Lin Corporation has a single product whose selling price is 120 and whose variable expense is 80 per unit. The company's monthly fixed expense is 50,000 .

(a) Using the equation method, solve for the unit sales that are required to earn a target profit of 10,000

Answers

Using the equation method, the unit sales that are required to earn a target profit of 10,000 are 1500 units.

given information:

selling price = $120 per unit

variable expense = 80 per unit

monthly fixed expenses = $50,000

And target profit = $10,000

Assuming 'x' is the units sold to achieve the target profit of $10,000

Using the equation method,

Sales = variable expense + fixed expense + target profit

Now, substituting the given values in the above equation we get,

120x = 80x + $50000 + $10000

120x = 80x + $60000

120x - 80x = $60000

40x = $60000

x = $60000/40

x = 1500 units

Hence, 1500 units are required to earn a target profit of 10,000.

Learn more about selling price:

https://brainly.com/question/17960859

#SPJ4

Related Questions

The process of controlling and making decisions about a business is called:

O Leadership

O Management

O Administration

Answers

Answer:

B. Management.

Explanation:

Management can be defined as the process of controlling and making decisions about a business.

The management comprises of top executives, board of directors or managers who generally control the affairs of a business firm or company.

Basically, they are saddled with the responsibility of defining the policies, set of rules, standards, and procedures so as to preserve or protect the company's assets, boost efficiency, enhance financial accountability, and prevent fraudulent behaviors among the employees.

Also, the decision-making process or responsibilities is essentially vested on the management of a business. Therefore, the management is typically responsible for the success, growth and development of their business.

Your building plan for your restaurant includes 4 bathrooms - 2 women’s and 2 men’s. The city inspector informs you , that you must have at least 400 square feet per bathroom. If your building is a total of 8,000 square feet, how many square feet are left for the development of other , non bathroom areas?

A) 4,000 square feet

B) 4,800 square feet

C) 6,400 square feet

D) 8,000 square feet

Answers

Answer:

C) 6,400 square feet

Explanation:

Each bathroom requires at least 400 square feet. There are four bathrooms.

In total, the four bathrooms will need 400 square feet multiplied by four.

= 400 square feet x 4

=1600 square feet

The space left for other developments

=total space - bathroom space

=8000 square feet - 1600 square feet

=6400 square feet

Which are examples of a service business? (Check all that apply)

Ford Dealership

Southwest Airlines

Procter & Gamble

McDonalds

Answers

Answer: Southwest Airlines, Ford Dealership & McDonalds

Explanation: For ex, airlines, banks, electronic support providers, law firms, plumbing repair companies, movie theaters, and managing management consulting firms are pure service companies. Foodservice McDonald's outlets. In more than 100 countries worldwide, these restaurants offer a diverse, but small value list.

Find a news report of a liability claim that one person (or entity) has made against another this year.

What is the url link to the report?

Describe the situation in your own words.

What type of liability does this fall under? Explain.

Would any of the defenses that we discussed in this unit be applicable to this situation? If so, which ones, if not, explain why.

Answers

Example situation:

In a recent news report, Person A has filed a liability claim against Company B for injuries sustained in a car accident. The accident occurred when a Company B delivery vehicle collided with Person A's car at an intersection. Person A claims that the accident was due to the negligence of the Company B driver, resulting in physical injuries and property damage.

Type of liability:

This situation falls under the category of "tort liability." Tort liability refers to a civil wrong or injury caused by one party to another, resulting in legal liability for the responsible party.

Applicability of defenses:

The applicability of defenses in this situation would depend on the specific circumstances, jurisdiction, and applicable laws. Here are a few defenses commonly used in liability claims:

1. Contributory negligence: If Person A is found to have contributed to the accident through their own negligence, it may impact their ability to recover damages or reduce the amount they can claim.

2. Comparative negligence: Some jurisdictions follow the principle of comparative negligence, which means that both parties' negligence is considered, and the damages awarded are proportionally reduced based on each party's degree of fault.

3. Assumption of risk: If Person A voluntarily assumed a known risk associated with the situation, such as engaging in a dangerous activity, Company B might argue that Person A knowingly accepted the risk and therefore cannot hold them fully liable.

