in the united states, which sexually transmitted infection (sti) represents the highest number of new cases annually?

Answers

The Sexually Transmitted Infection that represents the highest number of new cases annually, in the United States, is HPV.

What is the infection rate of HPV in the United States ?According to the Centers for Disease Control and Prevention (CDC), there are currently close to 80 million human papillomavirus (HPV) infected individuals in the United States. This places HPV above even chlamydia and herpes as the most prevalent sexually transmitted infection(STI) in the US.

Approximately 90% of HPV infections are treated by the immune system within two years. But chronic infections with high-risk HPV strains can cause genital warts and cancer.

According to the National Cancer Institute, the human papillomavirus is the most prevalent sexually transmitted infection (STI) in the United States, with an estimated 24 million current cases and 5.5 million new cases each year.

Find out more on sexually transmitted infections at https://brainly.com/question/1617826

#SPJ1

Related Questions

While Hannah attends college, she works part-time for a cutlery company. Using her personal connections and network of friends, she offers consumers face-to-

face presentations in their homes. This is an example of

Multiple Choice

Answers

Using her personal connections and network of friends, she offers consumers face-to-face presentations in their homes. This is an example of Direct selling.

Direct selling refers to the sale of products or services directly to consumers without the use of intermediaries like retail stores or wholesalers. It is a popular business model that has been used for decades and is often associated with home-based businesses and network marketing.

Direct selling companies typically offer their products through independent salespeople or distributors, who are responsible for promoting and selling the products to their network of customers. These distributors often earn commissions on their sales and can also build their own teams of distributors, earning additional commissions on their team's sales.

Direct selling can be a flexible and lucrative way to earn income, but it also requires hard work and dedication.

learn more about Direct selling here

https://brainly.com/question/16339654

#SPJ1

what can occur for project activities on a critical path that include slack time? more than one answer may be selected.

Answers

b) 'They can be completed after the project end date' and d) 'They need to be completed before other activities on the critical path' can occur for project activities on a critical path that include slack time.

Activities on the critical path are the ones that directly impact the project's overall duration. Slack time refers to the amount of time an activity can be delayed without causing a delay to the project's completion date. If an activity on the critical path has slack time, it means that it has flexibility in its schedule.

Given the nature of activities on the critical path and their impact on the project timeline, the following scenarios can occur for project activities with slack time:

b) They can be completed after the project end date: Activities with slack time can be delayed without affecting the project's completion date. This flexibility allows for adjusting the schedule to account for unforeseen delays or resource constraints.

d) They need to be completed before other activities on the critical path: While activities on the critical path have slack time, they still need to be completed before subsequent activities can begin. The critical path represents the longest sequence of dependent activities that determines the project's minimum duration. Completing activities on the critical path is crucial to maintain the project's timeline.

Regarding the other options:

a) They can be allocated fewer resources: This statement is not necessarily true. Activities on the critical path usually require sufficient resources to be completed within the planned time. Reducing resources may impact their timely completion and potentially affect the project's overall schedule.

c) They can be deemed a lower quality: Slack time does not necessarily imply lower quality for activities on the critical path. Quality standards should be maintained irrespective of the availability of slack time. The focus is on meeting the project's objectives and timeline while delivering the expected level of quality.

Hence, the correct answers are b) 'They can be completed after the project end date' and d) 'They need to be completed before other activities on the critical path'.

Correct Question :

What can occur for project activities on a critical path that include slack time?

More than one answer may be selected.

a) They can be allocated fewer resources.

b) They can be completed after the project end date.

c) They can be deemed a lower quality.

d) They need to be completed before other activities on the critical path.

To learn more about critical path here:

https://brainly.com/question/30664061

#SPJ4

Use the sum-of-year depreciation method to calculate the depreciation for the

following scenario. Company XYZ bought a new machine for $100,000 and

expects the machine will last for 10 years.

Answers

Answer:

20%

Explanation:

How to Calculate Straight Line Depreciation

The straight line calculation steps are:

Determine the cost of the asset.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount.

