If a new shirt costs $34. 99 and the sales tax is $2. 10, the sales tax rate is.

Answers

The sales tax rate can be calculated using the given information about the cost of the shirt and the amount of sales tax paid.

We can use the formula: Sales Tax Rate = (Sales Tax / Cost of Item) x 100 Using this formula, we can plug in the given values and calculate the sales tax rate: Sales Tax = $2.10 Cost of Item = $34.99 Sales Tax Rate = (Sales Tax / Cost of Item) x 100= ($2.10 / $34.99) x 100= 0.06 x 100= 6%Therefore, the sales tax rate is 6%. In 100 words, we can say that the sales tax rate is a percentage of the cost of an item that is charged by the government. It is calculated by dividing the amount of sales tax paid by the cost of the item and then multiplying the result by 100.

In this case, the sales tax rate for the shirt is 6%, which means that 6% of the cost of the shirt was charged as sales tax by the government.

To know more about Sales tax visit-

https://brainly.com/question/29442509

#SPJ11

Related Questions

How has the Internet changed entertainment marketing?

Answers

Explanation:

The evolution of the internet has made it possible for artists to target and grow fan followings all over the world. This means that the typical type of venue has also shifted. Instead of targeting one city or area, artists can advertise their new releases, concerts, and merchandise via social media posts.

while ppo subscribers may see any licensed physician or health care professional, and use any hospital or ancillary facility, in or out of the local network, a subscriber's out of pocket expense will be what when using in-network providers?

Answers

When using in-network providers, a PPO (Preferred Provider Organization) subscriber's out-of-pocket expense is typically lower compared to using out-of-network providers.

PPO networks consist of a group of healthcare providers, including physicians, hospitals, and ancillary facilities, that have contracted with the PPO to provide services at negotiated rates. These providers are considered "in-network" for PPO subscribers.

When a PPO subscriber chooses to receive care from an in-network provider, the PPO plan typically offers discounted rates or a higher level of coverage for services rendered. This means that the subscriber's out-of-pocket expenses, such as deductibles, copayments, and coinsurance, are usually lower when using in-network providers.

In contrast, if a PPO subscriber decides to use an out-of-network provider, they may incur higher out-of-pocket costs. Out-of-network providers may not have negotiated rates with the PPO, and the consumer may be responsible for a larger portion of the costs or may need to meet a separate out-of-network deductible.

It's important for PPO subscribers to review their specific plan details and coverage policies to understand the extent of their out-of-pocket expenses when using in-network providers.

learn more about consumer here: brainly.com/question/30132393

#SPJ11

When inventory is adjusted down to reflect net realizable value, which of the following can occur? (Select all that apply.)

a. Credit inventory income

b. Debit sales expense

c. Credit inventory

d. Debit cost of goods sold

e. Debit inventory

Answers

When inventory is adjusted down to reflect net realizable value, the following can occur: Credit inventory, Debit cost of goods sold, and Debit inventory. Hence, the correct options are C, D, and E.

When inventory is adjusted down to reflect net realizable value, the following can occur:

c. Credit inventory: The value of the inventory is reduced by crediting the inventory account.

d. Debit cost of goods sold: The cost of goods sold is increased by debiting the cost of goods sold account to reflect the lower value of the inventory.

e. Debit inventory: The inventory account is reduced by debiting the inventory to reflect the decrease in its value.

Options a and b are not applicable in this context. Credit inventory income and debit sales expense is not directly related to adjusting inventory down to reflect net realizable value.

To learn more about cost click here

https://brainly.com/question/15135554

#SPJ11

What is a What? Its a trick question

Answers

Name two programs created by the economic opportunity act.

Answers

Answer:

Among the other programs funded by the EOA were the Neighborhood Youth Corps, which provided training and jobs for young people (age 16–21) from impoverished families, work-study programs, and community action programs. The act also provided loans to small businesses and farmers.

If demand for potato chips decreases when the price of salsa increases, that means the two goods are ________.

Answers

If demand for potato chips decreases when the price of salsa increases, that means the two goods are compliments.

