Nataro, Incorporated, has sales of $680,000, costs of $342,000, depreciation expense of $86,000, interest expense of $53,000, a tax rate of 23 percent, and paid out $40,000 in cash dividends. The firm has 29,800 shares of common stock outstanding.

a. What is the earnings per share, or EPS, figure? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

b. What is the dividends per share figure? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Answers

Part a: Earnings Per Share (EPS) = $5.14

Part b: Dividend per share = $1.67

Earnings Per Share (EPS) refers to the earnings of each shareholder of company

Earnings Per Share (EPS) = Net income of company/ Number of common shares outstanding

Calculation of Earnings Per Share (EPS):

Particulars Amount

Sales $680,000

Less: Costs $342,000

Depreciation $86,000

Interest expense $53000

Earnings before tax $199,000

Less: Tax at 23% $45,770

Net income (A) $1,53,230

Number of common shares outstanding (B) 29800

Earnings Per Share (C) = (A) / (B) = 5.14

Hence, earnings Per Share (EPS) = $5.14 (round off)

Part b:

We know, dividend per share = Total amount of dividends paid/ Number of common shares outstanding

So, Dividend per share = $40000 / 29800

So, the Dividend per share = $1.34

Hence, dividend per share = $1.67 (round off)

Learn more about dividends:

https://brainly.com/question/29510262

#SPJ4

Related Questions

Goods or services reach the marketplace through.

Answers

Answer:

Marketing Channels

Explanation:

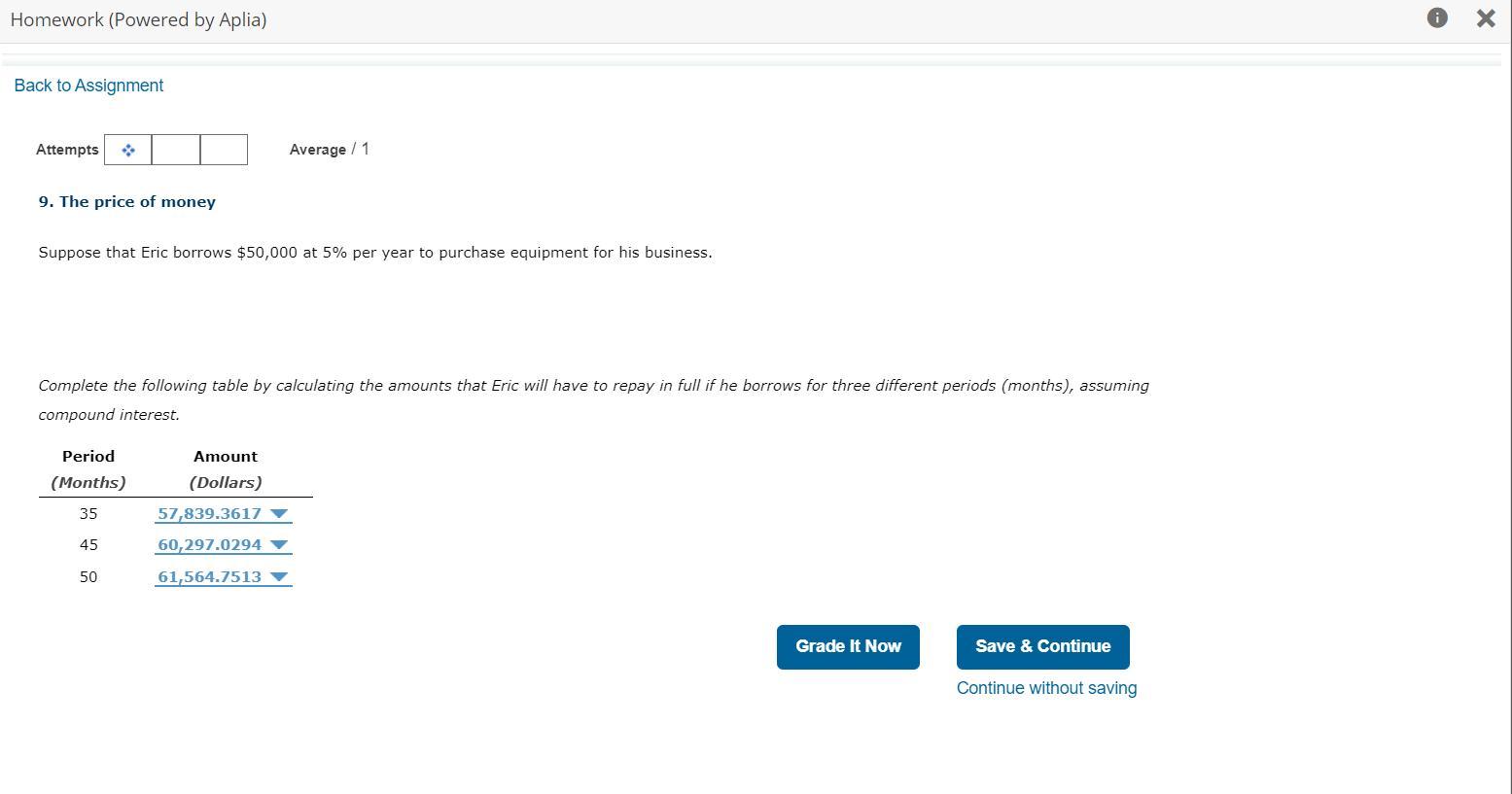

Suppose that Eric borrows $50,000 at 5% per year to purchase equipment for his business.

