The following transactions occur for Badger Biking Company during the month of June: a. Provide services to customers on account for $32,000. b. Receive cash of $24,000 from customers in (a) above. c. Purchase bike equipment by signing a note with the bank for $17,000. d. Pay utilities of $3,200 for the current month. Analyze each transaction and indicate the amount of increases and decreases in the accounting equation. (Decreases to account classifications should be entered as a negative.)

Answers

Answer:

The Accounting Equation is: Assets = Liabilities + Stockholders' Equity. Thus, we will see how each transaction affects liabilities, assets, or, stockholders' equity.

a. Provide services to customers on account for $32,000.

Service revenue: $32,000 to stockholders equity.

Accounts receivable: $32,000 to assets.

b. Receive cash of $24,000 from customers in (a) above.

Cash: $24,000 to assets.

Accounts Receivable: ($24,000) to assets.

c. Purchase bike equipment by signing a note with the bank for $17,000.

Equipment: $17,000 to assets.

Accounts payable: $17,000 to liabilities.

d. Pay utilities of $3,200 for the current month.

Uitlities expense: ($3,200) to stockholders equity.

Cash: ($3,200) to assets.

Related Questions

A stock will pay no dividends for the next 5 years. Then it will pay a dividend of $5 growing at 2%. The discount rate is 10%. What should be the current stock price?

Answers

Answer:

$38.81

Explanation:

The value of the stock is the present value of its future divided payments, bearing in mind that the first dividend is payable six years from,hence, the present value of dividend in year 5( a year before its payment) is then computed thus:

PV of dividend at the end of year 5=expected dividend/discount rate-growth rate

expected dividend in year 6=$5

discount rate=10%

growth rate=2%

PV of dividend at the end of year 5=$5/(10%-2%)

PV of dividend at the end of year 5=$62.50

We need to discount the PV backward by 5 years to show the stock value today

the current stock price=$62.50/(1+10%)^5

the current stock price= $38.81

An electronic card that is derectly connected to a checking account is known as a

Answers

Answer:

debit card

Explanation:

a checking account is also known as a savings account

Two new companies start to produce HDTVs. This results in _____ in the _____ HDTVs.

an increase, supply of

an increase, demand for

no change, supply of

no change, demand for

Answers

Answer:

an increase, supply of

Explanation:

Answer:

AN INCREASE SUPPLY OF

Explanation:

trust me bro

Alfred E. Old and Beulah A. Crane, each age 42, married on September 7,2017. Alfred and Beulah will file a joint return for 2019. Alfred's Social Security number is 111-11-1109. Beulah's Social Security number is 123-45-6780, and she adopted "Old" as her married name. They live at 211 Brickstone Drive, Atlanta, GA 30304. Alfred was divorce from Sarah Old in March 2016. Under the divorce agreement, Alfred is to pay Sarah $1,250 per month for the next 10 years or until Sarah's death, whichever occurs first. Alfred pays Sarah $15,000 in 2019. In addition, in January 2019, Alfred pays Sarah $50,000, which is designated as being for her share of the marital property. Also, Alfred is responsible for all prior years' income taxes. Sarah's Social Security number is 123-45-6788. Alfred's salary for 2019 is $150,000. He is an executive working for Cherry.Inc. (Federal I.D. No. 98-7654321). As part of his compensation package, Cherry provides him with group term life insurance equal to twice his annual salary. His employer withheld $24,900 for Federal income taxes and $8,000 for state income taxes. The proper amounts were withheld for FICA taxes. Beulah recently graduated from law school and is employed by Legal Aid Society.Inc. (Federal I.D. No. 11-1111111), as a public defender. She receives salary of $42,000 in 2019. Her employer withheld $7,500 for Federal income taxes and $2,400 for state income taxes. The proper amounts were withheld for FICA taxes. Alfred and Beulah had interest income of $500. They received $1,900 refund on their 2018 state income taxes. They claimed the standard deduction on their 2018 Federal income tax return. Alfred and Beulah pay $4,500 interest and $1,450 property taxes on their personal residence in 2019. Their charitable contributions total $2,400 (all to their church). They paid sales taxes of $1,400, for which they maintain the receipts. Alfred and Beulah have never owned or used any virtual currency, and they do not want to contribute to the Presidential Election Campaign. Compute the Old's net tax payable (or refund due) for 2019. Suggested software: ProConnect Tax Online

