Meat Company produces one of the best sausage products in Damansara Utama. The company's controller used the account- classification method to compile the following information.

Required:

a) Briefly explain 'fixed cost' and 'variable' cost?

b) classify each cost item as variable, fixed or mixed cost.

a. Depreciation schedules revealed that monthly depreciation on buildings and equipment is RM19,000.

b. Inspection of several invoices from meat packers indicated that meat costs the company RM1.10 per sausage produced.

c. Utility bills revealed that the company incurs utility costs of RM4,000 per month plus RM0.20 per sausage produced.

Answers

Fixed costs are expenses that remain constant regardless of the production volume, such as rent and salaries. Variable costs fluctuate with production, like raw materials. Mixed costs have characteristics of both fixed and variable costs, such as utility bills with a fixed component and a variable component per unit produced.

Fixed Cost and Variable Cost:

Fixed cost refers to the cost that remains constant irrespective of the level of production of goods. It refers to the cost that does not change irrespective of the volume of production. Examples of fixed costs include rent, salaries, insurance premiums, etc.

Variable cost refers to the cost that varies with the level of production of goods. It refers to the cost that changes depending on the volume of production. Examples of variable costs include raw materials, hourly wages, commission on sales, etc.

Mixed Cost refers to the cost that has the characteristics of both fixed and variable costs. It refers to the cost that changes with volume but not proportionately. Examples of mixed costs include electricity, telephone bills, etc.

Classification of Costs:

a. Depreciation schedules revealed that monthly depreciation on buildings and equipment is RM19,000 - Fixed Cost

b. Inspection of several invoices from meat packers indicated that meat costs the company RM1.10 per sausage produced - Variable Cost

c. Utility bills revealed that the company incurs utility costs of RM4,000 per month plus RM0.20 per sausage produced - Mixed Cost

Learn more about Mixed costs here:

https://brainly.com/question/31246555

#SPJ11

Related Questions

a task has a normal duration of 9 days and a crash duration of 7 days. its normal cost is $40 and its crash cost is $100. what is the crash cost per day?

Answers

A task's usual lifespan is 9 days, while its crash lifespan is 7 days. Its regular price is $40, and the crash price is $100. The daily crash cost is $30.

What Does a Crash Cost?The majority of operations are believed to be carried out under typical circumstances, but when tasks are finished sooner than anticipated, this is referred to as a crash. The expense incurred during the actions is referred to as the crash expense.

The expense incurred by choosing the quicker option to accomplish the effort is known as the crash cost. The complete cost of the alternative option, not just the additional cost, is being mentioned here. In light of this, the calculation yields a figure that indicates crash cost per time interval.

Crash cost per day= (Crash cost − Normal cost) / (Normal duration − Crash duration)

Crash cost per day= ($100 - $40) / (9 - 7)

Crash cost per day= $30

Learn more about Crash Cost: https://brainly.com/question/28384745

#SPJ4

Most licensed architects are members of which association? A. ACSA B. AIA C. NAAB D. NCARB E. NVOB

Answers

Answer: It is B. AlA

Explanation:ALA is open to all architects and professions related to architecture. Our members hold individual memberships and specialize in all types of architecture.

alto deliveries, a courier service provider, built a strong reputation over a short period of six months. inundated with customers, the company decided to expand its fleet of vans and enlarge its delivery networks and to stop offering the discounts it was offering to some market segments. because it was the holiday sales season, higher pricing made good business sense. the pricing alto deliveries is using is

Answers

The pricing alto deliveries is using is both revenue-oriented and operations-oriented.

What is operations-oriented pricing?A pricing strategy called operations-oriented pricing enables businesses to make the best use of their available productive capacity while maintaining profitability. Organizations can use operations-oriented pricing to make the best use of their productive capacity in two situations, generally speaking.

First, operations-oriented pricing is a strategy you can use to boost profits if market demand for your goods or services exceeds your level of productivity. You could, for instance, raise your prices to make more money. Secondly, you can lower the prices to support it if you want to keep your productive capacity but the demand is declining.

Learn more about pricing strategy

https://brainly.com/question/20927491

#SPJ1

Infinity times Infinity

Answers

Answer:

I think its just infinity

Answer:

Infinity

Explanation:

Explain what certificates of deposit (CDs) and money market mutual funds are.