4. Statute of limitations: If the claim was filed beyond the statute of limitations specified by the relevant laws, Company B may argue that the claim is time-barred and should be dismissed.

It's important to note that the specific application of defenses would depend on the jurisdiction and the facts of the case. Consulting a legal professional would be necessary to determine the applicable defenses in a real-life scenario.

Learn more about Contributory negligence here:

https://brainly.com/question/29829781

#SPJ11

What is a stap you can take toward committing to a career path?

A Take some career assessments

B. Check for positions in your area

, )

Keep your options Open

O D. Find out how popularitis

Answers

Answer:

B. Check for positions in your area

Explanation:

i think though!! im not sure

PROJECT: USING ADVANCED FORMULAS

Suppose you own a small business with ten employees. Small businesses use spreadsheets for a variety of reasons.

OBJECTIVES

Create a spreadsheet to track payroll.

Directions

Create a spreadsheet to calculate the your company's payroll, or how much you pay each employee and the total you pay all employees.

You pay your employees every two weeks, and for the last two weeks, your employees worked the following hours:

Employee 1: 78

Employee 2: 75

Employee 3: 80

Employee 4: 45

Employee 5: 50

Employee 6: 80

Employee 7: 65

Employee 8: 60

Employee 9: 78

Employee 10: 75

Your spreadsheet should calculate:

the total hours worked for each employee

the gross pay for each employee (pay rate is $12.50 per hour)

the state income tax for each employee (use 5.7%)

the Federal income tax for each employee (use 15%)

Social Security for each employee (use 3.5%)

the net pay for each employee by subtracting the income tax and Social Security from the gross pay

the total gross pay, total state income tax, total Federal income tax, total Social Security, and total net pay paid to all employees

When you finish your spreadsheet, estimate your answers to check for accuracy. Make any necessary corrections. Use formatting techniques to make your spreadsheet easy to read. Upload your spreadsheet using the Upload tool in the box below.

Answers

Answer:

Total hours worked for two weeks by all employees = 686 hours

Total Gross pay of all employees = $8,575.00

Total State income tax of all employees = $488.78

Total Federal income tax of all employees = $1,286.25

Total Social Security of all employees = $300.13

Total Net Pay of all employees = $6,499.85

Explanation:

Note: See the attached excel file for the calculation of the company's payroll or amount paid to each employee and the total amount paid to all employees on a spreadsheet as required by the question.

In the attached excel file, the following formula are used:

Gross pay for each employee = Pay rate of $12.50 per hour * Total hours worked for two weeks by each employee

State income tax for each employee = 5.7% * Gross pay for each employee

Federal income tax for each employee = 15% * Gross pay for each employee

Social Security for each employee = 3.5% * Gross pay for each employee

Answer:

here you go edmentum

Explanation:

On november 1, lawn & order, inc. Paid $24,000 for two years of rent in advance for rent beginning on november 1. How much should be expensed for the month of november?.

Answers

If on november 1, lawn & order, inc. Paid $24,000 for two years of rent in advance for rent beginning on november 1. The amount that should be expensed for the month of november is: $1,000

Expensed amount for the month of November2 years = 24 months

Now let find or determine the amount that should be expensed for the month of November using this formula

Expensed amount= ( 1/24 months ×Rent amount paid)

Where:

Rent amount paid = $24,000

Let plug in the formula

Expensed amount = 1/24× $24, 000

Expensed amount=$1,000

Based on the above calculation we can conclude that the expense amount for the month of November is $1,000.

Therefore If on november 1, lawn & order, inc. Paid $24,000 for two years of rent in advance for rent beginning on november 1. The amount that should be expensed for the month of november is: $1,000 ,

Learn more about expensed amount here: https://brainly.com/question/25806993

#SPJ1

I NEED THIS NOW

Three key skills are necessary if you want to be a leader: ___________, ___________, and ___________.

A. interpersonal communication, problem solving, and organizational skills

B. organizational skills, teamwork, and problem solving

C. teamwork, conflict resolution, and athletic ability

D. teamwork, problem solving, and motivation

Answers

The three key skills that are necessary for a leader: interpersonal communication, problem solving, and organizational skills

Who is a leader?A leader is someone who get things done through others. The leader in an organization directs the affairs hence would be held accountable for the success or otherwise of the organization.

