Answers

Answer:

$7,480

Explanation:

Mr Thano withdrew $22,000 at the age of 47

Marginal Tax rate= 24%

At the age of 47 means that the withdraw was made prematurely. Immature withdrawal of retirement plans means withdrawal made before the age of 60-65 years depending on the Country Policy

Hence, Tax Cost = 24% * 22,000

Tax cost = 5,280.

In addition, Mr Thano will be charge premature withdrawal cost of 10% as well

10% * 22000 = 2,200.

In total, the tax cost on the withdrawal of $22,000 is = $5,280 + $2,200 = $7,480

Related Questions

There are 713 identical plastic chips numbered 1 through 713 in a box.

What is the probability of reaching into the box and randomly drawing the chip numbered 564? Express your answer as a simplified fraction or a decimal rounded to four decimal places.

Answers

Answer:

0.0014

Explanation:

There are 713 chips.

Only one chip is numbered 564.

Finding the probability of picking no. 564 will be

=1/713

=0.0014

On January 1, 2016, Knorr Corporation issued $1,400,000 of 6%, 5-year bonds dated January 1, 2016. The bonds pay interest annually on December 31. The bonds were issued to yield 7%. Bond issue costs associated with the bonds totaled $22,107.40.

Answers

The preparation of the journal entries concerning the bond transactions for 2016 and 2017 for Knorr Corporation is as follows:

Journal Entries:Jan. 1, 2016: Debit Cash $1,342,597

Debit Discount on Bonds Payable $57,403

Bonds Payable $1,400,000

To record the issuance of bonds for cash.Jan. 1, 2016: Debit Deferred Bond Issue Costs $22,107.40

Cash $22,107.40

To record the payment of bond issuance costs.Dec 31, 2016: Debit Interest Expense $93,982

Credit Discount on Bonds Payable $9,982

Credit Cash $84,000

To record the payment of the first interest expense and discount amortization.Dec. 31, 2016: Debit Interest Expense 4,421.48

Credit Deferred Bond Issue Costs 4,421.48

To record the first amortization of bond issuance costs.Dec 31. 2017: Debit Interest Expense $94,681

Credit Discount on Bonds Payable $10,681

Credit Cash $84,000

To record the payment of the second interest expense and discount amortization.Dec 31, 2017: Debit Interest Expense $4,421.48

Credit Deferred Bond Issue Costs $4,421.48

To record the second amortization of bond issuance costs.Transaction Analysis:January 1, 2016:

Face value of bonds payable = $1,400,000

Bond proceeds (PV) = $1,342,597

Bond discounts = $57,403 ($1,400,000 - $1,342,597)

Maturity period = 5 years

Coupon interest rate = 6%

Effective interest rate = 7%

Bond issuance costs = $22,107.40

Annual amortization of bond issuance costs (straight-line) = $4,421.48 ($22,107.40 ÷ 5)

December 31, 2016:

Interest expense = $93,982 ($1,342,597 x 7%)

Interest payment = $84,000 ($1,400,000 x 6%)

Amortization of bond discount =$9,982 ($93,982 - $84,000)

Bonds Payable = $1,352,579 ($1,342,597 + $9,982)

December 31, 2017:

Interest expense = $94,681 ($1,352,579 x 7%)

Interest payment = $84,000 ($1,400,000 x 6%)

Amortization of bond discount =$10,681 ($94,681- $84,000)

Bonds Payable = $1,363,260 ($1,352,579 + $10,681)

Jan. 1 Cash $1,342,597 Discount on Bonds Payable $57,403 Bonds Payable $1,400,000

Jan. 1 Deferred Bond Issue Costs $22,107.40 Cash $22,107.40

Dec 31 Interest Expense $93,982 Discount on Bonds Payable $9,982 Cash $84,000

Dec. 31 Interest Expense 4,421.48 Deferred Bond Issue Costs 4,421.48

Dec 31 Interest Expense $94,681 Discount on Bonds Payable $10,681 Cash $84,000

Dec 31 Interest Expense $4,421.48 Deferred Bond Issue Costs $4,421.48

Learn more about journal entries for bond transactions at https://brainly.com/question/15877561

#SPJ1

Question Completion:Prepare the journal entries to record the following:

Additional Instructions

January 1, 2016: Sold the bonds at an effective rate of 7%

December 31, 2016: First interest payment using the effective interest method

December 31, 2016: Amortization of bond issue costs using the straight-line method

December 31, 2017: Second interest payment using the effective interest method

December 31, 2017: Amortization of bond issue costs using the straight-line method

What is the trial balance used?

a. It is a financial statment.

b. It doesn't contribute to the accounting cycle.

c. It records balance of a balance sheet.

d. It records balance of accounts.

