Answers

Answer:

Price skimming. When you use a price skimming strategy, you're launching a new product or service at a high price point, before gradually lowering your prices over time. ... Penetration pricing. ...Explanation:

Related Questions

the earned income tax credit, a government program that supplements the incomes of low wage workers, is an example of

A. Minimum-wage law

B. Price ceiling

C. Wage subsidy

D. Rent subsidy

Answers

The earned income tax credit, a government program that supplements the incomes of low wage workers, is an example of Wage subsidy.

What is wage subsidy?A wage subsidy is a sum of money given to employees by the government, either directly or via their employers. Its objectives are to reduce unemployment through income redistribution and avoiding the welfare trap associated with other forms of aid. The way to execute it most organically is to change the income tax structure. In his 1933 book The Theory of Unemployment, A. C. Pigou made the wage subsidy suggestion. Later, it was promoted as participation income by British economist Tony Atkinson, American policy advisor Oren Cass, and American economists Edmund Phelps and Scott Sumner.

The wage subsidy is distinct from universal basic income (UBI) in that only people who are employed for a wage are eligible for it.

To learn more about Wage subsidy, visit:

https://brainly.com/question/28320550

#SPJ13

The graphs illustrate an initial equilibrium for the economy. Suppose that the stock market broadly increases.

Use the graphs to show the new positions of aggregate demand (AD), short-run aggregate supply (SRAS), and long-run

aggregate supply (LRAS) in both the short run and the long run, as well as the short-run and long-run equilibriums resulting

from this change. Then, indicate what happens to the price level and real GDP (or aggregate output) in the short run and in the

long run.

Answers

Since the stock market increases broadly, this has the effect of expanding the aggregate demand thus, shifting it rightwards. This consequently leads to an increase in price level and real GDP. See the Short Run Effect Graph.

In the Long Run, given that demand shifted to the right, this created an imbalance between demand and expected price levels.

All things being, equal the laws of demand and supply as it affects price trigger an upward adjustment in price hence creating a new equilibrium point. See the Long Run Effect Graph.

What is aggregate demand?Aggregate demand, also known as domestic final demand in macroeconomics, is the entire demand for final products and services in an economy at any particular time.

It is frequently referred to as effective demand, albeit this phrase is differentiated at times. This is a country's demand for its gross domestic output.

Aggregate demand is estimated by combining consumer expenditure, government and business investment spending, and net imports and exports. AD = C + I + G + Nx is the equation that represents it.

Learn more about Short Run and Long Run in Economics:

https://brainly.com/question/13029724

#SPJ1

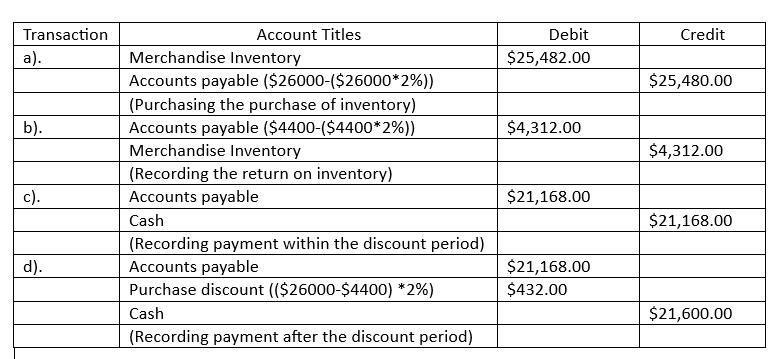

Stylon Co., a women's clothing store, purchased $26,000 of merchandise from a supplier on account, terms FOB destination, 2/10, n/30, using the net method under a perpetual inventory system. Stylon returned merchandise with an invoice amount of $4,200, receiving a credit memo.

Answers

The date, the amount to be credited as well as debited, a short description of the transaction, and the accounts impacted are all included in each journal entry along with other information pertinent to a single business transaction.

What is in a journal entry?Any exchange, whether or not it is an economic one, can be recorded as a diary entry. An accounting journal that displays the debit and credit balances of a business lists transactions. Multiple recordings, each of which is whether its a debit or a credit, may be included in the diary entry.