Leaders need to have various skills that will contribute to the success of their leadership abilities. However, the basic ones are interpersonal communication, problem solving, and organizational skills.

Some other leadership skills are ;

Decisiveness, ability to make decisionsCapabilities to mentor as well to teachRelationship building strategyAbility to solve problemPerseveranceHence, the three key skills that are necessary for a leader: interpersonal communication, problem solving, and organizational skills

Learn more about leadership skills here: https://brainly.com/question/13679833

David Gain is the chief executive officer (CEo) of Forest Media Corp., which is interested in acquiring RS Communications, Inc. To initiate negotiations, Gain meets with RS's CEo, Gill Raz, on Friday, July 12. Two days later, Gain phones his brother, Mark, who buys 3,800 shares of RS stock on the following Monday. Mark discusses the deal with their father, Jordan, who buys 20,000 RS shares on Thursday. on July 25, the day before the RS bid is due, Gain phones his parents' home, and Mark buys another 3,200 RS shares. over the next few days, Gain periodically phones Mark and Jordan, both of whom continued to buy RS shares. on August 5, RS refuses Forest's bid and announces that it is merging with another company. The price of RS stock rises thirty percent, increasing the value of Mark's and Jordan's shares by nearly $660,000 and $400,000, respectively.

Required:

a. Is Gain guilty of insider trading?

b. Could a court hold Gain liable? Why or why not?

Answers

Based on the scenario described and the actions of those related to Gain:

a. Gain is indeed guilty of insider trading b. A court could indeed hold Gain liableInsider trading:

Occurs when one buys shares because they know something that the rest of the public does not Allows such traders to gain great profits or avoid huge lossesWhen a company is to be acquired, its shares generally rise in price. Gain must have told his brother that he was trying to acquire RS Communications which was why both his brother and father purchased those shares.

In conclusion, Gain engaged in insider trading because his brother and father bought RS shares knowing they would rise as a result of the confidential information Gain shared with them and a court would hold him liable for this.

Find out more on insider trading at https://brainly.com/question/15848966.

if interest is charged on the principal, what equal annual payment would be required to complete the repayment of the loan in 7 years? the equal annual payment required is _____.

Answers

To calculate the equal annual payment required to complete the repayment of a loan in 7 years, we first need to consider the loan amount, interest rate, and the number of payments.

Let's assume that the loan amount is $10,000, and the interest rate is 5% per annum. The repayment period is 7 years, and interest is charged on the principal. We can use the formula for calculating the equal annual payment required for a loan, which is: A = P * r / (1 - (1 + r)^-n) Where:A = equal annual payment required

P = loan amount r = interest rate per payment period n = total number of payments To calculate the interest rate per payment period, we need to divide the annual interest rate by the number of payments per year. In this case, since we have annual payments, the interest rate per payment period is 5%/1 = 5%. Using the values given, we can substitute them into the formula: A = 10,000 * 0.05 / (1 - (1 + 0.05)^-7) Solving this equation, we get: A = $1,928.06 (rounded to the nearest cent) Therefore, an equal annual payment of $1,928.06 would be required to complete the repayment of the loan in 7 years.

learn more about loan here:

https://brainly.com/question/11794123

#SPJ4

On January 2,2015 , Concord Corporation issued $1,100,000 of 10% bonds at 98 due December 31,2024. Interest on the bonds is payable annually each December 31 . The discount on the bonds is also being amortized on a straight-line basis over the 10 years. (Straight-line is not materially different in effect from the preferable "interest method:") The bonds are callable at 101 (i.e., at 101\% of face amount), and on January 2,2020 , Concord called $660,000 face amount of the bonds and redeemed them. Ignoring income taxes, compute the amount of loss, if any, to be recognized by Concord as a result of retiring the $660,000 of bonds in 2020. (Round answer to 0 decimal places, e.g. 38,548.) Loss on redemption $ Prepare the journal entry to record the redemption. (Round answers to 0 decimal places, e.g. 38,548 . If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when omount is entered. Do not indent manually.)

