suppose your upstream supplier becomes more profitable. then: group of answer choices you become more profitable by acquiring it you become less profitable by acquiring it acquiring it will make you more profitable as you can charge a higher price due to complementarity acquiring it will make your firm more profitable only if there are synergies to exploit through the acquisition previous

Answers

Acquiring it will make you more profitable as you can charge a higher price due to complementarity.

What is profitable?Profitability is a measure of an organization’s profit relative to its expenses. Organizations that are more efficient will realize more profit as a percentage of its expenses than a less-efficient organization, which must spend more to generate the same profit.Profitability is a situation in which an entity is generating a profit. Profitability arises when the aggregate amount of revenue is greater than the aggregate amount of expenses in a reporting period. If an entity is recording its business transactions under the accrual basis of accounting, it is quite possible that the profitability condition will not be matched by the cash flows generated by the organization, since some accrual-basis transactions (such as depreciation) do not involve cash flows.To learn more about business transaction refer to:

https://brainly.com/question/28036250

#SPJ4

Related Questions

As you learned in the unit, social media can be a help or a hindrance when it comes to your career. Name two social media platforms that are used by people to help them in their careers. Describe two ways each of those platforms can provide advantages in a job search and two ways each of those platforms could put job seekers at a disadvantage.

Answers

Answer:

Explanation: As previously said, social media can be both advantageous and harmful to your job. As a result, it is entirely dependent on how you used these sites.

(A) LinkedIn :

Advantages:This is a good search tool that may help you identify individuals in your sector and keep you informed about what's going on around you.It is beneficial in acquiring exposure to potential employers.Disadvantages:There is a possibility of identity theft.This platform's time consumption is one of its most significant drawbacks and turnoffs.Learn more about the social media here:

https://brainly.com/question/23976852

In early 2018, selected automobiles had an average cost of $20,000. The average cost of those same motor vehicles is now $24,000. What was the rate of increase for this item over this time period

Answers

Answer:

20%

Explanation:

Calculation for What was the rate of increase for this item over this time period

Using this formula

Rate of increase= (Ending avarage cost − Beginning avarage cost )/ Beginning avarage cost

Let plug in the formula

Rate of increase= ($24,000 − $20,000) / $20,000

Rate of increase= $4,000/$20,000

Rate of increase= 0.2*100

Rate of increase= 20%

Therefore the rate of increase for this item over this time period is 20%

Why should businesses take on the task of training the hard-core unemployed?

Answers

As part of their contributions to corporate social responsibility, businesses must provide training to hard-core unemployed groups.

As part of their obligations to the society in which they operate in order to generate profits, every profit-making business organization must fulfill a corporate social responsibility .

Providing the unemployed with basic skills training increases their likelihood of finding employment in a variety of sectors of the economy. It falls under the umbrella of corporate social responsibility because it is a welfare activity.

As a result, the significance of corporate social responsibility has been discussed previously.

Learn more about Hard core unemployed:

brainly.com/question/28548939

#SPJ1

Application of Forensic Accounting Concepts

Complete Case 21 & 28. Refer to the Case in the textbook for detailed instructions.

Answers

Answer:

An essential step in the incident response process is digital forensics. In order for law enforcement to use the information about a criminal incident, forensic investigators must identify and document it.

What is Digital Forensics?

In a court of law, rules and regulations governing this procedure are frequently crucial in demonstrating guilt or innocence. A person who is motivated to follow the trail of evidence and virtually solve a crime is a digital forensics investigator.

In this case, a computer forensic analyst would be called in to assess how attackers got onto the network, how they moved around it, and what they did there, including whether they stole data or installed malware.

In similar situations, a digital forensic investigator's job is to recover information such as documents, images, and emails from computer hard disks and other data storage devices, like zip and flash drives, that has been lost, destroyed, or in some other way altered.

Therefore, An essential step in the incident response process is digital forensics. In order for law enforcement to use the information about a criminal incident, forensic investigators must identify and document it.

Explanation:

Which regulation helps ensure that employees get pensions and other welfare benefit plans from their employers?

A.

Occupational Safety and Health Act

B.

Workers’ Compensation Program

C.

Fair Labor Standards Act

D.

Employee Benefit Security

Answers

D. Employee Benefit Security.

I have one problem in solving this accounts question. Please help me to find this answer

Answers

Based on the information, the Account to be debited and Account to be credited so given below.

How to explain the information(a) Bought office machinery on credit from D Isaacs Ltd.