What is recession?The term recession is defined as decrease in growth of GDP or we can say that negative growth which leads to unemployment. So we can say that decrease in GDP will increase unemployment rate.

There are several types of recession such as K - shaped, depression, U - shaped, W - shaped, L - shaped and Supply - side shock. These are the types of recession.The term recession is defined as decrease in growth of GDP or we can say that negative growth which leads to unemployment.

Therefore, If demand for potato chips decreases when the price of salsa increases, that means the two goods are compliments.

Learn more about recession here:

brainly.com/question/14737261

#SPJ1

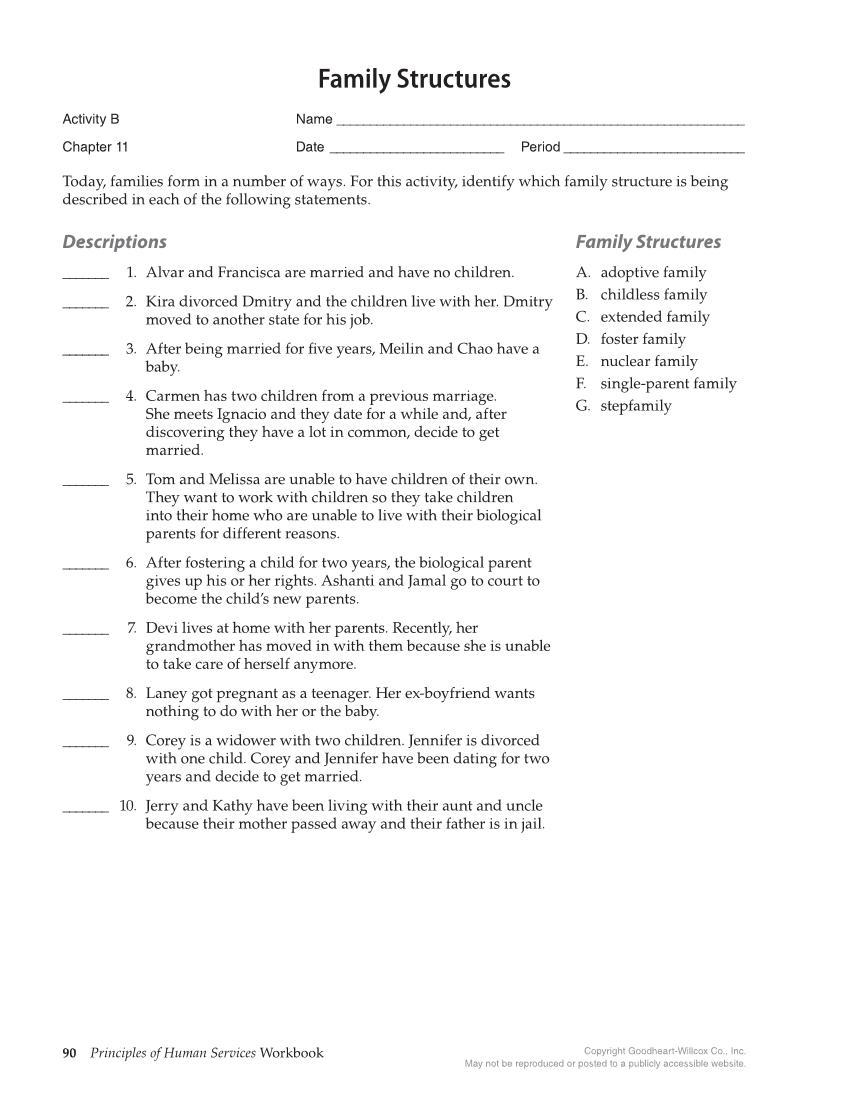

for human services pleaseeeeeeeeeeee help <3

Answers

Answer:

gghddhshdjshsjgsgsgshsnssmadWhat is the difference between Comparison level (CL) and Comparison level of alternatives (CLalt) ?

Answers

The Comparison Level (CL) and Comparison Level of Alternatives (CLalt) are psychological concepts used in social exchange theory to understand relationships and decision-making.

