The following events occur for The Underwood Corporation during 2021 and 2022, its first two years of operations.

June 12, 2021 Provide services to customers on account for $33,200.

September 17, 2021 Receive $18,500 from customers on account.

December 31, 2021 Estimate that 45% of accounts receivable at the end of the year will not be received.

March 4, 2022 Provide services to customers on account for $48,200.

May 20, 2022 Receive $10,000 from customers for services provided in 2021.

July 2, 2022 Write off the remaining amounts owed from services provided in 2021.

October 19, 2022 Receive $38,500 from customers for services provided in 2022.

December 31, 2022 Estimate that 45% of accounts receivable at the end of the year will not be received.

Required:

Calculate net accounts receivable at the end of 2021 and 2022.

2021 2021

Total accounts receivable

Less: Allowance for uncollectible acounts

Net accounts receivable

Answers

Answer:

Net account receivable

2021 $8,085

2022 $5,335

Explanation:

Calculation for the net account receivable

2021 2022

Total account receivable 14,700 9,700

(33,200-18,500=14,700)

(48,200-38,500=9,700)

Less: Allowance for doubtful accounts (6,615) (4,365)

(45%*14,700=6,615)

(45%*9,700=4,365)

Net account receivable 8,085 5,335

(14,700-6,615=8,085)

(9,700-4,365=5,335)

Therefore Net account receivable will be :

2021 $8,085

2022 $5,335

Related Questions

the oriole mills company has just disclosed the following financial information in its annual report sales of 1.47 million, cost of goods sold of $817,100, depreciation expenses of $179,600, and interest expenses of $ 94,000. Assume that the firm has an average tax rate of 29 percent. Compute the cash flows to investors from operating activity.

Answers

The cash flows to investors from operating activities for Oriole Mills Company is $543,973.

To compute the cash flows to investors from operating activities, we need to start with the net income and make adjustments for non-cash expenses and changes in working capital. The formula to calculate cash flows from operating activities is as follows:

Cash Flows from Operating Activities = Net Income + Depreciation Expenses + Non-Cash Interest Expenses - Increase in Current Assets + Increase in Current Liabilities + Decrease in Current Assets - Decrease in Current Liabilities

Given the financial information provided, we can calculate the cash flows to investors from operating activities as follows:

Net Income:

Net Income = Sales - Cost of Goods Sold - Depreciation Expenses - Interest Expenses - Taxes

Net Income = $1,470,000 - $817,100 - $179,600 - $94,000 - ($1,470,000 - $817,100 - $179,600 - $94,000) * 0.29

Net Income = $1,470,000 - $817,100 - $179,600 - $94,000 - ($379,300 * 0.29)

Net Income = $1,470,000 - $817,100 - $179,600 - $94,000 - $109,927

Net Income = $269,373

Depreciation Expenses = $179,600

Non-Cash Interest Expenses = $94,000

Changes in Working Capital:

Increase in Current Assets = 0 (no information provided)

Increase in Current Liabilities = 0 (no information provided)

Decrease in Current Assets = 0 (no information provided)

Decrease in Current Liabilities = 0 (no information provided)

Finally, we can calculate the cash flows to investors from operating activities:

Cash Flows from Operating Activities = $269,373 + $179,600 + $94,000 + 0 + 0 + 0 + 0

Cash Flows from Operating Activities = $543,973

Therefore, the cash flows to investors from operating activities for the Oriole Mills Company is $543,973.

For more question on investors visit:

https://brainly.com/question/31358905

#SPJ8

What is market environment

Answers

Answer:

The market environment is the combination of external and internal factors that affect a company's ability to establish a relationship with and serve its consumers.

Explanation:

The internal factors relate to the company itself, such as owners, workers, materials, components, etc.

The external factors are divided into macro and micro components. The macro component is the broad environment which includes societal forces that affect society as a whole. The micro component is task-related, which includes factors that influence the production, manufacturing and distribution of a product or service.

Question 2 of 10

Which action is a bank most likely to take when evaluating a loan application

from a person with a low credit score and a poor credit history?

A. Reducing the interest rate to encourage the person to borrow

more

B. Increasing the value of the loan to earn more interest over time

O C. Denying the loan because the person is unlikely to pay it back

O D. Requiring the person to take more than one loan at a time

SUBMIT

PREVIOUS

Answers

Answer:

C is the correct answer

Explanation:

Denying the loan because the person is unlikely to pay it back is a bank most likely to take when evaluating a loan application from a person with a low credit score and a poor credit history.

What is loan application?Borrowers apply for loans via a loan application. Through the loan application, borrowers provide vital financial information to the lender.

The loan application is crucial in determining whether or not the lender will approve your funding or credit request.