Answers

Answer:

c

Explanation:

Suppose that with free trade, the cost to the United States of importing a sweater from Mexico is $20.00, and the cost of importing a sweater from China is $18.00. A sweater produced in the United States costs $25.00. Suppose further that before NAFTA, the United States maintained a tariff of 15% against all sweater imports. Then, under NAFTA, all tariffs between Mexico and the United States are removed, while the tariff against imports from China remains in effect. Assume that the tariff does not affect the world price of sweaters.

Before NAFTA, the United States imported sweaters from: _________

Answers

Based on the price of sweaters, it was likely that because NAFTA, the United States imported sweaters from China.

Why did the U.S. import sweaters from China?Nations will generally import from nations that charge the cheapest amount for the goods and services being imported.

Before NAFTA made Mexican sweaters cheaper thanks to the removal of tariffs, Chinese sweaters were cheaper at $18.00 which means the U.S. likely imported sweaters from China.

Find out more on NAFTA at https://brainly.com/question/644093.

Which is an example of a diversified portfolio?

A. A variety of stocks, bonds, and bank accounts

B. A variety of high-risk stocks

C. High-yield bonds and growth stocks

D. Multiple bank accounts with high interest

Answers

A variety of stocks, bonds, and bank accounts.

What Is Diversification?

A portfolio's investments are mixed together in a broad variety as part of the risk management approach known as diversification. To reduce exposure to any one asset or risk, a diversified portfolio combines a variety of different asset classes and investment vehicles.

This strategy is justified by the idea that a portfolio made up of many asset classes would, on average, produce superior long-term returns and reduce the risk of any one holding or security.

In order for the beneficial performance of certain assets to offset the bad performance of others, diversification aims to smooth out unsystematic risk occurrences in a portfolio. The benefits of diversity only apply if the assets in the portfolio are not fully linked; in other words, if they react to market factors differently, frequently in opposite directions.

to learn more about Diversification click:

https://brainly.com/question/29558669

#SPJ1

onsumer Economics: Tutorial

Part E

At what wage rate will there be excess labor supplied in the market?

Answers

Excess labor supply in the market occurs when the wage rate is above the equilibrium level.

Consumer economics refers to the study of how individuals and households make decisions about what they consume, how they save and invest, and how they allocate their resources.The wage rate at which there will be an excess supply of labor in the market is known as the equilibrium wage rate. This means that the quantity of labor demanded equals the quantity of labor supplied.

At a wage rate above the equilibrium level, there is a surplus of labor available as the quantity supplied of labor is greater than the quantity demanded for labor. On the other hand, at a wage rate below the equilibrium level, there is a shortage of labor as the quantity demanded of labor is greater than the quantity supplied for labor. Thus, the equilibrium wage rate is essential to maintain stability in the labor market.The equilibrium wage rate is determined by the forces of demand and supply.

The demand for labor arises from the demand for goods and services that labor produces. The supply of labor arises from the willingness of people to work at a particular wage rate. The equilibrium wage rate is the wage rate where the quantity of labor demanded is equal to the quantity of labor supplied in the market.Therefore, excess labor supply in the market occurs when the wage rate is above the equilibrium level.

For more such questions on labor

https://brainly.com/question/29522683

#SPJ8

During job interviews, potential employers often ask candidates to describe a time where they have demonstrated their initiative and/or results driven skills. This week, you’ll have a chance to practice.

In paragraph 1, describe a time at work, home, or school where there was a problem and you took the initiative to solve that problem and to seek results on your own.

In paragraph 2, explain how the process went and describe the solution that you developed.

