Robyn owns a music production company Gala Music (Pty) Ltd (“Gala”). The primary function of a music production company is to locate artists and facilitate the recording, manufacturing, and distribution of musical products. Gala entered into an agreement with Buntu Events (Pty) Ltd (“Buntu”). Buntu is a full-service event planning company that provides complete planning, consulting, and supervision for both corporate and social events. In this agreement, Gala will provide performing artists for Buntu’s Durban July party on 2 July 2022, and in exchange Buntu will waive the performers' registration fee of R28 750 (VAT inclusive).

Gala charges R11 500 (VAT inclusive) booking fees (not registration fee) for its artists per event. Gala will provide three performing artists for Buntu’s Durban July party on 2 July 2022. Both companies have 30 June year ends and both are registered vendors in terms of the Value-Added Tax Act, 1991 (Act 89 of 1991), as amended.

With reference to the paragraph “Dr Robyn Miekle”, discuss in terms of the Value-Added Tax Act, 1991 (Act 89 of 1991) and applicable case law, if any, the output tax consequences for Gala Music (Pty) Ltd of entering into the agreement with Buntu Events (Pty) Ltd for the year ended 30 June 2023. For this question, assume that Gala Music (Pty) Ltd had not received nor issued a valid tax invoice.

Answers

The will be no output tax consequences for Gala Music (Pty) Ltd for entering into the agreement with Buntu Events (Pty) Ltd for the year ended 30 June 2023 under the Value-Added Tax Act 1991.

What was the Value-Added Tax Act 1991?It was a federal legislation that impose and charge Value Added Tax on certain goods and services and to provide for the administration of the tax and matters.

The Value-Added Tax Section 89 of 1991 Act does the follwing:

provide for taxation in respect of the supply of goods and services and the importation of goodsamend the Transfer Duty Act, 1949amend the Stamp Duties Act, 1968repeal the Sales Tax Act, 1978.Because the Value-Added Tax have been abandoned for a long time in the country, there will be no output tax consequences for Gala Music (Pty) Ltd for entering into the agreement with Buntu Events (Pty) Ltd for the year ended 30 June 2023 under the Value-Added Tax Act 1991.

Read more about Value-Added Tax

brainly.com/question/22241921

#SPJ1

Related Questions

January 4—Sold two ice cream systems to Day Dreamer’s Ice Cream. The estimated direct labor is $8,200.00. The estimated direct material is $3,350.00. The estimated indirect material is $350.00. Day Dreamer’s is to be billed in the amount of $20,925.00 on account. A check for $5,000.00 will be collected as a deposit against that sale. The start date will be January. The date promised will be January 23. Assign the contract to Job 74.

January 4th sold two ice cream systems to Day Dreamer's Ice Cream. THe estimated direct labor is $8,000.00. The estimated direct material is $2,250.00. The estimated indirect material is $350.00. Day Dreamers is to be billed in the amount of $20,925.00 on account. A check for $5,000.00 will be collected as a deposit against that sale. The start date will bew January 7th. The date Promised will be January 23rd.

January 19—Apply from direct materials requisition $2,800.00 of direct materials. Apply from indirect materials requisition $325.00 of indirect materials. Apply from time cards s $7,950.00 of direct labor to Job 74 completing the job.Applied factory overhead is based on 25% of direct labor cost. Transfer the completed job to the COGS account from Direct Material and Indirect Material and Factory Overhead accounts. When making the journal entry for applying direct labor debit COGS for the gross pay and credit FWT Payable and FICA Tax Payable for the appropriate amounts with the net pay going to Salaries Payable

what would all the monthly journal entries be?

Answers

When the job is completed, the costs incurred in the Work in Progress account will be transferred to the Finished Goods account.The following are the monthly journal entries:January 4, 20XX: Sold two ice cream systems to Day Dreamer's Ice Cream and the total amount billed on account is $20,925.00. Cash collected on account was $5,000.00.

To record sales on account:

Debit: Accounts Receivable: $20,925

Credit: Sales Revenue: $20,925

To record cash received on account

:Debit: Cash: $5,000

Credit: Accounts Receivable: $5,000

January 7, 20XX: Job 74 began and the direct and indirect materials are requisitioned and job order costs were incurred.

To record the beginning of the job, the following entry will be made:

Debit: Work in Progress: $5,800

Credit: Direct Materials: $2,250

Credit: Indirect Materials: $350

Credit: Direct Labor: $8,000

January 19, 20XX: Direct materials of $2,800 and indirect materials of $325 were used and direct labor costs were incurred amounting to $7,950.00.

To record the use of direct materials:

Debit: Work in Progress: $2,800

Credit: Direct Materials: $2,800

To record the use of indirect materials:Debit: Work in Progress: $325

Credit: Indirect Materials: $325To record the payroll expenses:

Debit: Work in Progress: $7,950

Credit: Salaries Payable: $6,137.50

Credit: FICA Taxes Payable: $612.50

Credit: Federal Withholding Taxes Payable: $200

Credit: State Withholding Taxes Payable: $1,000

To record the application of overhead:Debit: Work in Progress: $1,987.50

Credit: Manufacturing Overhead: $1,987.50.When the job is completed, the costs incurred in the Work in Progress account will be transferred to the Finished Goods account.