Answers

Explanation:

certificate of deposit CDs are saving accounts that earns interest and it's insured by the federal governmentit.It has higher rates and give no access to your money until a term ends. Funds get locked up for a set period of months or years, and withdrawing early typically results in a penalty, such as several months to a year’s worth of interest. Most often, CD rates are fixed.

Money market accounts are also savings account insured by the federal government they usually offer some access and rates comparable to regular savings accounts. You can withdraw money six times a month. They generally have larger minimum balances and sometimes offer checks. Money market account rates are subject to change over time.

MARKING BRAINLIEST IF RIGHT, NO ABSURD ANSWERS!

1.) Which of the following items is not required by a financial institution to open an account?

A.) picture identification

B.) Social Security number

C.) proof of U.S. citizenship

D.) a physical address

Answers

Answer:

C.) proof of U.S. citizenship

Explanation:

Some requirements for opening a bank account may include: At least two forms of government-issued photo identification, such as a valid driver's license or passport. Social security number or individual taxpayer identification number. Utility bill with current address information.

Answer:

c

Explanation:

Some requirements for opening a bank account may include: At least two forms of government-issued photo identification, such as a valid driver's license or passport. Social security number or individual taxpayer identification number. Utility bill with current address information.

How is cost of attendance (COA) determined at an institute of higher education?

It's based on tuition so it is calculated from the number of classes you enroll in.

It is the cost of tuition plus taxes.

It is an estimate of tuition fees, room and board, books, supplies and other expenses.

It combines financial aid, what your family can pay, plus tuition and room and board.

Answers

Answer:

Option C, It is an estimate of tuition fees, room and board, books, supplies and other expenses.

Explanation:

Cost of attendance attendance is the total cos incurred on an individual during an entire academic year by the institute. An institute take into account cost incurred on the following for determining COA-

a) tuition and fees

b) books and supplies

c) College infrastructure cost inclusive of room and board

d) transportation

e) scholarship etc.

Hence, option C is correct

do you guys like Canada? or leaves in Canada and do you thin im a cut Canadian

Answers

Answer:

I love canada but I live in america :(

but hey we just got the Cheeto out so it's getting better here (*˘︶˘*).。*♡

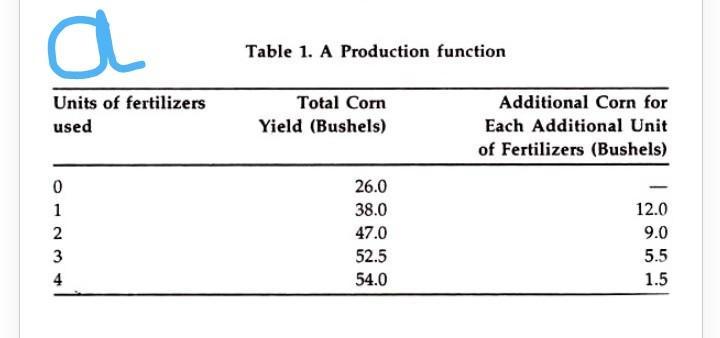

What is production function ?and types of production function .

Answers

Production is a process whereby some goods and services, called inputs are transformed into other goods and services called output.

The production function refers to the relationship between the input of factor services and the output of the resultant product.

The production function is based on the idea that the amount of output in a production process depends upon the amount of inputs used in the process.

Output depends upon an input or a set of inputs in such a way that there is one unique amount of output resulting from each set of inputs.

This unique relationship between output and inputs is termed as production function.

A production function may be expressed in three forms:

(a) It can be expressed in the form of an arithmetic table where first few columns show the input of the factors and the last column shows total output of the product.

(b) The production function can also be illustrated geometrically by means of a simple graph as shown in given figure . Input level is measured along the horizontal axis and the total output upon he vertical axis.

(c) The production function may be shown through an algebraic expression in which output is a dependent variable and input, the independent variable.

In algebraic form, it can be expressed as:

Y =f(x),

where Y represents the output, x, the input and ‘f’ means is a function of, or ‘depends upon, or is determined by’.