Complete the following table by calculating the amounts that Eric will have to repay in full if he borrows for three different periods (months), assuming compound interest.

I have the problem completed... is it correct?

I would appreciate a response as soon as possible. Thanks!

Answers

The completion of the table showing the amounts that Eric will repay in full (future value) if he borrows for three different periods (months) with compounding interest is as follows:

Period Amount

(months) (Dollars)

35 $57,839

45 $60,297

50 $61,565.

How is the future value determined?The future value is the compounded present value of the borrowed credit.

Compounding adds interest in computing subsequent interest.

The future values for the various periods can be determined using an online finance calculator as follows:

Future Value at 35 months:N (# of periods) = 35 months

I/Y (Interest per year) = 5%

PV (Present Value) = $50,000

PMT (Periodic Payment) = $0

Results:

Future Value (FV) = $57,839

Total Interest = $7,839

Future Value at 45 months:N (# of periods) = 45 months

I/Y (Interest per year) = 5%

PV (Present Value) = $50,000

PMT (Periodic Payment) = $0

Results:

Future Value (FV) = $60,297

Total Interest = $10,297

Future Value at 50 months:N (# of periods) = 45 months

I/Y (Interest per year) = 5%

PV (Present Value) = $50,000

PMT (Periodic Payment) = $0

Results:

Future Value (FV) = $61,565

Total Interest = $11,565

Learn more about the future value at https://brainly.com/question/24703884

#SPJ1

You, a Captain, are a section chief in Military Personnel and 2d Lt Smith’s supervisor. Lt Smith is a Force Support Officer. She has been on active duty for a year and in her present job for 10 months. She supervises 21 enlisted personnel who perform a variety of administrative tasks in support of a tactical fighter wing. She majored in business administration in college, served 3 years as an administrative specialist, and was an E-4 before being accepted for OTS. As an enlisted member, she graduated from technical school as an honor graduate and was cited on numerous occasions for outstanding performance. Her supervisors considered her a valuable asset to the unit and an expert in her area of responsibility. She’s very enthusiastic about her work and plans to make the Air Force a career.

Lieutenant Smith took over her job 2 months after the unit had received a rating of “marginal” by the numbered Air Force Inspector General’s evaluation team. At the end of her first week on the job, Lt Smith called her NCOIC and key supervisors together and told them that she wouldn’t tolerate marginal performance, that she had previous experience in this type of work, and would be looking at the quality of their work very closely. Since that time, Lt Smith has attempted to supervise every phase of work in her office and, at times, has involved herself in even the most routine decisions. Lt Smith assigns people to certain jobs within the office, plans the work schedule, leave schedule, and does most of the counseling in the office.

In the last 6 months, Lt Smith has ordered several people to work overtime to complete routine work ahead of schedule. Each time this has happened, the NCOIC has asked the lieutenant for permission to speak to her immediate supervisor. On each occasion, the lieutenant has told the senior master sergeant he must not take these internal problems to you, because she’ll take care of any problems in her section--and the NCOIC should remember who writes his EPR.

Most of the time, when Lt Smith approaches the work or break area where the workers are congregated, she notices all conversation stops and the personnel won’t talk to her unless she addresses them first. After reviewing a report yesterday, Lt Smith became very impatient. She bypassed his NCOIC and took the report directly to the Airman who had typed it. While Lt Smith was berating the Airman about the typing errors, the NCOIC walked into the office and asked the Airman what the problem was. The lieutenant became flustered, told the NCOIC she was tired of doing his job for him, and shoved the report into his hands. Lt Smith then went into her office and slammed the door.

The NCOIC relayed this situation to you and asked for your help. How will you help? BACKGROUND

*ENVIRONMENT: Airforce Base

*PEOPLE INVOLVE: The Captain, Lt Smith, Airman and NCOIC.

PROBLEM DEFINATION

*Lt Smith Unprofessional Behavior

DIAGNOSIS

*Marginal Performance

*Previous Experience

*Enthusiastic With her Job

*Academic Credibility

Answers

The lieutenant Smith has taken leave, and everything is running smoothly. People are, however, more attentive when she is present. Decisions are being delayed, and morale was low. The and other important supervisors are worried which some people may decide to due to her supervision, leave the service style.

Several issues must be addressed as a result of this case study. Lieutenant Smith's micromanagement technique is causing morale issues and may lead to retention issues, which is one of the main concerns. It's also troubling that she's requesting people to work extra hours without proper authorization or regard for the impact on their personal lives.