Thus, option C is correct.

For more details about loan application, click here

https://brainly.com/question/16053104

#SPJ2

Longview Hospital performs blood tests in its laboratory. The following standards have been set for each blood test performed:

Standard quantity or hours Standard price or Rate

Direct materials 2.0 plates $2.75 per plate

Direct labor 0.2 hours $15.00 per hour

Variable manufacturing overhead 0.2 hours $7.00 per hour

During May, the laboratory performed 1,500 blood tests. On May 1 there were no direct materials (plates) on hand; after a plate is used for a blood test it is discarded. Variable overhead is assigned to blood tests on the basis of standard direct labor-hours. The following events occurred during May:

• 3,600 plates were purchased for $9,540

• 3,200 plates were used for blood tests

• 340 actual direct labor-hours were worked at a cost of $5,550 The direct materials purchases variance is computed when the materials are purchased.

56/75.The materials price variance for May is: A. $360 F B. $360 U C. $740 F D. $740 U

57/76.The materials quantity variance for May is: A. $1,650 F B. $1,650 U C. $550 U D. $720 F

58/77.The labor rate variance for May is: A. $225 F B. $225 U C. $450 F D. $450 U

59/78.The labor efficiency variance for May is: A. $600 F B. $600 U C. $515 U D. $515 F

60/79.The variable overhead efficiency variance for May is A. $350 F B. $350 U C. $280 U D. $280 F

Answers

Answer:

Instructions are below.

Explanation:

Giving the following information:

Standard:

Direct materials 2.0 plates $2.75 per plate

Direct labor 0.2 hours $15.00 per hour

Variable manufacturing overhead 0.2 hours $7.00 per hour

Actual:

1,500 blood tests.

3,600 plates were purchased for $9,540

3,200 plates were used for blood tests

340 actual direct labor-hours were worked for $5,550

1)The materials price variance:

Direct material price variance= (standard price - actual price)*actual quantity

Direct material price variance= (2.75 - 2.65)*3,600= $360 favorable

2) The materials quantity variance:

Direct material quantity variance= (standard quantity - actual quantity)*standard price

Direct material quantity variance= (2*1,500 - 3,200)*2.75

Direct material quantity variance= $550 unfavorable

3) The labor rate variance:

Direct labor rate variance= (Standard Rate - Actual Rate)*Actual Quantity

Direct labor rate variance= (15 - 16.32)*340= $448.8 unfavorable

4) The labor efficiency variance:

Direct labor time (efficiency) variance= (Standard Quantity - Actual Quantity)*standard rate

Direct labor time (efficiency) variance= (1,500*0.2 - 340)*15

Direct labor time (efficiency) variance= $600 unfavorable

5) The variable overhead efficiency variance:

Variable overhead efficiency variance= (Standard Quantity - Actual Quantity)*Standard rate

Variable overhead efficiency variance= (1,500*0.2 - 340)*7

Variable overhead efficiency variance= $280 unfavorable

Consider the following statement: “An increase in the cost of oil will cause the price of a plane ticket to increase. This increase

in price will cause a decrease in demand for airline travel and a leftward shift in the demand curve."

What is the flaw of this reasoning?

O A decrease in demand will shift the curve rightward, not leftward.

O The increase in the cost of oil will cause a decrease in the price of a plane ticket.

O The cost of oil affects supply and not demand so prices of tickets will remain the same.

O An increase in the sice of a ticket will not cause a decrease in demand, but rather a decrease in quantity demanded.

Answers

The flaw in the reasoning is an increase in the price of a ticket will not cause a decrease in demand, but rather a decrease in quantity demanded.

When is there a change in quantity demanded?

There is a change in quantity demanded when the price of a good changes. For example, if the price of plane tickets increase, there would be a decrease in quantity demanded for airplane travel.

There is a change in demand when other factors except for the price of a good change. For example, if there is a news that airplane travel increase lifespan, there would be an increase in demand for airplane travel.

For more information about the change in demand, please check: https://brainly.com/question/25871620

*WILL MARK AS BRAINLIEST!*

The ICD-10-CM Index and Tabular List contains:

a. anatomic sites with four cellular classifications: malignant, benign, uncertain behavior, and unspecified nature

b. secondary codes that capture the cause, intent, place, activity, and status surrounding an injury or illness

c. specific illnesses, injuries, eponyms, abbreviations, and other descriptive diagnostic terms

d. a chronological list of codes compiled in 21 chapters based on body system or condition

Answers

Option D is correct

The index of ICD-10 CM contains alphabetical list of terms and corresponding values.A person or company that sells goods and or services to customers customer is called a

Answers

Answer: vendor

Explanation: A vendor is a general term for anyone who buys and sells goods or services. A vendor purchases products and services and then sells them to another company or individual. Large retailers, like Target, rely on many different vendors to supply products, which it buys at wholesale prices and sells at higher retail prices.