For more question on Work in Progress account

https://brainly.com/question/14756495

#SPJ8

Prepare the journal entries to record the following transactions of Wildhorse Company's books under a perpetual inventory system. Clarify which are debit and which are credit.

(a) On March 2nd, Windsor Company sold $854,200 of merchandise to Wildhorse Company on account, terms 2/10, n/30. The cost of merchandise sold was $517800.

(b) On March 6th, Wildhorse Company returned $109800 of the merchandise purchased on March 2nd. The cost of the merchandise returned was $66800.

(c) On March 12th, Windsor Company received the balance due from Wildhorse Company.

Answers

a) Credit Inventory for $517,800

b) Debit Inventory for $66,800

c) Credit Accounts Receivable (or Trade Receivables) for the same amount

(a) The journal entry to record the sale of merchandise from Windsor Company to Wildhorse Company on March 2nd would be:

Debit Accounts Receivable (or Trade Receivables) for $854,200

Credit Sales Revenue for $854,200

Debit Cost of Goods Sold for $517,800

Credit Inventory for $517,800

The debit to Accounts Receivable represents the amount owed by Wildhorse Company for the merchandise purchased on account. The credit to Sales Revenue recognizes the revenue generated from the sale. The debit to Cost of Goods Sold recognizes the cost of the merchandise sold, and the credit to Inventory reduces the inventory balance as the goods are no longer in stock.

(b) The journal entry to record the return of merchandise by Wildhorse Company on March 6th would be:

Debit Sales Returns and Allowances for $109,800

Credit Accounts Receivable (or Trade Receivables) for $109,800

Debit Inventory for $66,800

Credit Cost of Goods Sold for $66,800

The debit to Sales Returns and Allowances reduces the revenue from the original sale. The credit to Accounts Receivable reduces the amount owed by Wildhorse Company for the returned merchandise. The debit to Inventory increases the inventory balance as the goods are returned to stock, and the credit to Cost of Goods Sold reduces the cost of the merchandise originally sold.

(c) The journal entry to record the payment received by Windsor Company on March 12th would be:

Debit Cash (or Bank) for the amount received from Wildhorse Company

Credit Accounts Receivable (or Trade Receivables) for the same amount

The debit to Cash represents the inflow of funds from the customer's payment. The credit to Accounts Receivable reduces the amount owed by Wildhorse Company, reflecting the settlement of the outstanding balance.

for more such questions on amount

https://brainly.com/question/28147009

#SPJ8

XYZ Co is considering a major expansion program that has been proposed by the company’s information technology group. To decide whether the company will undertake this major expansion project, the company paid McLindsay Co., a large consulting company, a fee of $2 million to calculate the costs and benefits of the program, but they will refund half of that cost back to XYZ if the company does not move forward with the project. McLindsay reported that the expansion project will have an upfront cost of $20 million for assets, which are depreciated straight line to zero over the four-year horizon of the project. The company does not need to invest in net working capital (i.e., NWC = 0). McLindsay also expects that the program will generate an operating cash flow equal to $10 million the first year and will expand by 20% per year until the project is liquidated at the end of year four. The liquidation value from selling the equipment will be $4 million. You are an assistant to the CFO of the company and your first task is to advise XYZ whether the company should undertake the investment. The CFO has provided you with the following data, which he believes may be relevant to your task (all the market data are current). The firm’s tax rate is 20%. The market data on XYZ Co’s securities are:

Debt

oBond A: 42,750 bonds with a 5.4% coupon rate, with 20 years to maturity selling at par. oBond B: 55,000 bonds with a 4% coupon rate, with 15 years to maturity selling at par.

Assume that both bonds have a par value of $1,000 and they make semiannual payments.

Common stock

o 1,000,000 shares outstanding, selling for $95 per share; XYZ Co just paid a dividend of $4 per share and is expected to increase its future dividends at a constant rate of 5%. The firm’s beta is 1.8. Assume the risk-free rate is 2% and the market return is 8%.

Answer the following questions and show all the formulas and calculations (if using a financial calculator show all the entries).

a. What is XYZ Co’s cost of debt?

b. What is XYZ Co’s cost of equity using the CAPM?

c. What is XYZ Co’s cost of equity using the dividend growth model?

d. What is XYZ Co’s cost of capital? (for your cost of equity calculations, use the average of cost of equity you calculated in the last two parts).

e. Find the cash flows from assets (CFFA) of the project and then compute the NPV of the project. Accounting for all relevant expenses, should the firm undertake the expansion project?

f. Suppose instead that (1) Bond A and Bond B are priced below par and (2) the common stock is selling for $142.50 per share and the last dividend paid was $6. Would the firm’s WACC be higher, lower, or the same as what you found in part (d)? Explain.