Business transactions are initially entered into a journal in manual accounting or bookkeeping methods. the name "notebook entry" was born. Depending on the business, it may identify affected divisions, tax details as well as other information.

Journal entries are attached below:

c). Accounts payable = $25,480 - $4,312

= $21,168

To know more about journal entry, visit:

https://brainly.com/question/20421012

#SPJ1

Rest of the question is,

a. Journalize Stylon’s entry to record the purchase. If an amount box does not require an entry, leave it blank.

b. Journalize Stylon’s entry to record the merchandise return. If an amount box does not require an entry, leave it blank.

c. Journalize Stylon’s entry to record the payment within the discount period of 10 days. If an amount box does not require an entry, leave it blank.

d. Journalize Stylon’s entry to record the payment beyond the discount period of 10 days. If an amount box does not require an entry, leave it blank.

Leimersheim GmbH has adopted the following policies regarding merchandise purchases and inven-

tory. At the end of any month, the inventory should be €15,000 plus 90% of the cost of goods to be

sold during the following month. The cost of merchandise sold averages 60% of sales. Purchase terms

are generally net, 30 days. A given month’s purchases are paid as follows: 20% during that month and

80% during the following month.

Purchases in May had been €150,000 and the inventory on May 31 was higher than planned

at €230,000. The manager was upset because the inventory was too high. Sales are expected to be

June, €300,000; July, €290,000; August, €340,000; and September, €400,000.

1. Compute the amount by which the inventory on May 31 exceeded the company’s policies.

2. Prepare budget schedules for June, July, and August for purchases and for disbursements for

purchases.

Answers

1. The amount by which the inventory on May 31 exceeded the company’s policies is €53,000.

2. The preparation of the budget schedules for June, July, and August for purchases and for disbursements for purchases is as follows:

a) Purchases:May June July August

Cost of goods sold 180,000 174,000 204,000

Ending Inventory €230,000 171,600 198,600 231,000

Goods available for sale 351,600 372,600 435,000

Beginning Inventory 230,000 171,600 198,600

Purchases €150,000 121,600 201,000 236,400

b) Disbursement for purchases:May June July August

20% during the month 24,320 40,200 47,280

80% following month 120,000 97,280 160,800

Total disbursements €144,320 €137,480 €208,080

How is the difference between actual inventory and inventory per company policy determined?Expected ending inventory = €15,000 plus 90% of the next month's cost of goods.

Cost of goods sold = 60% of sales

Purchase terms = net 30 days

Purchase payments:

20% during the month

80% following month

May June July August September

Expected Sales €300,000 €290,000 €340,000 €400,000

Cost of goods sold 180,000 174,000 204,000 240,000

Purchases €150,000

Ending Inventory €230,000

= €15,000 plus 90% of €180,000 = €177,000

Excess ending inventory for May = €53,000 ( €230,000 - €177,000)

Data and Calculations:Purchases:May June July August September

Expected Sales €300,000 €290,000 €340,000 €400,000

Cost of goods sold 180,000 174,000 204,000 240,000

Ending Inventory €230,000 171,600 198,600 231,000

Goods available for sale 351,600 372,600 435,000

Beginning Inventory 230,000 171,600 198,600 231,000

Purchases €150,000 121,600 201,000 236,400

Disbursement for purchases:20% during the month 24,320 40,200 47,280

80% following month 120,000 97,280 160,800

Total disbursements €144,320 €137,480 €208,080

Learn more about Purchases Budgets at https://brainly.com/question/17076342

#SPJ1

"Gamboa, Inc. sold 100 selfie sticks for $25 each. If the selfie sticks had an average cost of $1 to produce, how much profit did the company make

Answers

Answer:

$2400

Explanation:

Average cost is the ratio of total cost of production to the total number of units produced, it is the sum of both the average fixed cost and the average variable cost. The average cost is given by the formula:

Average cost = Total cost / number of units.

Given that:

The total number of units produced = 100 selfie sticks, Average cost = $1 and Price of each selfie stick = $25

From Average cost = Total cost / number of units.

