Answers

It should be noted that the demand for orange will be elastic because when there's a change in price, there'll be a larger change in quantity demanded.

It should be noted that an elastic demand simply means a situation whereby a change in the price of a good lead to a larger change in the quantity demanded.

In this case, the demand for orange will be elastic because when there's a change in price, there'll be a larger change in quantity demanded. For example, an increase in price will make the customers buy other fruits.

Learn more about demand on:

https://brainly.com/question/25585026

Related Questions

The management of Shatner Manufacturing Company is trying to decide whether to continue manufacturing a part or to buy it from an outside supplier. The part, called CISCO, is a component of the company’s finished product. The following information was collected from the accounting records and production data for the year ending December 31, 2020.

1. 7,900 units of CISCO were produced in the Machining Department.

2. Variable manufacturing costs applicable to the production of each CISCO unit were: direct materials $4.58, direct labor $4.51, indirect labor $0.45, utilities $0.41.

3. Fixed manufacturing costs applicable to the production of CISCO were:

Cost Item Direct Allocated

Depreciation $1,900 $860

Property taxes 530 320

Insurance 870 610 $3,

300 $1,790

All variable manufacturing and direct fixed costs will be eliminated if CISCO is purchased. Allocated costs will have to be absorbed by other production departments.4. The lowest quotation for 7,900 CISCO units from a supplier is $63,200.5. If CISCO units are purchased, freight and inspection costs would be $0.60 per unit, and receiving costs totaling $1,270 per year would be incurred by the Machining Department.Required:a) Prepare an incremental analysis for CISCO.

Answers

Answer:

Financial advantage of purchasing Cisco from outside vendor = $9,440

Explanation:

7,900 units produced

variable costs allocated to Cisco units (avoidable):

direct materials $4.58 per unitdirect labor $4.51 per unitindirect labor $0.45 per unitutilities $0.41 per unittotal $9.95 x 7,900 units = $78,650fixed manufacturing costs allocated to Cisco:

depreciation $860property taxes $320Insurance $610total $1,790an outside supplier can provide Cisco for $63,200 plus:

freight and inspection costs $0.60 per unit x $7,900 = $4,740total receiving costs $1,270total $6,010Incremental Analysis

Produce Purchase Difference

Cisco Cisco amount

Variable production $78,650 $78,650

costs

Purchase price $63,200 ($63,200)

Additional expenses $6,010 ($6,010)

Financial advantage of purchasing Cisco $9,440

Allocated fixed costs are not included in this analysis since they cannot be avoided by either action, producing or purchasing.

Wolverine, Inc. began operations on January 1 of the current year with a $12,400 cash balance. 45% of sales are collected in the month of sale; 55% are collected in the month following sale. Similarly, 15% of purchases are paid in the month of purchase, and 85% are paid in the month following purchase. The following data apply to January and February:

January February

Sales $ 39,000 $ 59,000

Purchases 32,000 44,000

Operating expenses7,400 9,400

If operating expenses are paid in the month incurred and include monthly depreciation charges of $2,900, determine the change in Wolverine's cash balance during February.

a) $4,800 increase.

b) $7,700 increase.

c) $10,550 increase.

d) $13,450 increase.

e) Some other amount.

Answers

Answer:

$7,700 increase

Explanation:

We can determine the change in Wolverine's cash balance by deducting the cash disbursement and operating expenses from the cash receipts.\

Change in cash balance = Cash receipts - Cash disbursement - Operating expense

Change in cash balance = $48,000 - $33,800 -$6,500

Change in cash balance = $7,700

WORKING:

Cash Receipts

Sales

February ( 59,000 x 45%) $26,550

January ( 39,000 x 55%) $21,450

Total $48,000

Cash disbursement

Purchases

February ( 44,000 x 15%) $6,600

January ( 32,000 x 85%) $27,200

Total $33,800

Operating expenses

Incurred $9,400

Depreciation ($2,900)

Net $6,500

Bathtub Refinishing Oldsmar FL

Answers

Answer:

cool

Explanation:

Multiple-Step Income Statement

Use the following information to prepare a multiple-step income statement, including the revenue section and the cost of goods sold section, for Sauter Office Supplies for the year ended December 31, 20--.

Sales $156,876

Sales Returns and Allowances 2,344

Sales Discounts 4,155

Interest Revenue 419

Merchandise Inventory, January 1, 20-- 27,769

Purchases 112,094

Purchases Returns and Allowances 5,517

Purchases Discounts 2,710

Freight-In 870

Merchandise Inventory, December 31, 20-- 33,028

Wages Expense 27,611

Supplies Expense 744

Phone Expense 888

Utilities Expense 7,988

Insurance Expense 1,294

Depreciation Expense—Equipment 3,809

Miscellaneous Expense 584

Interest Expense 4,692

Answers

Answer:

Sauter Office Supplies

Multi-step Income Statement for the year ended December 31, 20--

Net sales $150,377

Cost of goods sold $99,478

Gross profit $50,899

Expenses:

