Siambanopolis Company

Presented below are selected transactions from Siambanopolis Company for 2015. Amortization is calculated on a straight-line basis. You will have to calculate accumulated amortization. Journalize each transaction.

a) On January 1, the company retired a piece of machinery that was purchased on January 1, 2009 for $6 000. It had a useful life of six years and no residual value.

b) On June 30, the company sold a computer purchased on January 1, 2010. It was sold for $600. The computer cost $4 000 and had a useful life of six years with a residual value of $250.

c) On January 1, the company discarded a delivery truck that was purchased on January 1, 2010. The truck cost $30 000. It was amortized based on a six-year useful life with a $3 000 residual value.

Zaara's Mining Co.

Zaara's Mining Co purchased a mine for $8 million on July 1, 2014. The mine will generate an estimated 30 million tonnes of nickel. The mine has a residual value of $500 000, and the restoration cost at the end of the mine's useful life is estimated at $600 000. In the first year, 5 million tonnes of nickel were extracted.

Prepare the journal entry to record the amortization expense for the first year, ended June 30, 2015.

Beaufort Corporation The following are the transactions concerning the intangible assets of Beaufort Corporation for 2015:

Jan 1 - Paid $200 000 for the artistic development of a trademark. Also paid $50 000 to register the trademark and for the associated legal fees. The useful life of the trademark is indefinite.

Feb 15 - Purchased a patent with an eight year useful life for $480 000.

March 15 - Goodwill was purchased along with the assets of another company for $50 000. It has an indefinite useful life.

April 1 - Research and development costs were incurred amounting to $550 000. There is no marketable product identified to these costs.

Dec 31 - Any amortization on the previous intangible assets is calculated and recorded.

a) Record the journal entries for the above transactions.

b) Record the entries needed for amortization of these assets as at December 31, 2015.

PART B – Short Answer Answer all questions in full sentences. 1. What factors must a company consider when choosing an amortization method to use for a fixed asset? Be sure to refer to IFRS and the effect of the decision on the financial statements. 2. What is the Capital Cost Allowance and how does it affect the amortization of assets?

Answers

CCA's tax deduction regulations and rates affect asset amortization. Deferred tax accounting addresses tax-accounting amortization discrepancies.

A company must consider several factors when choosing a fixed asset amortization method. These include the asset's type, useful life, the company's accounting procedures, and relevant accounting standards like IFRS. Under IFRS, the amortization method should represent the company's projected usage of the asset's economic advantages. Straight-line and declining balancing approaches are the most prevalent. The straight-line technique equally distributes asset costs over its lifespan. For assets that create benefits at a steady rate, this expense recognition method may be suitable. The declining balance method, on the other hand, recognizes higher expenses in the early years of an asset's life and lower expenses in later years. This method may be suitable for assets that generate more significant benefits in the early years, such as technology-related assets.

To know more about CCA's tax

https://brainly.com/question/32199995

#SPJ11

Related Questions

Why might it be difficult to rely on profits to get an overall impression of the firm's cash flows?

Answers

Profits alone may not provide an accurate representation of a firm's cash flows due to various factors such as non-cash expenses, timing differences, and changes in working capital.

Profits, also known as net income, are calculated based on the matching principle, which matches revenues and expenses in a specific accounting period. However, profits can be influenced by non-cash expenses, such as depreciation and amortization, which do not involve actual cash outflows. These non-cash expenses can inflate profits without a corresponding increase in cash flows.

Moreover, timing differences between recognizing revenues and expenses can affect cash flows differently. For example, if a firm recognizes revenue in one period but does not receive cash until a later period, its profits may be higher than the actual cash inflow for that period. Similarly, expenses paid in advance may reduce profits in the current period but do not impact cash flows.

Additionally, changes in working capital, including accounts receivable, accounts payable, and inventory, can affect cash flows independently of profits. An increase in accounts receivable, for instance, indicates sales made on credit but not yet collected, which reduces cash inflow despite generating profits.

Therefore, relying solely on profits may not provide an accurate assessment of a firm's cash flows, and it is essential to analyze cash flow statements to get a comprehensive understanding of the financial health and liquidity of the business.