Answers

To compute the Olds' net tax payable (or refund due) for 2019, we need to gather all the relevant information and calculate their taxable income, apply the appropriate tax rates, deductions, and credits. Since the tax calculation involves various factors and tax laws, it would be best to use tax software such as ProConnect Tax Online or consult with a tax professional. The software will streamline the process and ensure accurate calculations based on the specific tax laws and regulations applicable to the Olds' situation.

Identify the environmental factor that is a characteristic of an an attractive environment.

Answers

the answer was already on brainly btw!

There are five environmental factor for an attractive environment.

Few CompetitorsLow threatFew substitutesMany suppliersMany customers.Types of Environmental FactorsInternal environmental factors: In the internal business environment there are elements within an organization that influence the approach and success of commercial operations.External environmental factors: The external environment comprises a range of factors outside a commercial enterprise over which we do not have much control.For more information about environmental factors click on https://brainly.com/question/13310446

#SPJ2

Determine the total expenses based on the following data

assets 72,000

owner's equity 70,000

revenues 20,000

liabilities 16,000

Answers

From the given data, it appears that the expenses result in a negative value of $-14,000. This indicates a deficit, which suggests that the company's liabilities and owner's equity exceed its assets.

To determine the total expenses based on the given data, we need to use the accounting equation: Assets = Liabilities + Owner's Equity. In this case, we are given the values of assets, owner's equity, and liabilities.

Assets = $72,000

Owner's Equity = $70,000

Liabilities = $16,000

Using the accounting equation, we can calculate the total expenses by rearranging the equation:

Expenses = Assets - Liabilities - Owner's Equity

Expenses = $72,000 - $16,000 - $70,000

Expenses = $-14,000

for more questions on expenses

https://brainly.com/question/28995167

#SPJ8

Explain how collaboration could improve team performance

Answers

Answer:Why is collaboration important? Collaboration improves the way your team works together and problem solves. This leads to more innovation, efficient processes, increased success, and improved communication

Explanation:Brainliest award

a) Identify and discuss three (3) major risks fims are always averse when they enter into

international markets especially developing economies.

(b)

Prices of goods quoted in the international marvets always have trade terms. Identify four (4)

of these terms and briefly discuss/define giving their implications for the parties involved.

Answers

Foreign exchange and political risks are the two main dangers that come with doing business internationally. It may occasionally be difficult for businesses to sustain steady and predictable revenue because of these difficulties.

What do you mean by the international market?Marketing goods or services to consumers outside of your brand's home market is known as international marketing. Consider it to be a form of international trade.

Brands may build a worldwide audience, raise their profile, and, of course, expand their business by entering international markets.

Export, licensing, franchising, joint ventures, and foreign direct investment are examples of several forms of international marketing. The goal of global marketing is to meet customer demands internationally.

Therefore, IBM's international market is any location where it operates outside the confines of the United States. The company's domestic market, which is the geographical area inside the boundaries of a company's home country, is conceptually opposed to an international market.

Therefore, Foreign exchange and political risks are the two main dangers that come with doing business internationally. It may occasionally be difficult for businesses to sustain steady and predictable revenue because of these difficulties.

To know more about the international market, visit:

https://brainly.com/question/25010904

#SPJ5

What types of people make up a persons personal network

Answers

Match the terms with their correct definition:

______ Income

______ Land, labor, capital, entrepreneurship

______ Expenditures

______ Rent, wages, interest, profit

______ Revenue

Answers

Answer:

hope to help Please just read

Match the drawbacks of the scientific management theory to their respective outcomes in the workplace.

rigidity

lack of autonomy

mechanical nature

lack of feedback

Answers

Answer:

Explanation:

Plato Users

Production methods are standardized with no opportunity for individual initiative is known as lack of autonomy.

What are Production methods?A production process is a way to use economic resources, such as labor, expensive machinery, or land, to create goods and services for customers.