Determine the useful life of the asset.

Divide the sum of step (2) by the number arrived at in step (3) to get the annual depreciation amount.

Straight Line Example

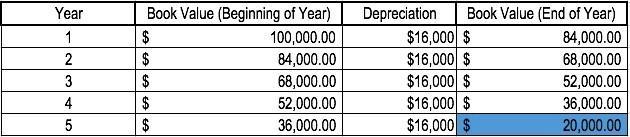

Company A purchases a machine for $100,000 with an estimated salvage value of $20,000 and a useful life of 5 years.

The straight line depreciation for the machine would be calculated as follows:

Cost of the asset: $100,000

Cost of the asset – Estimated salvage value: $100,000 – $20,000 = $80,000 total depreciable cost

Useful life of the asset: 5 years

Divide step (2) by step (3): $80,000 / 5 years = $16,000 annual depreciation amount

Therefore, Company A would depreciate the machine at the amount of $16,000 annually for 5 years.

The depreciation rate can also be calculated if the annual depreciation amount is known. The depreciation rate is the annual depreciation amount / total depreciable cost. In this case, the machine has a straight-line depreciation rate of $16,000 / $80,000 = 20%.

robert recently completed a soc engagement for a customer and is preparing a report that describes his firm's opinion on the suitability and effectiveness of security controls after evaluating them over a six-month period. what type of report is he preparing?

Answers

Type I and Type II are the only two forms of SOC reports. Regarding the adequacy of the design of security controls, both reports offer information. Only a Type II report expresses an opinion regarding the controls' long-term operational effectiveness.

What is soc engagement?A Service Organization Controls (SOC) engagement from Copeland Buhl gives your clients and potential clients peace of mind that appropriate controls are in place for IT security, data availability, processing integrity, confidentiality, financial reporting, and privacy.A SOC 1 engagement is an examination of the internal reporting controls, specifically internal controls over financial reporting, that a service company has put in place to safeguard client data.System and Organization Controls (SOC) is a group of services that CPAs can give in relation to system controls.controls of a service organization or controls at the entity level of other organizationsTo learn more about soc engagement refer to:

https://brainly.com/question/29242419

#SPJ4

Type I and Type II are the only two forms of SOC reports. Regarding the adequacy of the design of security controls, both reports offer information. Only a Type II report expresses an opinion regarding the controls' long-term operational effectiveness.

What is soc engagement?A Service Organization Controls (SOC) engagement from Copeland Buhl gives your clients and potential clients peace of mind that appropriate controls are in place for IT security, data availability, processing integrity, confidentiality, financial reporting, and privacy.A SOC 1 engagement is an examination of the internal reporting controls, specifically internal controls over financial reporting, that a service company has put in place to safeguard client data.System and Organization Controls (SOC) is a group of services that CPAs can give in relation to system controls.controls of a service organization or controls at the entity level of other organizationsTo learn more about Service Organization Controls refer to:

brainly.com/question/29242419

#SPJ4

The decision to purchase additional production machinery is considered a: a. Infrastructural decision b. Structural decision c. Operational decision d. Critical decision e. Formational decision

Answers

One example of an infrastructure decision is the choice to buy more production equipment. Long-term investments in the company's capabilities, resources, and organisational structure are related to infrastructure decisions.

The company's production capacity, efficiency, and ability to compete in the market can all be significantly impacted by the purchase of new machinery. This choice necessitates a careful examination of the organization's long-term strategic objectives, financial situation, and market developments. The choice to buy more production equipment is regarded as an infrastructure choice since it entails improving and growing the company's physical and administrative infrastructure to support operations and growth.

learn more about infrastructure here:

https://brainly.com/question/14527131

#SPJ4

on july 1, 2019, allen company signed a $100,000, one-year, 6 percent note payable. the principal and interest will be paid on june 30, 2020. how much interest expense should be reported on the income statement for the year ended december 31, 2019?