Learn more about Profits here:

https://brainly.com/question/32381738

#SPJ11

What activities are involved in offering the products customers want?.

Answers

Answer:

Just dispaly

Explanation:

Showing the use of the product,where the product can be obtained,when the product is used,Other complementary products and so many

Check all of the following that are correct that can have a single owner ? MARK YOU THE BRAINLIEST!

Answers

The establishment/items that can ave a single owner includes:

Sole proprietorshipPrivate corporationNon-profit corporationWhat is a single owner?This refers to any form of establishment that can be owned and operated by a natural person.

Therefore, in the list, the Sole proprietorship, Private corporation and Non-profit corporation are establishment that can have a single owner.

Read more about single owner

brainly.com/question/523607

#SPJ1

The blank is the the minimum amount of your bill you must pay each month.

Answers

minimum payment

the least amount of money that must be paid at the end of a month

When fire alarm sounds. Why should you evacuate children immediately even if you do not see flames?

Answers

Answer: because even if there is no fire there could be an explosion, fire and gasoline WILL make an explosion. So Basically it can start with fire but soon turn into an explosion. If it's a fire DRILL then it's for practice if that actually does happen.

An annual report promotes an open

line of ____

for all those

invested in a company.

A. capital

B. liability

C. communication

Answers

Answer:

I woulod say c

Explanation:

it makes the most sense

The buying of goods and services for a business

Answers

The buying of goods and services for a business is commonly referred to as procurement.

What is procurement?

It involves identifying the needs of the business, sourcing and selecting suppliers, negotiating contracts and agreements, and ultimately purchasing the goods or services needed. And keeping records of all the steps in the process. These activities require a strong understanding of market trends, organizational objectives, and supplier capabilities to ensure success.

Effective procurement is important for businesses as it can help to reduce costs, improve efficiency, and ensure the availability of essential resources.

Procurement can also involve managing supplier relationships, ensuring quality control, and assessing supplier performance.

One of the advantages of procurement is that it enables companies to smoothly carry out their business operation as the items they need for their business operation have been made procured or made available.

Read more about Procurement at https://brainly.com/question/26101126

#SPJ11

what revenue per inpatient day is required to obtain a profit of $1,000,000 at a volume of 10,000 patient days?

Answers

To calculate the revenue per inpatient day required to obtain a profit of $1,000,000 at a volume of 10,000 patient days, we need to first determine the profit per patient day.

Profit per patient day = Total profit / Total patient days

Profit per patient day = $1,000,000 / 10,000 patient days

Profit per patient day = $100

Next, we can calculate the revenue per inpatient day using the formula:

Revenue per inpatient day = (Total revenue / Total patient days)

We know that profit is the revenue minus the expenses, so we can rearrange this formula to solve for the revenue:

Revenue = Profit + Expenses

We're given the profit we want to achieve ($1,000,000) and the number of patient days (10,000), so we can solve for the revenue:

$1,000,000 = Revenue - Expenses

$1,000,000 + Expenses = Revenue

Revenue = $1,000,000 + Expenses

Now we can substitute this expression for revenue into our original formula:

Revenue per inpatient day = (Total revenue / Total patient days)

Revenue per inpatient day = (($1,000,000 + Expenses) / 10,000 patient days)

We know the profit per patient day is $100, so we can also substitute this expression for expenses:

$100 = Revenue per patient day - Expenses per patient day

$100 = Revenue per patient day - (Expenses / Total patient days)

$100 = Revenue per patient day - (Expenses / 10,000)

Expenses = $100 * 10,000 - Revenue per patient day * 10,000

Now we can substitute this expression for expenses into our revenue formula:

Revenue = $1,000,000 + Expenses

Revenue = $1,000,000 + ($100 * 10,000 - Revenue per patient day * 10,000)

Revenue = $2,000,000 - Revenue per patient day * 10,000

Finally, we can solve for the revenue per inpatient day:

Revenue per inpatient day = (($2,000,000 - Revenue per patient day * 10,000) / 10,000 patient days)

Simplifying this equation, we get:

Revenue per inpatient day = $200 - 0.1 * Revenue per patient day

To solve for the revenue per inpatient day, we can use algebraic methods to isolate the variable on one side of the equation:

Revenue per inpatient day + 0.1 * Revenue per inpatient day = $200

1.1 * Revenue per inpatient day = $200

Revenue per inpatient day = $200 / 1.1

Therefore, the revenue per inpatient day required to obtain a profit of $1,000,000 at a volume of 10,000 patient days is approximately $181.82.