Answers

a. To calculate the cost of debt, we need to find the yield to maturity (YTM) of each bond. We can calculate the YTM of Bond A as 5.4% and the YTM of Bond B as 4%. Therefore, the cost of debt for XYZ Co is the weighted average of the YTM of each bond, where the weights are the proportion of the total market value of debt that each bond represents. Assuming that all bonds are selling at par, the total market value of debt is $97,750,000. Thus, the weight of Bond A is 42,750/97,750 = 0.4376 and the weight of Bond B is 55,000/97,750 = 0.5624. Therefore, the cost of debt is:

Cost of Debt = 0.4376 × 5.4% + 0.5624 × 4% = 4.48%

b. Using the CAPM, we can calculate the cost of equity as:

Cost of Equity = Risk-Free Rate + Beta × (Market Return - Risk-Free Rate)

= 2% + 1.8 × (8% - 2%)

= 13.6%

c. Using the dividend growth model, we can calculate the cost of equity as:

Cost of Equity = (Dividend / Price) + Growth Rate

= ($4 / $95) + 5%

= 9.3%

d. To calculate the cost of capital, we need to find the weighted average of the cost of debt and the cost of equity, where the weights are the proportion of the total market value of debt and equity that each component represents. Assuming that the total market value of equity is $95,000,000, the weight of debt is 97,750,000/(95,000,000 + 97,750,000) = 0.5073 and the weight of equity is 1 - 0.5073 = 0.4927. Therefore, the cost of capital is:

Cost of Capital = 0.5073 × 4.48% + 0.4927 × 13.6% = 9.54%

e. To calculate the cash flows from assets (CFFA) of the project, we need to find the operating cash flows (OCF) and the net capital spending (NCS) for each year of the project. Using the given data, we can calculate the OCF for each year as:

Year 1: OCF = $10,000,000

Year 2: OCF = $12,000,000 (20% increase from year 1)

Year 3: OCF = $14,400,000 (20% increase from year 2)

Year 4: OCF = $17,280,000 (20% increase from year 3)

The net capital spending (NCS) for year 0 is the upfront cost of the project, which is $20,000,000. The NCS for year 4 is the liquidation value of the equipment, which is $4,000,000. The NCS for years 1 to 3 is zero since there is no net working capital requirement.

Calculating the CFFA for each year:

Year 0: CFFA = - $20,000,000

Year 1: CFFA = $10,000,000 - $0 - $20,000,000 = -$10,000,000

Year 2: CFFA = $12,000,000 - $0 = $12

for more such questions on bond

https://brainly.com/question/29324611

#SPJ11

The income statement, balance sheets, and additional information for Great Adventures, Inc., are provided below.

GREAT ADVENTURES, INC.

Income Statement

For the year ended December 31, 2022

Net revenues: $ 172,710 Expenses: Cost of goods sold $ 38,900 Operating expenses 56,280 Depreciation expense 17,850 Interest expense 7,782 Income tax expense 14,900 Total expenses 135,712 Net income $ 36,998 GREAT ADVENTURES, INC.

Balance Sheets

December 31, 2022 and 2021

Increase (I) or

2022 2021 Decrease (D)

Assets Current assets: Cash $ 211,112 $ 61,860 $ 149,252 (I)

Accounts receivable 48,320 0 48,320 (I)

Inventory 7,800 0 7,800 (I)

Other current assets 980 4,820 3,840 (D)

Long-term assets: Land 580,000 0 580,000 (I)

Buildings 824,000 0 824,000 (I)

Equipment 70,240 44,000 26,240 (I)

Accumulated depreciation (26,050 ) (8,200 ) 17,850 (I)

Total assets $ 1,716,402 $ 105,200 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable $ 24,320 $ 2,960 $ 21,360 (I)

Interest payable 790 790 Income tax payable 14,900 14,080 820 (I)

Other current liabilities 23,400 0 23,400 (I)

Notes payable (current and long-term) 603,704 30,800 572,904 (I)

Stockholders’ equity: Common stock 128,000 20,000 108,000 (I)

Paid-in capital 976,800 0 976,800 (I)

Retained earnings 58,488 33,850 24,638 (I)

Treasury stock (114,000 ) 0 (114,000 ) (I)

Total liabilities and stockholders’ equity $ 1,716,402 $ 105,200 Additional Information for 2022:

Land of $580,000 was obtained by issuing a note payable to the seller.

Buildings of $824,000 and equipment of $26,240 were purchased using cash.

Monthly payments during the year reduced notes payable by $7,096.

Issued common stock for $1,080,000.

Purchased 10,800 shares of treasury stock for $19 per share.

Sold 4,800 shares of treasury stock at $20 per share.

Declared and paid a cash dividend of $12,360

Required:

Prepare the statement of cash flows for the year ended December 31, 2022, using the indirect method. (List cash outflows and any decrease in cash as negative amounts.)

GREAT ADVENTURES, INC.

Statement of Cash Flows

For the Year Ended December 31, 2022

Cash Flows from Operating Activities Adjustments to reconcile net income to net cash flows from operating activities: Net cash flow from operating activities $0

Cash Flows from Investing Activities Net cash flow from investing activities 0

Cash Flows from Financing Activities Net cash flows from financing activities 0

0

Cash at the beginning of the period Cash at the end of the period $0

Note: Noncash Activities

Answers

GREAT ADVENTURES, INC.