Wages Expense 27,611

Supplies Expense 744

Phone Expense 888

Utilities Expense 7,988

Insurance Expense 1,294

Depreciation Expense 3,809

Miscellaneous Expense 584 $42,918

Operating income $7,981

Interest revenue 419

Interest Expense (4,692)

Income before taxes $3,708

Explanation:

a) Data and Calculations:

Sales $156,876

Sales Returns and Allowances 2,344

Sales Discounts 4,155

Interest Revenue 419

Merchandise Inventory, January 1, 20-- 27,769

Purchases 112,094

Purchases Returns and Allowances 5,517

Purchases Discounts 2,710

Freight-In 870

Merchandise Inventory, December 31, 20-- 33,028

Wages Expense 27,611

Supplies Expense 744

Phone Expense 888

Utilities Expense 7,988

Insurance Expense 1,294

Depreciation Expense—Equipment 3,809

Miscellaneous Expense 584

Interest Expense 4,692

Sales $156,876

Sales Returns and Allowances (2,344)

Sales Discounts (4,155)

Net sales $150,377

Cost of goods sold:

Merchandise Inventory, January 1, 20-- 27,769

Purchases 112,094

Purchases Returns and Allowances (5,517)

Purchases Discounts (2,710)

Freight-In 870

Merchandise Inventory, December 31, 20-- (33,028)

Cost of goods sold $99,478

I The indirect and direct methods of preparing the statement of cash flows are identical except for

a significant non-cash activity section

operating activities section

cmesting activities section

a financing activities section

etcrease or decrease in cash

Answers

The cash flow statement (CFS) measures how well a company manages its cash position, meaning how well the company generates cash to pay its debt obligations and fund its operating expenses. The cash flow statement complements the balance sheet and income statement and is a mandatory part of a company's financial reports since 1987.1

In this article, we'll show you how the CFS is structured, and how you can use it when analyzing a company.

KEY TAKEAWAYS

A cash flow statement is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company.

The cash flow statement measures how well a company manages its cash position, meaning how well the company generates cash to pay its debt obligations and fund its operating expenses.

The cash flow statement complements the balance sheet and income statement and is a mandatory part of a company's financial reports since 1987.1

The main components of the cash flow statement are cash from operating activities, cash from investing activities, and cash from financing activities.

The two methods of calculating cash flow are the direct method and the indirect method.

Scobie Company began 2016 with a retained earnings balance of $142,400. During an examination of its accounting records on December 31, 2016, Scobie found it had made the following material errors, for both financial reporting and income tax reporting, during 2015.

1. Depreciation expense of $15,000 inadvertently had been recorded twice for the same machine.

2. No accrual had been made at year-end for interest; therefore, interest expense had been understated by $4,000.

Scobie’s net income after taxes during 2016 was $60,000. The company has been subject to a 30% income tax rate for the past several years. It declared and paid dividends of $13,000 during 2016.

Required:

1. Prepare whatever journal entries in 2016 are necessary to correct Scobie’s books for its previous errors. Make your corrections directly to the Retained Earnings account.

Answers

The total retained earnings on 31st December 2016 is $197,100. The journal entry are attached below.

What is Retained Earnings?Retained earning is basically the profits of the company which is kept aside to meet the future requirement of the company. It the amount which is left over after deducting all cost such as direct cost, indirect cost, income taxes and dividend.

The retained earning is used in the future projects or for buying the equipment for the company.

Learn more about retained earnings here:

https://brainly.com/question/14529006

#SPJ1

.

Question 1 of 5

What type of goal can help you be prepared for unexpected costs, such as

car repairs?

Long-term financial goal

An emergency fund

Retirement savings

Short-term financial goal

Subsi

Continue

Answers

A goal that can help you to be prepared when there are unexpected costs such as car repairs is An emergency fund.

How can you be prepared for unexpected costs?In order to be prepared for unexpected costs, the best thing to do is to have an emergency fund where you are able to save for when you may have to spend money that you are not prepared for.

The emergency fund would be best placed into an account that can earn interest but at the same time can be eaisly accessible. This was you can earn more money while saving for emergencies, and also be able to use the money for those unexpected costs.

Find out more on emergency funds at https://brainly.com/question/13420184

#SPJ1

You and nine of your wealthy friends decide to purchase a local minor league baseball team. The purchase price is $15 million, 60 percent of which you contribute to the business as capital. Your nine friends will contribute the remaining $6 million. All 10 of you agree that you will be the sole general manager of the business, making all business and baseball decisions, except as you delegate them to employees of the business, such as a team manager or vice president of baseball operations. Due to the way you will account for the purchase of the team and player salaries, you expect the business not to make a profit until year 4. You expect that all 10 of you will remain owners of the business for at least 10 years, at which time you expect to sell the team at a profit. Which business form do you believe is best for this business

Answers

Answer:

Limited liability company

Explanation:

A limited liability company is a company where the liabilities of partners is limited to the amount invested in the company. A limited liability company has features of both a partnership and a sole proprietorship

The partnership is made up of a general partner and the limited partners. the general partner is involved in the daily running of the business. The limited partners are not involved in the daily running of the business. They just contribute capital.