Answers

Concord Corporation incurs a $220,000 loss when redeeming $660,000 face amount of bonds in 2020. The journal entry for the redemption involves debits to Bonds Payable, Discount on Bonds, and Loss on Redemption, and a credit to Cash.

To compute the amount of loss recognized by Concord Corporation as a result of retiring the $660,000 face amount of bonds in 2020, we need to compare the carrying amount of the bonds to the cash paid for their redemption.

First, let's calculate the carrying amount of the bonds at the time of redemption:

Carrying amount = Face amount of bonds - Accumulated amortization of discount

The face amount of the bonds is $660,000.

To calculate the accumulated amortization of discount, we need to determine the annual amortization amount. Since the discount is being amortized on a straight-line basis over 10 years, the annual amortization amount can be calculated as follows:

Discount amortization per year = Total discount / Number of years

= ($1,100,000 - $660,000) / 10

= $440,000 / 10

= $44,000

The bonds were redeemed after 5 years (from 2015 to 2020), so the accumulated amortization of discount is:

Accumulated amortization of discount = Discount amortization per year * Number of years

= $44,000 * 5

= $220,000

Now, let's calculate the carrying amount of the bonds at the time of redemption:

Carrying amount = Face amount of bonds - Accumulated amortization of discount

= $660,000 - $220,000

= $440,000

The cash paid for the redemption is $660,000.

To determine the amount of loss, we compare the carrying amount of the bonds ($440,000) with the cash paid for redemption ($660,000). If the cash paid exceeds the carrying amount, there is a loss.

Loss on redemption = Cash paid for redemption - Carrying amount

= $660,000 - $440,000

= $220,000

Therefore, the amount of loss recognized by Concord Corporation as a result of retiring the $660,000 of bonds in 2020 is $220,000.

Now let's prepare the journal entry to record the redemption:

Date: January 2, 2020

Debit: Bonds Payable (face amount) $660,000

Debit: Discount on Bonds $220,000

Debit: Loss on Redemption $220,000

Credit: Cash $660,000

No Entry: No additional entry is needed for interest expense or amortization, as the interest payment date has not yet been reached.

To learn more about Discount, Visit:

https://brainly.com/question/9841818

#SPJ11

An investor buys two 20-year bonds each having semiannual coupons and each maturing at par. For each bond the purchase price produces the same yield rate to maturity. One bond has a par value of $500 and a coupon of $45; the other bond has a par value of $1,000 and a coupon of $30. The dollar amount of premium on the first bond is twice as great as the dollar amount of discount on the second bond. What yield rate, convertible semiannually, does the investor realize

Answers

To determine the yield rate, convertible semiannually, that the investor realizes, we need to find the yield rate that makes the present value of each bond's cash flows equal to its purchase price.

Let's denote:

r = Yield rate, convertible semiannually

P1 = Purchase price of the first bond

P2 = Purchase price of the second bond

C1 = Coupon payment for the first bond

C2 = Coupon payment for the second bond

N = Number of periods (20 years * 2 semiannual periods = 40)

For the first bond with a par value of $500 and a coupon of $45, the cash flows consist of 40 coupon payments of $45 each and the par value of $500 at maturity.

The present value (PV) of the first bond can be calculated using the present value formula for a bond:

P1 = (C1/r) * (1 - (1 + r)^(-N)) + (Par value / (1 + r)^N)

For the second bond with a par value of $1,000 and a coupon of $30, the cash flows consist of 40 coupon payments of $30 each and the par value of $1,000 at maturity.

The present value of the second bond can be calculated similarly:

P2 = (C2/r) * (1 - (1 + r)^(-N)) + (Par value / (1 + r)^N)

Given that the dollar amount of premium on the first bond is twice as great as the dollar amount of discount on the second bond, we have:

(P1 - Par value) = 2 * (Par value - P2)

Simplifying the equation, we have:

P1 - Par value = 2 * Par value - 2P2

P1 + 2P2 = 3 * Par value

Now, we can substitute the coupon and par values into the equations and solve for r using numerical methods or financial calculators to find the yield rate, convertible semiannually, that the investor realizes.