Account to be debited - Office Machinery

Account to be credited - Accounts Payable (D Isaacs Ltd)

(b) The proprietor paid a creditor, C Jones, from his private funds.

Account to be debited - Accounts Payable (C Jones)

Account to be credited - Owner's Equity (Private Funds)

(c) A debtor, N Fox, paid us in cash.

Account to be debited - Cash

Accounts Receivable (N Fox)

(d) Repaid part of loan from P Exeter by cheque.

Account to be debited - Loans Payable (P Exeter)

Cash

(e) Returned some office machinery to D Isaacs Ltd.

Account to be debited - Accounts Payable (D Isaacs Ltd)

Office Machinery

(f) A debtor, N Lyn, pays us by cheque.

Account to be debited - Cash

Accounts Receivable (N Lyn)

(g) Bought van by cash.

Account to be debited - Van

Cash

Learn more about account on

https://brainly.com/question/26181559

#SPJ1

Jacqul makes $35 an hour working as an accounting assistant. She works 40 hours each month.

Answers

Answer:

35x40=1,400

Explanation:

jacqul will make 1,400 dollars per month or 16,800 a year

Answer:

9800

Explanation:

35x40=1400

1400x7=9800

2. Adama Garment which is operating in Adama currently has opened four new stores in Ethiopia. Data on monthly sales volume and labor hours are given below for each town. Which store location has the highest labor productivity?

Store

Bale-robe

Hawassa

Nekemt

Dahirdar

Sales volume

12000birr

60000birr

40000birr

25000birr

Labor hours

60

500

250

200

3. Adama Garment accountant (from Problem 2) suggests that monthly rent and hourly wage rate also be factored into the productivity calculations.

Hawassa pays the highest average wage at birr 6.75 an hour. Bale-Robe pays birr

6.50 an hour, Nekemte birr 6, and Bahirdar birr 5.50. The cost to rent store space

is birr 2000 a month in Hawassa, birr 800 a month in Nekemte, birr 1200 a month

in Bale-Robe, and birr 1500 a month in Bahirdar.

Which store is most productive?

Adama garment general manager is not sure it can keep all four stores open. Based on multifactor productivity, which store would you close? What other factors should be considered?

Answers

Adama Garment's Bale-robe store has the highest labor productivity. It generates 200 birr per labor hour, followed by Hawassa (40 birr/hour), Nekemt (16 birr/hour), and Dahirdar (12.5 birr/hour).

How to solveTo calculate labor productivity, we divide the monthly sales volume by the labor hours. Bale-robe has the highest labor productivity because it generates the most sales per labor hour.

Here is the table showing the labor productivity of each store:

Store Sales volume (birr) Labor hours Labor productivity (birr/hour)

Bale-robe 12,000 60 200

Hawassa 60,000 500 40

Nekemt 40,000 250 16

Dahirdar 25,000 200 12.5

Read more about labor productivity here:

https://brainly.com/question/6430277

#SPJ1

The initial investment for a project is $400,000, of which 35% will be financed with debt. The project would generate $72,000 in cash flow for equity holders if the firm were unlevered. If the interest rate on the debt is 8% and the tax rate is 24%, what is the cash flow to the equity holders given that the firm is leveraged?

Answers

Answer:

$63,488

Explanation:

Calculation for the cash flow to the equity holders given that the firm is leveraged

Using this formula

Equity holders Cash flow=Cash flow for equity holders -[(1-Tax rate)× Debt interest rate ×(Initial investment debt rate×Project initial investment)]

Let plug in the formula

Equity holders Cash flow=$72,000 - [(1−0.24)× 0.08 ×(0.35×$400,000)]

Equity holders Cash flow=$72,000 -(0.76× 0.08 × $140,000)

Equity holders Cash flow=$72,000-$8,512

Equity holders Cash flow=$63,488

Therefore the cash flow to the equity holders given that the firm is leveraged will be $63,488

Measure the angle in degrees.

Answers

Answer:

45°

Explanation:

If you look at it since the is backward due to the angle 180 would represent 0 and the 140 would be 40 so it is between the 140 and 130 marks so it is 45°.

Santeria Trading Inc. has manipulated its accounts to inflate its expenditure so it is subject to fewer taxes than it would have to pay

otherwise. Which element of the internal accounting control does Santeria fail to comply with?