Answers

The interest expense that should be reported on the income statement for the year ended December 31, 2019 is $3,000.

How to find the interest expense?To calculate this amount, we need to find the amount of interest that has accrued during the period from July 1, 2019 to December 31, 2019.

Since the note payable is for a one-year term, with 6 percent interest, the interest rate per half year is 6 percent / 2 = 3 percent. So, the interest expense for the first half year from July 1, 2019 to December 31, 2019 is:

$100,000 * 3% * (6 / 12) = $3,000

Therefore, the interest expense is $3,000.

Learn more about interest expense here:https://brainly.com/question/28117787

#SPJ1

Andrew is a software tester. He runs through the same kinds of programs day after day, looking for bugs and reporting them. The workers in another department look at Andrew's reports and do the programming needed to fix the problems; Andrew never knows if his reports result in any software changes. Andrew is taking night classes in programming. Often, he knows the best solution for many of the bugs he finds, but is forbidden to make the fix or even offer suggestions. Which part of this description relates most to Task Identity

Answers

Answer: The workers in another department do the programming needed to fix the problems

Explanation:

Every organization has job roles and task for which individuals where employed for and in most cases workers are not really permitted to do beyond their task unless they are asked to do so by the organization or they are asked by their colleagues to assist them, despite Andrew taking classes in software training, he would still need approval from the organization before he can carry out task in another department.

Sarah needs to transfer money from one of her bank accounts to another. She would call someone from the Banking Services pathway of the Finance career cluster to help her do this.

A. True

B. False

Answers

The Answer is: A. True

She would need to call someone from the Banking Services pathway of the Finance career cluster to help her.

Antoine is giving a speech about the national mall in washington,

d.c. and plans to highlight three key locations. first, he plans to talk about the capitol building, which is located on the east end of the mall. second, he plans to talk about the washington monument, which is located in the middle of the mall. finally, he plans to talk about the lincoln memorial, which is located on the west end of the mall. which pattern of organization is antoine using

Answers

Answer:

Spatial

Explanation:

The pattern of organization that antoine was using is SPATIAL PATTERNS OF ORGANISATION.

Spatial pattern of organization is the type of patterns that help to arranges or organized information according to how they exists in relation to another which is why SPATIAL pattern is useful in a situation where a writer wishes or desire to create a great mental picture of something which has several parts differentiated by physical location during a speech just as in the case of Antoine in which

he first plans to talk about the capitol building, located on the east end of the mall. The second location he plans to talk about was the washington monument, located in the middle of the mall while the third location he plans to talk about was the lincoln memorial, located on the west end of the mall. This shown that Antonie was using SPATIAL pattern of organisational when he was planning on how to give the speech reason been that the speech Antonie intended to speak about based on three locations was plan ,organized and arranged based on how the location fit together in physical space.

quincy's framing and art supplies frames artwork. the cost formula for the company's supplies cost is $1,880 per month plus $8 per frame. for the month of march, the company planned for activity of 628 frames, but the actual level of activity was 632 frames. the actual supplies cost for the month was $7,350. the activity variance for supplies cost in march would be closest to:

Answers

The Activity Variance for the cost of supplies is $80. Unfavorable Cost of Supplies Activity Variance = $80 Unfavorable

Budgeted Cost

=[(616 Frames x $10)+ $1,760]

=$7,920

Flexible Cost

= [(624 Frames x $10)+ $1,760]

=$8,000

The Activity Variance for supplies cost

=Budgeted Cost - Flexible Cost

=$7,920 - $8,000

= $80 Unfavorable

An examination of the discrepancy between anticipated and actual Activity Variance numbers is the essence of variance analysis. The Unfavorable total of all deviations provides an overview of the overall over- or under-performance for a given reporting period. Companies evaluate each item's favorability by contrasting real costs with average industry expenses.