Which of the following is a buyer's obligation to the agent under a buyer representation agreement?

Unset starred question

Assisting in negotiations

Locating and showing properties

Notifying the other party of all changes to financing

Providing guidance throughout the transaction

Answers

In order to establish a foundation for a business connection, buyer's agents present to leads in a brief. Option C is correct .

What is buyer representation agreement?Semi-formal manner known as a buyer presentation. Agents utilize buyer presentations to better understand the true desires of their leads and to establish expectations for the market and the client-agent relationship.

The exclusive right to represent is another name for this arrangement. By agreeing to this contract, the buyer binds himself or herself to pay the brokerage company compensation in the event that the buyer purchases any property of the kind specified in the contract.

Learn more about buyer representation agreement here

https://brainly.com/question/28288628

# SPJ 1

Troy Juth wants to purchase new dive equipment for Underwater Connection, his retail store in Colorado Springs. He was offered a $63,000 loan at 8.5% for 24 months. What is his monthly payment by table lookup? (Use Table 14.2)

Note: Round your answer to the nearest cent.

Answers

If he was offered a $63,000 loan at 8.5% for 24 months. His monthly payment by table lookup is : $3071.

What is monthly payment?Monthly payment can be defined as the amount a person received on a monthly basis.

First step is to convert the month to year

Month to year = 24 / 12

Month to year = 2 years

Second step is to find the interest using this formula

I = P × R×T

Where:

I = Interest

P = Principal

R = rate

T = time

Hence

I = 63,000 × 2 × 8.5%

I = 10,710

So,

P+ I = 63,000 + 10,710

P+I = 73,710

Now let find the monthly payment:

Monthly payment = 73,710 / 24 months

Monthly payment = $3,071.25.

Monthly payment = $3,071 (Approximately)

Therefore the monthly payment is the amount of $3071

Learn more about monthly payment here: https://brainly.com/question/25599836

#SPJ1

the 3 hour per week that 100 million volunteers donate every year in the US is equal to how many full time worker

a. 1 million

b. 7.5 million

c. 100 million

d. 750 million

Answers

The equivalent number of full-time workers based on the 3 hours per week volunteered by 100 million volunteers in the US is approximately 144,230 full-time workers. Option C is the correct answer.

To calculate the equivalent number of full-time workers based on the 3 hours per week that 100 million volunteers donate every year in the US, we need to determine the total number of hours volunteered and divide it by the number of hours worked by a full-time worker in a year.

Let's assume a full-time worker works an average of 40 hours per week, and there are 52 weeks in a year.

Total hours volunteered per year:

3 hours per week * 100 million volunteers = 300 million hours

Total hours worked by a full-time worker per year:

40 hours per week * 52 weeks = 2,080 hours

Equivalent number of full-time workers:

300 million hours / 2,080 hours = approximately 144,230 full-time workers

Option C is the correct answer.

For such more question on equivalent:

https://brainly.com/question/29754038

#SPJ8

odson Company manufactures a product with a standard direct labor cost of 2.3 hours of labor per unit at $10.60 per hour. Last month, 170 units were produced using 90 hours at $11.60 per hour. What was the company's labor quantity variance

Answers

Answer:

Direct labor time (efficiency) variance= $3,190.6 favorable

Explanation:

To calculate the direct labor quantity variance, we need to use the following formula:

Direct labor time (efficiency) variance= (Standard Quantity - Actual Quantity)*standard rate

Direct labor time (efficiency) variance= (391 - 90)*10.6

Direct labor time (efficiency) variance= $3,190.6 favorable

Standard quantity= 2.3*170= 391

Summarize the benefits and problems of the global food system.

Answers

Answer: Their are many benefits of the global food system, there are also problems.

Explanation: Weather impacts our food globally when their are droughts, storms etc. You need to consider that some people don't have access to food, or water access. Climate change is a big factor when it comes tothe global food system.