Statement of Cash FlowsFor the Year Ended December 31, 2022

Operating Activities:Net income $36,998

Noncash operating expenses:

Depreciation expense 17,850

Cash flow from operations $54,848

Adjustments:

Increase/Decrease in working capital:

Accounts receivable (48,320)

Inventory (7,800)

Other current assets 3,840

Accounts payable 21,360

Income tax payable 820

Other current liabilities 23,400

Net cash flow from operating activities $48,148

Investing Activities:Building ($824,000)

Equipment (26,240)

Net cash flow from investing activities ($850,240)

Financing Activities:Note Payable ($7,096)

Common Stock 108,000

Paid-in Capital 976,800

Treasury Stock (114,000)

Cash Dividend (12,360)

Net cash flows from financing activities $951,344

Net cash flow $149,252

Cash at the beginning of the period $61,860

Cash at the end of the period $211,112

Net cash flow generated $149,252

Note: Noncash Financing and Investing Activities:

Note Payable $580,000

Land $580,000

What is a cash flow statement?A cash flow statement or a statement of cash flows summarizes the entity's cash inflows and outflows for the financial year.

The cash flow statement is classified into operating, financing, and investing activities, with a note for noncash activities.

GREAT ADVENTURES, INC.

Income StatementFor the year ended December 31, 2022

Net revenues $ 172,710

Expenses:

Cost of goods sold $ 38,900

Operating expenses 56,280

Depreciation expense 17,850

Interest expense 7,782

Income tax expense 14,900

Total expenses 135,712

Net income $ 36,998

GREAT ADVENTURES, INC.

Balance SheetsDecember 31, 2022, and 2021

2022 2021 Increase (I)

or Decrease (D)

Assets Current assets:

Cash $211,112 $61,860 $149,252 (I)

Accounts receivable 48,320 0 48,320 (I)

Inventory 7,800 0 7,800 (I)

Other current assets 980 4,820 3,840 (D)

Long-term assets:

Land 580,000 0 580,000 (I)

Buildings 824,000 0 824,000 (I)

Equipment 70,240 44,000 26,240 (I)

Accumulated depreciation (26,050) (8,200) 17,850 (I)

Total assets $ 1,716,402 $ 105,200

Liabilities and Stockholders’ Equity

Current liabilities:

Accounts payable $24,320 $2,960 $21,360 (I)

Interest payable 790 790

Income tax payable 14,900 14,080 820 (I)

Other current liabilities 23,400 0 23,400 (I)

Notes payable (current and long-term) 603,704 30,800 572,904 (I)

Stockholders’ equity:

Common stock 128,000 20,000 108,000 (I)

Paid-in capital 976,800 0 976,800 (I)

Retained earnings 58,488 33,850 24,638 (I)

Treasury stock (114,000) 0 (114,000) (I)

Total liabilities and stockholders’ equity $1,716,402 $ 105,200

Additional Information for 2022:

Note Payable paid = $7,096 ($30,800 + $580,000 - $603,704)

Building $824,000

Equipment $26,240

Common Stock $108,000

Paid-in Capital = $976,800 [$0 + $972,000 + (4,800 x $20 - $19)]

Treasury Stock = $114,000 [$0 + (10,800 - 4,800 x $19)]

Cash Dividend = $12,360

Learn more about cash flow statements using the indirect method at https://brainly.com/question/25717578

#SPJ1

What elements should an ideal CRR plan include?

Answers

The following components belong in a perfect CRR plan. communication lines that are clear, empathy and understanding, activity that is swift and efficient, Feedback and follow-up Continual development

A CRR report: what is it?The Cyber Resilience Assessment (CRR) is an evaluation of an organisation s resilience or cybersecurity measures based on interviews. Your organization will get knowledge of how to handle cyber risk during both regular operations and during periods of stress levels and catastrophe through the CRR.

What is CRR's emergency response?Your department can use what you already know to reduce hazards in your operational area with the aid of a community reducing risk (CRR) program. CRR employs a wide range of instruments to create a strategy and integrated program aimed at minimizing the occurrence and effects of local risks.

To know more about CRR visit:

https://brainly.com/question/30813799

#SPJ1

What enables a oligopoly to form within a market

Answers

It would be too costly to launch a competing business To establish Oligopoly in the market.

What is a market?

The entire number of buyers and sellers in the area or region under consideration is referred to as the market.

A market structure known as an oligopoly has a small number of enterprises, none of which can prevent the others from having a large impact.

The market share of the major companies is calculated using the concentration ratio.

Learn more about the oligopoly market:

https://brainly.com/question/15243178

#SPJ1

In its first month of operation, Ivanhoe Company purchased 320 units of inventory for $5, then 420 units for $6, and finally 360 units for $7. At the end of the month, 400 units remained. The company uses the periodic method. Compute the amount of phantom profit that would result if the company use FIFO rather than LIFO.

Answers

Answer:

If the company uses FIFO method, the cost of goods sold is lower increasing the gross profit. In this case, income will increase by $680.

Explanation:

Giving the following information:

purchases:

320 units of inventory for $5

420 units for $6

360 units for $7

At the end of the month, 400 units remained.

First, we need to determine the number of units sold:

Units sold= total units - ending inventory

Units sold= 1,100 - 400= 700

Now, we calculate the cost of goods sold using LIFO (last-in, first-out) and FIFO (first-in, first-out)

LIFO:

COGS= 360*7 + 340*6= $4,560

FIFO:

COGS= 320*5 + 380*6= $3,880

Finally, the difference:

Difference= 4,560 - 3,880= $680

If the company uses FIFO method, the cost of goods sold is lower increasing the gross profit. In this case, income will increase by $680.