The Comparison Level (CL) refers to an individual's personal standard or expectation of what they believe they should receive in a relationship. It is a subjective evaluation based on past experiences, social norms, and personal desires. The CL represents the threshold at which individuals consider a relationship to be satisfying. If the outcomes of a relationship meet or exceed the CL, the individual is likely to perceive the relationship as fulfilling and satisfactory. On the other hand, the Comparison Level of Alternatives (CLalt) refers to an individual's assessment of the potential outcomes and rewards they could attain in an alternative relationship or situation.

In summary, the CL is an individual's standard for satisfaction within a relationship, while the CLalt represents the assessment of potential outcomes and rewards in alternative relationships. Both concepts play a role in decision-making and can influence relationship satisfaction and stability.

Learn more about Comparison Level here:

https://brainly.com/question/15843640

#SPJ11

When pan-frying food, be sure the oil

A. comes one-half to two-thirds up the side of the food.

B. lightly coats the bottom of the pan.

C. comes within an inch of the top of the pan.

D. covers the food entirely. When pan-frying food, be sure the oil

Student Answer: B

Incorrect on Pennfoster.

Answers

Answer:

B. lightly coats the bottom of the pan.

Explanation:

Hope it helps!

Who takes Personal Finance???

Answers

Explanation:

I can try and learn it really quickly...?

Haul’m-in Marine manufactures diesel engines for shrimp trawlers and other small commercial boats. One of their CNC machines has caused several problems. Over the past 30 weeks, the machine has broken down as indicated below. Each time the machine breaks down, the firm loses an average of $3,000 in time and repair expenses. If preventive maintenance were implemented, it is estimated that an average of only one breakdown per week would occur. The cost of preventive maintenance is $1,000 per week. What is the weekly total maintenance cost of this program?

Number of breakdowns per week

0

1

2

3

4

Frequency (Number of weeks that breakdowns occurred)

8

3

5

9

5

A. $1,000

B. $3,000

C. $4,000

D. $6,000

E. $8,000

Answers

Answer:

The right solution is Option C "$4,000".

Explanation:

The given values are:

Breakdown cost,

= $3,000

Per week cost of preventive maintenance,

= $1,000

Breakdown per week,

= 1

Now,

The cost per week will be:

= \(Breakdown \ cost+Cost \ of \ preventive \ maintenance\)

On substituting the values, we get

= \(3000+1000\)

= \(4,000\) ($)

a real estate office handles a 40-unit apartment complex. when the rent is $520 per month, all units are occupied. for each $25 increase in rent, however, an average of one unit becomes vacant. each occupied unit requires an average of $50 per month for service and repairs. what rent should be charged to obtain a maximum profit?

Answers

To determine the optimal rent that maximizes the real estate office's profit, we need to consider the relationship between the rent, occupancy rate, and the cost of service and repairs.

Let's first calculate the total revenue generated by the apartment complex at the current rent of $520 per month. Since all 40 units are occupied, the monthly revenue is:

Monthly Revenue = Rent per unit x Number of occupied units

Monthly Revenue = $520 x 40

Monthly Revenue = $20,800

Now let's determine how the occupancy rate changes with rent increases. We know that for each $25 increase in rent, one unit becomes vacant. So if we increase the rent by $25, we will have 39 occupied units, and if we increase the rent by $50, we will have 38 occupied units, and so on. We can represent this relationship in a table:

Rent Occupied Units Vacant Units

$520 40 0

$545 39 1

$570 38 2

$595 37 3

$620 36 4

$645 35 5

$670 34 6

$695 33 7

$720 32 8

$745 31 9

Now let's calculate the monthly revenue and cost of service and repairs for each rent level:

Rent Occupied Units Vacant Units Monthly Revenue Monthly Cost

$520 40 0 $20,800 $2,000

$545 39 1 $21,255 $1,950

$570 38 2 $21,660 $1,900

$595 37 3 $22,015 $1,850

$620 36 4 $22,320 $1,800

$645 35 5 $22,575 $1,750

$670 34 6 $22,780 $1,700

$695 33 7 $22,935 $1,650

$720 32 8 $23,040 $1,600

$745 31 9 $23,095 $1,550

We can see that as the rent increases, the monthly revenue also increases, but so does the number of vacant units. As units become vacant, the cost of service and repairs decreases, but the revenue also decreases due to the lost rent.