To what extent is there anything positive to be said for bureaucratic structures? Select a large-scale organization of your choice and suggest ways in which it displays characteristics of a bureaucracy

Answers

Answer:

Even though the bureaucratic structure has received a lot of criticism, it has some advantages. Accountability, predictability, structure and job security are just a few to mention. Furthermore, a bureaucratic culture is based on impersonal relationships, discouraging favoritism

The subsidiary of a U.S. corporation located in Country Y generated income of $1,000,000 on which it paid $400,000 (40%) in taxes to Country Y. The subsidiary paid a dividend to the U.S. parent of $54,000. How much tax is currently owed to the U.S. government if the federal tax rate is 35%

Answers

Answer:

The tax currently owed to the U.S. government is:

$18,900

Explanation:

a) Data and Calculations:

Income generated by the foreign subsidiary = $1,000,000

Tax paid by the subsidiary in its country of residence = $400,000

Dividend paid to the U.S. parent = $54,000

Federal tax rate = 35%

Tax on the dividend = $18,900 ($54,000 * 35%)

b) The dividend of $54,000 is a foreign-source income earned by a U.S. parent corporation. This is this amount that will be subject to tax in the U.S. and not the net income of the subsidiary.

the wildlife department has been feeding special food to rainbow trout finger lings in a pond. A sample of weight of 40 trout revealed that the mean weight is 402.7 grams and the standard deviation 8.8 grams .

what is estimated mean wight of population? what is 99% confidence interval?,what degree of confidence is being used? interparet the result

Answers

We estimate the mean weight of the population to be 402.7 grams, with a 99% confidence interval of (398.77, 406.63) grams. The degree of confidence used is 99%.

To estimate the mean weight of the population of rainbow trout fingerlings, we can use the sample mean as an estimate. In this case, the sample mean weight is 402.7 grams.

Since the sample is a good representation of the population, we can consider this as our estimate for the population mean weight.

To determine the 99% confidence interval, we need to calculate the margin of error. The margin of error is given by multiplying the critical value (z*) with the standard deviation of the sample mean.

For a 99% confidence level, the critical value is 2.576 (obtained from a standard normal distribution table).

The margin of error is then calculated as 2.576 * (8.8 / sqrt(40)), which equals 3.932 grams. Therefore, the 99% confidence interval for the mean weight of the population is 402.7 ± 3.932, or approximately (398.77, 406.63) grams.

The degree of confidence used is 99%, meaning that if we repeated the sampling process multiple times, approximately 99% of the resulting confidence intervals would contain the true population mean weight.

In conclusion, we estimate the mean weight of the population to be 402.7 grams, with a 99% confidence interval of (398.77, 406.63) grams. This means we are 99% confident that the true population mean weight falls within this range.

For more such questions on population

https://brainly.com/question/25849702

#SPJ11

What is knowledge of your own thought process and strategies?

Answers

Answer:

Flavell said that metacognition is the knowledge you have of your own cognitive processes (your thinking). Flavell (1979). It is your ability to control your thinking processes through various strategies, such as organizing, monitoring, and adapting.

I don't know if that was the answer you were looking for.. but that's the best that I could do.

WHEN MUST A TAXPAYER WHO HAS RECIEVED STOCK APPRECIATION RIGHTS FROM AN EMPLOYER INCLUDE THE VALUE OF THE RIGHTS IN INCOME

Answers

Answer:

"There are no federal income tax consequences when you are granted stock appreciation rights. However, at exercise you must recognize compensation income on the fair market value of the amount received at vesting. An employer is generally obligated to withhold taxes. Depending on the rules of your plan, the employer may satisfy that withholding obligation by withholding cash or shares. The remaining net proceeds will be deposited into a brokerage account. If you receive net shares and sell them at a later point, the appreciation in value of the shares from the time of exercise to the time of sale will be treated as a capital gain or loss. Whether it is a long-term or short-term gain or loss will depend on how long the shares are held."

Explanation:

I don't know if this helps, but here is a quate i found.

https://www.fidelity.com/webcontent/ap002390-mlo-content/18.09/help/learn_stock_appreciation_rights.shtml

Which of the following government

debt instruments would be around 10

years (long term) in length?

A. bills

B. notes

C. bonds

D. mortgages

Answers

Hope this helps

The following balances were extracted from the books of VE Enterprise on 31 December 2021.

Particular RM RM

Capital 50,000

Motor vehicles 90,000

Fixtures & fittings 48,500

Inventory as at 1 January 2021 32,200

Allowance for doubtful debts 500

Accumulated depreciations as at 1 January 2021:

Motor vehicles 16,000

Fixtures & fittings 10,400

3% fixed deposit 30,000

4% bank loan 50,000

Sales 199,070

Purchases 73,500

Sales returns 2,050

Purchases returns 2,120

Discount allowed 2,550

Discount received 2,830

Account receivables 37,700

Account payables 48,650

Carriage inwards 3,570

Interest received 450

Commission received 2,600

Salaries 16,100

Electricity bills 5,400

Custom duty on purchases 3,000

Insurances 450

Maintenance expenses 3,300

Drawing 2,300

Cash in hand 6,800

Cash at bank 25,200

Additional information:

1. Inventory as at 31 December 2021 18,180

2. Depreciation for the year ended 31 December 2021 has yet to be provided as follows:

a. Fixtures & fittings: 10% using straight line method

b. Motor vehicles:15% using reducing balance method.