Answers

Answer:

During a pandemic everyone and everything is crazy and it hasn't gone very for me at work or at home. I guess that's why they say it's best for you stay home and quaretine for days because of a test that came back positive.

Explanation:

Do you believe that the citizenship process is fair? Why or why not?

Answers

Answer: no, because the way African Americans are being treated is horrible and the way cops think that they can just pop someone out of nowhere and have no consequences is brutal and lose their badge for it is cruel and how blacks can't get good jobs or good pay like "noncolored" people is horrible and how people want to come to the US for a better life but get punished for coming so do i think citizenship process is fair no i do not

An individual who has decided to start a business on their own may generally choose from any of the following structure types, EXCEPT:

Answers

Answer:

Here are the definitions for each term, but i would say C Corporation. (I don't know exactly)

explanation

Sole Proprietorship: is an unincorporated business, which means it would be under the supervision of government rules, unlike limited liability companies, corporations and so on

Partnership: Partnerships are unincorporated businesses with two or more owners (partners) who contribute in various ways (capital, labor, etc.) and may have legal liabilities. A written agreement should outline the partners’ roles, rights, and responsibilities.

C Corporation: A C-corp, like an S-corp, is a limited liability entity, which means the company, not its shareholders or owners, is held legally liable for the company’s debt and other obligations. Also, you can bring in an unlimited number of investors when your business is structured as a C corporation.

S Corporation:An S corporation, also known as an S subchapter, refers to a type of legal business entity. Requirements give a corporation with 100 shareholders or less the benefit of incorporation while being taxed as a partnership. Corporate taxes filed under Subchapter S may pass business income, losses, deductions, and credits to shareholders.

although, as a manager, anette may not have the best technical skills, she makes up for it through her excellent communication, team building, and coaching skills. thus, in the context of management skills, anette exhibits strong .

Answers

Anette demonstrates strong human skills in the context of his management abilities.

What is a human skill?

The kind of talents that make it possible for someone to collaborate effectively, engage with the team, and complete tasks on time are known as human skills.

The method enables the person to be among the best managers because it successfully interacts with, inspires, and motivates the team members, who then produce their best work.

The success of the squad depends on numerous managerial abilities. Technical, intellectual, interpersonal, analytic, and other important management abilities are some examples of these skills. But in addition to these, human talents also play a significant role in the efficacy of management. Managers benefit from an advanced human skill set since it enables them to discover and realize their potential and motivate their staff to do the same.

Visit the provided website to learn more about human skills.

brainly.com/question/28325646

#SPJ4

Determine the process followed by a purchasing manager before signing a contract with a supplier

Answers

Answer:

A buying manager often goes through a process before signing a contract with a supplier. They may consist of:

Determining the need: The buying manager determines the quantity and quality needed for the products or services inside their firm.

Finding suppliers: The buying manager does research to find possible vendors that can fulfill the needs of the company.

Requesting quotations: The buying manager may ask the chosen suppliers for quotes or proposals that list the products or services they can provide, together with their prices, deadlines, and other details.

Evaluation of bids: The purchasing manager assesses the submitted proposals in accordance with a number of factors, such as cost, level of quality, timeliness of delivery, terms of payment, and standing of the supplier.

Explanation:

What is one of the main economic benefits of free trade?

A. It reduces competition between businesses in different countries.

B. It encourages countries to specialize in producing particular

goods.

c. It ensures that all countries follow strict worker protection laws.

D. It allows countries to become more economically independent.

Answers

Answer: It encourages countries to specialize in producing particular goods

The correct option is D). It allows countries to become more economically independent.

What is free trade?Free trade refers to the international trade in which countries can import and export goods without any tariff barriers or other non-tariff barriers to trade.

It open new markets, increase gross domestic product (GDP), and invite new investments which directly led to the economic development of a country.

Free trade increased exports and provide great number of choice of goods as well.

Learn more about free trade here:-

https://brainly.com/question/10473895

#SPJ2

Part A Use this free trade agreements resource to complete the following chart for two of the countries listed (except Mexico and Canada). For a more complete picture of each trade agreement you select, find two additional websites and review them for additional information. List these websites in the spaces provided in the table.