Learn more about inpatient click here:

https://brainly.in/question/3277955

#SPJ11

Bond A is a par bond and Bond B is a premium bond. All else equal, which bond has the higher coupon rate?

A

B

A=B

Bond A is a par bond and Bond B is a discount bond. All else equal, which bond has the lower coupon rate?

A

B

A=B

Bond A is a corporate bond and Bond B is a municipal bond. Which bond should have the higher yield to maturity?

A

B

A=B

Answers

a)Bond B should have the higher coupon rate.

b) Bond A should have the lower coupon rate.

c) Bond B should have the higher yield to maturity.

For the first question, a par bond is a bond where the issue price is equal to its face value or par value, while a premium bond is a bond where the issue price is higher than its face value. Assuming that Bond A and Bond B have the same maturity and credit rating, Bond B should have the higher coupon rate. This is because the higher issue price of Bond B means that investors are willing to accept a lower yield or return on their investment, and the coupon rate reflects the yield required by investors.

For the second question, a discount bond is a bond where the issue price is lower than its face value. Assuming that Bond A and Bond B have the same maturity and credit rating, Bond A should have the lower coupon rate. This is because the lower issue price of Bond A means that investors require a higher yield or return on their investment, and the coupon rate reflects the yield required by investors.

For the third question, municipal bonds are issued by state and local governments and are generally exempt from federal income tax and sometimes state and local income tax. Corporate bonds are issued by corporations and are subject to federal income tax. Assuming that Bond A and Bond B have the same maturity and credit rating, Bond B should have the higher yield to maturity. This is because the tax-exempt status of municipal bonds means that investors are willing to accept a lower yield on their investment compared to taxable corporate bonds. Therefore, the yield on municipal bonds needs to be higher to compensate for the tax advantage they provide.

For more such questions on coupon rate

https://brainly.com/question/28528712

#SPJ11

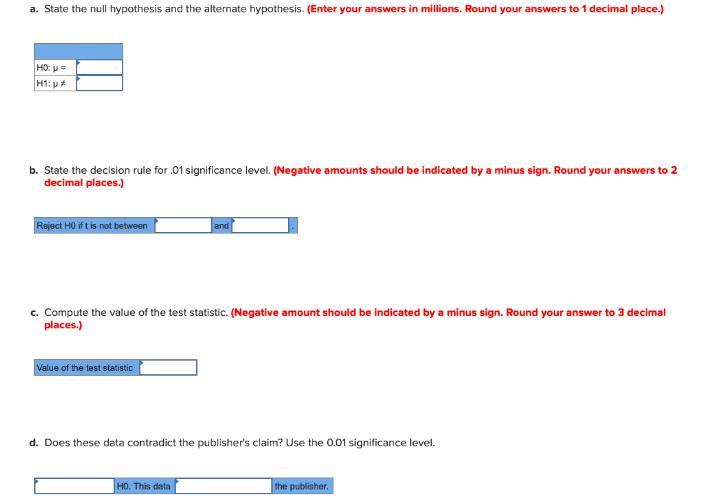

The publisher of Celebrity Living claims that the mean sales for personality magazines that feature people such as Megan Fox or Jennifer Lawrence are 1.5 million copies per week. A sample of 10 comparable titles shows a mean weekly sales last week of 1.3 million copies with a standard deviation of 0.9 million copies.

Answers

Answer and Explanation:

The computation is shown below:

For determining each part first we have to do the following calculations

Critical value of t = 3.250

Null hypothesis = 1.5

Alternative hypothesis ≠ 1.5

Population mean \(\mu\) = 1.5

Sample mean \(\bar X\)= 1.30

Sample size \(n\) = 10.00

Sample standard deviation \(s\) = 0.900

Standard error of mean is

\(s_x = \frac{s}{\sqrt{n} }\)

\(= \frac{0.900}{\sqrt{10.00}}\)

= 0.2846

Test static is

\(t = \frac{x - \mu}{s_x}\)

\(= \frac{1.30 - 1.5}{0.2846}\)

= -0.703

a. The null hypothesis is

μ = 1.5

Alternate Hypothesis is

μ ≠ 1.5

b. reject \(H_o\) if t is not between

-3.250 and 3.250

c. The value of the test statistic is

t = -0.703

(as we have computed above)

d. fail to reject \(H_o\) as this data does not contradict the publisher claim

What is the primary purpose of incident investigation?