Learn more about Coupon payment here:

https://brainly.com/question/30367472

#SPJ11

Which one of these items is NOT a processed material?

O Paper

O Steel

O Sand

O Glass

Answers

Paper was originally tree, steel was metal, glass was heated to become glass

Gold has historically functioned as money. This is due, in part, to the willingness of others to accept it as valid payment for goods and

services. In this case, gold is functioning as an) (1 point)

Answers

The willingness of others to accept gold as a valid payment for goods and services made gold a medium of exchange. In other words, gold was used to facilitate commercial exchanges when these became more developed.

Money has changed and developed over time, it has always been used to make business practices more simplified and standardized.

Some examples of the use of a medium of exchange were salt, which was a rare mineral that was offered in trade, hence the word salary.

Therefore, gold began to be used as a means of exchange from the need to use coins with greater durability.

Learn more here:

https://brainly.com/question/22273374

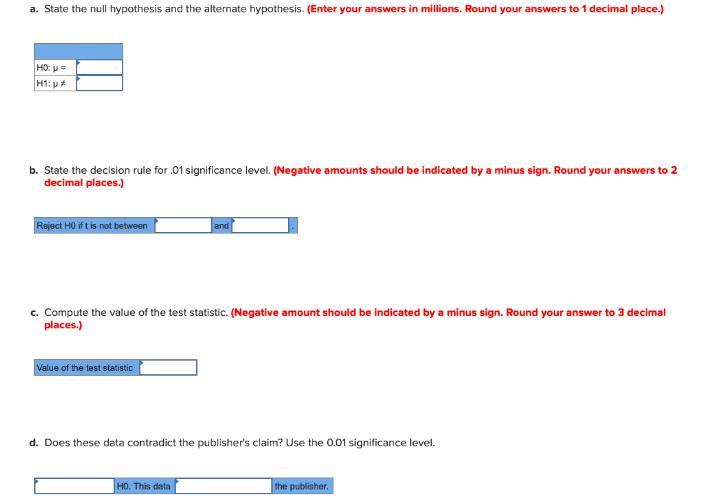

The publisher of Celebrity Living claims that the mean sales for personality magazines that feature people such as Megan Fox or Jennifer Lawrence are 1.5 million copies per week. A sample of 10 comparable titles shows a mean weekly sales last week of 1.3 million copies with a standard deviation of 0.9 million copies.

Answers

Answer and Explanation:

The computation is shown below:

For determining each part first we have to do the following calculations

Critical value of t = 3.250

Null hypothesis = 1.5

Alternative hypothesis ≠ 1.5

Population mean \(\mu\) = 1.5

Sample mean \(\bar X\)= 1.30

Sample size \(n\) = 10.00

Sample standard deviation \(s\) = 0.900

Standard error of mean is

\(s_x = \frac{s}{\sqrt{n} }\)

\(= \frac{0.900}{\sqrt{10.00}}\)

= 0.2846

Test static is

\(t = \frac{x - \mu}{s_x}\)

\(= \frac{1.30 - 1.5}{0.2846}\)

= -0.703

a. The null hypothesis is

μ = 1.5

Alternate Hypothesis is

μ ≠ 1.5

b. reject \(H_o\) if t is not between

-3.250 and 3.250

c. The value of the test statistic is

t = -0.703

(as we have computed above)

d. fail to reject \(H_o\) as this data does not contradict the publisher claim

Question 10 (1 point) Find the dividend payment of a preferred stock priced at $48.20 per share with a market return of 15.65 percent. $6.93 $7.25 $6.80 $7.42 $7.54

Answers

To find the dividend payment of a preferred stock, we need to multiply the stock's price by its dividend yield. The dividend yield can be calculated by dividing the annual dividend by the stock's price.

However, the annual dividend is not provided in the question. Therefore, we cannot directly calculate the dividend payment.

The dividend yield represents the annual dividend as a percentage of the stock's price. It is calculated as:

Dividend Yield = (Annual Dividend / Stock Price) * 100

Since the annual dividend is not given, we cannot calculate the dividend yield or the dividend payment. Without the annual dividend information, we cannot determine the correct answer from the given options.