Answers

The Central American-Dominican Republic Free Trade Agreement (CAFTA-DR), the North American Free Trade Agreement (NAFTA), and the European Union are examples of regional trade accords (EU).

What is a trade pact involving two or more nations?A free trade agreement (FTA) is a pact reached by two or more nations in which the parties specify commitments affecting trade in goods and services, investor protections, and intellectual property rights, among other things.

What transpires after two nations ratify a free trade agreement?In a free trade agreement, a collection of nations determines to reduce their tariffs or other trade restrictions in order to encourage greater trade with their trading partners. This makes it possible for all nations to gain access to resources and cut prices.

To know more about regional trade accords visit :-

https://brainly.com/question/14891815

#SPJ1

1. A requested task is subject to be reported when:

Requesting for a screenshot

When it is asking for 3 proofs

When it requests for email address to be submitted

The task requested promote violent and/or illegal activities

Answers

A requested task is subject to be reported when it promotes violent and/or illegal activities. This ensures that any content or actions that pose a threat or violate the law are appropriately addressed and handled. Reporting such tasks helps maintain a safe and secure environment for users and prevents the dissemination of harmful or unlawful content.

Promoting violent and/or illegal activities goes against community guidelines and ethical standards. By reporting such tasks, users can play an active role in upholding the rules and regulations of the platform or community they are a part of. Reporting serves as a mechanism for users to flag content or requests that could potentially harm individuals or society as a whole.

Requesting for a screenshot, asking for three proofs, or requesting an email address submission, on their own, may not necessarily warrant a report. These actions typically serve functional or practical purposes in various contexts. However, it is essential to assess the overall intent and impact of a requested task to determine whether it aligns with ethical standards and legal requirements. If a task requests actions that are potentially harmful or against the rules, it should be reported to the appropriate authorities or platform administrators for further investigation and appropriate action.

For more such answers on requested task

https://brainly.com/question/30042698

#SPJ8

All goods to be imported whether or not subject to import duties must be declared in writing on prescribed forms.

Answers

Prepare a 2018 balance sheet for Rogers Corp. based on the following information: Cash = $250,000; Patents and copyrights = $720,000; Accounts payable = $530,000; Accounts receivable = $129,000; Tangible net fixed assets = $3,400,000; Inventory = $345,000; Notes payable = $190,000; Accumulated retained earnings = $1,255,000; Long-term debt = $1,830,000. What is the common stock account balance for the company?

Answers

Answer:

Common stock balance= $1,039,000

Explanation:

A balance sheet can be described as a financial statement that presents the assets, liabilities and shareholders' equity of a company.

Common stock refers to the security such shares that represents ownership in a company.

In order to determine the common stock account balance for Rogers Corp., its balance sheet is first prepared as follows:

Rogers Corp.

Balance Sheet

For the year 2018

Particulars $ $

Intangible Assets:

Patents and copyrights 720,000

Tangible Assets:

Net fixed assets 3,400,000

Current Assets:

Cash 250,000

Accounts receivable 129,000

Inventory 345,000

Total Current Assets 724,000

Current Liabilities:

Accounts payable (530,000)

Notes payable (190,000)

Working Capital 4,000

Long-term Liabilities:

Long-term debt (1,830,000)

Net Total Assets 2,294,000

Financed by:

Common stock (w.1) 1,039,000

Accumulated retained earnings 1,255,000

Owners' Equity 2,294,000

Workings:

w.1: Common stock balance = Net total assets - Accumulated retained earnings = $2,294,000 - $1,255,000 = $1,039,000

When people buy more, or less, at ALL prices, there has been a change in _____.

Answers

There prices has been a change in demand and supply.

Pricing is the process of determining supply how much money a manufacturer will receive in exchange for services and commodities. The pricing approach is used to change the cost of the producer's offerings to make them more appealing to both the manufacturer and the client.

The pandemic shook the global economy, disrupting supply lines and causing to massive shipping delays. Labor shortages and rising consumer demand have aggravated the situation. Prices are rising as many items are in low supply and delivery costs rise. The cost or amount at which anything is valued is referred to as its price.