As her boss, you ought to tackle these concerns with Lt Smith and advise her on proper supervisory techniques. You could advise her to delegate more responsibilities to her NCOIC and other key supervisors, and to concentrate in strategic planning and decision-making instead of micromanaging every detail. We should also emphasise the significance of adhering to proper procedures for authorising overtime and taking into account the impact on personnel.

Learn more about lieutenant, here:

https://brainly.com/question/30148992

#SPJ1

PLEASE HELP!! This is economics/business work. Will give brainliest if correct!!

Answers

can someone pls help?

Answers

What is a good practice to remember when adding transitions to a presentation?

Answers

More loans can be made by lenders things to the availability of

Answers

Answer:

Secondary mortgage market

Explanation:

If this helps, please sub to Urfavshawtii on yt it would mean a lot thank you

Fickel Company has two manufacturing departments—Assembly and Testing & Packaging. The predetermined overhead rates in Assembly and Testing & Packaging are $19.00 per direct labor-hour and $15.00 per direct labor-hour, respectively. The company’s direct labor wage rate is $21.00 per hour. The following information pertains to Job N-60: Assembly Testing & Packaging Direct materials $ 375 $ 39 Direct labor $ 168 $ 84 Required: 1. What is the total manufacturing cost assigned to Job N-60? (Do not round intermediate calculations.) 2. If Job N-60 consists of 10 units, what is the unit product cost for this job?

Answers

The total manufacturing cost assigned to Job N-60 is $ 696. If Job N-60 consists of 10 units, the unit product cost for this job is $111.00.

How to find the manufacturing costs ?Direct materials (Assembly + Testing & Packaging) = $375 + $39

= $414

Direct labor (Assembly + Testing & Packaging) = $168 + $84

= $252

Overhead applied (Assembly + Testing & Packaging) = $19 * 168 + $15 * 84 = $316 + $126

= $442

Total manufacturing cost = $414 + $252 + $442

= $1110

Unit product cost = Total manufacturing cost / Number of units

= $1110 / 10

= $111.00

Find out more on manufacturing costs at https://brainly.com/question/24171150

#SPJ1

California residents are allowed a credit for net income taxes paid to another State on income also subject to the California income tax. However, the credit is not allowed for which of the following reasons?

Answers

The reason this credit is not allowed is because: A. If the other state allows California residents a credit for net income taxes paid to California

The types of tax.

In Economics, there are different types of tax and these include the following:

Gift taxExcise taxAlcohol taxIncome taxEstate taxEmployment taxNet income taxWhat is net income tax?Net income tax can be defined as a type of tax which grants either deductions or exemptions from an employee's gross income. Additionally, a net income tax is a system of taxation which is designed and developed to assess taxes on the basis of gross income, gross dividends or gross receipts.

In conclusion, it is a fact that any form of deductions or exemptions that doesn't qualify for a credit is not considered as a net income tax in California and every other part of the world.

Read more on income taxes here: brainly.com/question/27008617

#SPJ1

Complete Question:

California residents are allowed a credit for net income taxes paid to another State on income also subject to the California income tax. However, the credit is not allowed for which of the following reasons?

A. If the other state allows California residents a credit for net income taxes paid to California

B. If the income taxed by the other state has a source within the other state under California law

C. If such states do not allow their residents a credit for net income taxes paid to California

D. The amount of the credit is greater than the same proportion of the total California tax as the income taxed by both states bears to the total income taxed by California

In Western culture, when you borrow ideas and words from other sources, you must cite them properly. Well-documented data from solid sources will help reinforce your professional credibility. Familiarize yourself with the kinds of materials and sources you need to document in business writing. Also, develop good research habits, and be aware of when and how to use quotations. Complete the following sentence.

It is important to document report data properly in order to:_________

Answers

Answer:

help reinforce your professional credibility.

It is important to document report data properly in order to help reinforce your professional credibility.

What is professional credibility?Esty, honesty, trustworthiness, and other qualities that make you who you are. Your education, experience, performance, and proven professional progress all contribute to your professional reputation.

Professional recognition is crucial because it increases our reputation and fosters confidence among the individuals we work with. Personal qualities that characterize you as a person, such as honesty, integrity, and trustworthiness, make up your personal credibility.

Your education, experience, performance, and clearly established professional job history and progression all contribute to your professional reputation.

Thus, to help reinforce your professional credibility.

For more information about professional credibility, click here:

https://brainly.com/question/28189846

#SPJ2

>

2. Post to the cash short and over account (use Account No. 516).

20--

ACCOUNT

DATE

Cash Short and Over

ITEM

GENERAL LEDGER

POST. REF.

38

18

38

38

DEBIT

CREDIT

ACCOUNT NO.

BALANCE

DEBIT

CHE E UD

516

CREDIT

Answers

Cash shortage represents expense and cash overage represents revenue.