Substituting gibes:

$1 = Total cost / 100 selfie stick

Total cost = $1 × 100 = $100

Total cost = $100

Revenue = Price per item × Number of items

Revenue = $25 × 100 = $2500

Profit = Revenue - Total cost

Profit = $2500 - $100 = $2400

Total cost = $2400

3. When an account such as “Accounts Payable” has a credit balance and a credit entry is posted to the account, the account balance is:

a. Increased

b. Decreased

c. Can be increased or decreased

d. None of the above

Answers

For each of the following fiscal policy proposals, determine whether the primary focus is on aggregate demand, aggregate supply, or both.

a. $1,000 per person tax reduction

b. a 5% reduction in all tax rates

c. Pell Grants, which are government subsidies for college education

d. government-sponsored prizes for new scientific discoveries

e. an increase in unemployment compensation

1. (i) both; (ii) supply-side; (iii) supply-side; (iv) both; (v) demand-side

2. (i) demand-side; (ii) both; (iii) supply-side; (iv) supply-side; (v) both

3. (i) demand-side; (ii) both; (iii) both; (iv) supply-side; (v) demand-side

4. (i) supply-side; (ii) demand-side; (iii) demand-side; (iv) both; (v) both

5. (i) supply-side; (ii) supply-side; (iii) demand-side; (iv) both; (v) both

Answers

Answer:

2. (i) demand-side; (ii) both; (iii) supply-side; (iv) supply-side; (v) both

Explanation:

a. $1,000 per person tax reduction ⇒ focus on aggregate demand (more money for consumers to spend)

b. a 5% reduction in all tax rates ⇒ focus on both aggregate demand and supply (more money for consumers and suppliers)

c. Pell Grants, which are government subsidies for college education ⇒ focus on aggregate supply (more money for suppliers of college education)

d. government-sponsored prizes for new scientific discoveries ⇒ focus on aggregate supply (more money for suppliers of new scientific discoveries)

e. an increase in unemployment compensation ⇒ focus on both aggregate demand and supply (more money for consumers resulting in higher prices and lower output)

Suppose a U.S. investor wishes to invest in a British firm currently selling for £40 per share. The investor has $10,000 to invest, and the current exchange rate is $2/£. Suppose now the investor also sells forward £5,000 at a forward exchange rate of $2.10/£. Required: a. Calculate the dollar-denominated returns for each scenario. (Round your percentage answers to 2 decimal places. Negative amounts should be indicated by a minus sign.)

Rate of return(%) at given exchange rate

Price per share 1.80/£ 2.00/£ 2.20/£

35/£

40/£

45/£

Answers

Answer:

Explanation:

To calculate the dollar-denominated returns, we need to first determine how many shares the investor can purchase with their $10,000, and then calculate the future value of those shares at each exchange rate. We also need to calculate the future value of the £5,000 forward contract at the forward exchange rate.

With the current exchange rate of $2/£, the investor can purchase:

$10,000 / $2/£ = £5,000

With £40 per share, the investor can purchase:

£5,000 / £40/share = 125 shares

The total investment is:

125 shares x £40/share = £5,000 = $10,000

If the share price changes to £35/£, £40/£, or £45/£, then the dollar-denominated returns would be:

At £35/£:

Total investment = 125 shares x £35/share = £4,375 = $8,750

Rate of return = (($8,750 - $10,000) / $10,000) x 100% = -12.50%

At £40/£:

Total investment = 125 shares x £40/share = £5,000 = $10,000

Rate of return = (($10,000 - $10,000) / $10,000) x 100% = 0.00%

At £45/£:

Total investment = 125 shares x £45/share = £5,625 = $11,250

Rate of return = (($11,250 - $10,000) / $10,000) x 100% = 12.50%

With the forward contract, the investor has sold £5,000 at a forward exchange rate of $2.10/£, which means they will receive:

£5,000 x $2.10/£ = $10,500

The total investment is:

$10,000 (initial investment) + $10,500 (future value of forward contract) = $20,500

If the share price changes to £35/£, £40/£, or £45/£, then the dollar-denominated returns would be:

At £35/£:

Total investment = 125 shares x £35/share = £4,375 = $8,750

Future value of investment = $8,750 x $2.20/£ = £3,977.27 = $7,955.55

Total future value = $7,955.55 + $10,500 = $18,455.55

Rate of return = (($18,455.55 - $20,500) / $20,500) x 100% = -9.96%

At £40/£:

Total investment = 125 shares x £40/share = £5,000 = $10,000

Future value of investment = $10,000 x $2.20/£ = £4,545.45 = $9,090.91

Total future value = $9,090.91 + $10,500 = $19,590.91

Rate of return = (($19,590.91 - $20,500) / $20,500) x 100% = -4.44%

At £45/£:

Total investment = 125 shares x £45/share = £5,625 = $11,250

Future value of investment = $11,250 x $2.20/£ = £

In 2019, Perry, who is not otherwise involved in the gas station business, spends $53,000 investigating the acquisition of a gas station. All costs are ordinary and necessary. Perry decides not to acquire the gas station. What amount can Perry deduct in 2019 for the expenses incurred in investigating the acquisition of the gas station if Perry makes an election to accelerate his deductions as much as possible

Answers

Answer:

Perry and Investigation Expenses:

Perry can deduct the full $53,000.

He can also elect to capitalize the amount, assuming that he is acquiring the gas station, because, according to IRS, "general due-diligence and investigatory expenses incurred to decide whether to enter a new business, and which new business to enter, can be deducted/amortized under Sec. 195."

Explanation:

Facts as per scenario:

Perry is not involved in the gas station business.

Perry spends $53,000 investigating the acquisition of a gas station.

All costs are ordinary and necessary.

Perry does not acquire the gas station.

On May 16, 20X1. Safeway Company received a 90-day, 8 percent. $9.800 interest-bearing note from Black Company in settlement of Black's past-due account. On June 30, Safeway discounted this note at Fargo Bank and Trust. The bank charged a discount rate of 13 percent. On August 14, Safeway received a notice that Black had paid the note and the interest on the due date. Required: Prepare the entries in general journal form to record these transactions. Analyze: If the company prepared a balance sheet on July 31, 20X1. how should Notes Receivable-Discounted be presented on the statement? Prepare the entries in general journal form to record these transactions. (Use 360 days a year. Round your intermediate calculations and final answers to 2 decimal places.) View transaction list Journal entry worksheet 1 2 3 > Record entry for a 90-day, 8% note accepted for past-due account. Note: Enter debits before credits. Date General Journal Debit Credit May 16, 20X1 Record entry Clear entry View general Journal Journal entry worksheet < 1 2 3 Record the entry for discounting the 90-day note at 13% Note: Enter debits before credits. Date General Journal Debit Credit June 30, 20X1 Record entry Clear entry View general journal Journal entry worksheet < 1 N 3 Record payment of discounted note receivable. Note: Enter debits before credits. Date General Journal Debit Credit Aug 14, 20X1 Record entry Clear entry View general journal Safeway Company Balance Sheet (Partial) July 31, 20X1 < General Journal Analyze

Answers

Interest-bearing Notes is the term used to describe a collection of US Treasury paper money-related emissions from the Civil War era. The grouping comprises the one- and two-year notes

issued in the denominations of $10, $20, $50, $100, $500, and $1000 that were permitted by the Act of March 3, 1863. These notes paid interest at a 5% annual rate, were legal tender at face value, and bore interest at a 5% annual rate. The early civil war treasury notes, which matured in either sixty days or two years and carried interest at 6%, and the seventy-thirties, which matured in three years and bore interest at 7.3%, though none of these latter issues had legal tender status, are also commonly included in the grouping. [2] Compound interest treasury notes are sometimes included in reference books used by coin collectors.

learn more about Interest-bearing Notes here:

https://brainly.com/question/28098296

#SPJ4

What is a residual plot?

Answers

Answer:

A residual plot is a graph that has on the vertical axis, the residuals and on the horizontal axis, the independent variable.

Explanation:

The residual plot gives a representation of the closeness of how each data point is vertically from the graph of the prediction equation from the model. It shows a fairly random pattern. If the data point is above or below the graph of the prediction equation of the model that is supposed to be the most appropriate for the data.