3. Electricity bills was paid in advanced by RM500. Meanwhile RM400 commission are not

received yet.

4. One of the customers Amri Sport Enterprise was declare bankrupt and unable to pay the

debt amount RM700

5. The provision for doubtful debts is to be adjusted to 5% based on remaining account

receivables

6. Salaries are accrued by RM140.

3

7. ‘Purchases’ include goods valued at RM1,040 that were withdrawn by Azwin for her own

personal use.

Required:

a) Prepare Income Statement for the year ended 31 December 2021

(15 marks)

b) Prepare Statement of Financial Position as at 31 December 2021

Answers

a. The Income Statement for the year ended 31 December 2021 is RM80,360.

b. The Statement of Financial Position as at 31 December 2021 is RM206,645.

a) Income Statement for the year ended 31 December 2021:

Sales: RM199,070

Less: Sales returns: RM2,050

Net Sales: RM197,020

Cost of Goods Sold:

Opening Inventory: RM32,200

Purchases: RM73,500

Less: Purchases returns: RM2,120

Add: Carriage inwards: RM3,570

Goods Available for Sale: RM107,150

Less: Closing Inventory: RM18,180

Cost of Goods Sold: RM88,970

Gross Profit: RM197,020 - RM88,970 = RM108,050

Operating Expenses:

Discount allowed: RM2,550

Salaries: RM16,100 + RM140 = RM16,240

Electricity bills: RM5,400 - RM500 = RM4,900

Custom duty on purchases: RM3,000

Insurances: RM450

Maintenance expenses: RM3,300

Total Operating Expenses: RM30,340

Net Profit before Non-operating Items:

Gross Profit - Operating Expenses: RM108,050 - RM30,340 = RM77,710

Non-operating Items:

Interest received: RM450

Commission received: RM2,600 - RM400 = RM2,200

Total Non-operating Items: RM2,650

Net Profit before Tax:

Net Profit before Non-operating Items + Total Non-operating Items: RM77,710 + RM2,650 = RM80,360

b) Statement of Financial Position as at 31 December 2021:

Assets:

Non-current Assets:

Motor vehicles: RM90,000 - (RM90,000 * 15%) = RM76,500

Fixtures & fittings: RM48,500 - (RM48,500 * 10%) = RM43,650

Total Non-current Assets: RM120,150

Current Assets:

Inventory: RM18,180

Account receivables: RM37,700 - (RM37,700 * 5%) - RM700 = RM35,815

Prepaid electricity bills: RM500

Cash in hand: RM6,800

Cash at bank: RM25,200

Total Current Assets: RM86,495

Total Assets: RM206,645

Liabilities and Equity:

Equity:

Capital: RM50,000

Retained Earnings: RM80,360

Total Equity: RM130,360

Current Liabilities:

Account payables: RM48,650

Bank loan: RM50,000

Total Current Liabilities: RM98,650

Total Liabilities and Equity: RM206,645

For such more question on Financial:

https://brainly.com/question/989344

#SPJ8

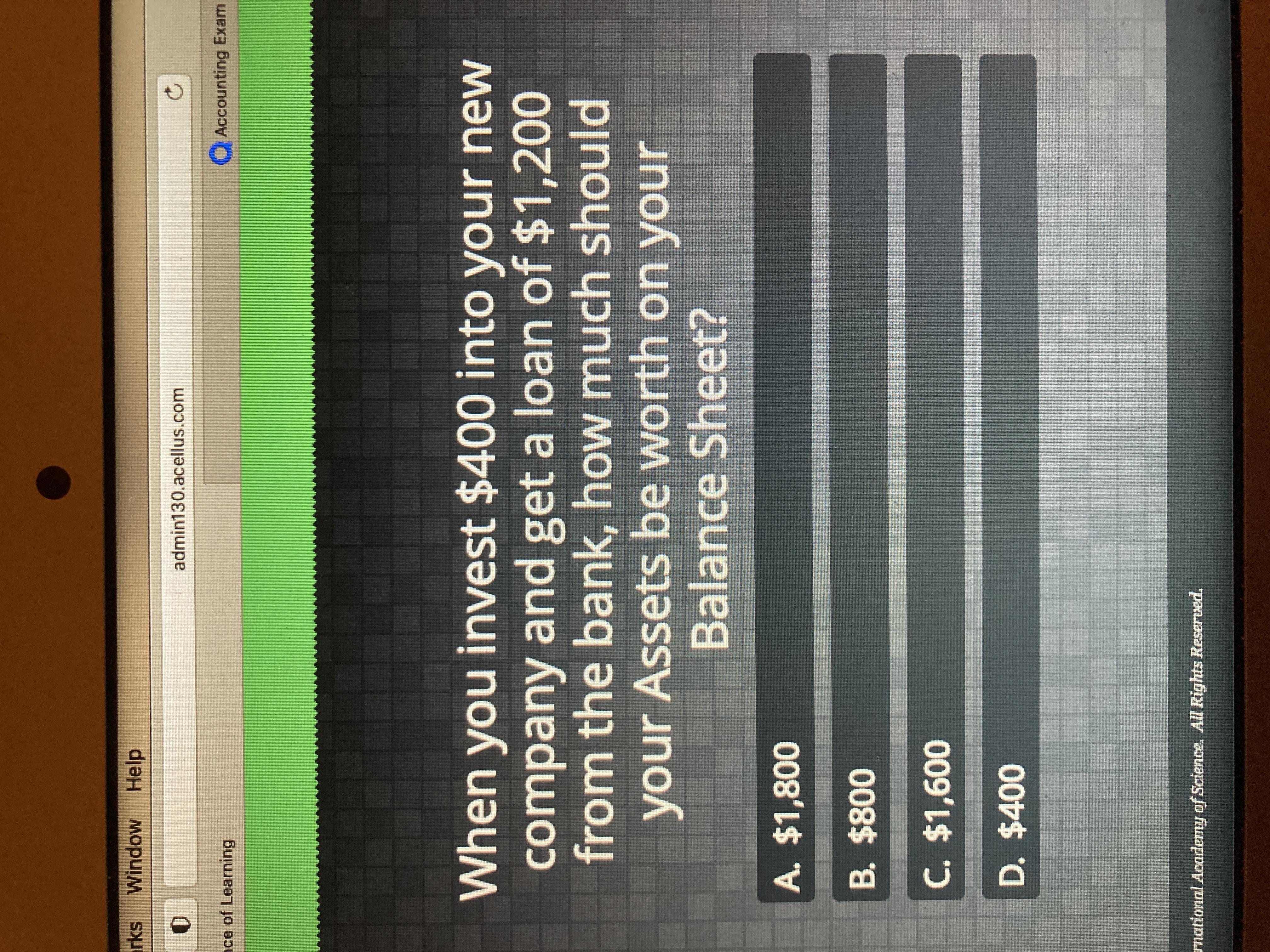

50 POINTS AND BRAINLIEST IF CORRECT!!!!

Answers

Answer:

C. $1600

Explanation:

You own $400 dollars worth of the company which is your asset/property. In addition, supposedly you're going to use that $1200 loan and invest that into the company as well, increasing your asset.

$1200 + $400 = $1600.

Answer:

The correct answer is (c) $1600. The balance sheet is a financial statement that shows a company's assets, liabilities, and equity at a specific point in time. When you invest $400 of your own money into the company and receive a loan of $1200 from the bank, the total value of your assets would be $1600, which is the sum of your investment and the loan.

The balance sheet is used to assess the financial health of a company by comparing its assets to its liabilities and equity. Assets represent the resources that a company owns or controls, such as cash, inventory, and property. Liabilities are obligations that a company owes to others, such as loans and accounts payable. Equity represents the residual interest in the assets of a company after liabilities have been settled.

In this case, your investment of $400 would be recorded as equity on the balance sheet, and the loan from the bank would be recorded as a liability. The total value of your assets would be $1600, which is the sum of your equity and the liability.

What is a work-study program?

(1 point)

O money given to somebody by an organization to help pay for their education

a type of loan designed to help students pay for postsecondary education and the associated fees, such as tuition, books and supplies, and living

expenses

O money, i.e., financial assistance, given by a government, organization, or person for a specific purpose

O

a federally funded program in the United States that assists students with the costs of postsecondary education by finding them employment

Answers

the work-study program is a federally funded program in the United States that assists students with the costs of postsecondary education by finding them employment. option (D)

A federally funded program in the United States that helps students with the costs of post-secondary education is the Federal Work-Study program, formerly known as the College Work-Study Program and commonly referred to as just "Work-study" in the country. An internship or work-study position in your academic area can give you valuable experience and even influence your future career decisions. Work-study is a fantastic way for students to make additional money while enhancing their resumes because many schools provide simple ways to locate jobs that are flexible and accommodating to class schedules. the work-study program is a federally funded program in the United States that assists students with the costs of postsecondary education by finding them employment.

Learn more about employment here :

https://brainly.com/question/29603057

#SPJ1

Coast-to-Coast Shipping Company's general manager reports quarterly to the

company president on the firm's operating performance. The company uses a

budget based on detailed expectations for the forthcoming quarter. The general

manager has just received the condensed quarterly performance report shown

below.

