asset.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount.

Determine the useful life of the asset.

Divide the sum of step (2) by the number arrived at in step (3) to get the annual depreciation amount.

Straight Line Example

Company A purchases a machine for $100,000 with an estimated salvage value of $20,000 and a useful life of 5 years.

The straight line depreciation for the machine would be calculated as follows:

Cost of the asset: $100,000

Cost of the asset – Estimated salvage value: $100,000 – $20,000 = $80,000 total depreciable cost

Useful life of the asset: 5 years

Divide step (2) by step (3): $80,000 / 5 years = $16,000 annual depreciation amount

Therefore, Company A would depreciate the machine at the amount of $16,000 annually for 5 years.

The depreciation rate can also be calculated if the annual depreciation amount is known. The depreciation rate is the annual depreciation amount / total depreciable cost. In this case, the machine has a straight-line depreciation rate of $16,000 / $80,000 = 20%.