The discrepancy between standards and actual performance metrics is what we refer to as a "variance." Variances are calculated for the cost Activity Variance and quantity of the materials, the labor cost, and the Unfavorable variable overhead, and they are then communicated to management. Not every difference, though, is significant.

Learn more about Activity Variance here

https://brainly.com/question/15421743

#SPJ4

Chapter 3-22 Recording adopted budget (L03-5) The town of willingdon adopted the following general fund budget for the fiscal year beginning July 1

Prepare journal entries to record the adopted budget

Answers

Journal entries are a way to record financial transactions in accounting. Each journal entry consists of at least two parts: a debit and a credit. The debit and credit amounts must always be equal, which is known as the accounting equation of Assets = Liabilities + Equity.

The general journal entries to record the adopted budget at the beginning of the fiscal year would be:

Debit: Estimated Revenues - Taxes $14,900,000

Debit: Estimated Revenues - Intergovernmental Revenues $600,000

Debit: Estimated Revenues - Charges for Services $810,500

Debit: Estimated Revenues - Fines and Forfeits $150,000

Debit: Estimated Revenues - Miscellaneous Revenues $98,200

Credit: Appropriations - General Government $5,400,000

Credit: Appropriations - Public Safety $8,550,000

Credit: Appropriations - Public Works $1,540,000

Credit: Appropriations - Culture and Recreation $960,000

Credit: Appropriations - Miscellaneous $80,000

a-2. The entries in the subsidiary ledger accounts would be:

Subsidiary Ledger - Estimated Revenues:

Taxes: Debit $14,900,000

Intergovernmental Revenues: Debit $600,000

Charges for Services: Debit $810,500

Fines and Forfeits: Debit $150,000

Miscellaneous Revenues: Debit $98,200

Subsidiary Ledger - Appropriations:

General Government: Credit $5,400,000

Public Safety: Credit $8,550,000

Public Works: Credit $1,540,000

Culture and Recreation: Credit $960,000

Miscellaneous: Credit $80,000

Learn more about Journal entries

https://brainly.com/question/20421012

#SPJ4

Full Question: During July, the first month f the fiscal year, the Town of Willingdon issued the following purchase orders and contracts.

General Government $800,000

Public Safety $400,000

Public works $75,000

Health and welfare $65,000

Miscellaneous $25,000

Total PO and contracts $1,365,000

Prepare the general journal entry to record the issuance of the POs and contracts.

Then show the entries in subsidiary ledger accounts.

In business writing, the main idea of a written work should be located

a. At the end of the first paragraph

b. In the body of the document

At the beginning of the first paragraph

d. In the salutation of the document

C.

Please select the best answer from the choices provided

Ο Α

B

С

OD

Answers

Answer:

c

Explanation:

cccccccccccccccccccccccccc

Answer:

well i blive its c

Explanation:

Which of the following indicates that the assessment of one employee is affecting the ability to be objective when rating another employee? A) Halo error B) Recency error C) 360 degree feedback D) Judgmental methods E) Fixed standards

Answers

The answer that demonstrates how one employee's evaluation affects one's ability to rate another employee objectively is A) Halo mistake.

Halo mistake happens when a rater's general opinion of an employee—whether it's favourable or unfavorable—influences how they rate that employee's performance along particular dimensions. This might result in a halo effect when the rater regularly evaluates the other employee higher or worse based on their predetermined notion if the evaluation of one employee is influencing the rater's view or prejudice. This mistake precludes the rater from giving an accurate and objective assessment of the person's performance relative to particular criteria. The halo error impairs the rating process's objectivity and impartiality.

learn more about employee's here:

https://brainly.com/question/32186991

#SPJ11

Explain how a change in banking policy may impact a life decision that you will one day, or maybe have in the past, come across. This can include, among other decisions, a major purchase, a decision regarding schooling, or a decision to start a business.

Answers

Banks act as intermediaries between those with excess funds and those in need of funds. Banks offer low-interest loans to a huge number of customers. They also help the sector by offering low-interest loans to industrialists.