Budget Actual Variance

Net revenue $8,000,000 $7,600,000 $400,000 U

Fuel $160,000 $157,000 $3,000 F

Repairs and maintenance 80,000 78,000 2,000 F

Supplies and miscellaneous 800,000 788,000 12,000 F

Variable payroll 5,360,000 5,200,000 160,000 F

Total variable costs* $6,400,000 $6,223,000 $177,000 F

Supervision $160,000 $164,000 $4,000 U

Rent 160,000 160,000 ___

Depreciation 480,000 480,000 ___

Other fixed costs 160,000 158,000 2,000 F

Total fixed costs $960,000 $962,000 $2,000 F

Total costs charged against Revenue $7,360,000 $7,185,000 $175,000 F

Operating income $640,000 $415,000 $225,000 U

U = Unfavorable F = Favorable

*For purposes of this analysis, assume that all these costs are totally variable with respect to sales

revenue. In practice, many are mixed and have to be subdivided into variable and fixed components

before a meaningful analysis can be made. Also assume that the prices and mix of services sold remain

unchanged.

Although the general manager was upset about not obtaining enough revenue, she was happy that her

cost of performance was favorable; otherwise her net operating income would be even worse.

The president was totally unhappy and remarked: "I can see some merit in comparing actual

performance with budgeted performance because we can see whether actual revenue coincided with our

best guess for budget purposes. But I can't see how this performance reports helps me evaluate cost

control performance."

Required:

1. Prepare a columnar flexible budget for Coast-to-Coast Shipping at revenue levels of $7,000,000;

$8,000,000; and $9,000,000. Assume that the prices and mix of products sold are equal to the budgeted

prices and mix.

2. Express the flexible budget for costs in formula form.

3. Prepare a condensed table showing the master (static) budget variance, the sales volume variance,

and the flexible budget variance

Answers

1. Columnar Flexible Budget:

$7,000,000 $8,000,000 $9,000,000

Net Revenue $7,000,000 $8,000,000 $9,000,000

Fuel $140,000 $160,000 $180,000

Repairs and Maintenance $70,000 $80,000 $90,000

Supplies and Miscellaneous $700,000 $800,000 $900,000

Variable Payroll $4,690,000 $5,360,000 $6,030,000

Total Variable Costs* $5,600,000 $6,400,000 $7,200,000

Supervision $140,000 $160,000 $180,000

Rent $160,000 $160,000 $160,000

Depreciation $480,000 $480,000 $480,000

Other Fixed Costs $160,000 $160,000 $160,000

Total Fixed Costs $940,000 $960,000 $960,000

Total Costs $6,540,000 $7,360,000 $8,160,000

Operating Income $460,000 $640,000 $840,000

2. Formula for Flexible Budget Costs:

Total Variable Costs = (Variable Cost per Unit * Net Revenue) + Total Fixed Costs

3. Condensed Table:

Variance Master (Static) Budget Sales Volume Variance Flexible Budget Variance

Net Revenue $400,000 UF $0 $200,000 UF

Total Costs $175,000 F $0 $50,000 F

Operating Income $225,000 U $0 $150,000 U

The Master (Static) Budget Variance is the difference between the budgeted net revenue and the actual net revenue. In this case, it is an unfavorable variance of $400,000.

The Sales Volume Variance is the difference between the flexible budget net revenue and the budgeted net revenue. Since there is no change in the sales volume, this variance is zero.

The Flexible Budget Variance is the difference between the flexible budget total costs and the actual total costs. In this case, it is a favorable variance of $50,000. This indicates that the company was able to control costs better than anticipated.

For more such questions on Miscellaneous

https://brainly.com/question/31590400

#SPJ11

With all other economic forces held constant, an increase in labor productivity throughout the country implies

(1 point)

an increase in GDP due to an increase in labor hours

a decrease in GDP with labor hours held constant

an increase in GDP with labor hours held constant

a decrease in GDP due to an increase in labor hours

Answers

When there is an increase in labor productivity, we observe that there is an increase in GDP with labor hours held constant.

Labor productivity:

Is goods produced by labor within a certain period of time Increases when more goods are produced in that periodLabor productivity therefore relates to goods being produced when the labor hours are kept constant. An increase in labor productivity is good for GDP because it means that more goods are being produced.

In conclusion, increased labor productivity means increased GDP at constant labor hours.

Find out more at https://brainly.com/question/6430277.

Here y'all!