OA

policies

OB

monitoring

Oc.

accounting system

OD.

risk assessment

ОЕ.

environmental control

Answers

Answer:

environmental control

Explanation:

Control environment refers to the company's attitude towards internal control. In this case, the company is manipulating its accounts on purpose, meaning that the whole attitude is to not follow internal control procedures. Sometimes companies forge financial records for different reasons and several employees and management collude in order to do it. An example is Enron, where even the auditing firm knew about the irregularities in Enron but decided to help them hide them.

Which moves the food from the esophagus to the stomach?

Answers

Answer:peristalsis

Explanation:

that is the job of your peristalsis after you swallow, peristalsis pushes the food down your esophagus into your stomach. hope this helps

The intangible assets of firms with a public good property tend to invest directly in foreign countries: Multiple Choice to use these assets on a larger scale, and to avoid the misappropriation that may occur while transacting in foreign countries through the market mechanism. None of the options. to avoid the misappropriation that may occur while transacting in foreign countries through the market mechanism. to use these assets on a larger scale.

Answers

Liability of foreignness refers to the assimilation benefits that make it alluring to create a decent administration in-house.

An intangible asset is a recognizable non-financial resource without actual substance. Such a resource is recognizable when it is divisible, or when it emerges from authoritative or other lawful freedoms. Divisible resources can be sold, moved, authorized, and so on.

The principal kinds of immaterial resources are altruism, brand value, Scholarly properties (Proprietary advantages, Licenses, Brand names, and Copyrights), authorizing, Client records, and Research and development. Generally, the upsides of elusive resources are not kept yet to be determined sheet. Generosity, memorability, and licensed innovation, like licenses, brand names, and copyrights, are elusive resources. Theoretical resources exist contrary to substantial resources, which incorporate land, vehicles, gear, and stock.

To learn more about intangible assets here

https://brainly.com/question/13848560

#SPJ4

Click to review the online content. Then answer the question(s) below, using complete sentences. Scroll down to view additional

questions.

Online Content: Site 1

What is the main difference in the way that "earned income" and "capital gains (or portfolio income)" are acquired?

Answers

The main difference in the way that "earned income" and "capital gains (or portfolio income)" are acquired is:

Earned income is money gained though occupation.Capital additions are medium of exchange gained though investment(s).Salary, bonuses, commissions, and tips that you receive from an employer or the company are examples of earned money.

Capital gains are funds received as a result of the sale of an investment such as stocks or real estate. Earned income is often taxed more heavily than gains from investments, which are taxed less heavily.

As a result, the significance of the main difference in the way that "earned income" and "capital gains (or portfolio income)" are acquired are the aforementioned.

Learn more about on earned income, here:

https://brainly.com/question/31313769

#SPJ1

When is economic expansion occur

Answers

Answer:

The expansion occurs during times of economic stimulation, where there is a rise in employment, followed by consumer confidence and discretionary spending. The phase is also known as economic recovery.

Why do people establish their own business?

Answers

Answer:

financial freedom

Explanation:

the reasons people start their own business is usually because they desire financial freedom meaning they would like have more disposable resources for themselves.

Gains on the sale of long-term assets are:

A. added to operating activities.

B. added to investing activities.

C. added to financing activities.

D. subtracted from operating activities.

Answers

Gains on the sale of long-term assets are added to investing activities. Therefore, option B is correct.

When a long-term asset is sold at a gain, the cash received from the sale is classified as a cash inflow in the investing activities section. This section of the statement of cash flows includes transactions related to the sale of long-term assets, such as property, plant, and equipment, and investments in other companies.

Gains on the sale of long-term assets are considered investment-related gains and are included in this section to provide a comprehensive view of the organization's investing activities.

Learn more about assets, here:

https://brainly.com/question/14826727

#SPJ1

what is your analysis on walmart financial health as of january 2021 compare to 2022

Answers

I think the analysis is good compared to the year of 2021

which of the following is not covered under the americans with disabilities act? employees of private organizations employment agencies state government employees labor unions

Answers

Act on Americans with Disabilities (ADA) The ADA forbids discrimination based on a handicap in the workplace, municipal, state, and federal government, as well as in commercial and public facilities.

What Doesn't the Americans with Disabilities Act Cover?Disabilities must be categorised as physical or mental problems under the ADA. For instance, conditions like broken bones that fully heal are not included by this definition of ADA disability. every kind of cancer.

What are the quizlet's key tenets regarding the Americans with Disabilities Act?It mandates that all federally financed programmes be usable by those with impairments, as well as that government employers make a reasonable effort to accommodate their disabled staff members.

To know more about federal government visit:-

https://brainly.com/question/30468020

#SPJ1

Given the information below, calculate the net cash provided from operating activities for Baskin Peter Pty. Ltd.