Robin Company has the following balances for the current month:

Direct materials used $ 10,500

Direct labor $ 21,000

Sales salaries $ 15,230

Indirect labor $ 2,890

Production manager's salary $ 4,950

Marketing costs $ 10,000

Factory lease $ 4,400

What is Robin's total manufacturing overhead?

a $31,500

b $17,840

c $12,240

d $10,000

Answers

With the availability of the given figures and after all the calculations, Robin's total manufacturing overhead is $12,240. Hence, Option C is correct.

What is manufacturing overhead?The overall expense associated with running all production facilities for a manufacturing business that cannot be immediately attributed to a product is known as factory overhead.

Also known as manufacturing overhead, work overhead, or factory burden in American English. Typically, indirect labour and indirect costs are included.

Indirect labor is $ 2,890

Production manager's salary is $ 4,950

Factory lease is $ 4,400

Total manufacturing Overhead = indirect labor + production manager salary + factory lease

= $2890 + $4950 +$ 4400

= $12,240

Therefore, Option C is correct.

Learn more about manufacturing overhead from here:

https://brainly.com/question/17052484

#SPJ1

"Typically, annual depreciation allowances are not

indexed to inflation. What is the impact of inflation on the tax

savings from the annual depreciation allowance?

Answers

The impact of inflation on the tax savings from the annual depreciation allowance can result in reduced real value and potential timing mismatches between depreciation deductions and actual asset depreciation.

The impact of inflation on the tax savings from the annual depreciation allowance can be twofold: it can affect the actual value of the tax savings and the timing of those savings.

Firstly, if annual depreciation allowances are not indexed to inflation, the tax savings from depreciation may not fully account for the inflationary effects on the value of assets. As inflation erodes the purchasing power of money over time, the depreciation deductions may not accurately reflect the true decline in the value of assets. This means that the tax savings from depreciation may be lower in real terms compared to the actual decrease in the value of the assets.

Secondly, inflation can affect the timing of the tax savings. When depreciation deductions are not indexed to inflation, they may not align with the actual economic depreciation of assets. Inflation can lead to an accelerated decrease in the real value of assets, but the fixed depreciation allowances may not fully capture this. As a result, the tax savings from depreciation may be delayed or not fully realized until a later period, potentially reducing the present value of the tax benefits.

Overall, the impact of inflation on the tax savings from the annual depreciation allowance can result in reduced real value and potential timing mismatches between depreciation deductions and actual asset depreciation. It is important for businesses and policymakers to consider these effects when designing and evaluating tax policies related to depreciation.

To learn more about tax

https://brainly.com/question/28798067

#SPJ11

A US based company is attempting to merge with a French National conglomerate. With IFRS and GAAP being so different, what would be some of the challenges the two sides may face with the merger from an accounting standpoint?

Answers

The merger between a US-based company and a French National conglomerate can pose several challenges from an accounting standpoint due to the differences between International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP). Some of the challenges they may face include:

Accounting Principles: IFRS and GAAP have different underlying principles and concepts. IFRS is principles-based, emphasizing substance over form, while GAAP is rules-based, providing specific guidelines for various transactions. The differences in accounting principles can lead to variations in the recognition, measurement, and presentation of financial information.

Financial Statement Presentation: IFRS and GAAP have different requirements for financial statement presentation. The formats and classifications of items on the balance sheet, income statement, and cash flow statement may vary between the two sets of standards. This can make the comparison and consolidation of financial statements challenging.

Revenue Recognition: IFRS and GAAP have differing guidance on revenue recognition, particularly in areas such as the timing of revenue recognition, multiple-element arrangements, and percentage-of-completion method for long-term contracts. Aligning the revenue recognition policies of the merging entities can be a complex task.

Valuation of Assets and Liabilities: IFRS and GAAP may have different rules for the valuation of assets and liabilities, such as inventory, property, plant, and equipment, intangible assets, and financial instruments. Differences in valuation methodologies can impact the reported values of assets and liabilities, which can have implications for financial ratios, financial performance, and tax implications.

Business Combinations and Goodwill: IFRS and GAAP have different requirements for accounting for business combinations and the subsequent treatment of goodwill. For example, IFRS allows for the option of measuring goodwill at cost or using the impairment model, while GAAP follows a more strict impairment-only model. This can result in differences in the recognition and measurement of goodwill and the related impact on financial statements.