In this question, the person involved in the running of the business is the general partner while the other 9 friends are the limited partners.

Answer:

Limited liability Company

Explanation:

A limited liability company is the US-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation.

Some of the benefits of an LLC include personal liability protection, tax flexibility, an easy startup process, less compliance paperwork, management flexibility, distribution flexibility, few ownership restrictions, charging orders, and the credibility they can give a business.

An LLC lets you take advantage of the benefits of both the corporation and partnership business structures. LLCs protect you from personal liability in most instances, your personal assets — like your vehicle, house, and savings accounts — won't be at risk in case your LLC faces bankruptcy or lawsuits.

in a 3 - 4 page essay, discuss warren Buffett's approach to business dealings, especially as they relate to business ethics.

Compare that approach to Benie Madoff's.

Apply ethical philosophies that you have learned about in this module and state which you think apply to Mr. Buffett.

Which ethical philosophies apply to Mr. Madoff? Why?

Answers

In this essay, we explore Warren Buffett's ethical approach to business, compare it to Bernie Madoff's, and analyze the applicable ethical philosophies for each.

Here are the steps to be followed:

1. Introduction:

2. Warren Buffett's Approach to Business Dealings and Business Ethics:

Explain Warren Buffett's overall approach to business dealings.Discuss his stance on business ethics, emphasizing any specific principles or values he adheres to.Provide examples or case studies that demonstrate Buffett's ethical decision-making in his business practices.Discuss the impact of his ethical approach on his reputation and long-term success.3. Bernie Madoff's Approach to Business Dealings and Comparison to Buffett:

Describe Bernie Madoff's approach to business dealings, specifically in relation to ethics.Highlight any unethical practices or actions committed by Madoff, such as his infamous Ponzi scheme.Compare and contrast Madoff's approach to Buffett's approach, pointing out the key differences in their ethical standards and behaviors.Discuss the consequences of Madoff's unethical actions, including the financial losses and damage to investors.4. Application of Ethical Philosophies to Warren Buffett:

Introduce the ethical philosophies that you have learned in the module.Identify which ethical philosophies apply to Warren Buffett based on his approach to business dealings.Explain why you believe these philosophies are applicable and provide supporting evidence or examples from Buffett's actions or statements.Discuss the implications and benefits of Buffett aligning with these ethical philosophies.5. Ethical Philosophies Applicable to Bernie Madoff and Reasons:

Analyze the ethical philosophies that can be applied to Bernie Madoff's actions.Discuss which ethical philosophies are relevant to understanding Madoff's unethical behavior.Provide justifications and explanations for the selected ethical philosophies, considering how they align with Madoff's actions or motivations.Reflect on the consequences of Madoff's departure from ethical principles.6. Conclusion:

Summarize the key points discussed in the essay regarding Warren Buffett's approach to business dealings and ethics, as well as the comparison to Bernie Madoff.Emphasize the importance of ethical decision-making in business and the long-term implications it can have.Offer any final thoughts or insights on the topic.Remember to support your arguments with evidence, examples, and references to credible sources. Properly cite any sources used in your essay according to the appropriate citation style.

Know more about Business ethics here:

https://brainly.com/question/32761617

#SPJ8

How does disintermediation benefit the consumer? How might it harm the consumer? Can you think of any revolutionary businesses created in the past few years due to disintermediation? Be sure to describe one not mentioned already in the chapter.

Answers

Disintermediation in an economy keeps prices and predatory pricing in control since there are no retailers between wholesalers and customers.

The client loses store knowledge and may have to use a single wholesaler, which might lead to monopoly. Customer service is affected.

Airbnb, which connects consumers and searchers to property owners and hotels without agents, is an innovative company.

What is a consumer?Generally, The major advantage of disintermediation for consumers is lower costs and less predatory pricing since there is no store acting as an intermediary between a wholesaler and the consumer.

The only drawback for the consumer in such an agreement is that they may have to go with a single wholesaler, which might result in monopoly, and they lose out on the retailer's knowledge in the engagement. A customer's experience with the service is also affected.

When the platform connects consumers and searchers to home owners and hotels who sought a platform to engage and do business without any middlemen in between, Airbnb is the one revolutionary company that has occurred as a result of disintermediation.

Read more about consumer

https://brainly.com/question/13420317

#SPJ1

With the cost approach to value, what is the reproduction cost?