Receipts from customers $279,247

Payments for property, plant & equipment $42,310

Interest paid $4,231

Proceeds from issue shares $25,836

Payments to supplier and employees $220,013

Repayment of borrowings $53,331

GST paid $16,924

Payments for motor vehicle $37,985

Interest received $6,770

Select one:

$61,773

$44,849

$55,345

$49,080

Answers

The cash inflows from operating activities are:

Receipts from customers: $279,247

Interest received: $6,770

Total cash inflows from operating activities: $286,017

The cash outflows from operating activities are:

Payments to suppliers and employees: $220,013

GST paid: $16,924

Total cash outflows from operating activities: $236,937

Therefore, the net cash provided from operating activities is:

Net cash provided from operating activities = Cash inflows from operating activities - Cash outflows from operating activities

Net cash provided from operating activities = $286,017 - $236,937

Net cash provided from operating activities = $49,080

Therefore, the net cash provided from operating activities for Baskin Peter Pty. Ltd. is $49,080.

So the answer is D) $49,080.

How is emotional intelligence related to motivation?

Answers

Answer:

Emotional intelligence means being self-motivated

Self-motivation relates to internal drive. Emotionally intelligent individuals understand the deeper meaning of their goals and the self-motivation skills required to achieve them.

Answer:

The results show that emotional intelligence is positively related to positive emotions and negatively related to negative emotions. Positive emotions positively predict both self-motivation towards physical education classes and resilience. Resilience positively predicts self-motivation.

What is the difference between final goods and intermediate goods?

Answers

A) Final goods are goods that are purchased by the end-consumer or user for their personal consumption or use.

B) Intermediate goods, on the other hand, are goods that are used as inputs in the production of other goods.

Final goods and intermediate goods are terms used in economics to distinguish between different types of goods in the production process. Here's a breakdown of the difference between the two:

1. Final Goods:

Final goods are goods that are purchased by the end-consumer or user for their personal consumption or use. These goods are ready for consumption and do not undergo further processing or transformation before reaching the final consumer. Examples of final goods include food products, clothing, electronics, furniture, and vehicles. Final goods are the end result of the production process and are intended for final consumption or use.

2. Intermediate Goods:

Intermediate goods, on the other hand, are goods that are used as inputs in the production of other goods. They are not intended for final consumption but are instead used as raw materials, components, or capital goods in the production process. Intermediate goods undergo further processing or transformation before being included in the final goods. Examples of intermediate goods include raw materials like steel or wood, components like circuit boards or engines, and machinery or equipment used in production.

The key distinction between final goods and intermediate goods lies in their purpose and stage in the production process. Final goods are produced for the ultimate satisfaction of consumers' needs and are ready for consumption, while intermediate goods are used in the production of other goods and undergo further processing.

It's important to note that when calculating a country's Gross Domestic Product (GDP), only the value of final goods is considered. Intermediate goods are excluded to avoid double-counting, as their value is already included in the final goods they contribute to. By focusing on final goods, GDP provides a measure of the value of goods and services produced for final consumption in an economy.

for more such question on goods visit

https://brainly.com/question/25262030

#SPJ8

Central, Inc., is a manufacturer of granite paints. Sales are seasonal due to the seasonality in the home-building industry. The expected pattern of sales for the first quarters of 2011 is as follows:

Answers

The monthly sales rate made from granite paints in Central incorporations is:

February = 400 gallons

March = 266.6 gallons

Calculating the monthly rate:

The 1st quarter sales is Q1

The 2nd quarter sales is Q2

Note:

Q1= January, February & March

Q2= April, May & June

Given from the question:

Q1= 1200 gallons

Q2= 800 gallons

The monthly sales rate of is calculated by dividing the quarterly rate by 3

Q1= 1200 gallons/3 = 400

Q2= 800 gallons /3 = 266.6

The monthly sales rate made from granite paints in Central incorporations is:

February = 400 gallons

March = 266.6 gallons

What is sales forecasting?Sales forecasting can simply be defined as the process of estimating the future revenue by predicting the amount of goods, products or services a sales unit will sell in the next week, month, quarter, or year.