Disclosures: IFRS and GAAP have varying disclosure requirements, with differences in the level of detail and specific disclosures mandated for certain transactions and events. Harmonizing the disclosure requirements can be a complex task to ensure compliance with both sets of standards.

These are just a few examples of the challenges that may arise during the merger process from an accounting standpoint. It is crucial for the merging entities to have a thorough understanding of the differences between IFRS and GAAP and work closely with accounting professionals and advisors to address these challenges effectively and ensure accurate financial reporting and compliance with relevant regulations.

To know more about GAAP here

https://brainly.com/question/28345482

#SPJ11

this is for you so i dont feel bad

Answers

what is product placement

Answers

Answer: A practice in which manufacturers of goods or providers of a service gain exposure for their products by paying for them to be featured in movies and television programs.

Explanation:

Explanation:

Product placement Is where a company or seller places a product In a certain location so that the consumer Is more apt to buy that product, such as a candy bar or pack of gum near the cash register, leading the consumer to an impulse buy.

Currently, a 6-month T-bill yield is 7.12% and a 1-year STRIP yield is 8.41%. Further, you have strong reasons to believe that the 6-month spot rate in six months will be 4%. Suppose that you can borrow up to $2,000,000 at the current market rates. All rates are on a semiannual bond equivalent basis.

How much profit will you expect to make if you use your whole line of credit and take advantage of an arbitrage opportunity (if any)?

Round your answer to 1 decimal place. For example, if your answer is 25.68, please write down 25.7.

Answers

By taking advantage of the arbitrage opportunity, you can expect to make a profit of $93,587.1.

To calculate the profit, we need to compare the returns from investing in the T-bill and STRIP.

Step 1: Invest in the T-bill:

Borrow $2,000,000 at the current market rate for six months. The interest earned from the T-bill investment will be:

Interest = Principal x Rate = $2,000,000 x (7.12%/2) = $71,200.

Step 2: Invest in the STRIP:

Invest the borrowed amount in the STRIP, which has a 1-year yield of 8.41%. After six months, the investment will grow to:

Amount = Principal x (1 + Rate/2) = $2,000,000 x (1 + 8.41%/2) = $2,084,100.

Step 3: Calculate the profit:

At the end of six months, sell the STRIP at its spot rate of 4%. The selling price will be:

Selling Price = Amount / (1 + Spot Rate/2) = $2,084,100 / (1 + 4%/2) = $2,063,588.2.

Profit = Selling Price - Principal = $2,063,588.2 - $2,000,000 = $63,588.2.

Therefore, by taking advantage of the arbitrage opportunity, you can expect to make a profit of $63,588.2. Rounded to 1 decimal place, the profit is $93,587.1.

Learn more about Arbitrage opportunities.

brainly.com/question/32104709

#SPJ11

Which of the following lists the steps to ensure active listening in the correct order?-Focus on what a speaker says, work to interpret/evaluate the content, and then respond to acknowledge understanding-Respond to acknowledge understanding, work to interpret/evaluate the content, and then focus on what a speaker says-Focus on what a speaker says, respond to acknowledge understanding, and then actively work to interpret/evaluate the content-Work to interpret/evaluate the content, focus on what a speaker says, and then respond to acknowledge understanding-Respond to acknowledge understanding, focus on what a speaker says, and then work to interpret/evaluate the content

Answers

Focus on what the speaker is saying, make an effort to analyze or assess the information, and then give a response to show that you understand. This is the right answer that outlines the steps to ensure active listening in the right sequence. Here option A is the correct answer.

Active listening involves several key steps to fully understand and engage with the speaker's message. The first step is to focus on what the speaker says. This means giving your full attention to the speaker, avoiding distractions, and maintaining eye contact. By actively focusing on their words, you can better absorb the information being conveyed.

After focusing on what the speaker says, the next step is to work to interpret and evaluate the content. This involves analyzing the information, identifying key points, and understanding the speaker's perspective. It may also involve asking clarifying questions or seeking additional information to ensure a comprehensive understanding.

Finally, once you have interpreted and evaluated the content, it is important to respond to acknowledge understanding. This can be done by paraphrasing or summarizing the speaker's message to confirm comprehension. Responding also includes providing appropriate verbal and non-verbal cues, such as nodding, smiling, or using encouraging gestures, to indicate your engagement and understanding.