To learn more about prices, click here.

https://brainly.com/question/18117910

#SPJ1

Jacques lives in Chicago and runs a business that sells pianos. In an average year, he receives $701,000 from selling pianos. Of this sales revenue, he must pay the manufacturer a wholesale cost of $420,000; he also pays wages and utility bills totaling $247,000. He owns his showroom; if he chooses to rent it out, he will receive $9,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if Jacques does not operate this piano business, he can work as a financial advisor, receive an annual salary of $32,000 with no additional monetary costs, and rent out his showroom at the $9,000 per year rate. No other costs are incurred in running this piano business.

What are Raphael's explicit costs of selling pianos?

1) The salary Raphael could earn if he worked in an accounting firm.

2) The wages and utilty bills that Raphael pays.

3) The wholesale cost for pianos that Raphael pays the manufacturer.

4) The rental income Raphael could receive per year if he chose to rent his showroom out.

Answers

What is this omg

I didn't saw a question like this

explain ten importance of studying constitutional law. 200words

Answers

Answer:

Studying constitutional law is important for understanding the fundamental principles by which a government exercises its authority. It is important for understanding how the different branches of government interact and how citizens’ rights and freedoms are protected. Constitutional law is also important for understanding the structure of a government, including the relationship between the central government and state, provincial, or territorial governments in federal countries. Constitutional law is also important for understanding the development of a nation and its legal system. It helps to explain why certain laws exist and how they have evolved over time. It can also provide insight into the history and culture of a nation. Constitutional law is also important for understanding how the government can be held accountable. It helps to ensure that the government does not overstep its authority and that its actions are in line with the principles of the constitution. Constitutional law is also important for understanding how to interpret and apply the law. It can provide guidance on how to interpret the constitution and how to apply legal principles to new and emerging situations. Finally, studying constitutional law is important for understanding the role of the judiciary in the legal system. It can provide insight into how judges interpret the constitution and how they make decisions. It can also provide

Explanation:

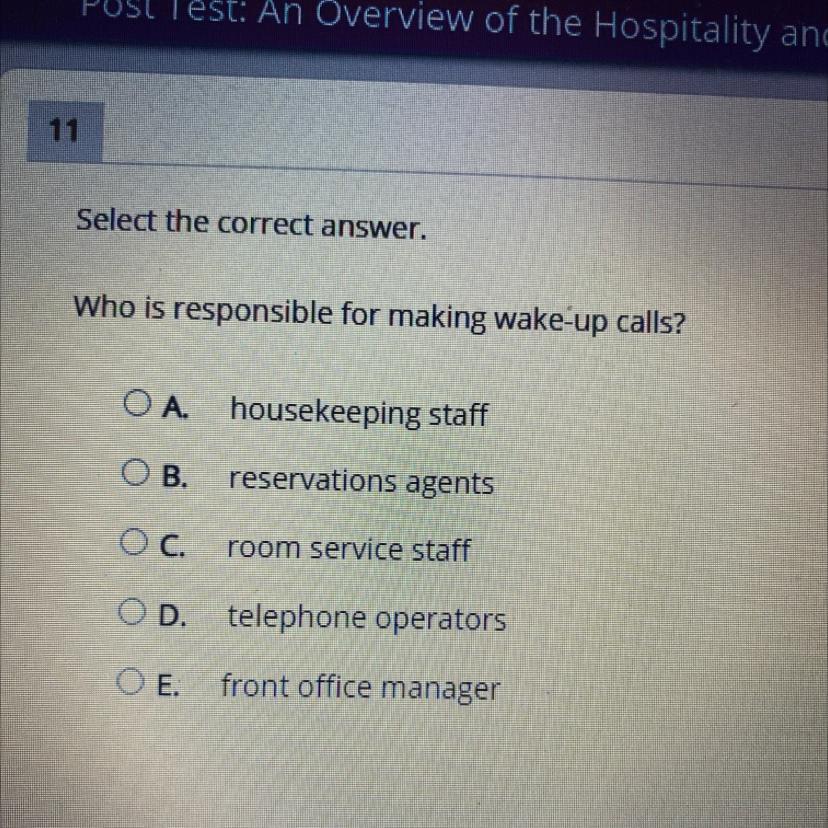

Select the correct answer.