To determine the optimal rent that maximizes profit, we need to find the point at which the marginal revenue from a rent increase equals the marginal cost of losing one occupied unit. In other words, we want to find the rent level that generates the most revenue while minimizing the loss of occupied units. We can calculate the marginal revenue and marginal cost for each rent level by looking at the change in revenue and cost from one rent level to the next:

Rent Marginal Revenue Marginal Cost

$520 -

For more information on revenue see:

https://brainly.com/question/8645356

#SPJ4

One disadvantage of the Herfindahl-Hirschmann Index is that the index:

A) is difficult to compute.

B) fails to reflect low barriers to entry.

C) fails to reflect the effect of mergers in the industry

Answers

One disadvantage of the Herfindahl-Hirschmann Index is that the index C) fails to reflect the effect of mergers in the industry.

The Herfindahl-Hirschman Index (HHI) is a measure of market concentration that is widely used in antitrust analysis. However, one of the disadvantages of the HHI is that it fails to reflect the effect of mergers in the industry. This is because the HHI is based on the market shares of the firms in the industry, and does not take into account the fact that mergers can change the number of firms in the industry. Therefore, the HHI can underestimate the level of market concentration after a merger, which can lead to anticompetitive behavior.

Despite this limitation, the HHI is still a useful tool for antitrust analysis. It provides a simple and objective measure of market concentration that can be used to identify potentially anticompetitive behavior in a market. However, it should be used in conjunction with other measures and factors, such as barriers to entry,

Option C is correct answer.

You can learn more about Herfindahl-Hirschmann Index at

https://brainly.com/question/29643027

#SPJ11

Job #4260 consisted of 1,000 units at a total cost of $200,000. The cost transferred to cost of goods sold for the sale of 600 of the units is ______.

Answers

Explanation:

job #4260 consisted of 1,000 units at a total cost of $200,000. The cost transferred to cost of goods sold for the sale of 600 of the units is:

total cost / units x sale of units

200,000 / 1,000 x 600

= 120,000

The cost transferred to cost of goods sold for the sale of 600 of the units is 120,000. Frequently, market analysts use models with two sources of info: actual capital, with amount K and work, with amount L.

What is Total cost?In financial matters, total cost (TC) is the base dollar cost of creating some amount of result.

This is the total monetary cost of creation and is comprised of variable cost, which changes as indicated by the amount of a decent delivered and incorporates information sources like work and natural substances.

Work #4260 comprised of 1,000 units at a total cost of $200,000. The cost moved to cost of products sold for the offer of 600 of the units is

Total cost / units x sale of units

200,000 / 1,000 x 600

= 120,000

The negligible cost can likewise be determined by tracking down the subordinate of total cost or variable cost. Both of these subsidiaries work in light of the fact that the total cost incorporates variable cost and fixed cost, yet fixed cost is a consistent with a subsidiary of 0.

The total cost of delivering a particular degree of result is the cost of the multitude of variables of creation. Total cost in financial matters incorporates the total open door cost (benefits got from the following best other option) of each element of creation as a feature of its fixed or variable costs.

Therefore The extra total cost of one extra unit of creation is called minor cost.

Learn more about Cost here:

brainly.com/question/15135554

#SPJ2

When dealing with customers face-to-face, a good customer service technique is to:

Use a positive tone of voice

Maintain eye contact

Actively Listen

Answers

The correct option is B i.e., When dealing with customers face-to-face, a good customer service technique is to maintain eye contact.

What does "customer" mean to you?An individual or business that purchases goods or services from another company is known as a customer. Consumers are crucial to businesses because they generate income; without them, they would cease to exist.