Banks are the economic backbone of the country. Banks act as a go-between for people who have extra cash and others who don't. They pay interest to depositors and charge interest to individuals who take out bank loans. The bank's major source of income is the difference between interest rates. Banks collect private savings and lend them to entrepreneurs and manufacturers. Bank loans facilitate trade.

To learn more about economic, click here.

https://brainly.com/question/14787713

#SPJ1

The broker while creating a CMA does not usually consider the full range of data about market conditions and comparable sales that the appraiser must consider and document. Therefore, the broker's opinion of value will be

Answers

Answer:

less reliable than the appraiser's.

Explanation:

in such a scenario the broker's opinion of value will be less reliable than the appraiser's. This is mainly because the broker does not have all the information that the appraiser has and is making his opinion without this information, which may lead to unforeseen consequences that would not otherwise occur if the broker had this information and was able to see a much bigger picture of the situation to incorporate into his opinion.

For tax porposes, you may nave to report the value of your assets, such as cars of religerators The value yod tepod diops with time. Strighit line depreciatiod" assumes that the value is a inear Value o dedas

Answers

Straight-line depreciation assumes that the value of assets depreciates evenly over time, following a linear decline.

Straight-line depreciation is a commonly used method for estimating the decline in the value of assets for tax purposes. Under this approach, it is assumed that the asset's value decreases at a constant rate over its useful life. In other words, the asset's value depreciates in a linear fashion. For example, if you have a car or a refrigerator, the straight-line depreciation method assumes that the asset's value will decrease by the same amount each year.

To calculate straight-line depreciation, you need to determine the initial value of the asset and its useful life. Then, you divide the difference between the initial value and the estimated salvage value (the value at the end of its useful life) by the number of years of the asset's useful life. This gives you the depreciation expense that can be deducted for tax purposes each year.

It's important to note that the straight-line depreciation method may not accurately reflect the actual decline in value for certain assets. Some assets may depreciate more rapidly in the early years and slow down later, while others may experience different patterns of depreciation. However, straight-line depreciation provides a simplified and consistent approach for reporting asset values for tax purposes.

Learn more about expense here:

https://brainly.com/question/29850561

#SPJ11

imapct of corona virus as one of the socio - economic issues on business

Answers

Answer: It has also sparked fears of an impending economic crisis and recession. Social distancing, self-isolation, and travel restrictions have lead to a reduced workforce across all economic sectors and caused many jobs to be lost. Schools have closed down, and the need for commodities and manufactured products has decreased.

Hope this helped!

Answer:

the impact of the corona virus on bussisess and the econmy has made people lose their jobs and bussineses shut down

Explanation:

can someone make up a paragraph about a energy drink pls just say how it helps and whats it for i have to create my drink

Answers

Answer:

It uses a brand new way of transferring electrolytes to your body due to the brand new electric containing bottle. Here's the best part it's all natural flavoring and there is no decline in energy afterwards. it can help with you exercising, it can help with thirst and it can even help you wake up.

hope this helps (:

PLEASE HELP QUICKLY: (FIRST ANSWER GETS BRAINLIEST)

Every monetary decision we make involves a level of choice, usually of one thing over another. What is the name for this financial trade-off?

A. personal risks

B. inflation

C.opportunity cost

Answers

Answer:

C.opportunity cost

Explanation:

this is super easy

Answer:

C

Explanation:

Took the test :)

Kudzu, Clemmons and Clancy form KCC Partnership with the following contributions:

Partner

Contribution

Adjusted Basis

Fair Market Value

Kudzu

Land

$52,000

$50,000

Kudzu

Services

N/A

$ 5,000

Clemmons

Property

$30,000

$40,000

Clancy

Property

$25,000

$30,000

What amount of taxable income to Kudzu results from the formation of KCC?