The manufacturing process typically addresses how to effectively and productively produce goods for sale so that clients can receive them fast without compromising the product's quality.

Depending on their manufacturing objectives, production volumes, and technology tools or software systems, organizations can use a wide range of production methods.

Making broad-based production decisions that have an impact on the productivity levels of product development and sales is a crucial component of the job of a manufacturing manager. Choosing the best production method frequently depends on the kind of technology you have access to.

For instance, without the right technology to track, categorize, or manufacture these products appropriately, you might not be able to adhere to a clear mass production structure if you receive a lot of orders for the same product.

Learn more about Production methods, here

https://brainly.com/question/14337394

#SPJ5

1. Some businesspeople believe that elimination agents and wholesalers reduce their operating expenses. Discuss the opportunity costs associated with eliminating intermediaries.

Answers

1. While eliminating intermediaries may result in reduced operating expenses, businesses need to weigh these savings against the associated opportunity costs. These costs may include the loss of expertise and value-added services, additional responsibilities and expenses, and reduced customer access to products.

Eliminating intermediaries such as elimination agents and wholesalers reduce operating expenses, but it also has associated opportunity costs that businesses need to consider. One of the primary costs is the loss of the expertise and value-added services that intermediaries offer to businesses and customers. Eliminating intermediaries may result in businesses taking on additional responsibilities and expenses such as marketing, distribution, and logistics.

This may result in the need for additional staff and resources to ensure that products reach customers on time. Furthermore, eliminating intermediaries may also result in reduced customer access to products, as intermediaries are often responsible for finding new markets and customer segments. In this case, businesses may need to invest additional resources to market and promote their products to reach new customers.

In conclusion, while eliminating intermediaries may result in reduced operating expenses, businesses need to weigh these savings against the associated opportunity costs. These costs may include the loss of expertise and value-added services, additional responsibilities and expenses, and reduced customer access to products.

For more such questions on opportunity costs

https://brainly.com/question/30191275

#SPJ8

Pls help me with the graph , the choices are below

Answers

the answer to your question is graph 1

Which of the following individuals has enrolled in a plan on a fixed income

Answers

Fixed income gives a steady of income to the individual.

What is a fixed income?The complete question wasn't found online. An overview was given as the complete information wasn't found.

It should be noted that a fixed income means an investment approach that is focused on presentation of capital and income.

The examples of fixed income include municipal bonds, certificate of deposit, etc.

It should be noted that fixed income orders a steady stream of income with less risk.

Learn more about income on:

brainly.com/question/2021736

#SPJ1

a US company owns 80% of interest in a company located on Mars. Martian currency is called The Martian credit during the year the parent company sold inventory that had a cost of 24500 to the subsidiary on account for 28,500 when the exchange was 0.519 to the subsidiary still held one half of the inventory and had not paid the parent company for purchase at the end of the physical year. The unsettled account is denominated in dollars the exchange rate at the fiscal year and was 0.4994 compute the amounts that would be reported for inventory and accounts payable in the subsidiary translated balance sheet the entities functional currency is the Martian credit

Answers

The amounts reported for inventory and accounts payable on the subsidiary translated balance sheet are 18,619 Martian credits and 14,217 Martian credits, respectively.

A US-based company that has an 80% stake in a Martian company has to report the assets, liabilities, and equity of its subsidiary on its consolidated financial statements in US dollars. The Martian currency is known as the Martian credit. During the year, the parent company sold inventory with a cost of 24500 to the subsidiary on account for 28,500 when the exchange rate was 0.519 to the subsidiary.

One-half of the inventory still belongs to the subsidiary, and at the end of the physical year, the subsidiary had not paid for the purchase.The account that remained unpaid is denominated in dollars, and the exchange rate was 0.4994 at the end of the fiscal year.