What three roles do customers play?Any marketplace transaction necessitates the participation of at least three client roles: purchasing, which entails making a decision on a good or service; paying for it; and utilizing it. So, a customer can be a user or consumer as well as a buyer or payment.

To know more about customers visit-

https://brainly.com/question/13735743

#SPJ1

Outline why it is important for a business owner to respond to technological and global issues when establishing a business?

Answers

Technology enables an increase in the efficiency of systems, products, and services. It helps track and streamline strategies, hold records go with the flow, and control contacts and employee records.

In reality, this expanded efficiency in operation enables lessened costs as well as allows the commercial enterprise to develop swiftly.

Technology has vital consequences on commercial enterprise operations. Irrespective of the scale of your business enterprise, technology has both tangible and intangible advantages that will help you make money and produce the results your customers demand. Technological infrastructure affects the subculture, performance, and relationships of a business.

The use of technology has made commercial enterprises and clients closer in many areas. E-mail and Social Media are getting used for answering queries related to products and services with clients. Giving customers all feasible methods to contact the agency is simple with the latest technology and packages over the internet.

Learn more about Technology here: https://brainly.com/question/25110079

#SPJ1

Which of the following are laws which protect workers?

Answers

Answer:

The Equal Employment Opportunity Commission (EEOC) enforces federal laws prohibiting employment discrimination. These laws protect employees and job applicants against: Discrimination, harassment, and unfair treatment in the workplace by anyone because of: Race.

Explanation:

A marketing plan includes this marketing objective: "Create positive feelings

about our brand." What is the main problem with this objective?

Answers

Answer:

The main problem with this objective is that it is too vague and does not provide any specific target or measure for success. "Positive feelings" are subjective and can vary greatly from person to person, making it difficult to accurately track and measure progress towards this objective. A more specific and measurable objective might be something like "Increase brand awareness by X% among target audience within Y months" or "Increase customer satisfaction ratings by X% within Y months."

E6-23 (Algo) Recording, Reporting, and Evaluating a Bad Debt Estimate Using Aging Analysis Lo6-2

Brown Cow Dairy uses the aging approach to estimate bad debt expense. The ending balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $13,500; (2) up to 120 days past due, $6,500; and (3) more than 120 days past due, $6,000. Experience has shown that for each age group, the average loss rate on the amount of the receivables at year-end due to uncollectibility is (1) 3 percent, (2) 13 percent, and (3) 20 percent, respectively. At December 31 (end of the current year), the Allowance for Doubtful Accounts balance is $720 (credit) before the end-of-period adjusting entry is made. Data during the current year follow:

a. During December, an Account Receivable (Patty's Bake Shop) of $670 from a prior sale was determined to be uncollectible; therefore, it was written off immediately as a bad debt. b. On December 31, the appropriate adjusting entry for the year was recorded. Required: 1. Give the required journal entries for the two items listed above. 2. Show how the amounts related to Accounts Receivable and Bad Debt Expense would be reported on the income statement and balance sheet for the current year. Disregard income tax considerations.

Answers

To address the given requirements, we need to perform the following steps:

1. Calculate the estimated bad debt expense using the aging approach and the provided loss rates.

2. Record the journal entries for the write-off of a bad debt and the adjusting entry for bad debt expense.

3. Show how the amounts related to Accounts Receivable and Bad Debt Expense would be reported on the income statement and balance sheet.

Step 1: Calculate the estimated bad debt expense

- Not yet due: $13,500 x 3% = $405

- Up to 120 days past due: $6,500 x 13% = $845

- More than 120 days past due: $6,000 x 20% = $1,200

Total estimated bad debt expense = $405 + $845 + $1,200 = $2,450

Step 2: Record the journal entries

a. Write-off of Patty's Bake Shop's uncollectible receivable:

Debit Allowance for Doubtful Accounts: $670

Credit Accounts Receivable (Patty's Bake Shop): $670

b. Adjusting entry for bad debt expense:

Debit Bad Debt Expense: $2,450

Credit Allowance for Doubtful Accounts: $2,450

Step 3: Report amounts on income statement and balance sheet

- Income Statement: Report Bad Debt Expense of $2,450 under operating expenses.