What is meant by Cash Shortage (if credit exceeds debit)?A cash shortage occurs when the total amount of cash that must be paid out is less than the amount of cash that is available. To put it another way, it occurs when the total amount of credit in a cash account exceeds the total amount of debit.

This scenario can occur in a variety of settings, including banking, business operations, and personal finance. In personal finance, for instance, an individual may run out of cash if their expenses are greater than their income. Also, if a company has to pay out a lot of money at once or its expenses are higher than its revenue, it may run out of cash.

To know more about Business Operation, visit:

https://brainly.com/question/24142702

#SPJ1

The efficiency of the typist is known to be 50 words/minute with standard deviation 5 words/minute she is given a new training in 36 tests. She is scored an average of 52words/minute. Do you conclude that the training has improved her speed at 0.05?

Answers

Based on the given data, we can conclude that the training has significantly improved the typist's speed at a significance level of 0.05.

How to determine if the training has improved her speed at 0.05To determine whether the training has improved the typist's speed significantly, we can perform a hypothesis test using the given information. We will use a significance level of 0.05, which means that we are willing to accept a 5% chance of making a Type I error (incorrectly concluding that the training has improved the speed when it actually hasn't).

Let's set up the null and alternative hypotheses:

Null hypothesis (H0): The training has not improved the typist's speed. μ = 50 words/minute.

Alternative hypothesis (H1): The training has improved the typist's speed. μ > 50 words/minute.

To test these hypotheses, we can perform a one-sample t-test since we know the population standard deviation.

The test statistic for a one-sample t-test is given by:

t = (xbar - μ) / (s / √n),

where xbar is the sample mean, μ is the hypothesized population mean, s is the standard deviation, and n is the sample size.

In this case, xbar= 52 words/minute, μ = 50 words/minute, s = 5 words/minute, and n = 36.

Let's calculate the test statistic:

t = (52 - 50) / (5 / √36) = 2 / (5 / 6) = 2 * 6 / 5 = 12 / 5 = 2.4.

Next, we need to find the critical value corresponding to a significance level of 0.05. Since the alternative hypothesis is one-sided (μ > 50), we will find the critical value from the t-distribution with degrees of freedom (df) equal to n - 1 (36 - 1 = 35) and a one-tailed significance level of 0.05.

Using a t-table or a t-distribution calculator, the critical value for df = 35 and a one-tailed significance level of 0.05 is approximately 1.691.

Since the test statistic (2.4) is greater than the critical value (1.691), we reject the null hypothesis. This means we have sufficient evidence to conclude that the training has improved the typist's speed at a significance level of 0.05.

Therefore, based on the given data, we can conclude that the training has significantly improved the typist's speed at a significance level of 0.05.

Learn more about significance level at https://brainly.com/question/15414435

#SPJ4

Your new business has 10,000 in monthly fixed expenses. You are selling sandwiches for an average price of $7 per sandwich. Each sandwich has a variable cost associated with production that costs an average of $3. What is your contribution margin?

$2,500

$3

$4

$7

$10,000

Answers

If each sandwich has a variable cost associated with production that costs an average of $3. Your contribution margin is $4.

Using this formula

Contribution margin=Selling price per unit-Variable cost per unit

Where:

Selling price per unit=$7

Variable cost per unit=$3

Let plug in the formula

Contribution margin=$7-$3

Contribution margin=$4

Inconclusion your contribution margin is $4.

Learn more here:

https://brainly.com/question/15015682

Attitudes are a person's lasting evaluations of objects

True false

Answers

Answer:

False

Explanation:

Wheat and oats are used to make different types of breakfast cereal and both are grown on the prairies What would happen to the supply and demand of oats if the price of wheat were to fall? What happens to the equilibrium price and quantity of oats?

Answers

If the price of wheat falls, the demand for oats would decrease and the supply of oats would increase.

The equilibrium price of oats would decline and the equlibrium quantity would be indeterminate.

What are subsistute goods?

Substitute goods are goods that can be used in place of another good.

if the price of a good decline, the demand for the substitute decreases and if the price of the good increases, the demand for the substitute decreases.

To learn more about substitute goods, please check: https://brainly.com/question/26551927

I need help with 1.5 ,1.6 and 1.7 please

Answers

Answer:

1.5.1 Business venture/Venture capital

1.5.2 a) Risk: High risk for the investor(s), if research is not properly done

b) period of investment: Inexperienced

business owners that make wrong

business decisions may experience

big losses/closing down of an existing

business.

1.6.1 unit trusts

1.6.2 - share price may fluctuate

- unit trusts are not allowed to borrow,

therefore reducing potential returns.

- not good for people who want to invest for

a short period

- not good for people who want to avoid

risks at all costs

1.5.1 Stocks, also known as shares or equities, is the best type of investment opportunity i would choose in future.

It is most well-known and simple type of investment. When you buy stock, you’re buying an ownership stake in a publicly traded company.