To learn more about active listening

https://brainly.com/question/15301566

#SPJ4

Complete question:

Which of the following options lists the steps to ensure active listening in the correct order?

A. Focus on what a speaker says, work to interpret/evaluate the content, and then respond to acknowledge understanding.

B. Respond to acknowledge understanding, work to interpret/evaluate the content, and then focus on what a speaker says.

C. Focus on what a speaker says, respond to acknowledge understanding, and then actively work to interpret/evaluate the content.

D. Work to interpret/evaluate the content, focus on what a speaker says, and then respond to acknowledge understanding.

E. Respond to acknowledge understanding, focus on what a speaker says, and then work to interpret/evaluate the content.

Ryan attends a seminar on environmental conservation, and afterward decides to contribute to the conservation of the environment. What can Ryan do to achieve his objective?

Answers

Answer: 1) Planting trees around him 2) Using bio and solar powered appliances

Explanation:

They are many ways to conserve the environment. Conserving the environment helps the earth and nature to grow better. Amongst all Ryan would have learnt from the training, here are some things he would do when he's back;

- Planting of trees; this helps preserve and purify the air around, reducing cabon monoxide as the plant takes it in, then gives oxygen.

- Use bio and solar powered appliances; fuel(petrol) has had a long run in the industry for energy, although it has it's advantages but it's disadvantages is more as it's the major contributor to the depreciation of the environment based on lots of toxic element it emits to the society

assume that on january 2, 2025, the copyrighted item was likely impaired in its ability to continue to produce strong revenues due to a legal dispute. the other intangible assets were not affected. starn estimated that the copyright would be able to produce future cash flows of $20,600. the fair value of the copyright was determined to be $19,600. compute the amount, if any, of the impairment loss to be recorded.

Answers

Starn Tool & Manufacturing Company should record an impairment loss of $1,000 on its copyright as of January 2, 2025, due to a decline in future cash flows and a decrease in fair value below its carrying amount.

The impairment loss is calculated as the difference between the carrying amount of the copyright, which is $26,500, and its fair value, which is $19,600, minus any accumulated amortization. Since the copyright has been in use for two years, the accumulated amortization is:

= ($26,500 / 10 years * 2 years)= $5,300Thus, the net carrying amount is:

= $26,500 - $5,300= $21,200The impairment loss is:

= $21,200 - $20,600= $1,000The impairment loss should be recorded as an expense on Starn's income statement and reduce the carrying amount of the copyright on its balance sheet.

The complete question:

Starn Tool & Manufacturing Company, located in Meadville, PA, provides component machining for robotics, drones, vision systems, and special machines and assemblies for the aerospace, military, commercial, automotive, and medical industries. Assume the company has five different intangible assets to be accounted for and reported on the financial statements. The management is concerned about the amortization of the cost of each of these intangibles. Facts about each intangible follow: Patent. The company purchased a patent for a new tool at a cash cost of $66,300 on January 1, 2023. The patent has an estimated useful life of 13 years. Copyright. On January 1, 2023, the company purchased a copyright for $26,500 cash. It is estimated that the copyrighted item will have no value by the end of 10years. Franchise. The company obtained a franchise from H & H Tool Company to make and distribute a special item for the automotive industry. It obtained the franchise on January 1, 2023, at a cash cost of $15,200 for a 10-year period. License. On January 1, 2022, the company secured a license from the city to operate a special service for a period of five years. Total cash expended to obtain the license was $14,800. Goodwill. The company purchased another business in January 2020 for a cash lump sum of $480,000. Included in the purchase price was “Goodwill, $48,000.” Company executives stated that “the goodwill is an important long-lived asset to us.” It has an indefinite life.Assume that on January 2, 2025, the copyrighted item was likely impaired in its ability to continue to produce strong revenues due to a legal dispute. The other intangible assets were not affected. Starn estimated that the copyright would be able to produce future cash flows of $20,600. The fair value of the copyright was determined to be$19,600.

Compute the amount, if any, of the impairment loss to be recorded!