Answers

Answer:Reproduction Cost- the estimated cost to construct, as of the effective appraisal date, an exact relica of the building being appraised, insofar as possible using the same materials, construction standards, design, layout, and quality of workmanship, including all the deficiencies, super-adequacies

Explanation:

Klever Kitchen (KK), retailer that sells smart kitchen appliances. The business commenced itx trading activities on January 2020. The following is a summary of business transactions that occurred during the first year of trading 1. The owners introduced RM 300,000 of cash, which was paid into a business bunk account 2 The company borrowed RM50,000 from a local bank 3. A motor vehicle was bought on 1 January 2020 for RM60,000. This is expected to be used in the business for nine years and then to be sold for RM6,000 4. Equipment costing RM20,000 was purchased for RM10,000 cash and signing a note payable for RM10,000. It has an expected useful conomic life of 6 years and an estimated residual value of RM2,000 $ The business purchased inventories on credit from a manufacturer Muster Kitchen) for RM120,000 Inventories totalling RM25.000 were bought for cash. 7 Sales revenue on credit totalled RM130,000 (cost of sales RM50.000) & Cash sales revenue totalled RM40,000 cost of sales RM15,000). 9, Salaries of RM12,000 were paid in cash. However, at the end of the year, the businca owed RM1,000 of salaries for the last week of the year, 10. Premises were rented from 1 January 2020 at an annual rental of RM15,000 During the year, rent of RM21,000 was paid to the owner of the promises 11. Electricity bills for the first three quarters of the year were paid totalling RM1,400 Atter 31 December 2020, but before the financial statements had been finalised for the year, the bill for the last quarter arrived showing a charge of RM120. 12. One of the customers was declared bankrupt und unable to settle his debts. The customer still owed RM60. 13. Receipts from trade receivables totalled RM80,000 14. Payments of trade payables totalled RM 70,000 NOTE: The business uses the straight-line method for depreciating its non-current Required: (a) Prepare an Income Statement of Klever Kitchen for the year ended 31 December 2020

Answers

Answer:

Klever Kitchen Income Statement for the year ended 31 December 2020

Sales revenue on credit: RM130,000

Cash sales revenue: RM40,000

Total revenue: RM170,000

Cost of sales:

Opening inventory: RM0

Purchases on credit: RM120,000

Cash purchases: RM25,000

Total cost of sales: RM145,000

Gross profit: RM25,000

Operating expenses:

Salaries: RM12,000

Rent: RM21,000

Electricity bills: RM1,400

Depreciation: (RM60,000 - RM6,000) / 9 years = RM6,000

Total operating expenses: RM40,400

Net profit before interest and tax: RM (15,400)

Interest expenses: RM50,000 x 5% = RM2,500

Net loss before tax: RM (17,900)

Tax expenses: RM0

Net loss after tax: RM (17,900)

Note: The company incurred a net loss for the year ended 31 December 2020.

Explanation:

Explain with examples, the process of screening and evaluating new venture opportunities.

Answers

According to the Arkansas Small Business Development Center, most small businesses fail because of poor management and the owner’s inability to manage resources. Before you even start researching the feasibility of your idea and the market you plan on entering, evaluate your own talents, desires and goals. Consider your willingness to take risks as well as the amount of time and energy you’ll need to make the business a success. Review your financial, personnel and marketing skills as well to ensure you have the necessary background to make a success of your new venture.

Financial Components

After learning about the investment required to purchase the existing business or franchise or the start-up costs you’ll need initially, evaluate your own resources. Part of a financial assessment includes the amount you have in personal savings to add to the initial investment. Banks typically require entrepreneurs to come up with a portion of the investment to show good faith and willingness to take a risk with the lender. Assess the financing available through the seller, investors and lenders when evaluating your chances of succeeding.

Market Research

To thoroughly understand what you’re getting into, perform an extensive market research project to determine the feasibility of your business. In addition to gleaning statistics of trends and current customer buying patterns, you need to know who your customers are, where they are located and what kind of competition exists in your area. Consider market research your first steps in opportunity analysis that help you understand exactly how you will sell products or services to a specific market.

Support

Finally, evaluate the amount of support you expect to receive from your family and the community.

Hofstede's Cultural Dimensions

The most important factor influencing international HRM is the culture of the country in which a facility is located. Culture affects employees' worldview and the norms and values they hold. Culture has a pervasive influence on other important attributes of a country, such as its legal system, human capital, economic system, and political system. As a result, culture strongly determines the effectiveness of most HRM practices. This makes a thorough understanding and appreciation of culture key for managing human resources globally

Hofstede's classification of cultural attributes has become one of the most commonly used methods for understanding culture. He identified five dimensions on which various cultures could be classified: (1) individual-collectivism, (2) power distance, (3) uncertainty avoidance, (4) masculinity-femininity dimension, and (5) long-termâshort-term orientation.

Carlos and Mary have just been assigned to work in foreign subsidiaries of their company. Carlos has worked in the headquarters of his company for five years and has now been given his first overseas assignment. Mary has just finished successfully turning around the struggling operations of one foreign subsidiary at her company and has now been tasked with doing the same in a different country.

Read the statements and explanations for each statement below, then for each select which is the correct cultural dimension.

a. High Individualism

b. High Collectivism

c. High Power Distance

d. Low Power Distance

e. High Uncertainty Avoidance

f. Low Uncertainty Avoidance

g. High Masculinity

h. High Femininity

i. Long-Term Orientation

j. Short-Term Orientation

1. In Carlos' experience, people in this country seek to reduce inequalities in money and wealth.

2. In Mary's experience, individuals in this culture tend to live in the moment' instead of planning for the future.

3. In Carlos' experience, this culture places an emphasis on making investments that might have low current benefits but are expected to be profitable in the future.