A. To determine the direct and root causes of the incident

B. To disturb physical evidence

C. To find fault

D.To satisfy the insurance company

Answers

please use a couple of paragraphs to explain:

Summarize and discuss either:

Keynes The General

Theory - Chapter 12

Hayek The use of knowledge in

society

Answers

Keynes' The General Theory is a masterpiece that attempted to resolve the various contradictions present in the classical economic system. Keynes' work on economics is divided into three main components: The classical model, the general theory, and the post-general theory Keynes.

refuted the fundamental beliefs of classical economics in Chapter 12 of The General Theory. Keynes' arguments in the chapter are focused on the criticisms of classical economists' assumption that "supply creates its own demand." He argues that if supply rises without a commensurate increase in demand, it will result in an oversupply of goods. Because of the surplus, producers will begin to decrease their production, resulting in a decrease in employment and output. Keynes proposed that the solution to the problem was to have a collective group of producers and consumers to balance demand and supply through a decentralized mechanism.

Hayek's The Use of Knowledge in Society was a response to the increasingly popular socialist and interventionist theories that were gaining traction in the early twentieth century. Hayek's primary argument was that socialist theories were predicated on the assumption that individuals had all the knowledge they required to make decisions, which was a flaw in socialist economic planning. Hayek proposes that economic decisions are based on dispersed knowledge that is impossible to centralize in a single person or group. Hayek proposes that the free-market system, with its emphasis on decentralized knowledge and decision-making, was the only system that could provide for economic prosperity and growth.

Learn more about theory Keynes here:

https://brainly.com/question/29553623

#SPJ11

1. Poverty is more than an economic problem, its a source of social discontent and political________; However, economic _________ has reduced the proportion of people living below the _______ line.

Answers

Poverty is more than an economic problem, it is a source of social discontent and political unrest; economic development has reduced the proportion of people living below the poverty line.

What is poverty?Poverty is shown as a deficiency of money and profitable resources to support long-term survival.

Hunger and starvation, restricted access to education and other basic services, social prejudice and exclusion, and a disinterest in decision-making are all examples of its expressions.

Poverty is a cause of social dissatisfaction and political upheaval; economic development has lowered the amount of people living in poverty.

Therefore, the poverty is a very big problem than the economic problem.

Learn more about the poverty, refer to:

https://brainly.com/question/10645433

#SPJ1

Economist: Some policymakers believe that our country's continued economic growth requires a higher level of personal savings than we currently have. A recent legislative proposal would allow individuals to set up savings accounts in which interest earned would be exempt from taxes until money is withdrawn from the account. Backers of this proposal claim that its implementation would increase the amount of money available for banks to loan at a relatively small cost to the government in lost tax revenues. Yet, when similar tax incentive programs were tried in the past, virtually all of the money invested through them was diverted from other personal savings, and the overall level of personal savings was unchanged. The author criticizes the proposed tax incentive program by

Answers

The options are:

A). Challenging a premise on which the proposal is based.

B). Pointing out a disagreement among policymakers.

C). Demonstrating that the proposal's implementation is not feasible.

D). Questioning the judgment of the proposal's backers by citing past cases in which they had advocated programs that have proved ineffective.

E). Disputing the assumption that a program to encourage personal savings is needed.

Answer:

A). Challenging a premise on which the proposal is based.

Explanation:

The author critiques the suggested program of tax incentives by 'questioning the very premise on which the suggestion is based.' In the given proposal, the claim is based on the premise that if people are exempted from paying taxes on their savings accounts, they will be encouraged for saving more money. However, the author rebuts this premise by displaying the failure of such programs previously where people just attempted to redirect their money in order to get them into the tax-exempted accounts instead of saving more. Thus, the percentage of money saved by people remained unaltered. Hence, option A is the correct answer.