The functional currency of the company is Martian credit, and the dollar amount of the balance sheet needs to be translated into the Martian currency. In order to calculate the inventory and accounts payable, we will use the current rate method. The first step in the calculation is to find the closing rate of the Martian credit to the US dollar.Exchange rate at the fiscal year-end: $1 = 0.4994

Martian creditThe amount reported for inventory on the subsidiary translated balance sheet can be calculated as follows:

Beginning inventory: 12,250 (since the subsidiary still holds one half of the inventory)

Cost of inventory sold to the subsidiary: 24,500

Closing rate of the Martian credit to the US dollar: 0.4994

Martian credit reported inventory = (12,250 + 24,500) × 0.4994 = 18,619

Martian credits The amount reported for accounts payable on the subsidiary translated balance sheet can be calculated as follows:

Beginning accounts payable: 0Amount owed to parent company: 28,500

Closing rate of the Martian credit to the US dollar: 0.4994

Martian credit reported accounts payable = (0 + 28,500) × 0.4994 = 14,217 Martian credits

For more such question on inventory visit:

https://brainly.com/question/29636800

#SPJ8

4. What was the closing price of the corporation on July 26th?

Answers

The closing price of a security, such as a stock or a commodity, is the final price at which it was traded on a particular trading day. The calculation of the closing price depends on the market in which the security is traded.

What is closing price?If you have access to the historical data of the security, you can easily calculate the closing price by finding the last recorded price of the security on a given trading day. Many financial websites and data providers offer this information in their daily summary of a security's trading activity.

However, if you are looking to calculate the closing price in real-time, you can use a real-time data provider that offers the latest market quotes for the security you are interested in. The closing price is usually determined at the end of the trading day, which varies depending on the market and the security being traded.

In general, to calculate the closing price of a security, you need to find the last traded price of the security for the day. This information can be obtained from various sources, such as stock exchange websites, financial news websites, or real-time data providers. Once you have this information, you can use it to calculate the closing price of the security for that particular trading day. An overview was given.

Learn more about closing price on

https://brainly.com/question/30155035

#SPJ1

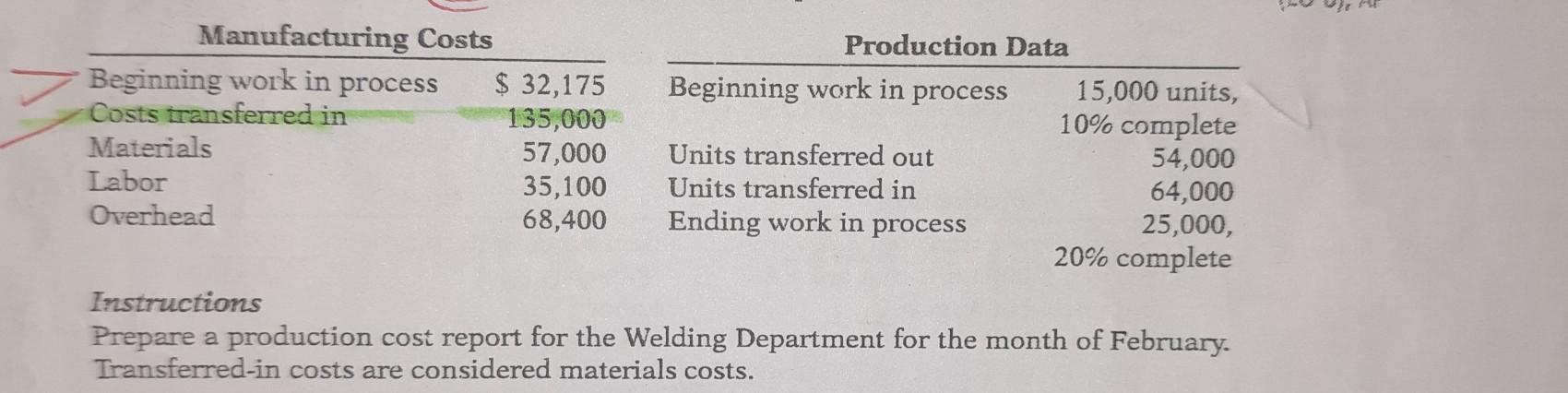

answer the following questions, please

Answers

The cost reconciliation indicates a discrepancy, as the total costs assigned exceed the beginning work in process costs. This could be due to additional costs.