4. In Maryâs experience, people in this culture like to show off, make money, and achieve highly visible accomplishments.

5. In Maryâs experience, people in this country rarely address others by their first names, instead relying on titles.

6. In Mary's experience, people in this country tend to look after their own interests instead of seeking protection from their larger community.

7. In Maryâs experience, this culture values rules, structure, and stability.

8. In Carlos' experience, people in this culture expect the larger community to protect them when they are in trouble.

9. In Carlos' experience, people in this culture are easygoing and flexible regarding different views.

10. ln Carlos' experience, this culture places a high value on protecting the natural environment and preserving quality of life, even if it means making less money.

Answers

Answer:\a. High Individualism.

Explanation:

Hope this helps!

Furniture purchased from Kailash for Rs. 6,000.

Answers

Answer:

What's the question or is this a statement?

Explanation:

?

Parker Company uses a job-order costing system and applies manufacturing overhead to jobs using a predetermined overhead rate based on direct labor-hours. Last year manufacturing overhead and direct labor-hours were estimated at $50,000 and 20,000 hours, respectively, for the year. In June, Job #461 was completed. Materials costs on the job totaled $4,000 and labor costs totaled $1,500 at $5 per hour. At the end of the year, it was determined that the company worked 24,000 direct labor-hours for the year and incurred $54,000 in actual manufacturing overhead costs. Required: a. Job #461 contained 100 units. Determine the unit product cost that would appear on the job cost sheet. b. Determine the underapplied or overapplied overhead for the year.

Answers

Answer:

Instructions are below.

Explanation:

First, we need to calculate the predetermined overhead rate:

Predetermined manufacturing overhead rate= total estimated overhead costs for the period/ total amount of allocation base

Predetermined manufacturing overhead rate= (50,000/20,000)

Predetermined manufacturing overhead rate= $2.5 per direct labor hour

Now, we can determine the total cost and unitary cost of Job 461:

Direct labor hours= 1,500/5= 300

Total cost= 4,000 + 1,500 + 2.5*300= $6,250

Unitary cost= 6,250/100= $62.5

To calculate the under/over allocation, first, we allocate overhead for the whole company:

Allocated MOH= Estimated manufacturing overhead rate* Actual amount of allocation base

Allocated MOH= 2.5*24,000= $60,000

Under/over applied overhead= real overhead - allocated overhead

Under/over applied overhead= 54,000 - 60,000

Under/over applied overhead= $6,000 overallocated

What variables (bases of segmentation)will you use for the market for: casual clothing,Holidays, bear

Answers

The segments can be made according to the product and its consumers, or geographical location (If multiple locations exist).

What is market segmentation?Market segmentation is performed to divide the business in lower segments that can be managed efficiently.

For Casual Clothing, Gender segmentation can be done, Men, Women and Kids wear can be separated.

For Holidays, Local and International trips can be separated and would allow to manage the business and orders accordingly.

For Bear, this can be segmented according to the customer where the consumers are kids and Women.

Learn more about segmentation at https://brainly.com/question/27400967

#SPJ1

Question What is the volume of this figure? Enter your answer in the box. cm³ A right rectangular prism with a trapezoidal prism. The rectangular prism has a length of 12 centimeters, a width of 10 centimeters, and a height of 80 centimeters. The trapezoidal prism shares a face with the rectangular prism. The trapezoid base has lengths of 22 centimeters and 12 centimeters and a height of 10 centimeters. The height of the trapezoidal prism is 80 centimeters.

Answers

The volume of the figure is 23,200 cm³.

To find the volume of the figure, we need to calculate the volumes of the rectangular prism and the trapezoidal prism separately and then add them together.

The volume of a rectangular prism is given by the formula:

Volume = Length × Width × Height

For the rectangular prism:

Length = 12 cm

Width = 10 cm

Height = 80 cm

Volume of the rectangular prism = 12 cm × 10 cm × 80 cm = 9,600 cm³

Now, let's calculate the volume of the trapezoidal prism. The formula for the volume of a prism is the product of the base area and the height.

The trapezoid base has lengths of 22 cm and 12 cm and a height of 10 cm.

To find the area of the trapezoid base, we use the formula:

Area = (a + b) / 2 × h

where a and b are the lengths of the parallel sides and h is the height.

Area of the trapezoid base = (22 cm + 12 cm) / 2 × 10 cm = 17 cm × 10 cm = 170 cm²

Now, we can calculate the volume of the trapezoidal prism:

Volume of the trapezoidal prism = Area of the trapezoid base × Height

Volume of the trapezoidal prism = 170 cm² × 80 cm = 13,600 cm³

Finally, we can find the total volume of the figure by adding the volumes of the rectangular prism and the trapezoidal prism:

Total Volume = Volume of the rectangular prism + Volume of the trapezoidal prism

Total Volume = 9,600 cm³ + 13,600 cm³ = 23,200 cm³

Therefore, the volume of the figure is 23,200 cm³.