Benefit of investment in stocks:

A. Dividend it the profit that i will get on shares

B. When I will buy a stock, there will be a hope that the price will go up so I can then sell it for a profit.

1.5.2 (a) The risk is that the price of the stock could go down, in which case I’d lose money.

1.5.2 (b) Shares in a company can be kept as long as I wish.

1.6.1 The investment chosen by Pearl is the investment in shares (joint stock exchange)

1.6.2 Disadvantages are dividend uncertainty, high risk, fluctuation in market price, limited control, residual claim etc.

*I hope it is helpful

imagine that you won the powerball. your lump sum jackpot ended up being $437 million! if you are going to follow the suggestions from the text on spending your winnings, which of the following should you not do?

Answers

If I were lucky enough to win the Powerball jackpot, I would consider the following three criteria when deciding whether to take a lump sum or an annuity:

My financial goalsMy age and life expectancyMy risk tolerance: What are the factors about?My financial goals: I would consider whether I have any specific financial goals that I want to achieve with the money, such as paying off debt, investing in a business, or securing my retirement. If I have long-term financial goals that will require a consistent stream of income, I may opt for the annuity to ensure that I have a reliable source of funds.

My age and life expectancy: I would also consider my age and life expectancy when making this decision. If I am young and have a long life expectancy, I may opt for the annuity so that I can receive a steady stream of income for a longer period of time. On the other hand, if I am older or have a shorter life expectancy, I may opt for the lump sum so that I can receive the full value of the prize upfront.

My risk tolerance: Finally, I would consider my risk tolerance when making this decision. If I am comfortable with taking on risk and feel confident in my ability to invest the lump sum wisely, I may opt for the lump sum. However, if I am more risk-averse and prefer a more predictable stream of income, I may opt for the annuity.

Ultimately, the decision between a lump sum and an annuity will depend on an individual's specific financial situation and priorities. It's important to carefully weigh the pros and cons of each option and seek the advice of a financial advisor or professional before making a decision.

Learn more about Jackpot from

https://brainly.com/question/4433780

#SPJ1

See full question below

The largest Powerball jackpot winner to date is Gloria MacKenzie, who won a reported $590.5 million in May 2013. She bought the winning ticket at a grocery store in Florida when another customer waiting to buy a ticket let her jump the line. The Powerball lottery is jointly played in 45 states, and the overall odds of winning the Powerball jackpot are about 1 in 175 million, according to the Multi-State Lottery Association. If you win the jackpot, one of the first choices you must make is whether to take your winnings in a single lump sum or to spread them out in annual installments over 30 years. Perhaps because MacKenzie was 84 years old and did not expect that she would still be around to collect her winnings at 114, she opted to take the lump sum cash payout. It turns out that holding the golden ticket did not entitle Ms. MacKenzie to $590.5 million. The prize is actually a growing annuity, which means that the payout rises each year (in this case by 4 percent to keep up with expected inflation) to equal $590.5 million spread over 30 years. If a winner selects the lump sum, she gets only the present value of the growing annuity. Ms. MacKenzie does not appear to have been outraged at being “shortchanged,” despite the fact that she received only $371 million—63 percent of the advertised prize. If the discount rate had been higher (it was approximately 3 percent), her lump sum would have been even less. If she had chosen the annuity, she would have received $10.5 million in the first year, but almost $33 million in the final year. Deciding which option to take in these circumstances is complicated. If you win the Powerball grand prize, contact your finance instructor for advice. You will probably discover that you are remembered as his or her favorite student.

imagine that you won the powerball. your lump sum jackpot ended up being $437 million! if you are going to follow the suggestions from the text on spending your winnings, which of the following should you not do?

which is the purpose of the U.S. treasury department?

Answers

Answer:

The Department of the Treasury manages Federal finances by collecting taxes and paying bills and by managing currency, government accounts and public debt. The Department of the Treasury also enforces finance and tax laws.

Give me brainliest answer pls

Producing goods and services and paying taxes are two ways that businesses:

Answers

Producing goods and services and paying taxes are two ways that business: benefit society.

What is taxation?Taxation can be defined as the involuntary fees that are levied on individuals or business firms by the government of a particular country, so as to generate revenues that can be used to fund public projects, institutions and activities.

The types of tax.In Economics, there are different types of tax levied on individuals or business firms by the government, and these include the following:

Sales taxProperty taxIncome taxIn this context, we can infer and logically deduce that the two ways through which business firms benefit society are by producing goods and services and paying taxes to the government.

Read more on tax here: brainly.com/question/25783927

#SPJ1

If 15,000 fans bought tickets totaling $450,000, what was the average price per ticket?

Answers

Answer:

$30

Explanation:

450,000 ÷ 15,000 = 30

The average price per ticket is $30.

What is Average?In mathematics, the Average value—which is determined by dividing the sum of all the values by the total number of values—is the average value in a collection of numbers.

To calculate the average of a collection of data, add up all the values and divide the result by the total number of values.