How did we arrive at this assertion?To prepare a production cost report for the Welding Department for the month of February, we need to calculate the following:

1. Equivalent units of production for materials, labor, and overhead.

2. Cost per equivalent unit for materials, labor, and overhead.

3. Total costs assigned to units transferred out and ending work in process.

4. Cost reconciliation.

Let's calculate each of these steps:

Step 1: Equivalent Units of Production

Equivalent units of production are calculated based on the percentage of completion for units in process.

For materials:

Beginning work in process: 15,000 units x 10% complete = 1,500 equivalent units

Units transferred in: 64,000 units

Ending work in process: 25,000 units x 20% complete = 5,000 equivalent units

Total equivalent units for materials: 1,500 + 64,000 + 5,000 = 70,500 equivalent units

For labor and overhead:

Since the given data does not provide the percentage of completion for labor and overhead, we assume it is the same as for materials. Therefore, the equivalent units for labor and overhead will also be 70,500 units.

Step 2: Cost per Equivalent Unit

To calculate the cost per equivalent unit, we divide the total costs by the total equivalent units.

Cost per equivalent unit for materials: $135,000 / 70,500 units = $1.91 per unit

Cost per equivalent unit for labor: $57,000 / 70,500 units = $0.81 per unit

Cost per equivalent unit for overhead: $35,100 / 70,500 units = $0.50 per unit

Step 3: Total Costs Assigned

To calculate the total costs assigned to units transferred out and ending work in process, we multiply the cost per equivalent unit by the equivalent units for each category.

For units transferred out:

Materials: 64,000 units x $1.91 per unit = $122,240

Labor: 64,000 units x $0.81 per unit = $51,840

Overhead: 64,000 units x $0.50 per unit = $32,000

For ending work in process:

Materials: 25,000 units x $1.91 per unit = $47,750

Labor: 25,000 units x $0.81 per unit = $20,250

Overhead: 25,000 units x $0.50 per unit = $12,500

Step 4: Cost Reconciliation

To reconcile the costs, we compare the total costs assigned to units transferred out and ending work in process with the beginning work in process costs.

Beginning work in process costs: $32,175

Total costs assigned to units transferred out: $122,240 + $51,840 + $32,000 = $206,080

Total costs assigned to ending work in process: $47,750 + $20,250 + $12,500 = $80,500

Total costs: $206,080 + $80,500 = $286,580

Since the total costs assigned exceed the beginning work in process costs, there may be some additional costs that need to be investigated or accounted for.

The production cost report for the Welding Department for the month of February is as follows:

------------------------------------------------------------------------

| | Equivalent Units | Cost per Equivalent Unit | Total Costs |

------------------------------------------------------------------------

| Materials | 70,500 | $1.91 | $135,000 |

| Labor | 70,500 | $0.81 | $57,000 |

| Overhead | 70,500 | $0.50 | $35, 100 |

------------------------------------------------------------------------

| Total (Transferred-out) | 64,000 | | $227,240 |

| Ending work in process | 25,000 | | $80,500 |

------------------------------------------------------------------------

| Total Costs $307,740 |

------------------------------------------------------------------------

Note that the cost reconciliation indicates a discrepancy, as the total costs assigned exceed the beginning work in process costs. This could be due to additional costs.

learn more about cost reconciliation: https://brainly.com/question/16342430

#SPJ1

In its first month of operations, Literacy for the Illiterate opened a new bookstore and bought merchandise in the following order: (1) 400 units at $7 on January 1, (2) 600 units at $10 on January 8, and (3) 930 units at $11 on January 29. Assume 1,130 units are on hand at the end of the month. Calculate the cost of goods available for sale, cost of goods sold, and ending inventory under the (a) FIFO, (b) LIFO, and (c) weighted average cost flow assumptions. Assume perpetual inventory system and sold 800 units between January 9 and January 28. (Round your intermediate calculations to 2 decimal places.)

Answers

Answer:

(a) FIFO

Cost of Goods Sold = $6,800

Ending Inventory = $12,230

(b) LIFO

Cost of Goods Sold = $7,400

Ending Inventory = $11,630

(c) weighted average cost

Cost of Goods Sold = $7,040

Ending Inventory = $11,990

Explanation:

Perpetual inventory method ensures that cost of sales and inventory value is determined after each and every transaction.