For more such questions on volume

https://brainly.com/question/29432171

#SPJ8

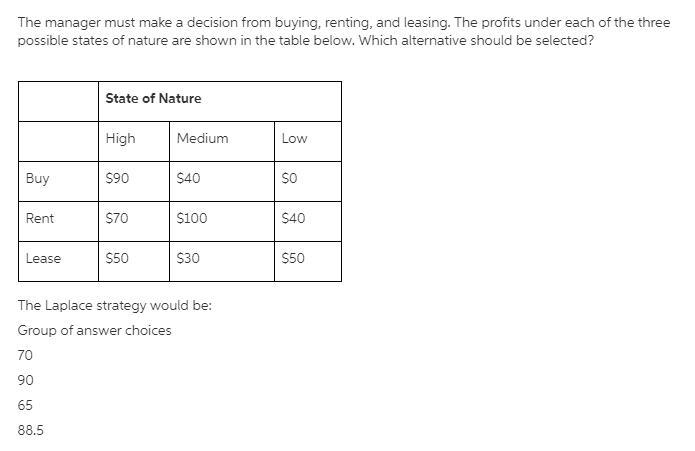

High Medium Low Buy $90 $40 $0 Rent $70 $100 $40 Lease $50 $30 $50 The Laplace strategy would be:

Answers

Answer:

a. $70

Explanation:

Note: The organized question and table is attached below as picture

In Laplace strategy also known as equally likely criterion, average payoff for each of the given alternatives is determined first. Then, the alternative with the highest average payoff or minimum cost is selected.

From the given information, average payoff for each alternative is determined below,

Buy = ($90 + $40 + $0) / 3 = $130 / 3 = $43.33

Rent = ($70 + $100 + $40) / 3 = $210 / 3 = $70 (highest)

Lease = ($50 + $30 + $50) / 3 = $130 / 3 = $43.33

The highest average payoff is for the Rent alternative. Therefore, Rent alternative should be selected under the Laplace strategy with a profit of $70.

Given the lack of formal structure, how important do you think Gore’s informal structure becomes?

Answers

Answer:

The lack of a formal structure makes Gore's informal structure more important as it creates social bonds among workers, which help to propel productivity in the workplace.

Explanation:

Gore's informal structure encourages the creation of rapport among workers outside the workplace. The social relationships that are developed by the workers enable them to tackle challenges and ensure the smooth running of the organization. Workers' morale is boosted through social relationships. Cohesion is created with social bonding and understanding. This helps the workers to work together to achieve organizational goals without the benefit of any formal structure.

The lack of formal structure makes Gore's informal structure more important for organizational processes, as it narrows social and professional relationships within a company.

Some advantages of the informal structure:

Greater organizational communication.Faster decision making.Increased motivation.Conflict reduction.Increased innovation and creativity.Therefore, the informal structure makes an organization more flexible, where employees feel more motivated to carry out innovative and productive work with the internal environment more focused on employee development.

Learn more here:

https://brainly.com/question/6476633

What causes retained earnings to decrease?

Answers

The transfer of profits to owners of common stock is referred to as a dividend. In essence, this is an appropriation of profits.

Raise accumulated other comprehensive income and decrease retained earnings. A loan principal or an intangible asset like intellectual property might regularly have its book value decreased over a predetermined period of time by using amortization in accounting. In contrast to amortizing a net actuarial gain for pensions, a net actuarial loss for pensions will result in a fall in retained earnings and a rise in accumulated other comprehensive income. The retained earnings are decreased and a liability is created when dividends are declared. A shareholder's entitlement to a dividend is established by the announcement and declaration of a dividend. Dividends are payments made from profits to holders of common stock. This is essentially the appropriation of profits.

Learn more about Retained earnings here:

https://brainly.com/question/16041758

#SPJ4

Mo’yur lawn landscaping worksheet

Answers

Answer:

Company Chart of AccountsAssets100 Cash110 Accounts Receivable120 Inventory125 Supplies128 Prepaid Insurance129 Prepaid Rent130 Computers & Software132 Accumulated Depreciation -Computers & Software136 Company Vehicles137 Accumulated Depreciation - Vehicles138 Office Building139 Accumulated Depreciation - Office Building140 Land150 Intangible Assets (Patents, Copyrights, etc.)Liabilities200 Accounts Payable210 Wages Payable220 Taxes Payable230 Short-term Loan240 Unearned Revenue220 Long-term LoanOwner's Equity300 Owner's Capital Contribution310 Owner's Draws320 Retained EarningsRevenue400 Merchandise Sales410 Fees Earned420 Other RevenueExpenses500 Wages Expense510 Rent Expense520 Utilities Expense530 Office Supplies Expense540 Depreciation Expense550 Meals & Entertainment Expense560 Maintenance & Repair Expense570 Postage Expense580 Printing Expense590 Miscellaneous Expense

Havel and Petra are married and will file a joint tax return. Havel has W-2 income of $38,588, and Petra has W-2 income of $46,227.