According to the given question, total number of fans are 15,000 and amount of total tickets are $450,000.

Average price per ticket can be computed as follows:-

Average = Total Amount ÷ Number of Observations

= 450,000 ÷ 15,000

= 30

Therefore, it can be concluded that the average price per ticket is $30.

Learn more about Average here:

https://brainly.com/question/27193544

#SPJ6

How do I get gud at craft

Answers

Answer:

practice at least two times per day

Answer: 90% of people marry there 7th grade love. since u have read this, u will be told good news tonight. if u don't pass this on nine comments your worst week starts now this isn't fake. apparently if u copy and paste this on ten comments in the next ten minutes you will have the best day of your life tomorrow. you will either get kissed or asked out in the next 53 minutes someone will say i love you.

Explanation:

100 points

Step 1

Research arguments for and against one of these topic questions:

Should government raise the minimum wage?

Step 2

Create a graph to show the effect (shortage or surplus) of the government regulation you chose. Discuss why these issues do or do not affect your claim. Include the appropriate labels for your graph such as:

price

quantity

supply

demand

surplus or shortage

Step 3

Write a persuasive argument as an essay or blog entry to address your topic. Use a minimum of 400 words. State your claim clearly with details from reliable sources. Be sure to include:

Your claim on the topic question

Three strong arguments that support your claim

At least one argument that opposes your claim, and how you challenge it

Economic terms from the lesson such as price controls, equilibrium price, shortage, and surplus

Step 4

Create a reference section that includes links to your sources. Be sure to include your sources in MLA format.

There are many 21st century tools available for effective collaboration and communication in the online environment. For more information about tools your school recommends, visit the resource tools area in your course or contact your instructor.

Answers

Answer:

Step 1: Research arguments for and against the idea of raising the minimum wage

Arguments for raising the minimum wage:

Increases in the minimum wage can help to reduce poverty and income inequality by giving low-wage workers more money to live on.

Higher wages can lead to increased consumer spending, which can stimulate economic growth and create jobs.

Higher wages can improve the quality of life for low-wage workers and their families, as they will be able to afford better housing, food, and other necessities.

Arguments against raising the minimum wage:

Higher wages can lead to increased costs for businesses, which may cause some companies to lay off workers or reduce their hours in order to save money.

Higher wages may lead to higher prices for goods and services, as businesses try to recoup their increased labor costs.

Higher wages may lead to companies outsourcing jobs to countries with lower labor costs in order to remain competitive.

Step 2: Create a graph to show the effect (shortage or surplus) of the government regulation on the minimum wage

[graph]

Explanation:

The graph shows the effect of the government raising the minimum wage on the labor market. The demand for labor (represented by the downward-sloping demand curve) reflects the willingness of businesses to pay for labor at different wage rates. The supply of labor (represented by the upward-sloping supply curve) reflects the willingness of workers to supply their labor at different wage rates.

At the equilibrium wage rate (W*), the quantity of labor demanded by businesses (Ld) is equal to the quantity of labor supplied by workers (Ls). This results in a balance between the supply and demand for labor, and there is no surplus or shortage of labor in the market.

If the government raises the minimum wage above the equilibrium wage rate (to Wmin), the demand for labor decreases (to Ld') as businesses are unwilling to pay the higher wage rate. This leads to a surplus of labor in the market, as the quantity of labor supplied by workers (Ls) exceeds the quantity of labor demanded by businesses.

Step 3: Write a persuasive argument in favor of raising the minimum wage

As the debate over the minimum wage continues, it is important to consider the benefits and drawbacks of increasing this important economic policy. While some argue that raising the minimum wage would lead to job losses and higher prices for goods and services, there is compelling evidence to suggest that raising the minimum wage would have a number of positive effects on workers, businesses, and the economy as a whole.

One of the main arguments in favor of raising the minimum wage is that it would help to reduce poverty and income inequality. According to a report by the National Bureau of Economic Research, increasing the minimum wage to $15 per hour (a rate that is currently being debated in many states) would lift millions of workers out of poverty and reduce income inequality by increasing the wages of low-paid workers relative to higher-paid workers. This would not only improve the quality of life for these workers and their families, but it would also stimulate consumer spending and boost economic growth.

Another argument in favor of raising the minimum wage is that it would lead to increased productivity and lower turnover rates among workers. Research has shown that when workers are paid higher wages, they are more likely to be motivated and engaged in their work, leading to higher levels of productivity. In addition, higher wages can lead to lower turnover rates, as workers are less likely to leave their jobs in search of higher pay elsewhere. This can save businesses money in the long run by reducing the costs associated with training new employees.

Research arguments for and against the idea of raising the minimum wage

Arguments for raising the minimum wage:

Increases in the minimum wage can help to reduce poverty and income inequality by giving low-wage workers more money to live on. Higher wages can lead to increased consumer spending, which can stimulate economic growth and create jobs.