$7,000

$2,000

$0

$5,000

Answers

The taxable income to Kudzu resulting from the formation of KCC is $0

To calculate this, we need to determine Kudzu's initial adjusted basis in the partnership, which is the sum of the adjusted bases of the property and services contributed. In this case, Kudzu contributed land with an adjusted basis of $52,000 and services with an adjusted basis of $0, for a total adjusted basis of $52,000.

Next, we need to determine Kudzu's share of the partnership's liabilities, which is $0 since none are listed in the question.

Finally, we compare Kudzu's share of the partnership's total fair market value to their initial adjusted basis to determine if there is any taxable income or loss. Kudzu's share of the total fair market value is ($50,000 + $5,000 + $40,000 + $30,000) x 1/4 (since there are four partners in the partnership) = $31,250.

Kudzu's initial adjusted basis of $52,000 is greater than their share of the total fair market value of $31,250, resulting in a loss of $20,750. However, since Kudzu did not contribute any cash or property with a built-in gain, there is no taxable income to Kudzu. Therefore, the answer is $0.

Know more about taxable income click here:

https://brainly.com/question/30617249

#SPJ11

Total Quality Management (TQM) is a management approach to long-term success through customer satisfaction. Quality management is a discipline for ensuring that outputs, benefits, and the processes by which they are delivered, meet stakeholder requirements and are fit for purpose. a) Identify the disadvantages of TQM on employees related to the training duration, the negative effect of cost and the current system. (5 marks) (CLO5:PLO8:C2) b) Identify the main different between Quality Control and Quality Assurances in Quality Management. Give TWO (2) examples each of Quality Control activities and Quality Assurances activities. (5 marks)

Answers

a) There are several disadvantages of TQM on employees, like training duration, negative effect on cost, etc. b)Quality Control (QC) and Quality Assurance (QA) are both important aspects of Quality Management, but they are different in several ways.

1. Training Duration: Implementing TQM requires a significant amount of training for employees, which can be time-consuming and disruptive to their regular work schedules.

2. Negative Effect on Cost: While TQM can ultimately lead to cost savings in the long run, the initial implementation and training can be expensive and may negatively affect the company's bottom line in the short term.

3. Current System: TQM requires a significant shift in the way that a company operates, and this can be difficult for employees who are used to the current system. This can lead to resistance and a lack of buy-in from employees, which can hinder the success of TQM.

b) Quality Control (QC) and Quality Assurance (QA) are both important aspects of Quality Management, but they are different in several ways.

Quality Control is focused on identifying and correcting defects in products or services before they are delivered to customers. QC activities include inspecting products, testing samples, and monitoring production processes.

Quality Assurance, on the other hand, is focused on ensuring that the processes used to create products or services are consistent and meet quality standards. QA activities include auditing processes, reviewing documentation, and conducting training.

Examples of Quality Control activities include:

- Inspecting products for defects before they are shipped to customers

- Testing samples of products to ensure they meet quality standards

Examples of Quality Assurance activities include:

- Conducting audits of production processes to ensure they are consistent and meet quality standards

- Reviewing documentation to ensure it is accurate and complete

To know more about Total Quality Management refer to-

brainly.com/question/17368639#

#SPJ11

the size of a tax and the deadweight loss that results from the tax are a. negatively related. b. equal to each other. c. independent of each other. d. positively related.

Answers

The relationship between the tax and the resulting deadweight loss from that tax are d. positively related.

How are taxes and deadweight loss related ?Taxes and deadweight loss are said to be positively related because they both increase and decrease together. In other words, if the government was to increase the taxes levied on people, then the deadweight loss would increase as well.

The reason for this is simply that the increase in taxes means that less people would be able to buy goods and services and so there would develop a deadweight loss from the difference in what people want to buy and what they can.

Find out more on deadweight loss at https://brainly.com/question/15415492

#SPJ1

Social factors exert the broadest and deepest influence over a person’s consumer behavior. True or false?.

Answers

False

An individual's decision-making process is unaffected by social, personal, or psychological variables.