To find the dividend payment of a preferred stock, it is essential to know the annual dividend amount or the dividend yield provided by the company or market data. Without this information, it is not possible to calculate the dividend payment accurately.

Question 10 (1 point) Find the dividend payment of a preferred stock priced at $48.20 per share with a market return of 15.65 percent. $6.93 $7.25 $6.80 $7.42 $7.54

To learn more about dividend payment click here : brainly.com/question/29316656

#SPJ11

John paid $10,000 in mortgage interest last year. He and his wife earned $150,000 from their jobs last year. Based on their circumstances, they can deduct the mortgage interest from their taxable income, meaning they only have to

pay federal income tax on what amount?

Answers

Answer:

$140,000

Explanation:

$150,000-$10,000= $140,000

I need help!!!!! :| !!!

Answers

Answer:

b

Explanation:

A force of lb is required to hold a spring stretched in. beyond its natural length. How much work is done in stretching it from its natural length to in. beyond its natural length

Answers

The work done in stretching the spring from its natural length to in. beyond its natural length is 0.5 * lb * in.

We'll use Hooke's Law and the work-energy principle. Hooke's Law states that the force (F) required to stretch or compress a spring is proportional to its displacement (x) from its natural length: F = kx, where k is the spring constant.

The work (W) done in stretching a spring is calculated by integrating the force with respect to displacement: W = ∫F dx. Since F = kx, we have W = ∫kx dx.

Let's integrate from the natural length (x = 0) to the stretched length (x = in. beyond its natural length):

W = ∫(kx) dx from 0 to in.

W = 0.5 * k * (in.)^2

Now, we need to find the value of k. Since a force of lb is required to hold the spring stretched in. beyond its natural length, we can use Hooke's Law:

lb = k * in.

Solving for k, we get k = lb / in.

Now substitute this value of k in the work equation:

W = 0.5 * (lb / in.) * (in.)^2

The "in." units cancel out, and we are left with:

W = 0.5 * lb * in.

To know more about Hooke's Law, visit:

https://brainly.com/question/30379950

#SPJ11

A central bank acts as a lender of last resort especially in times of financial crisis. What is the purpose of this function

Answers

Answer:

The purpose of the function is to lend the people indeed.

Explanation:

a central bank help to keep our money and give a loan

The purpose of the function is to lend the people indeed. A central bank help to keep our money and give a loan.

What are the functions of Central Bank?

The primary goal of central bank is to maintain a balance in order to meet the emergency foreign reserve requirements and avoid the negative balance.

Additionally, Central bank provide facilities like implementing monetary policies, setting the official interest rate and controlling the nation's entire money supply.

Learn more about bank, refer to the link:

https://brainly.com/question/11234711

Why is networking important? A. Actually, in today’s job climate, it’s not very important. B. It’s another tool to help connect you with your career goal C. It’s nearly impossible to get a good job unless you know someone in the field. D. If a network of people can’t find you a job, then you can try to convert them to friends.

Answers

Networking is important It’s another tool to help connect you with your career goal.

Why is networking crucial when looking for a job?

The greatest approach to find a job is by networking because people do business primarily with people they know and like. When used alone, cover letters and resumes are frequently too impersonal to convince employers to hire you. Because job postings frequently attract a large number of applicants, you are in fierce competition with many others. Cost-effectiveness, storage effectiveness, adaptability, and data security are further benefits. It also makes it simple for staff to share information, increasing productivity and efficiency.

Know more about networking - brainly.com/question/28457962

#SPJ1

the first part of a sustainability effort comes from processes used where to minimize waste of everything from food to energy?

Answers

The first part of a sustainability effort to minimize waste of everything from food to energy often comes from processes used in the production and consumption of goods and services.