Therefore, the monthly sales rate made from granite paints in Central incorporations is:

February = 400 gallons

March = 266.6 gallons

Complete question:

Central, Inc., is a manufacturer of granite paints. Sales are seasonal due to the seasonality in the home-building industry. The expected pattern of sales for the first quarters of 2011 is as follows: Sales in Units 1st quarter 2nd Quarter Quantity 1,200 gallons 800 gallons

How much quantity sales of granite paint was sold in month of

(I) February

(II)May

Learn more about sales forecasting;

https://brainly.com/question/14019463

#SPJ1

Pension plan assets were $320 million at the beginning of the year. The return on plan assets was 5%. At the end of the year, retiree benefits paid by the trustee were $14 million and cash invested in the pension fund was $18 million. What was the amount of the pension plan assets at year-end?

Answers

Answer:

the amount of the pension plan assets at year-end $340 million

Explanation:

The computation of the pension plan assets at year end is shown below:

Plan asset beginning of year $320 million

Add: Actual return(5%×320) $16 million

Add: Cash contribution $18 million

Less Retiree benefits ($14 million)

End of year pension plan asset $340 million

Hence, the amount of the pension plan assets at year-end $340 million

The same is considered and relevant too

An even numbered card is chosen randomly from a set of cards labeled with the numbers 1 through 8. A second even numbered card is chosen after the first card is replaced. Are these dependent or independent events?

a.

dependent

b.

independent

Answers

Answer:

independent. This is a fun question. I never thought about how I would explain it before.

Explanation:

Can you think of anything that might influence the second even card being drawn?

Let's make the question a whole lot easier. Suppose you have a coin and it's a fair one just coming from the mint. Suppose you toss it and you get either heads or tails. Can you think of a reason why you should get the same thing again or put another way, can you guess what you are going to get next?If you can't then the tosses are independent of each other. You haven't replaced anything, like once you get a tails, you weight the coin so you can never get tails again. That would be a dependent event.If you can guess consistently, you better submit a written paper to a math journal.Now go back your your question. You replaced the card. The odds are the same as for the first toss. Is there anything that has changed your mind about being able to guess.

You can't guess, so the events are independent.

Why is it important to consider your education, hobbies, personality traits and corporations affect your decision to start a business based on your personal attributes and qualities? n

Answers

While coming up with a business idea, crucial to take into account one's background, interests, personality, professional experience, the sustainability of enterprise depends on individual came up the concept.

Why are character attributes deemed crucial for business owners?Entrepreneurs that are knowledgeable and skilled tend to be more confident. They can listen to other people's viewpoints without feeling scared thanks to their confidence. Entrepreneurs should be very creative and innovative. Being resilient in spite of setbacks or difficulties enables you to keep going and try again till you win. This is among the qualities that are most crucial for success since it prevents individuals from giving out on their ambitions.

To know more about Entrepreneurs visit:

https://brainly.com/question/13897585

#SPJ1

2. In designing their strategy, most

international firms have to decide

whether they want to enter markets

incrementally (the waterfall approach)

shower

or simultaneously (the

approach). As a

international marketing,

student

of

what will be

your key arguments for choosing

either of such approaches.

Answers

The majority of global businesses must determine whether they wish to simultaneously enter markets or do it incrementally (the waterfall technique) (the approach). What will be your main justifications for deciding on one of these strategies, as a student of international marketing?

The Waterfall Strategy: This method allowed businesses to take advantage of the market; often beneficial structure small businesses need more resources to cover several industries at once. In a cascade system, the new product is often introduced in stages as follows: first in the organization's home market, then in other developed markets, and last in less developed areas. After completing the initial phase, the company should evaluate the new locations that it will use to market its products; the introduction to each market will be completed step by step, taking into account how this market should be similar to the commercial center where the product is currently found. The following are the main advantages of using the cascade technique:

• Enables firms with limited resources to start their internationalization cycle gradually and choose the best method to enter new business sectors based on their interactions with each market.

• The level of risk is lowered because the company will approach each area in a staged manner and may decide to quit if they find any unhappiness with the product market.

• The item displays are continuously presented, and the item life cycle is increased:

Items that are nearing the end of their life cycle in the domestic market may enter other markets, increasing turnover and preventing item stockpiling.

Several drawbacks of this system include:

• Difficulties in the primary stage in the event that low achievement levels occur.

• Early imitation of the thing being displayed innovation (s)

Contrary to the cascade methodology, this approach, known as the concurrent system, searches for the advantages offered by every country at the same time. It takes into account that the time used to arrive to various business sectors is brief. However, some unique nation meetings may be entered before others.

The short pattern of the item requires more interest in R&D, which means that the organization has less of an ideal opportunity to amortize these costs. This type of procedure is somewhat complex because it is not difficult to adjust branches in other countries to create a fruitful section of the item in a short amount of time.