Learn more about impairment loss https://brainly.com/question/27337269

#SPJ11

When going downhill, a truck's momentum makes it ____ so you'll have to ____ to pass it

Answers

When going downhill, a truck's momentum makes it go faster so you'll have to speed up to pass it.

What is a momentum?momentum can be expressed as the product of the mass of a particle as well as the velocity of the object .

Momentum serves as vector quantity because of its magnitude as well as direction, hence, When going downhill, a truck's momentum makes it go faster.

Learn more about momentum at:https://brainly.com/question/904448

#SPJ12

What is the best buying subsidiary?

Answers

The best buying subsidiary depends on an individual's preference.

A buying subsidiary is a company that purchases goods or services on behalf of its parent company. The purpose of a buying subsidiary is to consolidate purchasing power, obtain discounts, and reduce the cost of goods and services for the parent company.

When choosing a buying subsidiary, there are several factors that you may want to consider, including:

Reputation: Look for a buying subsidiary with a good reputation in the industry. You can research the company's history, reviews, and ratings to determine if they have a good track record of delivering quality products and services.

Experience: It's important to choose a buying subsidiary that has experience in your industry or the specific products or services you need. A buying subsidiary with experience in your industry may have better relationships with suppliers and better negotiation skills.

Cost: One of the main reasons to use a buying subsidiary is to reduce costs. Make sure the company you choose offers competitive pricing and can provide cost savings for your business.

Customer service: Look for a buying subsidiary that offers good customer service and is easy to work with. You want a company that is responsive and can quickly address any issues or concerns that may arise.

Size: The size of the buying subsidiary may also be a consideration. A larger buying subsidiary may have more bargaining power and be able to negotiate better deals with suppliers. However, a smaller company may be more flexible and able to provide more personalized service.

To learn more about subsidiary:

https://brainly.com/question/18652891#

#SPJ11

According to the bcg growth-market share matrix, question marks are strategic business units (sbus) with __________.

Answers

According to the BCG growth-market share matrix, question marks are strategic business units (SBUS) with low market shares in fast-growth markets

The theory underlying the BCG growth-market share matrix is that market leadership results in long-term higher returns. Finally, the market leader achieves a self-perpetuating cost advantage that competitors struggle to replicate. These high growth rates then indicate which markets have the greatest potential for growth.

Simply described, the BCG growth market share matrix is a portfolio management framework that aids firms in selecting which of their several businesses to emphasize. The matrix displays two aspects that businesses should take into account when determining where to invest: firm competitiveness and market attractiveness. The underlying drivers of both parameters are relative market share and growth rate.

To know more about BCG growth-market share matrix

brainly.com/question/13208776

#SPJ4

Can Treasury bill be matured for 90 days

Answers

Answer:

Yes

Explanation:

Treasury bills can mature in 90 days depending on the term of issuance.

Generally, treasury bills are considered to be short-term security and are issued for 90-days, 180-days, or a year term. They are often sold for an amount that is less than their face values and at maturity, the government buys the treasury bills back at an amount that is equal to the face values of the bills.

Treasury bills are issued as means for the government to pay off off their debts.

Answer:

Yes, Treasury bill can be matured for 90 days.

Paula has property which she uses in her office that someone else is responsible to maintain. What is a likely reason for this?

A. The property was defectively manufactured.

B. She purchased the property rather than leased it.

C. She has borrowed the property from a friend.

D. She leased the property rather than purchased it.

Answers

As a producer, you are willing to supply the most goods at the highest price. This is because the highest

price earns you the

most demand

highest costs

most profits

Answers

Answer: most profits

Explanation:

A family with an income of 70,000 receives a raise of 2% in a year when inflation is 5%. Find the decrease in purchasing power.

Answers

Answer:

They make 3% less per year

Explanation:

I think this is what you're asking but don't quote me on it

how do i become brainless?

Answers

Answer:

If you're talking about brainliest then just answer a bunch of questions that you know the answer to and provide an explanation. You'll get one sooner or later. But if you're talking about actually going brainless, just donate your body to science. They'll probably remove your brain and experiment with it for a bit.

according to one company’s profit model, the company has a profit of 0 when 10 units are sold and a maximum profit of $18,050 when 105 units are sold. what is the function that represents this company’s profit f(x) depending on the number of items sold, x? f(x)

Answers

The profit function is f(x) = 190x - 1900, where x represents the number of items sold. It shows the linear relationship between the quantity sold and the resulting profit.