Answer the following questions on the basis of the monopolist's situation is illustrated in the following graph.

a. At what output rate and price does the monopolist operate?

b. In the equilibrium, approximately what is the firm's total cost and total revenue?

c. What is the firm's economic profit or loss in equilibrium?

Answers

The following answers are based on a monopoly economy.

The output rate and the price at which the monopolist operates based on the graph is 100 quantities at $10.In the market equilibrium, the firm's total cost and total revenues are $750 and $1000 respectively. The firm's economic profit in the equilibrium is $250.What is a monopoly?A monopoly, as defined by Irving Fisher, is a market with "no competition," resulting in a scenario in which a certain individual or organization is the exclusive supplier of a given product.

To arrive at answer a, we need to recall that the equilibrium of a monopolist is when the Marginal Cost equals the Marginal Revenue and the Marginal Cost Curve (MC) cuts the Marginal Revenue Curve (MR ) from below.

At this point, the equilibrium output is 100, and the equilibrium price is $ 10 for every unit of production.

For the answer is b, given that the firm is producing 100 units of goods at an average total cost of $7.5 (derived from the point that aligns with MR = MC), therefore,

Total Cost = Equilibrium Output * ATC (Average Total Cost)

= 7.5 * 100

= $750

To arrive at answer c,

Recall that Economic profit is the difference between the money collected from the sale of a product and the expenses of all inputs utilized, as well as any opportunity costs, is the economic profit or loss.

Hence, Economic Profit = Total Revenue (TR) Less Total Cost (TC)

= $1000 - $ 750

= $250

Learn more about a monopoly:

https://brainly.com/question/13113415

#SPJ1

During May, 2021, Breakfront Corporation announced a 2-for-1 stock split. This brought the number of shares outstanding from 25,000,000 shares to _____ shares, and its $2.00 par value to _____ per share.

Answers

Answer:

50,000,000 shares. $1.00 per share.

Explanation:

A 2:1 split doubles the shares and halves the value.

Shares are fractional ownership interests in a corporation. For some businesses, shares are a type of financial instrument that allows for the equitable distribution of any declared residual profits in the form of dividends.

Answer : 50,000,000 shares. $1.00 per share.

A 2:1 split doubles the shares and halves the value.

How do you determine the price per share?Take a company's net income and deduct preferred dividends to get earnings per share. Subtract that sum from the typical number of outstanding ordinary shares.

For instance, if you decide to set the par value of your company's shares at $1, all stock buyers are required to pay a minimum of this sum for each share they buy. If you buy 10,000 shares, you must invest at least $10,000 to do so.

Gains Margins : Day traders experience a wide range of outcomes, which are mostly influenced by the amount of capital they are willing to risk and their money management prowess. A successful day could result in a gain of 5%, or $500, on a $10,000 trading account.

To Learn more About Shares, Refer:

https://brainly.com/question/25818989

#SPJ2

Management at Work

A hurricane has disrupted operations at one of your company’s facilities and shut down operations completely for several of your key suppliers. Inputs to your manufacturing process will be exhausted within days, and the company will be unable to fulfill its contracts with customers. In addition, many employees have suffered serious damage to their homes, and a few people are missing. You are a manager, and your employees are looking to you for leadership.

Which of the following do you do? Check all that apply.

- Set up a system for communicating facts as soon as they are determined so employees hear them first from management and not on the news.

- Use a highly emotional tone to communicate how seriously you take the situation and a sense of urgency.

- Walk around to be visible and accessible to as many employees as possible so they know you are engaged in crisis management.

- In oral and written communications, focus on the damage and loss of life that has occurred, since any note of optimism would be disrespectful.

Answers

Answer:

✔ Set up a system for communicating facts as soon as they are determined so employees hear them first from management and not on the news.

✘ Use a highly emotional tone to communicate how seriously you take the situation and a sense of urgency.

✔ Walk around to be visible and accessible to as many employees as possible so they know you are engaged in crisis management.

✘ In oral and written communications, focus on the damage and loss of life that has occurred, since any note of optimism would be disrespectful.

______________ is appropriate for the initial web presence of an organization.

Answers

Answer:

virtual hosting is appropriate

One way that marketing mix characteristics differ for organizational buying compared to consumer buying is that for organization buying

advertising is often technical in nature.

promotions of all kinds are avoided.

price is firmly quoted and attempts at negotiation are considered bad form.

distribution is of negligible importance.

product quality is assumed among sellers and is rarely a buying criteria.

Answers

One way that marketing mix characteristics differ for organizational buying compared to consumer buying is that for organization buying, advertising is often technical in nature is advertising is often technical in nature. Option (A) is correct.

What is a Marketing mix?The marketing mix classifies the set of actions, or tactics, which is used by a company to promote its brand or product in the market. The 7Ps of the marketing mix are product, pricing, place, promotion, physical evidence, people, and processes.

Consumers purchase many commodities to use to satisfy their needs. Organizational buyers buy limited goods to use to conduct business. Unlike the consumer buying process, organizational buying involves decision-making by a group of people and enforcing rules for making decisions.

Therefore, Option (A) is correct.