FIFO

This method assumes that the units to arrive first, will be sold first. This means the cost of sales is based on the earlier (old) prices and inventory valuation is based on recent (later) prices.

Cost of Goods Sold = 400 x $7 + 400 x $10 = $6,800

Ending Inventory = 200 x $10 + 930 x $11 = $12,230

LIFO

This method assumes that the units to arrive last , will be sold first. This means the cost of sales is based on the recent (later) prices and inventory valuation is based on earlier (old) prices.

Cost of Goods Sold = 600 x $10 + 200 x $7 = $7,400

Ending Inventory = 200 x $7 + 930 x $11 = $11,630

Weighted Average Cost Method

A new unit cost is calculated with each and every purchase made. This new unit cost is then used to determine the cost of goods sold and the value of inventory.

New Unit Cost - 8 jan = (400 x $7 + 600 x $10) ÷ 1,000 = $8.80

New Unit Cost - 29 jan = (200x $8.80 + 930 x $11) ÷ 1,130 = $10.61

therefore,

Cost of Goods Sold = 800 x $8.80 = $7,040

Ending Inventory = 1,130 x $10.61 = $11,990

It is an attempt to combine separate economies into larger economic region.

Answers

Answer:

economic integration I believe

with a progressive income tax, people with lower income pay a lower tax rate than people with higher income.

Answers

With a progressive income tax, people with lower income pay a lower tax rate than people with higher income. This statement is true.

What do you mean by the progressive income tax?The average tax burden rises with income under a progressive tax. Low- and middle-income taxpayers bear a disproportionately tiny amount of the tax burden, compared to high-income families.

A progressive tax involves an increasing (or progressing) tax rate as taxable income rises. This is typically accomplished by establishing tax brackets that divide taxpayers according to income levels.

Since the majority of taxes are levied on people with the greatest incomes, progressive tax systems tend to raise more revenue than flat or regressive tax systems.

Therefore, the With a progressive income tax, people with lower income pay a lower tax rate than people with higher income. This statement is true.

To know more about the progressive income tax, visit:

https://brainly.com/question/21514240

#SPJ1

Economic demand is?

A. the amount of a good or service that consumers are willing and able to buy at one price.

B. the amount of a good or service that consumers are willing and able to buy at various prices.

C.the amount of a good or service that producers are willing and able to produce at various prices.

D. the amount of a good or service that consumers are willing but not able to buy at various prices.

Which of the following is correct?

Answers

The correct answer is B. Economic demand is the amount of a good or service that consumers are willing and able to buy at various prices.

It reflects the relationship between the price of a product and the quantity that consumers are willing to purchase at that price. Demand is influenced by factors such as price, consumer preferences, income levels, and availability of substitutes.

As the price of a product decreases, the quantity demanded generally increases, and vice versa, following the law of demand. The demand curve represents this relationship, showing the quantity of a good or service that consumers are willing and able to buy at different price points.

For more such answers on Economic demand

https://brainly.com/question/30703626

#SPJ8

Which of the following would appear in the cash flows from investing activities section of the statement of cash flows?

a. Cash received from stock issued

b. Cash received from bonds payable

c. Depreciation expense on equipment

d. Cash paid for equipment

Answers

The correct answer is:

d. Cash paid for equipment

Cash flows from investing activities include transactions related to the acquisition or sale of long-term assets such as property, plant, and equipment. Cash paid for the purchase of equipment would be categorized as an investing activity because it involves the outflow of cash for the acquisition of a long-term asset.

Hinck Corporation reported net cash provided by operating activities of $361,200, net cash used by investing activities of $150,800 (including cash spent for capital assets of $206,000), and net cash provided by financing activities of $78,900. Dividends of $126,900 were paid.

Answers

Answer:

$28,300

Explanation:

Missing word: "Calculate free cash flow."

Free cash flow = Operating cash flow - Capital expenditures - Dividends

Free cash flow = $361,200 - $206,000 - $126,900

Free cash flow = $28,300

So, the Free cash flow of Hinck Corporation is $28,300.