- Balance Sheet: Report Accounts Receivable (net of allowance) as follows:

Total Accounts Receivable: $13,500 + $6,500 + $6,000 = $26,000

Less: Allowance for Doubtful Accounts (initial $720 - $670 + $2,450) = $2,500

Accounts Receivable (net): $26,000 - $2,500 = $23,500

To learn more about balance sheet, visit:

https://brainly.com/question/29414667

SPJ11

Why do lenders often require a down payment when credit is used to purchase a good?

It reduces risk to the lender.

It eliminates interest charges.

It reduces the cost of the financed good.

It increases the cost of financing the good.

Answers

The payments are done through a down payment reduces the risk to the lender and therefore the lender requires down payments when credit is used to purchase a good. Thus (A) is the correct option.

What is a down payment?The amount of money that a purchaser pays on the purchasing of any expensive object. The down payment showcases a portion of the total purchasing amount.

It is made in the initial stage of purchasing. It reduces the risk of the lender and therefore, (A) is the correct option.

To know more about a Down Payment, visit the link below:

https://brainly.com/question/13385303

#SPJ2

The repair service that fixes your farming equipment doesn’t seem to fix your plow correctly. The technician says that if you are not happy, you can buy a new plow from him, but the cost is extremely high. Do you have other options available to you for higher-quality repairs or cheaper equipment? Explain your answer.

Answers

Answer:

Your best option would be for higher quality repairs and higher quality equipment, this would save you more money and time in the long run where you have the ability to do other things.

Explanation:

Mark as Brainliest please!

Ill give u a cookie

Answer:

No, because in command economies, there is no competition. So, there are no other repair services that would offer higher-quality repairs or cheaper equipment. Additionally, no incentive exists for the technician to provide high-quality service.

Explanation:

the actual answer

How can we apply accounting and bookkeeping in our daily lives?

Answers

What does a mission statement do?

A) tells your business concept.

B) reflects the purpose of the company.

C) tells the major goals of a business.

PLEASE ANSWER

Answers

I think C) tells the major goals of a business

Hope it helped

Golden Company has a binding commitment from another company to purchase its copyright at the end of the asset's useful life. The agreed upon amount is $150,000. When calculating copyright amortization, Golden Company should utilize a residual value of

Answers

Answer:

$150,000

Explanation:

Given an intangible asset like a copyright, it is amortized using the straight-line method, thus, to determine the amount of amortization in a given year, the formula is to divide the copyright's value by the length of its useful life.

However, in this case, since the Golden Company has a binding commitment from another company to purchase its copyright AT THE END of the asset's USEFUL LIFE, then, the value of the copyright equals zero.

What this simply means is that, when calculating copyright amortization, Golden Company should utilize a residual value of $150,000, because the value of the copyright at that moment equals zero.

all the people involved in the buying decision in an organization are collectively known as

Answers

The people involved in the buying decision in an organization are collectively known as the buying center. The buying center is a group of individuals within an organization who are responsible for making purchase decisions.

This group may consist of various stakeholders such as managers, employees, suppliers, and consultants who work together to identify, evaluate, and select the best product or service to meet the organization's needs.

The buying center can be divided into different roles, each with its responsibilities and tasks. These roles include the initiator, influencer, decider, buyer, and user. The initiator is the person who identifies the need for a product or service.

The influencer is the person who provides information or recommendations to the decision-makers. The decider is the person who makes the final decision to purchase the product or service. The buyer is the person responsible for negotiating the terms and conditions of the purchase, and the user is the person who uses the product or service.

It is essential for marketers to identify the members of the buying center, their roles, and their influence in the decision-making process. This knowledge can help them tailor their marketing strategies to target the right individuals, provide them with the relevant information, and address their concerns to influence the purchase decision positively.

Understanding the buying center's dynamics can also help marketers build long-term relationships with the organization and improve customer satisfaction.