Learn more about Marketing mix, here;

https://brainly.com/question/14591993

#SPJ1

Amy borrowed $10,500 to purchase a new Toyota Yaris and agreed to pay back $14,320 in

220days. What ordinary interest rate was she paying? (Round your answer to the pearest tenth

of a percent.)

Answers

Answer: 60.36%

Explanation:

Interest = Amount - Principal

= 14320 - 10500

= 3820

Time = 220 days

Rate = Unknown

Interest = PRT/100

3820 = (10500 × R × 220/365)/100

3820 = (10500 × R × 0.6027397)/100

3820 = 6328.7671R/100

Cross multiply

3820 × 100 = 6328.7671R

R = 382000/6328.7671

R = 60.36%

The ordinary interest rate was 60.36%

1. Describe an example from your past where you have been effective in inspiring other

leaders around a common purpose and shared values.

2. How effective are you today at empowering other people to step up and lead? How do

you go about doing this? What are you doing to improve your effectiveness?

3. Recall a situation in which you faced a conflict between empowering other people and

reaching your performance goals.

a. How did you resolve the conflict?

b. Did you give preference to reaching your goals or to your relationship?

c. Would you act differently in the future when facing a conflict between

relationships and performance?

Answers

Answer:

One effective way to inspire other leaders around a common purpose and shared values is to lead by example. I demonstrate a commitment to the values and purpose that are important to the team. Furthermore, I consistently take actions that align with those values and purpose. These steps can inspire others to do the same. Additionally, I create opportunities for open and honest communication, collaboration, and shared decision-making. These measures can help build trust and empower other leaders to promote the team's success.Empowering others to step up and lead can involve creating opportunities for skill-building and growth, providing guidance and support, and giving people the autonomy to make decisions and own their work. To improve effectiveness, I seek feedback from others. I also informed about best practices and emerging trends in leadership. Lastly, I continuously work on developing communication, coaching, and mentoring skills.Get instant answers, essays, and research papers through proffrank01 at g m ail.con. This helps you score maximum points without straining too much.

3. When facing a conflict between empowering other people and reaching performance goals, I considered the long-term impact of each decision. I prioritized relationships and empowered others to better outcomes in the long run. This required a short-term sacrifice to reach immediate performance goals. I communicated openly and honestly with the team about the situation and worked collaboratively to find a solution that aligns with both performance goals and relationship-building. In the future, I could reflect on the situation and consider how to approach similar conflicts in a more proactive manner.

Explanation:

Help! Select the qualification that is best demonstrated in each example.

Melanie is a fitness instructor who encourages her students to achieve their goals. ____

1. Ability to handle money

2. Accuracy and attention to detail

3. Leadership skills

4. Organizational skills

Jacob counts and organizes cash at a casino. _____

1. Maintenance of safety

2. Communication skills

3. Teamwork skills

4. Ability to handle money

Adra is proud that she has never had an accident while running a ride at an amusement park. ______

1. Organizational skills

2. Leadership skills

3. Ability to operate equipment safety

4. Communication skills

Juan plans fun activities for groups of people. _____

1. Communication skills

2. Accuracy

3. Teamwork skills

4. Organizational

Answers

2. Ability to handle money

3. Ability to operate equipment safety

4. Organizational

Answer:

What ghazaryanelen101 Said ↑↑↑↑

Explanation:

eorge and Weezy received $30,200 of Social Security benefits this year ($12,000 for George; $18,200 for Weezy). They also received $5,000 of interest from jointly owned City of Ranburne Bonds and dividend income. What amount of the Social Security benefits must George and Weezy include in their gross income under the following independent situations

Answers

Answer:

$0

Explanation:

George and Weezy will not get any amount as social security benefit if they file married joint. The sum of their modified AGI plus the 50% of their social security benefit is [$5,000 + $8,000 + $15,100]. This equals to $28,100 which is below the minimum amount of social security.

3. Every time you owe a person or business money, you have options for how to pay them. List 3 factors you should consider when choosing a payment type.

Answers

A steam generation system at a biomassfueled power plant uses an electrostatic precipitator (ESP) to clean its gaseous effluents. The power plant has consistently made use of the same type of ESP over the past several years. The installed cost of a new ESP has been relatively constant at $80,000. Records of operation and maintenance expenses indicate the following average expenses per year as a function of the age of the ESP. The MVs of the ESP are also reasonably well known as a function of age. Determine the best time to replace the ESP if the MARR

is 15% per year

Answers

A steam generation system at a biomass-fueled power plant uses an electrostatic precipitator (ESP) to clean its gaseous effluents. the best time to replace the ESP is mathematically given as

EUAC3= 46377.48

What is the best time to replace the ESP if the MARR is 15% per year?Generally, the equation for the EUAC for the yrs of operation is mathematically given as

For Year 1

EUAC1 = 85000 * (A/P,9%,1) + 25000 - 63000 * (A/F,9%,1)

EUAC1 = 54650

Solving till year 5

EUAC2= 46525.60

EUAC3= 46377.48

EUAC4= 48730.91

EUAC5= 50730.79

In conclusion, the best time to replace the ESP if the MARR is 15% per year will be at the EUAC3= 46377.48 since EUAC is the lowest at that year.