What are some Sustainability Efforts?The first component of a sustainability endeavor to reduce waste of everything from food to energy is frequently derived from methods employed in the production and use of goods and services. This includes efforts to reduce waste and increase efficiency in the use of resources, such as:

Designing products and processes for sustainability: This involves incorporating sustainable practices and principles into the design and development of products and processes, with the goal of reducing waste, energy consumption, and environmental impact.Implementing resource-efficient production processes: This involves adopting resource-efficient technologies and practices, such as using renewable energy, recycling and reusing materials, and reducing water usage.Promoting sustainable consumption: This involves encouraging consumers to make more sustainable choices, such as choosing products that are eco-friendly, energy-efficient, and made from sustainable materials.Managing waste: This involves managing waste in a way that minimizes its impact on the environment, such as by recycling, composting, and properly disposing of hazardous materials.Overall, minimizing waste and promoting sustainability requires a comprehensive approach that involves all stakeholders, from producers and consumers to policymakers and regulators.

Learn more about sustainability here: https://brainly.com/question/4677073

#SPJ1

True or false: A manager trying to motivate his subordinates by focusing on the pride they will feel for completing a task successfully is unlikely to be successful if his subordinates are hungry or cold at the time.

Answers

It is TRUE that a manager who tries to motivate his subordinates by focusing on the pride they will feel for completing a task successfully cannot meet with success if his subordinates are hungry or cold at the time.

What is the motivation of workers?The motivation of workers stems from the enthusiasm, energy level, commitment, and amount of creativity that an employer or supervisor allows the employees to bring to the workplace.

Some factors have been recognized to provide employee motivation. They include:

Meaningful and purposeful workPositive company cultureRecognition for hard workEmpathyCreating opportunities for learning and developmentCareer progression.Thus, it is TRUE that a manager who tries to motivate his subordinates by focusing on the pride they will feel for completing a task successfully cannot meet with success if his subordinates are hungry or cold at the time.

Learn more about employee motivation at https://brainly.com/question/18852626

1.What is a farm business plan used for?

2.What environmental issues could have a negative effect on a farm?

3.Why is knowing agricultural statistics, background info, and soil characteristics about the territory in which your farm is located important?

Answers

Answer:

1. A farm business plan is used to outline the goals, strategies, and financial projections for a farm, and to guide decision-making and management.

2. Environmental issues that could have a negative effect on a farm include soil erosion, drought, flooding, pests and diseases, climate change, pollution, and loss of biodiversity.

3. Knowing agricultural statistics, background information, and soil characteristics about the territory in which your farm is located is important because it helps farmers make informed decisions about what crops to grow, how to manage the land, and how to address challenges and opportunities. This information can help farmers optimize their resources, improve their yields and profitability, and minimize risks and negative impacts on the environment.

what are ""off balance sheet"" transactions? what is ""mark to market accounting"" why are these significant in the context of enron?

Answers

Enron Scandal

The corporation was able to create the appearance of higher current earnings by writing unrealized future gains from some trading contracts into current income statements using mark-to-market accounting.

What Enron accounting controversy occurred?The Enron Scandal involves Enron misleading the regulators by using phony holdings and off-the-books accounting techniques. In order to conceal its toxic assets and enormous debts from investors and creditors, the corporation used special purpose companies.

How did the Enron scandal affect corporate governance?Other additional compliance procedures were brought forth by the Enron scandal. The Financial Accounting Standards Board (FASB) also significantly increased its standards for moral behavior. Additionally, corporate boards of directors developed greater independence, keeping an eye on the audit firms and swiftly removing subpar managers.

To learn more about Off Balance Sheet visit:

https://brainly.com/question/14862266

#SPJ4

47. Indian economy is a mixed economy as it consists of both privately owned and

government owned business enterprises. Therefore, we can classify the Indian economy

into two sectors, viz, Private Sector and Public Sector. In a capitalistic economy, the

private sector is dominating, while in a socialistic economy, the public sector is

dominating. In a mixed economy, both the private sector and public sector go hand in

hand.

. In the light of the above paragraph explain Indian economy?

Answers

Yes, the Indian economy is a mixed economy which consists of two sectors viz, Private Sector and Public Sector.