Know more about marketing strategies here:

https://brainly.com/question/29376574

#SPJ11

Which best describes a mixture?

ООО

It has a single composition, and it has a set of characteristics that does not change.

It can have different compositions, but it has a set of characteristics that does not change.

It has a single composition, but it has a set of characteristics that does change.

It can have different compositions, and it has a set of characteristics that does change.

Answers

Answer: it can have different compositions, and it has a set of characteristics that does change.

Explanation:

A mixture is form when other substances are being mixed together. In such scenario, it has different composition and it characteristics are been altered.

Therefore, the option that best describes a mixture is option D "It can have different compositions, and it has a set of characteristics that does change"

Answer:

D.

Explanation:

One of the reasons it has been so difficult for Congress to bring federal spending under control is because

A.the crowding-out effect has been ineffective.

B.the pay-as-you-go provisions have been so expensive.

C.the federal budget has many entitlements that people do not want cut.

D.sequestration has worked so well.

Answers

Answer:

Correct Answer:

C.the federal budget has many entitlements that people do not want cut.

Explanation:

In U.S, there are so many sectors with so many budget mapped out and controlled in-order to benefits the citizens. For example, in this pandemic situation, there are budgets for those who lost their jobs, those unable to pay their house rent, those with medical challenges etc. all these entitlements are what people are not willing to lose. Bringing the federal spending under control means cutting off some of these budgets which might trigger crises.

Online content that has been created and posted by unpaid contributors such as customers or fans of a product or service is referred to as:.

Answers

Online content that has been created and posted by unpaid contributors such as customers or fans of a product or service is referred to as User-generated content.

User-generated contentUGC for short is content that is created, published or submitted by users of a brand. In numerous cases, it's the most influential content for brands. Usually, contributors are unpaid fans who encourage a brand instead of the brand promoting itself.

Online users are evolved increasingly savvy in knowing which companies are using messy marketing tactics, and which ones are being genuine and evident.

To learn more about User-generated content visit the link

https://brainly.com/question/3717193

#SPJ4

for which person would renting a home be a better option than getting a mortgage?

Answers

Answer:

Someone who wants ro avoid spending time and money on maintenace

Explanation:

PLEASE HELP ASAP!!! I'll MARK BRAINLIEST!! FOR CAREER!!

1. Nara learned about prototyping, feedback, and testing as part of her biomedical engineer career. She is considering changing careers. Could she apply these concepts in a different career? Give one example of how Nara could use prototyping, feedback, and testing in a career.

2. Imagine you’re a human resources manager interviewing applicants for two jobs: IT security specialist and web developer. Could you hire one person to do both jobs? Why or why not? Describe the skills and personal qualities that candidates for each job should have.

3. If you work as a human resources manager, you’ll need a well-developed sense of empathy in order to succeed. How could you explain that part of your job to a new employee? Would empathy be important if you worked in a different career? Explain.

4. General contractors must make decisions based on ethics and safety. What other careers require people to follow safety regulations? Do the regulations protect the public, workers, companies, or a combination of these? How do the regulations compare to the safety guidelines you might follow in your everyday life, such as seat belt rules or lab rules in science class?

5. Helena is considering a new, full-time job at a construction company that’s part of a union. She’d make $20 per hour and earn a salary of about $40,000 per year. The union would charge her two and a half times her hourly wage. So her monthly union dues would be $50. What would her union dues be per year? Would it be worth it? Should she take the job? Explain why or why not.

Answers

Yes, Nara may use the ideas of testing, feedback, and prototyping in a different line of work.

What is prototyping?

Design teams experiment with, bring to life, and iterate on ideas through the process of prototyping, which can involve everything from digital designs to paper ideas. A prototype is fundamentally an early rendition of a design that enables users to engage with it or envision it before a finished product is created.

For instance, if Nara decided to pursue a career in software development, she might utilize prototyping to produce early iterations of the program and collect user input to enhance it. The program could then be tested to make sure it functions as intended and any problems could be fixed.

Learn more about prototyping here:

https://brainly.com/question/30655140

#SPJ1