Use the appropriate Tax Tables and Tax Rate Schedules.

Required:

a. What is their tax liability using the Tax Tables?

b. What is their tax liability using the Tax Rate Schedule?

Note: Round your intermediate computations and final answer to 2 decimal places.

a. Tax liability using Tax Tables

b. Tax liability using Tax Rate Schedule

Answers

1. The liability using Tax Tables will be $7186

2. The tax liability using Tax Rate Schedule is $7,185.28

How to calculate the tax liability?A tax is a mandatory fee or financial charge that a government imposes on a person or a business in order to raise money for public projects like building the greatest infrastructure and services. Different public expenditure programs are then funded with the funds that have been raised. Tax liability is the sum of money that a person, company, or other entity owes to a federal, state, or municipal taxing body.

Total Income ($38,588 + 49,381) $87,969

Less: Standard deduction 2020 for Married Filing Jointly -24,800

Taxable Income $63,169

Tax liability using the tax table $7,186

Tax liability using tax rate Schedule $7,185.28

Learn more about tax on:

https://brainly.com/question/25783927

#SPJ1

What could be driving the tremendous growth in Salesforce.com’s stock price and revenue? and Why do you think investors put such a high premium on Salesforce.com’s stock?

Answers

Salesforce's fourth quarter of fiscal 2023, which concluded on January 31, saw a 14% year-over-year increase in revenue to $8.4 billion. Wall Street forecasts projected for $8 billion in revenue, thus this exceeded their projections.

Why investors put such a high premium on Salesforce.com’s stock?

Shares of Salesforce (CRM) are soaring after the software giant reported profits that above analyst expectations, provided a more optimistic outlook, and announced intentions to increase stock buybacks in response to pressure from activist investors. Salesforce's $8.4 billion in revenue increased by 14%, above the predicted 9.2% rise. The yearly revenue for Salesforce in 2023 was $31.352 billion, an increase of 18.35% over 2022.

Salesforce's yearly sales in 2022 increased by 24.66% from 2021 to $26.492 billion. A 24.3% rise from 2020, Salesforce's yearly revenue in 2021 was $21.252 billion. According to valuation criteria, Salesforce Inc. can be overpriced. It would not be a good choice for value investors, according to its Value Score of D. CRM's financial stability and expansion prospects show that company has the potential to perform worse than the market.

Learn more about growth:

https://brainly.com/question/28789953

#SPJ1

What was centerpiece arrangements retained earnings for December 31, 2024? And retained earnings for January 1 2024? And Net income for the year January 2024?

Answers

1. Centerpiece Arrangements' retained earnings for December 31, 2024, were $2,400.

2. Centerpiece Arrangements' retained earnings for January 1, 2024, were $5,100.

3. Centerpiece Arrangements' Net Income for January 1, 2024, was $2,100.

What are Retained Earnings?Retained earnings are the undistributed profits of an entity accumulated over a period of time.

The formula for computing the Retained Earnings is Beginning Retained Earnings Plus Net Income or Loss Minus Dividends.

Data and Calculations:Centerpiece Arrangements

Statement of Retained EarningsFor December 31, 2024

Retained Earnings, January 1, 2024, $5,100

Net Income 2,100

Dividends 4,800

Retained Earnings, December 31, 2024, 2,400

Learn more about Retained Earnings at https://brainly.com/question/25998979

#SPJ1

Question Completion:Centerpiece Arrangements - X Data Table

Retained Earnings, January 1, 2024, $5,100

Accounts Payable 17,600

Office Supplies 1,700

Common Stock 9,000

Accounts Receivable 8,000

Cash 7,200

Equipment 12,100

Centerpiece Arrangements

Income StatementYear Ended December 31, 2024

Revenues:

Service Revenue $ 70,000

Expenses:

Salaries Expense $ 46,000

Rent Expense 16,000

Insurance Expense 4,500

Utilities Expense 1,400

Total Expenses 67,900

Net Income $ 2,100

In collecting information on a family, you learn that the father has been unemployed for nine months; the mother is struggling with diabetes; and the family does not feel supported in the community. With your knowledge as a social worker, to what might these factors lead?

depression

truancy for children

discrimination

substance abuse

Answers

If the mother is struggling with diabetes; and the family does not feel supported in the community. With your knowledge as a social worker, these factors might lead to: A. depression.

What is Depression?Depression can be defined as the way in which a person is often moody or feel sad and this can tend to occur as a result of life experience. A depressed person can begin to disassociated themselves with other in which in turn can have effect on their day to day activities.

Unemployment or Lack of job, struggling with sickness or illness, loneliness among others are some of the factors that can cause depression.

Therefore the correct option is A.

Learn more about depression here:https://brainly.com/question/21711771

#SPJ1

Analyze if the investment in new equipment is profitable based on the information given below. Cost of new equipment $66,000 Yearly expected cash flows to be received $20,000 Expected life 4 years Minimum desired rate of return 10% Present Value of an Annuity of $1 at 10% for 4 years 3.170

a.The internal rate of return is greater than 10% and is not profitable.

b.The internal rate of return is greater than 10% and is profitable.

c.The internal rate of return is less than 10% and is profitable.

d.The internal rate of return is less than 10% and is not profitable.