2. Do you think these moral licensing effects are common across all kinds of green consumers? Or are there other factors (i.e., demographics, psychographics) that might either exacerbate or weaken the effects? Why or why not?

Answers

Moral licensing is "people's sense that they are allowed to engage in activities that may be viewed as socially undesirable or morally dubious as a result of a history of moral behaviors."

What is Moral licensing?According to the moral licensing idea, leaders may exhibit contradictory behaviors, and followers may at times put up with or even approve of their dubious behavior. "People's impression that they are allowed to perform activities that may be considered as socially unpleasant or morally problematic, due to history of moral behaviors," is the definition of moral licensing.

The moral credit model and the moral credential model are two possible processes that might underlie the moral licensing effect. According to the moral credit concept, past behavior can cancel out or make up for any future transgression.

Learn more about moral licensing, here:

https://brainly.com/question/29401188

#SPJ1

Score: 0/450

Question Value:

In 2018, the U.S. balance of payment numbers showed that income received was $1,060.4 billion and

income payments were $816.1. What was the net result?

an outflow of $816.1 billion

a net inflow of $244.3 billion

a net outflow of $244.3 billion

an inflow of $1,060.4 billion

Answers

The net result of the U.S. balance of payment numbers in 2018 was a net inflow of $244.3 billion.

In 2018, the U.S. balance of payment numbers indicated that income received was $1,060.4 billion, while income payments amounted to $816.1 billion.

To determine the net result, we need to subtract the income payments from the income received.

Net Result = Income Received - Income Payments

Substituting the given values into the equation, we have:

Net Result = $1,060.4 billion - $816.1 billion

Calculating the difference, we find:

Net Result = $244.3 billion

This signifies a net inflow of funds, indicating that the United States received more income from abroad than it paid out. It is important to note that a positive net result implies a surplus in the current account, which includes trade in goods and services, income receipts, and unilateral transfers.

This surplus indicates a favorable position for the U.S. economy in terms of its international financial transactions during that period.

For more such questions net,Click on

https://brainly.com/question/18848923

#SPJ8

1. You are the manager of a small store that specializes in hats, sunglasses, and other accessories. You are considering a sales promotion of a new line of hats and sunglasses. You will offer the sunglasses only to those who purchase two or more hats, so you will sell at least twice as many hats as pairs of sunglasses. Moreover, your supplier tells you that, due to seasonal demand, your order of sunglasses cannot exceed 100 pairs. To ensure that the sale items fill out the large display you have set aside, you estimate that you should order at least 210 items in all. Assume that you will lose $3 on every hat and $2 on every pair of sunglasses sold. Given the constraints above, how many hats and pairs of sunglasses should you order to lose the least amount of money in the sales promotion? [Using Graphic method]

Answers

We should order 70 hats and 140 pairs of sunglasses to lose the least amount of money in the sales promotion. It is calculated using linear optimization.

What is linear optimization?Linear programming (LP), also known as linear optimization, is a method for achieving the best outcome (such as maximum profit or lowest cost) in a mathematical model with linear relationships representing the requirements.

This is a linear optimization problem that can be solved using the graphic method.

The problem is set up as follows:

Let x be the number of hats and y be the number of pairs of sunglasses.

The constraints are:

y = 2x (because for every 2 hats sold, 1 pair of sunglasses is sold)

y <= 100 (because the supplier can only provide 100 pairs of sunglasses)

x + y >= 210 (because we want to sell at least 210 items in total)

x, y >= 0 (because the number of items sold cannot be negative)

The objective function is: -3x - 2y (because we lose $3 on every hat sold and $2 on every pair of sunglasses sold)

To graph the constraints, we can start by plotting the inequality y <= 100. This creates a line that goes from the origin (0,0) to (50,100) and is shaded in below the line.

Next, we can plot the inequality x+y >= 210 which creates a line that goes from (0, 210) to (210, 0) and is shaded in above the line.

Finally, we can plot the equation y = 2x, which represents the relationship between the number of hats and sunglasses sold.

The feasible solution for this problem is the point where the lines intersect and that lies within the feasible region. In this case, the point where the three lines intersect is (70, 140) which is the optimal solution.