Who is responsible for making wake-up calls?

O A. housekeeping staff

OB. reservations agents

Oc.

room service staff

OD. telephone operators

O E.

front office manager

Answers

Answer:

room service should be responsible for that.

Answer:

Telephone operators

Explanation:

The Reminder wakeup call or follow up call or 2nd Wake-up call need to be performed by the Front desk staff or the telephone operator. Once the 2nd wakeup call is completed ticket mark that reservation on the report and update the remarks section on the report. If the Guest does not answer to the 2nd reminder call then try again after 5 minutes.

Investment is an example of which of the following risks?

O Political risk

O Uncontrollable risk

O Pure risk

O Speculative risk

Answers

Answer:

Political risk

Explanation:

Investment is an example of Political risk of the following risks?

Answer:speculative risk

Explanation:

correct answer

Linda installed a special pool for the hydrotherapeutic treatment of severe arthritis, as prescribed by her doctor. The cost of installing the pool was $16,160, and her insurance company paid $4,040 toward its cost. The pool increased the value of Linda's house by $5,656, and it has a useful life of 10 years.

How much of a deduction (before any AGI limitations) is Linda entitled to in the year of installation of the pool?

$fill in the blank 1

Answers

Linda installed a special pool for the hydrotherapeutic treatment of severe arthritis, as prescribed by her doctor. The amount of deduction is $6464

What are AGI limitations?Generally, Your Adjusted Gross Income (AGI) will never be more than the total gross income reported on your tax return, and in certain instances, it may even be lower.

On more information, please refer to the instructions for Form 1040 (PDF Schedule 1). If you file your taxes using the Married Filing Jointly status, the $73,000 AGI ceiling applies to the total amount of income that both of you bring in as a married couple.

Compute the amount of deduction as follows:

The deduction amount would be allowed as an expense in the year of installation.

Amount of deduction allowable = Special Equipment cost - Increase in property value -Insurance Received

Therefore

=16160- 4040 - 5656

= 6464

Read more about AGI limitations

https://brainly.com/question/13873941

#SPJ1

The 15-year average return for the S&P 500 from January 1973 to December 2016 (29 separate 15 year periods) was as high as a 20% average annual return and as low as a 3.7% average annual return. Additionally, the average dividend yield for the S&P is 4.11% and the average annual dividend growth rate is 6.11%.

Using this information, please compare the investment in the 5% 15-year corporate bond with a $100,000 investment in a stock with a 3.7% dividend yield (10 percent less than the S&P 500 average yield) and a 3% dividend growth rate (50 percent of the S&P 500 dividend growth rate).

The annual investment returns are as follows:

Year 1 (13.40%) Year 2 (23.37%) Year 3 26.38% Year 4 8.99%

Year 5 3.00% Year 6 13.62% Year 7 3.53% Year 8 (38.49%)

Year 9 23.45% Year 10 12.78% Year 11 0.00 Year 12 13.41%

Year 13 29.60% Year 14 11.39% Year 15 (0.73%)

The bond interest payment of 5 percent is paid annually and not reinvested. To compare accurately with the bond investment, the stock dividend will not be reinvested, but paid annually as well.

Please calculate the value of the stock account at the end of each year and the dividend income from the stock on an annual basis.

Once you have performed the calculations, please let me know if you prefer to invest in a 5% corporate bond for 15 years or the stock and why.

What is the value of the stock after year 2? Year 8? Year 11? When does the annual dividend income of the stock exceed the annual interest income of the bond?

Answers

1. The value of the stock account after Year 2 is $155,401.626.

2. The value of the stock account after Year 8 is $96,110.0674.

3. The value of the stock account after Year 11 is $96,110.0674.

4. The annual dividend income of the stock exceeds the annual interest income of the bond at the end of Year 15.

Bond interest rate: 5%

Stock dividend yield: 3.7% (10% less than S&P 500 average yield)

Stock dividend growth rate: 3% (50% of S&P 500 dividend growth rate)

We'll assume an initial investment of $100,000.