Higher wages can improve the quality of life for low-wage workers and their families, as they will be able to afford better housing, food, and other necessities.

Arguments against raising the minimum wage:

Higher wages can lead to increased costs for businesses, which may cause some companies to lay off workers or reduce their hours in order to save money.

Higher wages may lead to higher prices for goods and services, as businesses try to recoup their increased labour costs. Higher wages may lead to companies outsourcing jobs to countries with lower labour costs in order to remain competitive.

A graph to show the effect (shortage or surplus) of the government regulation on the minimum wage:

The graph shows the effect of the government raising the minimum wage on the labour market. The demand for labour (represented by the downward-sloping demand curve) reflects the willingness of businesses to pay for labour at different wage rates. The supply of labour (represented by the upward-sloping supply curve) reflects the willingness of workers to supply their labour at different wage rates.

At the equilibrium wage rate (W*), the quantity of labour demanded by businesses (Ld) is equal to the quantity of labour supplied by workers (Ls). This results in a balance between the supply and demand for labour, and there is no surplus or shortage of labour in the market.

If the government raises the minimum wage above the equilibrium wage rate (to Wmin), the demand for labour decreases (to Ld') as businesses are unwilling to pay the higher wage rate. This leads to a surplus of labour in the market, as the quantity of labour supplied by workers (Ls) exceeds the quantity of labour demanded by businesses.

A persuasive argument in favour of raising the minimum wage:

As the debate over the minimum wage continues, it is important to consider the benefits and drawbacks of increasing this important economic policy. While some argue that raising the minimum wage would lead to job losses and higher prices for goods and services, there is compelling evidence to suggest that raising the minimum wage would have a number of positive effects on workers, businesses, and the economy as a whole.

One of the main arguments in favour of raising the minimum wage is that it would help to reduce poverty and income inequality. According to a report by the National Bureau of Economic Research, increasing the minimum wage to $15 per hour (a rate that is currently being debated in many states) would lift millions of workers out of poverty and reduce income inequality by increasing the wages of low-paid workers relative to higher-paid workers. This would not only improve the quality of life for these workers and their families, but it would also stimulate consumer spending and boost economic growth.

Another argument in favour of raising the minimum wage is that it would lead to increased productivity and lower turnover rates among workers. Research has shown that when workers are paid higher wages, they are more likely to be motivated and engaged in their work, leading to higher levels of productivity. In addition, higher wages can lead to lower turnover rates, as workers are less likely to leave their jobs in search of higher pay elsewhere. This can save businesses money in the long run by reducing the costs associated with training new employees.

To know more about the Government:

https://brainly.com/question/1078669

A promissory note can best be described as __________., a. an interest-bearing IOU, b. a guarantee of a line of credit, c. a commitment to lend money to someone, d. a government-backed bond

Answers

A promissory note can best be described as: a. an interest-bearing IOU.

What is promissory note?Promissory note can be defined as a written note that help to shows that a person who lend a money from another person promise to payback. The note contains a promise by the borrower to pay back the lender within a stipulated period of time.

A promissory note can tend to be described as IOU which full meaning is I OWE YOU which implies that a borrower is telling the lender that he/she owe the lender some certain amount of money which the borrower will have to payback.

A promissory note also contains the terms and conditions of the agreement and this terms and agreement includes the following :

The principal amountThe loan maturity dateThe interest etcTherefore we can conclude that the correct option is A.

Learn more about promissory note here:https://brainly.com/question/27132271

#SPJ1

11. a. Suppose David spends his income M on goods x1 and x2, which are priced p1 and p2, respectively. David’s preference is given by the utility function

(1, 2) = √1 + √2.

(i) Derive the Marshallian (ordinary) demand functions for x1 and x2. (25 marks)

(ii) Show that the sum of all income and (own and cross) price elasticity of demand

for x1 is equal to zero. (25 marks) b. For Jimmy both current and future consumption are normal goods. He has strictly convex and strictly monotonic preferences. The initial real interest rate is positive. If the real interest rate falls, in each of the following cases, argue what will happen to his period 2 consumption level? Clearly illustrate your argument on a graph.

(i) He is initially a borrower. (25 marks)

(ii) He is initially a lender. (25 marks)

Answers

Answer:

Explanation:

D

East Corp. manufactures stereo systems that carry a two-year warranty against defects. Based on past experience, warranty costs are estimated at 4% of sales for the warranty period. During 2005, stereo system sales totaled $3,000,000, and warranty costs of $67,500 were incurred. In its income statement for the year ended December 31, 2005, East should report warranty expense of:

Answers

Answer:

$52,500

Explanation:

The cost associated with repair or replacement of a product incase it foes not function after its purchase is termed warranty. It is debited to the warranty expense account and credited to warranty to the warranty liability account

Total sales for the year $3,000,000

Warranty estimated basis 4%

Estimated warranty = $3,000,000 × 4% = $120,000

Warranty cost incurred $67,500

Balance to be recorded for the year

= $120,000 - $67,500

= $52,500

Identify different ways of interpreting the Constitution. (Site 1)

Answers

Answer:

1. Living Constitution: Many authors claims that law can be interpreted on this way , which is to believe that Constitution has many meanings and that changes with the contemporary societies , when found main constitutional phrases to interpret.