What is decision-making process?Determining a decision, acquiring data, and weighing potential solutions are all steps in the decision-making process. You can make more careful, intelligent decisions by organizing pertinent information and outlining alternatives by following a step-by-step decision-making process.

People are influenced by others in their "in-group" who are typically persons who share their age, sex, ethnicity, or religion, as well as friends, family members, coworkers, and classmates, while making decisions.

What are the 6 factors of the decision-making process? Individual elements organizational aspects,Social aspects Environmental considerations Social and behavioral aspects. Elements that affect one's ability to make decisions.To know more about decision-making visit:

https://brainly.com/question/13448538

#SPJ4

Whats better: Mustang or Dodge

Answers

Answer:

Mustang

Explanation:

Answer:

I think Mustang

Explanation:

It's just my choice because I think it's the best and maybe I don't know if dodge is the foreign one lol?

please help me quick :( (sorry meant to put chem not business)

Answers

A credit sale of $2,500 to a customer would result in:A debit to the Accounts Receivable account in the general ledger and a debit to the customer's account in the accounts receivable ledger. A debit to the Accounts Receivable account in the general ledger and a credit to the customer's account in the accounts receivable ledger. A credit to the Accounts Receivable account in the general ledger and a credit to the customer's account in the accounts receivable ledger. A credit to the Accounts Receivable account in the general ledger and a debit to the customer's account in the accounts receivable ledger.

Answers

Answer:A debit to the Accounts Receivable account in the general ledger and a debit to the customer's account in the accounts receivable ledger.

Explanation:

In Recording a Credit Sale in the general Ledger, the following should be made

Account Debit Credit

Accounts receivable $2,500

Sales revenue $2,500

In Recording a Credit Sale in the accounts receivable ledger, the following should be made

Account Debit Credit

Cash(Customer's account) $2,500

Accounts receivable $2,500

Therefore, A credit sale of $2,500 to a customer would result in A debit to the Accounts Receivable account in the general ledger and a debit to the customer's account in the accounts receivable ledger

NEED HELP ASAP PLEASE

please define these words for me

-Right to Redress

-Secure Credit

-Unsecure Credit

-Collateral

-Principal

-Mortgage

-Insurance

HURRY PLEASE

Answers

-beetle juice

which wheel settings change when you mount the subframe incorrectly in the transverse direction? Check all that apply

TOE

CAMBER

STEERING AXIS INCLINATION (SAI)

CASTER

Answers

The wheel settings that change when you mount the subframe incorrectly in the transverse direction is "CASTER" (Option D)

What is Caster?Caster is the process of aligning a wheel with the direction of travel, which can be performed by caster displacement or caster angle. As with the front wheels of a shopping cart, caster displacement shifts the steering axis forward of the axis of wheel rotation. The steering axis is moved away from the vertical by the caster angle.

The caster angle, also known as the castor angle, is the angular displacement of the steering axis from the vertical axis of a steered wheel of a car, motorbike, bicycle, another vehicle, or watercraft as seen from the side.

Positive caster enhances the responsiveness of your vehicle while negotiating bends and the stability of your car when going at greater speeds. The sole disadvantage of a positive caster is that it increases the amount of effort required to steer your car.

Turning plates and a digital or bubble camber/caster gauge are the two most common methods for measuring caster angles. Measuring the upper and lower wishbone mounting points or the MacPherson strut angle.

Learn more about Wheel Settings:

https://brainly.com/question/11372596

#SPJ1

John Maynard Keynes argued that governments should:

Answers

Answer:

Keynes believed that governments should increase spending and lower taxes in order to stimulate demand in the face of recession.

Explanation:

Answer:

Spend more money to help reduce unemployment.

Explanation:

A nurse, police office, and teacher would all have _____ interests. a. scientific b. social c. office operations d. craft Please select the best answer from the choices provided A B C D

Answers

Answer:

B

Explanation:

They all have to talk to their fellow co-workers. Therefore B is the best answer

Answer:

B) social

Explanation:

Just took the test