Year 1:

Bond interest income: $100,000 * 0.05 = $5,000

Stock dividend income: $100,000 * 0.037 = $3,700

Value of stock account: $100,000 + ($100,000 * 0.2337) = $123,370

1. Year 2:

Bond interest income: $100,000 * 0.05 = $5,000

Stock dividend income: $100,000 * 0.037 = $3,700

Value of stock account: $123,370 + ($123,370 * 0.2638) = $155,401.626

2. Year 8:

Bond interest income: $100,000 * 0.05 = $5,000

Stock dividend income: $100,000 * 0.037 = $3,700

Value of stock account: $155,401.626 + ($155,401.626 * (-0.3849)) = $96,110.0674

3. Year 11:

Bond interest income: $100,000 * 0.05 = $5,000

Stock dividend income: $100,000 * 0.037 = $3,700

Value of stock account: $96,110.0674 + ($96,110.0674 * 0) = $96,110.0674

4. At the end of Year 15, the dividend income of the stock exceeds the interest income of the bond.

Stock dividend income: $100,000 * 0.037 = $3,700

Bond interest income: $100,000 * 0.05 = $5,000

For such more question on account:

https://brainly.com/question/28326305

#SPJ8

An example of secured credit is a

A. payday loan.

B. credit card.

C. mortgage.

D. medical bill.

Answers

Answer:.

C. mortgage

Explanation:

Mortgage Secured loans are protected by an asset of collateral of some sort. So the answer would be mortgage because the finance company will hold the deed until the loan is paid in full including interest.

An example of secured credit from the options provided is mortgage.

What is secured credit?Secured credit is a line of credit that is backed up by an asset. In the case that the borrower defaults, the asset used to back up the credit can be possessed by the lender.

On the other hand, unsecured credit is a line of credit that is not backed up by any asset. An example is a credit card.

To learn more about mortgage, please check: https://brainly.com/question/9285857

Problem 9-3 Withholding Methods (LO 9.1) Sophie is a single taxpayer. For the first payroll period in July 2020, she is paid wages of $2,200 monthly. Sophie claims one allowance on her pre-2020 Form W-4. Click here to access the withholding tables. IRS Publication 15-T, Federal Income Tax Withholding Method Pay period 2020 Allowance Amount Weekly $ 83 Biweekly 165 Semimonthly 179 Monthly 358 Quarterly 1,075 Semiannually 2,150 Annually 4,300 Round intermediate computations and your final answer to two decimal places. a. Use the percentage method to calculate the amount of Sophie's withholding for a monthly pay period. Sophie's withholding: $fill in the blank 276f67fd3f97003_1 b. Use the wage bracket method to determine the amount of Sophie's withholding for the same period. $fill in the blank 92701d098054043_1 c. Use the percentage method assuming Sophie completed a 2020 Form W-4 and checked only the single box in Step 1(c). $fill in the blank 75763bf84f9d024_1 d. Use the wage bracket method using the same assumptions in part c of this question. $fill in the blank 73d4ce04b013fc1_1

Answers

Many students take out private loans for some or all college tuition costs. If you take out a loan for $25,000, and the interest rate on that loan is 4.5% over 360 months, what would the total interest on the loan end up being? Explain how you came to this conclusion.

Answers

Answer:

1,625 interes

Explanation:

4.5% x 360 = 1,620

Use the following information to calculate for the year ended December 31, 2018

(a) net income,

(b) ending retained earnings, and

(c) total assets.

Supplies $ 3,000

Revenues $25,000

Operating expenses 12,000

Cash 15,000

Accounts payable 9,000

Dividends 1,000

Accounts receivable 3,000

Notes payable 1,000

Beginning retained earnings 5,000

Equipment 6,000

Answers

Answer:

a. $13,000

b. $17,000

c. $27,000

Explanation:

a= Net income (loss) = Service revenue - Other operating expenses

Net income (loss) = $25,000 - $12,000

Net income (loss) = $13,000

b. Ending retained earnings = Beginning retained earnings + Net income - Dividends

Ending retained earnings = $5,000 + $13,000 - $1,000

Ending retained earnings = $17,000

c. Total assets = Cash + Accounts receivable + Supplies + Equipment

Total assets = $15,000 + $3,000 + $3,000 + $6,000

Total assets = $27,000

Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding, No. 5888 for $1,028.05 and No. 5893 for $494.25. The following information is available for its September 30, 2017, reconciliation.