Your broker charges a commission of 5.1% of the cost of the stock you so if you sell a batch of stock worth 2,617,75 how much commission will you owe the broker

Answers

Answer:

a

Explanation:

$133.51 commission will you owe the broker, if you sell a batch of stock worth 2,617,75.

Thus, the correct option is A.

Who is a broker?

A broker is a free-standing individual or business that conducts financial transactions on behalf of others. Stocks, foreign exchange, real estate, and insurance are just a few of the asset groups that are impacted by these transactions.

The trading broker only acts on behalf of others, whereas the trader only deals with his or her own assets ("on his or her own account"). The broker acts on your behalf by using your assets, not his.

A broker deals in currencies, commodities, and financial instruments. The broker always acts on behalf of others, which is how they differ from traders. Worldwide, there is a huge variety of brokers, each with a different style, level of quality, and regulatory setup.

The spread, fee, or financing costs associated with a trading position generate revenue. The other CFD broker, in contrast, solely benefits financially from the trader's loss. Any gain achieved by the trader is a loss for the broker, which is why positions are manipulated or withdrawals are not executed.

Learn more about broker, here

https://brainly.com/question/14094023

#SPJ6

Can someone please help me!

Answers

Answer:

The awnser is the Nature of Business

Answer:

nature of business that's

Unreimbursed employment related expenses are classified as deductions for agi.

a. true

b. false

Answers

False, Unreimbursed employment expenses are miscellaneous itemized deductions subject to the 2% of AGI floor, which is no longer deducted.

Unreimbursed employee expenses are those charges for which the company has not paid you back or given you an allowance. The IRS classifies employee expenses as regular and important charges.

Adjusted Gross Income, or AGI, starts together with your gross earnings and is then reduced by sure “above the line” deductions. Some common examples of deductions that lessen adjusted gross profits include 401(k) contributions, health savings account contributions, and educator prices.

Adjusted Gross income (AGI) is defined as gross income minus adjustments income. Gross income consists of your wages, dividends, capital gains, commercial enterprise earnings, and retirement distributions in addition to other profits.

Learn more about Adjusted Gross Income here brainly.com/question/1931633

#SPJ4

What are 20 things to do at home when I have nothing to do and have done all my online school?

Answers

1. Eat a carrot

2. Vomit because carrots are disgusting

3. Play video games DUHH

4. Don’t waste your time on brainly

if ford decides to manufacture and sell electric vehicles into the market, what type of development would it be?

Answers

If Ford decides to manufacture and sell electric vehicles into the market, what type of development would it be New product lines.

What do you mean by new product lines?A new product line is when a business introduces a new category of goods that they haven't before offered. As an illustration, Ninja Tech recently produced Ninja Tech Nutritional Bars to enhance memory. This move into the food sector would be seen as a new product line because all of their prior items were all connected to technology.

What is the name of the lines on a product?A product line is a grouping of similar goods that a business sells and markets under a single brand. Businesses may run many product lines under a single brand, but they may also have multiple brands.

To know more about new product lines visit:

https://brainly.com/question/29108880

#SPJ4

According to SFAC 5, the four criteria that must be met for an item to be recognized in the basic financial statements are Multiple select question. the item can be matched with associated revenues. the information about the item is reliable. The item meets the definition of an element. the information about the item is relevant to decision making. the item can be valued at fair value. the item has relevant attributes that are measurable.

Answers

Answer:1)the information about the item is relevant to decision making

2)the item has relevant attributes that are measurable

3)the item meets the definition of an element

4)the information about the item is reliable

Explanation:

The four criteria for met out an item that should be recorded in the financial statements is as follows:

The information for the item that is considered for the decision-making.The item that met out the element definition.The item contains significant characteristics that are measurable in terms.The information related to the item should be accurate & reliable.The information related to the financial statement is as follows:

It is written records that show the financial profitability, financial position, and financial performance of the company. It includes the profit & loss account, balance sheet, cash flow statement.It represents reliable and accurate results.Therefore we can conclude that the above statements are considered.