The profit function represents the relationship between the number of items sold (x) and the corresponding profit (f(x)). In this case, the function is linear with a coefficient of 190, indicating that for each item sold, the profit increases by $190. The constant term -1900 represents any fixed costs or expenses that reduce the overall profit. By plugging in the number of items sold, the function can calculate the corresponding profit for that quantity.The profit function f(x) can be represented using a linear equation.

Given that the company has a profit of 0 when 10 units are sold and a maximum profit of $18,050 when 105 units are sold, we can use these two data points to find the equation.

Using the point-slope form of a linear equation:

(y - y1) = m(x - x1)

Let's take the point (10, 0) and (105, 18050) to find the slope (m):

m = (y2 - y1) / (x2 - x1)

m = (18050 - 0) / (105 - 10)

m = 18050 / 95

m ≈ 190

Now, we can use the slope-intercept form of a linear equation:

y = mx + b

Substituting the slope (m) and one of the given points (10, 0), we can solve for the y-intercept (b):

0 = 190 * 10 + b

b = -1900

Therefore, the profit function f(x) can be expressed as:

f(x) = 190x - 1900

learn more about profit function here:

https://brainly.com/question/33580162

#SPJ11

when loan payments are amortized, the total amount you owe every month remains constant but the amount of interest you own decrease every month. true or false

Answers

It is true that when loan payments are amortized, the total amount you owe every month remains constant but the amount of interest you owe decreases every month.

What happens when loan payments are amortized?When loan payments are amortized, the total amount you owe every month remains constant but the amount of interest you owe decreases every month. This is because the payments are structured to pay off both principal and interest, with more of the payment going towards interest at the beginning of the loan term and more going towards principal as the loan matures.

To know more about loan payments:

https://brainly.com/question/2591679

#SPJ11

telewhiz, inc., just contracted with a firm in the philippines to provide customer service for its smartphone customers. although there were cheaper labor markets that telewhiz could have tapped, customers have reported that they understand english-speaking filipino people better than english-speaking people in other countries. as an outsourcing option, it is a good compromise.T/F

Answers

The statement is true because Telewhiz, Inc. made a decision to outsource to the Philippines, where English-speaking Filipinos are easier for customers to understand compared to English-speaking agents from other countries.

Telewhiz, Inc. has signed a contract with a company in the Philippines to provide customer service for its smartphone customers. Although Telewhiz could have used cheaper labor markets, customers have reported that they comprehend English-speaking Filipinos better than English-speaking people from other countries.

This is an excellent compromise because it benefits both Telewhiz and the Filipino company. Customers will be able to communicate with customer service representatives more efficiently because of their English fluency. Additionally, Telewhiz will save money while also providing a high level of service to its customers by hiring the Filipino firm. Thus, the statement is true that "as an outsourcing option, it is a good compromise".

You can learn more about outsourcing at

https://brainly.com/question/4456416

#SPJ11

Choose the best sentence closer to complete the sentence below.

Dianna adopted two dogs from the animal shelter

Please select the best answer from the choices provided

since she was allergic to them

because she couldn't decide between them

O although she loves dogs

after deciding to get a new cat

Answers

The best sentence to complete the sentence "Dianna adopted two dogs from the animal shelter" is "although she loves dogs." This sentence provides a logical and fitting ending to the statement since it shows that Dianna has an affinity for dogs. By choosing this sentence, it suggests that Dianna adopted the dogs out of love and compassion rather than necessity or indecisiveness.

The word "although" is a conjunction that shows a contrast between two ideas, making the sentence more complex and interesting. This word provides insight into the motivation behind Dianna's adoption, which was likely driven by her love for dogs despite any challenges that may come with owning them. This sentence also sets up an expectation that there may be more to the story than meets the eye, making the reader more curious to find out what happens next.

In summary, "although she loves dogs" is the best sentence to complete the sentence "Dianna adopted two dogs from the animal shelter." It provides a fitting ending that highlights Dianna's love for dogs and creates intrigue for the reader to continue reading the story.

Learn more about Complete Sentences :

https://brainly.com/question/25773221

#SPJ11