From the September 30 Bank Statement

Answers

Answer:

Most of the information is missing, so I looked it up and attached it (it is a lot of information).

Bank reconciliation:

Bank balance September 30 $18,453.25

+ deposits in transit $1,682.75

- outstanding checks

Check 5893 $494.25 Check 5906 $982.30 Check 5908 $388.00 ($1,864.55)Reconciled bank account $18,271.45

Cash account reconciliation:

Book balance September 30, 2018 $17,404.20

+ Interests $12.50

+ Note collected $1,500

- Bank fees for collection of note ($15)

- NSF check ($600.25)

- Error in recording check 5904 ($30)

Reconciled cash account $18,271.45

The adjusted bank balance and adjusted balance per book is $18271.45.

The bank reconciliation statement for Chavez company for the month ended September 30, 2017 will be calculated thus:

Balance per book = $18453.25Add: Deposit in transit = $1682.75Total = $20136.00Less: Outstanding checks5893 = $494.255906 = $982.305908 = $388.00Total = $1864.55Adjusted bank balance = $20136.00 - $1864.55 = $18271.45Balance per book = $17404.20Add: Interest earned = $12.50Add: Proceeds not less than $15 = $1485.00Total = $18901.70Less: NSF Check = $600.25Error in recording the check 5904 = $30.00Total = $630.25Adjusted balance per book = $18901.70 - $630.25 = $18271.45

Read related link on:

https://brainly.com/question/16917074

What is the interest expense on December 31?

Answers

The interest expense on December 31 of the first year is $5,250.

What is the interest expense on bonds?The interest expense for a bond that has the same coupon rate as the market rate is always the same for all periods of the bond.

This shows that the bond was issued at neither premium nor discount but at par.

Data and Calculations:N (# of periods) = 20

I/Y (Interest per year) = 7.5%

PMT (Periodic Payment) = $5,250 ($140,000 x 7.5% x 1/2)

FV (Future Value) = $140,000

Results:

PV = $140,000.00

Sum of all periodic payments = $105,000 ($5,250 x 20)

Total Interest = $105,000

SchedulePeriod PV PMT Interest FV

1 $140,000 $5,250 $5,250 $140,000

2 $140,000 $5,250 $5,250 $140,000

Thus, the interest expense on December 31 of the first year is $5,250.

Learn more about the interest expense of bonds issued at par at https://brainly.com/question/16995383

#SPJ1

Which of the following best describes the initial impact this deposit will have on the bank’s balance sheet?

Answers

The initial impact of a deposit on a bank's balance sheet is an increase in both assets and liabilities. The deposit increases the bank's liabilities in the form of customer deposits and increases the bank's assets in the form of cash or reserves.

The initial impact of a deposit on a bank's balance sheet can be described as an increase in both assets and liabilities.

When a customer makes a deposit, the bank records the deposit as a liability because it owes the customer the money.

At the same time, the bank also records the deposit as an asset because it now has the customer's money, which it can use for lending and other activities.

Specifically, the deposit will increase the bank's liabilities in the form of customer deposits. This is because the bank is now obligated to return the deposited funds to the customer upon request.

At the same time, the deposit will increase the bank's assets in the form of cash or reserves. This is because the bank now has more money available to fulfill its obligations to customers.

In terms of the balance sheet equation (Assets = Liabilities + Equity), the deposit will increase both sides of the equation. The increase in liabilities represents the increase in customer deposits, while the increase in assets represents the increase in cash or reserves.

It's important to note that this initial impact on the balance sheet does not affect the bank's equity. Equity represents the bank's ownership interest and is not directly impacted by the deposit.

However, the bank can use the increased assets resulting from the deposit to generate profits, which can then increase the bank's equity over time.

For more such questions on assets

https://brainly.com/question/30764400

#SPJ8