Read more about EUAC

https://brainly.com/question/20038349

#SPJ1

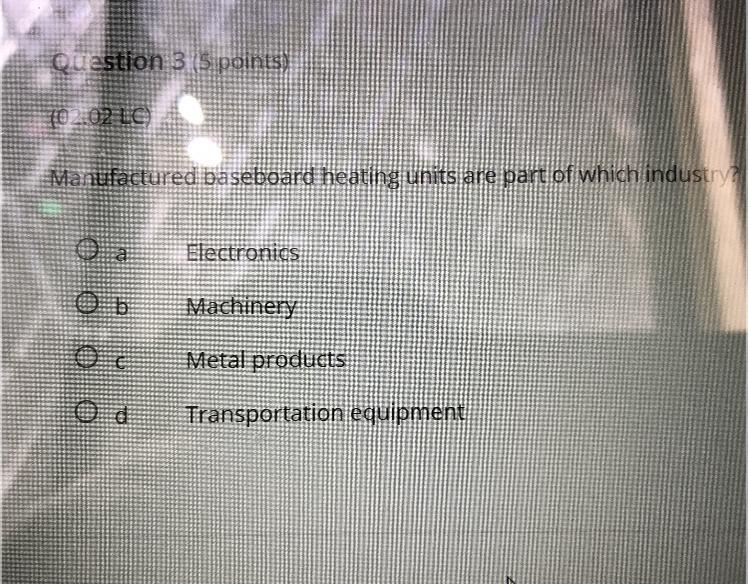

Please answer need help asap

Answers

Answer:

Machinery

Explanation:

Match the definition to the term.

1. commute

2. lifestyle

3. lifestyle budget

lists the costs of items you chooseto spend your money on

the way a person chooses to live

commute the distance you travel to

and from work

Answers

The correct matching of the term and its definitions are:

commute - the distance you travel to and from work

lifestyle - the way a person chooses to live

lifestyle budget - lists the costs of items you choose to spend your money on.

What is Lifestyle Budget?A lifestyle budget is a budgeting approach that concentrates on allocating money toward the choices, needs, and prioritizations of an individual or household.

This type of budget incorporates expenditures such as amusement, dining at restaurants, pastimes, holidays, clothing, as well as other optional acquisitions into the total monetary scheme. By creating a lifestyle budget, individuals can feasibly manage their money and attain their financial aspirations while still cherishing their preferred lifestyle.

Read more about lifestyle budget here:

https://brainly.com/question/26361038

#SPJ1

Based on the available terms and the definition in the option, the right matching includes lifestyle budget = lists the costs of items you choose to spend your money on.

What is the Definition?The definition is a term that is used to describe the statement of meaning of a term or word, or phrase.

Generally, the term Definitions can be classified into two large categories: intensional definitions which aim to give the sense of a term, and extensional definitions which list the objects that a term defines.

Hence, in this case, we have the following words and their meanings:lifestyle budget = lists the costs of items you choose to spend your money on.lifestyle = the way a person chooses to livecommute = commute the distance you travel toand from workTherefore, in this case, it is concluded that each word or phrase has a specific meaning.

Learn more about definition here: https://brainly.com/question/9823471

#SPJ1

Finance professionals make decisions that fall into three distinctive areas: corporate finance, capital markets, and investments. Below is a set of decisions made by finance professionals. Categorize the decisions according to the area of finance that they belong to.- Wilson, a trader at the New York Stock Exchange, executes the decisions made by investors and takes action based on requests by different buyers and sellers in the market.- As a technical trader, you will be analyzing investor psychology and making investment decisions based on how investors behave during certain situations.- Jacob, the chief executive officer (CEO) of ABC Corp., must make decisions that help achieve the primary goal of the corporation: maximize shareholders' wealth.

Answers

Here is a categorization of the decisions according to an area in finance :

Wilson, a trader at the New York Stock Exchange, executes the decisions made by investors and takes action based on requests by different buyers and sellers in the market. - capital market

As a technical trader, you will be analyzing investor psychology and making investment decisions based on how investors behave during certain situations - investments

Jacob, the chief executive officer (CEO) of ABC Corp., must make decisions that help achieve the primary goal of the corporation: maximize shareholders' wealth. - corporate finance

Corporate finance is a branch of finance that is concerned with how companies manage their sources of funds, capital structure and make investment decisions.

Jacob is going to make decisions on how to maximise the resources (funds) entrusted to him by shareholders.

Capital market is a market where buyers and sellers come together to buy and sell financial securities.

There are two types of capital markets :

1. Primary market - new issues of stocks and securities are traded in this market.

2. Secondary market -previously issued securities are traded in this market.

Wilson would execute the trades on the capital market.

Investment is an asset purchased that has the potential to increase wealth or income of the purchaser.

For example, the purchase of of securities has the potential to increase the wealth of the holder.

In order to make successful investment decisions, it is important to analyse and understand investor psychology. This would help identify certain bias that an investor might have that would prevent from making optimal investment decisions.

To learn more about capital markets, please check : https://brainly.com/question/14934453?referrer=searchResults

Define the term ethical objectives

Answers

Answer:

Explanation:

the moral principles and values

the right or wrong of business objectives

When writing a sales message in which price is an issue, what can you do to reduce resistance? Check all that apply.