Answers

Answer:

D

Explanation:

Internal rate of return is the discount rate that equates the after-tax cash flows from an investment to the amount invested

IRR can be calculated with a financial calculator

Cash flow in year 0 = $-66,000

Cash flow each year from year 1 to 4 = $20,000

IRR = 8.16%

For the project to be profitable, the IRR has to be greater than the desired rate of return

Since the IRR (8.16%) is lower than the desired rate of return (10%), the project isn't profitable

To find the IRR using a financial calculator:

1. Input the cash flow values by pressing the CF button. After inputting the value, press enter and the arrow facing a downward direction.

2. After inputting all the cash flows, press the IRR button and then press the compute button.

Bakersfield Corp. pays income tax at an average rate of 30 percent. This year its revenue is $124,000 and its expenses are $82,000. The adjusting entry to record the income tax expense will:

Multiple Choice

decrease net income by $42,000.

increase shareholders' equity by $12,600.

decrease liabilities by $12,600.

decrease shareholders' equity by $12,600.

Answers

The adjusting entry to record the income tax expense for Bakersfield Corp. will decrease net income by $42,000. Option A is the correct answer.

The adjusting entry to record the income tax expense for Bakersfield Corp. will decrease net income by $42,000.

The income tax expense is calculated by applying the applicable tax rate to the taxable income. In this case, Bakersfield Corp. has revenue of $124,000 and expenses of $82,000, resulting in a taxable income of $42,000 ($124,000 - $82,000).

Since Bakersfield Corp. pays income tax at an average rate of 30 percent, the income tax expense will be 30 percent of the taxable income:

Income tax expense = Taxable income x Tax rate

= $42,000 x 0.30

= $12,600

Adjusting entries are made at the end of an accounting period to ensure that revenues and expenses are properly recognized. In this case, the adjusting entry will decrease net income by the amount of the income tax expense.

This adjustment reflects the company's obligation to pay income tax and reduces its reported net income.

Therefore, the correct option is: "Decrease net income by $42,000."

For such more question on income:

https://brainly.com/question/14510611

#SPJ8

Step 4: Use the line chart to determine the approximate price of the stock at the beginning of 2003. How much money would you have earned if you bought one share of stock at the beginning of 2003 and sold it at today's current price?

Answers

The amount of money earned with the purchase of one share of stock at the beginning of 2003 and selling it at today's current price is $22.81 ($61.81 - $39).

What is the price of stock?The price of a share of stock is the cost that is paid to buy it or the revenue received when it is sold.

The price of a stock reflects the value that investors place on the issuing company.

Thus, the amount of money earned with the purchase of one share of stock at the beginning of 2003 and selling it at today's current price is $22.81.

Learn more about determining the price of a stock at https://brainly.com/question/8084221

On January 1, 2021, Shay Company issues $430,000 of 8%, 15-year bonds. The bonds sell for $417,100. Six years later, on January 1,

2027, Shay retires these bonds by buying them on the open market for $450,425. All interest is accounted for and paid through

December 31, 2026, the day before the purchase. The straight-line method is used to amortize any bond discount.

1. What is the amount of the discount on the bonds at issuance?

2. How much amortization of the discount is recorded on the bonds for the entire period from January 1, 2021, through December 31,

2026?

3. What is the carrying (book) value of the bonds as of the close of business on December 31, 2026?

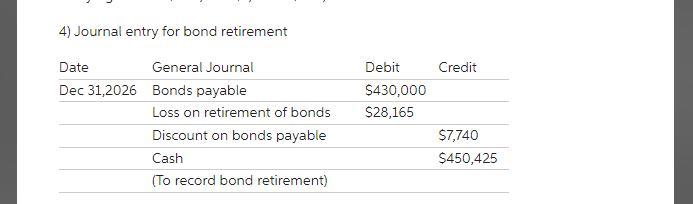

4. Prepare the journal entry to record the bond retirement.

Answers

(1). The amount of the discount on the bonds at issuance are at issuance = Par value of bonds-Issue price of bonds = $430,000-$417,100 = $12,900.

What is the amount?The size or quantity of non-count substantives is indicated by the language unit "amount." You can count the magnitude of air in a bottle or the volume of water in a cup, for instance.

(2). As amortization of the discount is recorded on the bonds for the entire period from January 1, 2021, through December 31, 2026, was December 31, 2026 = $12,900/15*6 = $5,160

(3). The carrying (book) value of the bonds as of the close of business on December 31, 2026

Carrying value = Par value-Unamortized discountUnamortized discount = Total discount-Amortized discount = $12,900-$5,160 = $7,740Carrying value = $430,000-$7,740 = $422,260Therefore, As a result, above are the straight-line method is used to amortize any bond discount.

Learn more about the amount here:

https://brainly.com/question/13024617

#SPJ9