What is the Indian economy?The economy of India is a mixed middle-income developing social market economy. It is the world's fifth-largest economy by nominal GDP and third-largest economy by purchasing power parity.The essential characteristics of developing economies are overpopulation, extreme poverty or below the poverty line, poor infrastructure, agriculture-based economies, slow pace of capital development, and low per capita income.The Indian economy is characterized by a low real per capita income rate, a high population growth rate, and a high degree of dependence on the primary industry. Covid 19 has had a negative impact on the Indian economy. The Covid pandemic has led to industry shutdowns and subsequent job losses.An economy is a system of interconnected production and consumption activities that ultimately determine the allocation of resources within a group. The production and consumption of goods and services as a whole meet the needs of the people who live and work there.to know more about the Indian economy refer to

https://brainly.com/question/16352684

#SPJ1

Can anyone help me think of an advertisement for a product I’m selling which is a drone.

Answers

Regardless of the variety of options available, all forms of advertising share two objectives: to influence customers so that they become leads or customers.

How to Influence Customers?

Consumer behavior is influenced by four psychological factors: attitude or set of beliefs, perception, learning, and motivation. Behaving in a manner that offers others the opportunity to change (their behavior, attitudes, thoughts, and ways) and/or accommodate your own wishes is one aspect of influencing skills. However, it is important to recognize that others may be unable to, unwilling to, or unprepared to respond to our request to be influenced. Human behavior is influenced by a variety of factors and characteristics. These are distinctions that are unique to the person with whom you are collaborating. Personality traits.

These are things that affect how a person interacts with other people. Institutional elements. Factors that affect the community and Public policy.

To know more about Influence Customers, visit:

https://brainly.com/question/28101484

#SPJ1

T/F disparagement differs from defamation in that defamation pertains to personal reputation, whereas disparagement pertains to business interests.

Answers

The statement "Disparagement differs from defamation in that defamation pertains to personal reputation, whereas disparagement pertains to business interests" is TRUE.

Disparagement is an offence in tort law in which the plaintiff claims that the defendant has made false or misleading comments about the plaintiff's product or services, causing economic harm. Disparagement can be done orally, in writing, or through behavior that implies something negative about someone else's goods, goods, or business practices. What is defamation?Defamation is the act of harming another person's reputation by making a false statement to someone else. It's an offense that's split into two categories: slander, which refers to false and malicious spoken comments, and libel, which refers to false and malicious written comments. The main difference between the two is that defamation deals with personal reputation while disparagement deals with business interests.

To know more about Defamation, visit:

https://brainly.com/question/29829998

#SPJ11

For each of the following examples, indicate whether the transaction would be included in the gross investment component of gdp, and if so, indicate which category it would be included

Answers

When Leandro pays a general contractor to build a new house, it would be included in gross investment as residential fixed investment. So the option B is correct.

Residential fixed investment, also known as residential fixed capital formation or residential investment, is the amount of money spent to purchase or improve existing housing stock. This includes new construction, remodeling, and repairs.

It does not include spending on purchasing furniture, appliances, or other goods for the home. Residential fixed investment is an important factor in economic growth and is often used as an indicator of housing market strength.

To learn more about gross investment link is here

brainly.com/question/17252319

#SPJ4

The complete question is:

For each of the following examples, indicate whether the transaction would be included in the gross investment component of GDP and if so, indicate which category it would be included.

When Leandro pays a general contractor to build a new house, it would

A. be included in gross investment as business fixed investment

B. be included in gross investment as residential fixed investment

C. be included in GDP as a net export

D. not be included in gross investment

E. be included in gross investment as inventories

What accounts are inventory invoices placed into?

Answers

Inventory invoices are usually placed into one of the following accounts in an accounting system:

Inventory Account: This account is used to track the cost of goods that a business has in stock. The inventory invoices are recorded as a debit in this account.

1. Purchases Account: This account is used to track the cost of goods purchased by a business. The inventory invoices are recorded as a credit in this account.

2. Cost of Goods Sold (COGS) Account: This account is used to track the cost of goods sold by a business. The inventory invoices are recorded as a debit in this account when the goods are sold.

3. Accounts Payable Account: This account is used to track the amount owed to suppliers for goods purchased on credit. The inventory invoices are recorded as a debit in this account until they are paid.

4. The specific accounts that inventory invoices are placed into may vary depending on the accounting system and the business's accounting policies. It's important to consult with an accountant or financial advisor to determine the most appropriate accounts to use for your business.