Answers

Answer:

1. Explain your pricing structure

2. Focus on the value of your product or service

3. Compare your prices to the competition

4. Offer a discount or free trial

5. Give away free gifts or prizes.

These all sound like great ways to reduce resistance. However, it is always important to be honest and transparent in all marketing and sales messages. If you cannot offer a free trial or discount, then don't.

Explanation:

Market failure implies that the market mechanism:_________.

Answers

Answer:

Leads the economy to the wrong mix of output

Explanation:

Market failure is the when there is an inefficient distribution of goods and services in the free market.

One of the types of market failure is externality

Externality is when the production or consumption activities of economic agents have effects on people not involved in the economic activity. Externality can either be positive or negative

A good has positive externality if the benefits to third parties not involved in production is greater than the cost. an example of an activity that generates positive externality is research and development. Due to the high cost of R & D, they are usually under-produced. Government can encourage the production of activities that generate positive externality by granting subsidies.

A good has negative externality if the costs to third parties not involved in production is greater than the benefits. an example of an activity that generates negative externality is pollution. Pollution can be generated at little or no cost, so they are usually overproduced. Government can discourage the production of activities that generate negative externality by taxation

in large organization why is decentralization conidered almost essential?

Answers

Answer: Decentralisation can be defined as even and systematic distribution of authority at every level of management. Under decentralisation every employee working at different levels gets some share in the authority. Decentralization is a policy matter and managers plan in advance whether to go for centralised or decentralized policy. Sometimes company follows a mixed policy of centralisation and decentralisation. They keep the important matters such as financial decisions, structural decisions with the top level management only and share the common decisions with the people working at different levels as generally an organisation can never be completely centralised or decentralised.

Explanation:

A company has beginning inventory of $20,000, purchases of $15,000, and ending inventory of $2,500. The cost of goods available for sale is ___.

Answers

The cost of goods sold formula is Starting inventory plus purchases minus ending inventory which is equal to the cost of goods sold. In this case, the cost of goods sold is equal to $32,500.

What is Cold of good sold?The cost of goods sold (COGS) is actually the price of manufacturing the products an agency then sells. In the case of physical goods, it usually consists of the cost of current stock plus any associated substances and direct labor prices incurred over the year.

The cost of goods sold formula is:

Starting inventory + purchases − ending inventory = cost of goods sold.

As per the given information,

beginning inventory - $20,000

purchases - $15,000

ending inventory - $2,500

\(\rm\,Cost \,of\, goods \,sold = \$20,000 + \$15,000 - \$2,500\\\\\rm\,Cost \,of\, goods \,sold = \$32,500\)

hence, the cost of goods sold is equal to $32,500.

Learn more about cost of goods sold here:

https://brainly.com/question/26635856

#SPJ1

"Group decision making is better". Do you agree or disagree with the statement? Give 3 reasons why do you say so?

Answers

Answer:

I agree because it make the group bring out more ideals

sometimes group decision make some people to voice out their problems

group decision help organization and firms to operate in good aims

How do businesses and the society benefit from marketing?

Answers

Answer:

Marketing stimulates a competitive economy, promotes products and services, and targets consumers who are most likely to become purchasers. Higher sales for a company that employs effective marketing strategies translate into expansion, job creation, higher government tax revenue, and eventually, overall growth.

HAVE A GOOD DAY!

The US Senate overwhelmingly passed the 2022 Defense Authorization Act. The $768 billion "Defense Authorization Act" not only exceeds the defense spending proposed by the Biden administration by $25 billion, but also increases the US defense budget by about 5% compared to last year.

Answers

The US Senate passed the 2022 Defense Authorization Act, a $768 billion bill that surpasses the Biden administration's defense spending proposal by $25 billion and represents a 5% increase in the US defense budget compared to the previous year.

1. The US Senate passed the 2022 Defense Authorization Act.

2. The Defense Authorization Act is a bill that determines the budget and expenditures for the US defense sector.

3. The total amount allocated for the Defense Authorization Act is $768 billion.

4. The defense spending proposed by the Biden administration was exceeded by $25 billion in this Act.

5. The Act represents a 5% increase in the US defense budget when compared to the previous year.

6. This increase in the defense budget indicates a commitment to strengthening the country's defense capabilities.

7. The Act was passed overwhelmingly, indicating strong support from the Senate.

8. The Defense Authorization Act is an essential piece of legislation that ensures the funding and resources necessary for the US military to carry out its operations effectively.

9. The Act covers various aspects of defense spending, including military personnel, equipment, research and development, and strategic initiatives.

10. By passing the Defense Authorization Act, the US Senate has demonstrated its commitment to national security and defense preparedness.

For more such questions on Defense Authorization Act, click on:

https://brainly.com/question/29225501

#SPJ8

Environment degradation does not consist of

Answers

Answer: None of the above

Explanation:

The options include:

A. Land degradation and soil erosion

(B) Problem of overgrazing and ecological degradation

(C) Floods

(D) None of the above

Environmental degradation simply refers to the deterioration of the environment whcih occurs when there's depletion of the resources like soil, water and air, pollution and the the destruction of habitats and ecosystems.

It should be noted that environmental degradation consist of land degradation and soil erosion, problem of overgrazing and ecological degradation, floods etc.

Therefore, the correct option is None of the above.