Shower protocol elements:

• Concurrent division into business segments

• Entry into the business sectors in a reasonably brief period of time; timeliness of the separation of useable issues;

· Establishing auxiliary

Benefits of the procedure include:

• Successful entry into industry sectors (also known as "amortization") for:

o quick invention and item cycles (for example semiconductors, PCs)

R&D processes might take a very long period.

• Ability to define market boundaries for competitors (by setting up a picture, for example).

profile)

the following basic flaws:

• Increasing need for co-appointment ("greatest" coordination issue)

• The need to promote co-appointment tools very fast.

To Know more about market

https://brainly.com/question/13414268

#SPJ9

The parameters of a waiting line system include all of the following except: a. service time.b. cost of capacity.c. queue discipline.d. arrival rates.

Answers

Answer:

b. cost of capacity

Explanation:

A waiting line system can be defined as the number of customers (people) or items (products) that are waiting to receive a service or cleared for the service taken i.e to successfully complete a transaction.

Hence, the parameters of a waiting line system include all of the following;

a. Service time: this is simply the total time it takes to complete a transaction process successfully.

b. Queue discipline: it is uses rules such as first-in first-out.

c. Arrival rates: the time each customer arrives for the service.

QUESTION ONE

ABC Ltd wishes to expand its business. On 31 Dec 2021, the company had

the following existing and proposed capital structures to support the

expansion programme.

1. The existing 8% debt capital has a book value of Ksh 50 000 000 and

matures in 10 years. The market value of debt at the close of business on

31 Dec 2021 was Ksh 40 000 000

2. A ten year loan of Ksh 300 000 000 is to be raised at an interest of 10

percent p.a. A cost of Ksh 20 000 000 will be incurred in raising this loan

3. A 12% preference stock capital stands in the books at Ksh 100 000 000

( 1 000 000 shares) and has a total market value of Ksh 150 000 000.

4. There are 40 000 000 ordinary shares with a current market price of Ksh

1500 each. The firm’s expected earnings per share (EPS) stand at Ksh

200, its growth rate is 6% and has a dividend payout of 60%.

5. The company plans to issue 10 000 000 ordinary shares at a market price

of Ksh 1 500 per share. The cost of floating the shares is estimated at Ksh

10 000 000.

Required:

i) Firm’s current weighted average cost of capital (10 marks)

ii) Firm’s expected weighted average cost of capital after the expansion

programme (i.e. marginal cost of capital) (5 marks)

QUESTION TWO

An investor intends to place Ksh 112,000,000 in the 91 days Treasury bill at a quoted rate/yield of 7.65%

p.a.

Required:

a) Compute the investor’s return, assuming that he is withholding tax-payer

b) Compute the investor’s return, assuming that he is non-withholding taxpayer (6 marks)

Answers

Answer:

rat

Explanation:

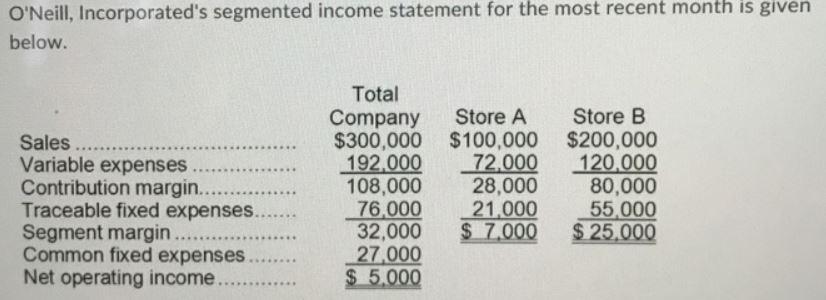

O'Neill, Incorporated's income statement for the most recent month is given below. If sales in Store B increase by $30,000 as a result of a $7,000 expenditure in fixed expenses: Select one: a. the contribution margin should increase by $18,000 b. the segment margin should increase by $12,000 c. the contribution margin should increase by $11,000 d. the segment margin should increase by $5,000

Answers

Answer: $5,000

Explanation:

The Contribution Margin (CM) given it $80,000 for Store B.

The Contribution margin ratio is;

= CM / Sales

= 80,000 / 200,000

= 40%

Given an increase of $30,000 in sales, increase in CM is;

= 30,000 * 40%

= $12,000

Traceable fixed costs for that increase was $7,000 so the segment margin will be;

= CM - Traceable fixed cost

= 12,000 - 7,000

= $5,000