1. an increase in GDP with labor hours held constant

2. A graphic designer attends a week-long seminar and learns advanced skills she can apply to her work.

3. the discovery of a way to improve software speed that increases employee productivity

4. discovering an inexpensive way to make steel

5. false since technological improvements can lead to certain jobs becoming obsolete

Your welcome ;)

The creditors are not paid on time and added interest to the account of the business. What will be the consequences if this continues to happen?

Answers

Answer:

Your debt will go to a collection agency, and your credit history and score will be affected!

Explanation:

What is true about writing a cover letter

Answers

The true statements about writing cover letters are that:

A cover letter should be tailored to meet the objectives of the job you are seekingA cover letter should highlight your skills and experiencesWhat goes into the cover letter?A cover letter is the letter written to a company that you are applying for a job in. The cover letter basically introduces who you are, why you are applying, and what you think you can add to the company that would be of value. As a result, it is best that you tailor the cover letter to the objectives of the job that you are applying for, or that you are seeking.

To help you stand a better chance of being considered, you should include your skills and experiences. Even though these will already be highlighted in your resume, there is still a need to summarize it on the cover letter so that the person doing the screening can take note. However, be careful of the fact that some jobs don't ask for cover letters.

Options for this question include:

A cover letter should be tailored to meet the objectives of the job you are seekingA cover letter should explain skills you don't possessA cover letter should be informal and talkative to make the best impressionA cover letter should highlight your skills and experiencesA cover letter should describe why you left your former jobFind out more on cover letters at https://brainly.com/question/3602860

#SPJ1

Circle Square, incorporated had an ROI of 9%, turnover of 3.0, and sales of 4 million for the year. What is the margin for the year

Answers

The margin for the year is 30% for Circle Square, incorporated had an ROI of 9%, turnover of 3.0, and sales of 4 million for the year.

What is margin?

To calculate the margin, we can use the formula:

Margin = Net Income / Sales

First, we need to find the net income, which is calculated as:

Net Income = ROI x Total Assets

Total Assets = Sales / Turnover

Net Income = ROI x (Sales / Turnover)

Net Income = 0.09 x (4,000,000 / 3.0)

Net Income = $1,200,000

Now we can calculate the margin:

Margin = Net Income / Sales

Margin = $1,200,000 / $4,000,000

Margin = 0.30 or 30%

Therefore, the margin for the year is 30%.

What are the assets?

An asset is a resource that is owned or controlled by an individual, company, or organization that has economic value and is expected to generate future benefits. Assets can be both tangible and intangible. Tangible assets are physical objects that can be seen and touched, such as buildings, equipment, inventory, and cash. Intangible assets, on the other hand, are non-physical items that do not have a physical presence but still have value, such as intellectual property, brand names, patents, trademarks, and copyrights.

Assets are recorded on a company's balance sheet and are typically classified as current assets, such as cash or inventory that can be converted to cash within one year, or long-term assets, such as buildings or equipment that will provide future economic benefits over a period of several years.

To know more about margin, visit:

https://brainly.com/question/7781429

#SPJ1

Discuss how expatriates experience reverse culture shock in the repatriation process. What can companies do to help expatriates continue to be part of their home communities? If you were going through the repatriation process, what would you want the company to do for you and your family?

Answers

Answer:

fvsvfdc

Explanation:

A designated brokerage appointment is established when

Answers

Designated Brokerage was established to completely detach the broker-client connection from the company, the employing broker, and any employed associate brokers.

What exactly is a designated appointed agency?In a real estate transaction, a designated agency occurs when two agents from the same broker represent the parties. Agency appointed is another name for designated agency. In a designated agency scenario, despite the fact that both agents are employed by the same broker, each party has the option of receiving representation from a separate agent.

Note that a designated broker is the owner of a real estate company who is in charge of managing daily operations for other brokers, office personnel, and private clients.

Learn more about brokerage from

https://brainly.com/question/14898119

#SPJ1

Describe two types of organizational documents that can help you organize a job search. What is the purpose of each document? need answer asap

Answers

Answer: A job search should be done using various filters in the search engines so that one can get only the specific results.

Explanation:

A JOB LEADS SOURCE LIST:

It can help us to find all the specific job lists.

The information includes contact information about the source company.

A PERSPECTIVE EMPLOYER RECORD:

It is used to gather information about hiring status, recording information, and can help in asking questions related to employment.

Answer:

Two documents that you could use to organize your job search include a Job Leads Source List and a Prospective Employer Record. A Job Lead Source List is used to help record all of the job leads you find. It includes contact information and a plan of action for how to use the job lead. A Prospective Employer Record is used to gather additional information about a job lead, using the contact information and plan of action from the Job Lead Source List. The Prospective Employer Record gathers information about each job leads hiring status, job potential, and follow-up methods.

Explanation:

Sample response; edge 2020

What is the total cost of ownership