Learn more about the decision-making here: brainly.com/question/20075422

Strategies for managing conflict

Answers

Can I get a brainest point plsssssss

1. Don't Ignore Conflict

If you're someone who dislikes dealing with conflict, it might seem tempting to just put your head in the sand and pretend it doesn't exist, hoping it will resolve itself on its own. While this sometimes can happen, the truth is that the vast majority of the time, this will only cause the situation to get worse. Ignored conflicts have a tendency to fester over time and reappear at inopportune moments, so do your team a favor and address conflicts when they occur, nipping a potentially toxic situation in the bud as soon as you recognize it.

2. Clarify What the Issue Is

If you're dealing with a conflict between two members of your team, it's important that you get all the facts. Sit down with each individual involved and find out exactly what the issue is. How is each individual perceiving the situation? What needs are not being met? What does each party see as an appropriate resolution? Make sure that all parties involved understand that you are acting as an impartial mediator, and let them know they can feel comfortable to share sensitive information.

3. Bring Involved Parties Together to Talk

Once you've had a chance to talk to all involved parties separately, bring them together in a meeting so that they can hash out their differences in a neutral environment. This is a time for brainstorming, active listening, and being open to different perspectives - the goal is to come to a common understanding of what the problem is, what role each individual is playing in the conflict, and what some possible solutions might be.

4. Identify a Solution

After both parties have had a chance to discuss the situation at hand, it's time to identify what a satisfactory resolution might be - and how to get there. Ideally, by this point, both parties will understand the other's side, and oftentimes the conflict will be resolved just through facilitated, open dialogue. However, if the situation requires further resolution, you will need to step in and help them negotiate a reasonable solution. This phase can require some time and effort, as it requires both parties to set aside their differences and preferences and find some common ground to work towards (which may involve not getting everything they want out of the situation). Then, work with both individuals to come up with a concrete list of steps that will result in the solution being achieved.

5. Continue to Monitor and Follow Up on the Conflict

Just because a solution has been identified and addressed doesn't mean it will just go away. As a manager, it's your responsibility to check in with both parties to ensure that the conflict has truly been dealt with, and that the steps identified to reach a solution are being followed. If all seems to be going well, simply remember to stop and observe from time to time, just to see if things really are going smoothly or if there are still lingering tensions under the surface that need to be handled. If it's clear that the solution didn't work, or wasn't the right resolution for the situation, make sure to be proactive in working with both parties to readjust expectations, identify alternative solutions, and continue their dialogue to create a positive and healthy work environment.

what is a business?

Answers

A business is defined as an organization or enterprising entity engaged in commercial, industrial, or professional activities. The term "business" also refers to the organized efforts and activities of individuals to produce and sell goods and services for profit.

how do u respond to lol

Answers

Answer:

depends on what you are lol ing about

Explanation:

You own an office supply store. You purchase desk

lamps at a wholesale cost of $14 each. You use a

markup of 45 percent to determine the selling (retail) price. At the end of the season, you offer a discount

price using a markdown of 20 percent of the selling

price. The discount price for desk lamps is

Answers

Answer:

$16.24

Explanation:

______ of a security interest is the act of establishing the secured party's rights ahead of the rights of other creditors.

Answers

Perfection of a security interest is the act of establishing the secured party's rights ahead of the rights of other creditors.

A secured party under UCC Law is a person who obtains the benefit of a security interest created or provided under a security arrangement, whether or not there is a security obligation.

Security interest. Interest in collateral (eg, private property or equipment) to secure payment or performance of an obligation.

The collateral is interested in the proceeds when the collateralize transfers the proceeds to the collateral's property or when the collateral makes a financing statement on the proceeds.

Learn more about security interests at

https://brainly.com/question/7507570

#SPJ1

why is a higher interest rate important when saving money

(A) it pays interest on principal and interest

(B) it means a person will owe the bank less over time

(C) it grows savings at a faster pace

(D) it requires a lower amount be deposited each month

Answers

Answer:

C.

Explanation:

I believe it is C. because I'm pretty sure its talking about the interest which is where you receive some money from the bank for keeping you money there or whatnot.

The correct option is (C). it grows savings at a faster pace is a higher interest rate important when saving money.

A higher interest rate means that the saver will earn more interest on their savings, which will grow their savings at a faster pace.