Originalism: On this kind of interpretation, many authors says that Constitution and all its statements have to be interpreted on the way that originally all the people at the time did back in 1776.

Textualism: Here several authors claims that no one can give other meaning that one that stands in the statement on the law. Its a formalism form of interpretation and the main interpretation is based on the meaning of the legal text.

Purposive Approach: Many Authors like Aharon Barak claims that common law courts can interpret a statute, part of a statute, or a clause of a constitution within the context of the law's purpose.

Strict Constructionism: Strict constructionism claims that has to give a narrow, or strict, interpretation to a legal text, like the U.S. Constitution to any judge. It means that a judge can interpret a text ONLY as it is written.

2.It is called a "living document " because no law can be passed that would contradict its principles but it also allows for changes.A living document is a document that can be changed as new things come up.

3.The Constitution has laid out four paths for amendments.ratification by state legislatures. They describe the path that has been used for most amendments.

Explanation:

Answer:1. Living Constitution: Many authors claims that law can be interpreted on this way , which is to believe that Constitution has many meanings and that changes with the contemporary societies , when found main constitutional phrases to interpret.

Originalism: On this kind of interpretation, many authors says that Constitution and all its statements have to be interpreted on the way that originally all the people at the time did back in 1776.

Textualism: Here several authors claims that no one can give other meaning that one that stands in the statement on the law. Its a formalism form of interpretation and the main interpretation is based on the meaning of the legal text.

Explanation:

Hope this helps ;}

Oceanic Company has 15,000 shares of cumulative preferred 2% stock, $50 par and 50,000 shares of $5 par common stock. The following amounts were distributed as dividends:

20Y1 $22,500

20Y2 7,500

20Y3 45,000

Need help understanding this problem!

Answers

The dividends per share for the cumulative preferred stock and the common stock is :

20Y1 20Y2 20Y3

Dividend per share:

Preferred Stock $1 $0.50 $1.50

Common Stock $0.15 $0 $0.45

What is dividend per share ?Dividend per share is the sum of declared dividends issued by a company for every ordinary share outstanding . It is calculated by dividing the total dividend by the number of shares in the issue for each class of stock.

However, the dividend is distributed to preferred stockholders first, followed by common stockholders.

In any year where the dividend is insufficient to cover the cumulative preferred stockholders, whatever is left over is distributed to the preferred stockholders, leaving common stockholders with nothing.

If there are sufficient dividends, the cumulative preferred dividend arrears must be settled in addition to the fixed dividend for the year

The dividend per share is calculated as:-

Cumulative Preferred 2% Stock = 15,000 shares

Par value = $50

Value of Cumulative preferred stock, 2% stock = $750,000 (15,000 x $50)

Fixed preferred dividend each year = $15,000

Common Stock = 50,000 shares

Dividend Distribution Preferred Common Stock

20Y1 $22,500 $15,000 $7,500 ($22,500-$15,000)

Dividend per share $1 $0.15 ($7,500/50,000)

20Y2 7,500 $7,500 $0

Dividend per share $0.50 $0

20Y3 45,000 $22,500 $22,500 ($45,000 - $22,500)

Dividend per share $1.50 $0.45

Preferred stock dividend for 20Y3 = $22,500 ($7,500 + $15,000)

Therefore, the dividend per share for Oceanic Company is calculated.

To learn more about dividend per share, click here:

https://brainly.com/question/13402434

#SPJ1

The _____________ and ______________ provide specific guidelines regarding minimum identification requirements for clients who complete applications for financial products.

Answers

Based on existing rules and regulations, the Truth in Lending Act and Truth in Savings Act provide specific guidelines regarding minimum identification requirements for clients who complete applications for financial products.

The purpose of the Truth in Lending Act & Truth in Savings ActThe United States government explicitly made the Truth in Lending Act & Truth in Savings Act to enable customers or citizens to make informed financial decisions precisely when making applications for financial products.

It also requires financial institutions like banks to provide to consumers disclosures on terms and costs relating to deposit accounts, savings, and lending.

Hence, in this case, it is concluded that the correct answer is "Truth in Lending Act and Truth in Savings Act."

Learn more about the Truth in Savings Act here: https://brainly.com/question/21714367

define default economics.

Answers

Answer:

Default is the failure to repay a debt, including interest or principal, on a loan or security. A default can occur when a borrower is unable to make timely payments, misses payments, or avoids or stops making payments.

Explanation:

Answer:

the failure to repay a debt

Explanation:

the failure to repay a debt

WHich of the following is not a type of skill needed by effective leaders?

Answers

Answer:

WHich of the following is not a type of skill needed by effective leaders?

Answer. power hankering skil