Therefore, we should order 70 hats and 140 pairs of sunglasses to lose the least amount of money in the sales promotion.

To learn more about linear optimization visit,

brainly.com/question/25828237

#SPJ1

How can a company take advantage of viral diffusion in a rapidly growing market?

a. They can give opinion leaders free products to use.

b. They can identify and court opinion leaders in a particular market.

c. All of these are ways for companies to take advantage of viral diffusion in a rapidly growing market.

d. They can encourage experts in the field to use the product first.

e. They can create a partnership with opinion leaders to help further develop the technology.

Answers

Answer:

The answer is D

Explanation:

I think so

The answer is d. They can encourage experts in the field to use the product first is the advantage of viral diffusion in a rapidly growing market

Which marketing tactic qualifies as product proliferation in a developed market?

Product proliferation is a strategy used by businesses to increase the range of products they provide in a market or submarket in order to saturate the market and reduce the amount of unmet demand (Mainkar, Lubatkin, & Schulze, 2006).

Product proliferation, pricing games, and preserving surplus capacity are the key strategies used by businesses in established markets to thwart entrants.

a dominator strategy for market share. Market share dominance is not one of Porter's general competition strategies. The best-cost provider, low-cost provider, differentiation, and concentrated low-cost are the four main general categories of competitive strategy.

To learn more about Product proliferation refer to:

https://brainly.com/question/14101671

#SPJ2

Reggie, who is 55, had AGI of $35,200 in 2022. During the year, he paid the following medical expenses:

Drugs (prescribed by physicians)

Marijuana (prescribed by physicians)

Health insurance premiums-after taxes

Doctors' fees

Eyeglasses

Over-the-counter drugs

$ 570

1,470

1,280

1,320

445

270

Required:

Reggie received $570 in 2022 for a portion of the doctors' fees from his insurance. What is Reggie's medical expense deduction?

Answers

Reggie's medical expense deduction is $7,276.

AGI, or adjusted gross income, is a person's total income minus certain deductions and is used to calculate taxable income.

Reggie, who is 55 years old, had an AGI of $35,200 in 2022. During the year, he incurred the following medical expenses:

Drugs (prescribed by physicians): $5,701

Marijuana (prescribed by physicians): $1,470

Health insurance premiums-after taxes: $1,280

Doctors' fees: $1,320

Eyeglasses: $445

Over-the-counter drugs: $270

Reggie was reimbursed $570 by his insurance company for a portion of the doctors' fees. To calculate his medical expense deduction, we first need to subtract any reimbursements from his total medical expenses.

Total medical expenses: $5,701 + $1,470 + $1,280 + $1,320 + $445 + $270 = $10,486

Reimbursements: $570

Medical expenses after reimbursements: $10,486 - $570 = $9,916

To claim a medical expense deduction, the expenses must exceed a certain percentage of AGI, which varies depending on the taxpayer's age. For taxpayers who are 65 or younger, the threshold is 7.5% of AGI. For taxpayers who are over 65, the threshold is 7%.

Since Reggie is 55 years old, the threshold is 7.5% of his AGI or $35,200 x 0.075 = $2,640.

Therefore, Reggie can deduct the portion of his medical expenses that exceed $2,640.

Amount of medical expenses that exceed the threshold: $9,916 - $2,640 = $7,276

Therefore, Reggie's medical expense deduction is $7,276.

Know more about Adjusted gross income here:

https://brainly.com/question/31249839

#SPJ8

Which banker would a software company most likely visit for help to raise large amounts of capital to acquire, or buy out another company?

a community banker

an investment banker

a commercial banker

an executive banker

Answers

Answer and Explanation: it's B

The banker that would be visited to raise large amounts of capital to buy another company is an investment banker

Who is an investment banker?

This is a person that is involved in helping to raise capitals for large corporations and organizations.

The answer to this question is best suited to the explanation because the banker is helping to raise the money that woiuld be used to acquire a company.

Read more on investment banking here:

https://brainly.com/question/12301548

Why does the quantity a supplier is willing to give go up when the price goes up