Option (A) is incorrect because interest is only paid on principal, not on interest.

Option (B) is incorrect because a higher interest rate will not mean that a person will owe the bank less over time.

Option (D) is incorrect because a higher interest rate does not require a lower amount to be deposited each month.

Here is an example to illustrate this point. Let's say you have $1,000 in a savings account with an interest rate of 1%. After one year, you will have earned $10 in interest.

If the interest rate on your savings account were 2%, you would have earned $20 in interest after one year. Therefore, a higher interest rate will help your savings grow at a faster pace.

A higher interest rate will help your savings grow at a faster pace because you will earn more interest on your savings.

Learn more about interest,here:

https://brainly.com/question/32946283

#SPJ6

the marginal product of labor is how much an additional unit of labor affects

Answers

The marginal product of labor is the increase in total production that a firm experiences when one more unit of labor is added while all other elements of production stay constant.

The marginal product of labor is normally positive when employees are first hired, but it does not always exhibit steady returns. As the number of employees rises, the MPL will inevitably begin to slow, and they will have to start sharing resources like equipment during the manufacturing process.When adding an additional worker disrupts the firm and causes a loss in output, the MPL eventually turns negative. The law of declining marginal returns refers to this. The MRPL determines a company's labor demand curve, demonstrating that corporations will seek workers until their MRPL matches their marginal cost of labor.

To know more about marginal product of labor:

https://brainly.com/question/13617399

#SPJ4

manoli reed retired at age 65. soon he began to receive monthly checks from the federal government. what kind of tax had mr. reed paid that entitled him to this money?

Answers

Mr. Reed was entitled to receive money since he had paid the social security tax.

How much do social security fees cost?

Compulsory payments made to the general government known as social today ’s financial give recipients the right to receive a probable social benefit in the future.

What's the purpose of the Social Security fee?

In most circumstances, you are required to pay social security and Medicare taxes if you are an employee in the United States. Your eligibility for benefits under the American social security system is influenced by the you pay in taxes. Each time you receive a paycheck, your company deducts these taxes.

According to Section 6 of the Value Added Tax Act No. 14 of 2002, the Levy shall be levied at a rate of 2.5% upon that worth of the article determined for the purposes of the Value Added Tax.

To know more about levied click here

brainly.com/question/30063828

#SPJ4

What are the two steps in comparison?

Answers

Comparison is the phenomenon of comparing one thing with the other

Comparison typically involves two steps:

Identifying similarities and differences: This step involves looking at the items being compared and noting any similarities and differences between them.

Evaluating the significance of the similarities and differences: This step involves considering how the similarities and differences impact the overall assessment of the items being compared.

It's important to note that, depending on the context, there could be more than 2 steps, but in general comparison is made by identifying similarities and differences, then evaluating them.

Know more about Comparison - https://brainly.com/question/29547177

#SPJ4

Using the midpoint method, the price elasticity of demand for corn between the prices of $10 and $8 per bushel is , which means demand is between these two points. Therefore, you would tell the grower that her claim is , because total revenue will as a result of the spell of good weather.

Answers

Answer and Explanation:

The computation is shown below:

Price elasticity of demand is

= (Q2 - Q1 ÷ {(Q2 + Q1) ÷ 2}) × {(P2 - P1 ÷ 2) ÷ (P2 + P1)}

where,

Q2 = 30

Q1 = 25

P2 = $10

P1 = $8

Now put these values to the above formula

So, the price elasticity of demand is 0.82

So, Demand is inelastic.

Her claim is correct.

So, the total revenue will Decrease.

Total revenue at the time of prior smell of good weather

= 10 × 25

= 250

And, the Total revenue at the time of after smell of good weather

= 8 × 30

= 240

Therefore, you would tell the grower that her claim is correct because total revenue will decrease as a result of the spell of good weather.

Based on the complete question, it should be noted that the price elasticity of demand is 0.82. in this case, since the price elasticity of demand is less than 1, it's an inelastic demand.

Also, it implies that her claim is correct. The total revenue from the information given will then be:

= 10 × 25 = 250 and 8 × 30 = 240.

Therefore, there's a decrease in revenue.

Read related link on:

https://brainly.com/question/15602440