It is typically used to find problem with regression

Consider total cost and total revenue, given in the following table:

In the final column, enter profit for each quantity. (Note: If the firm suffers a loss, enter a negative number in the appropriate cell.)

Total Cost Marginal Cost

(Dollars)

Quantity (Dollars)

0

1

2

3

4

5

6

7

5

6

8

11

15

20

26

35

05

06

07

Total Revenue Marginal Revenue

(Dollars)

(Dollars)

0

6

12

18

24

30

36

42

AAAAAAA

Profit

(Dollars)

In order to maximize profit, how many units should the firm produce? Check all that apply.

04

Answers

The solution to the given question when we consider total cost and total revenue, given in the following table:

The Financial TableQuantity | Total Cost | Marginal Cost | Total Revenue | Marginal Revenue | Profit

------- | -------- | -------- | -------- | -------- | --------

0 | 5 | 5 | 0 | 0 | -5

1 | 11 | 6 | 6 | 6 | 1

2 | 17 | 6 | 12 | 6 | 5

3 | 24 | 7 | 18 | 6 | 4

4 | 31 | 8 | 24 | 6 | -7

5 | 39 | 8 | 30 | 6 | -9

6 | 47 | 8 | 36 | 6 | -11

7 | 55 | 8 | 42 | 6 | -13

As you can see, the firm's profit is maximized at quantity 3. This is because the marginal revenue is equal to zero at this point, which means that the firm is not making any additional profit by producing more units. In fact, if the firm produces more units, it will actually start to lose money.

Therefore, the answer to the question is 3.

In summary:

The firm's profit is maximized at quantity 3.This is because the marginal revenue is equal to zero at this point.If the firm produces more units, it will start to lose money.Therefore, the answer to the question is 3.Read more about marginal revenue here:

https://brainly.com/question/13444663

#SPJ1

Jacob distributed a survey to his fellow students asking them how many hours they'd spent playing sports in the past day. He also asked them to rate their mood on a scale from 000 to 101010, with 101010 being the happiest.

Answers

Answer:

whats the question

Explanation:

Answer:

the answer is A 1.5

Explanation:

Your friend John works producing dress shirts and dress pants. Currently John can work a maximum of 8 hours per day. With the equipment he has, and the current level of expertise, he can finish either 2 shirts or 8 pairs of pants in an hour. This is true when he is performing at full capacity. Meaning doing the best possible work.

1. What is the maximum number of shirts he can make in a day? (10 points)

2. What is the maximum number of pants he can make in a day? (10 points)

3. What is the opportunity cost of making one pair pants (in terms of the amount of shirts he won't be able to make)? As an example, when you give up $20 dollars in exchange for 40 pencils, you can say that the “cost” per pencil was $0.50, because $20/40 = $0.50. (15 points)

4. What is the opportunity cost of making one shirt (in terms of the amount of pants he won't be able to make)? (15 points)

5. John's friend Anne, can make 2 shirts or 10 pairs of pants in an hour. Who has a lower opportunity cost of making shirts? In other words, who has a comparative advantage in the production of shirts? Explain your rationale (15 points)

6. Imagine now, that John and Anne are the only shirt and pants producers in their small town, how would you suggest that they spend their time at work to achieve the highest production of shirts and pants for the town? Explain your rationale. (15 points)

7. Imagine now, that John completes a training that doubles his capacity to make both shirts and pants per hour. a) What is the maximum number of shirts he can make in a day? b) What is the maximum number of pants he can make in a day? (15 points)

8. In 250 words, explain the relationship between comparative advantage and specialization. Support your answer with an example. (5 points)

Answers

To answer the questions provided, we must understand the concept of opportunity cost and comparative advantage and take the data into consideration.

John can make 16 shirts in day, that is, 2 shirts per hour worked, working 8 hours.Working 8 hours a day, John can make 64 pairs of pants, that is, 8 pairs per hour worked.The opportunity cost would be 0.25.The opportunity cost would be 4.Both John and Anne can make the same amount of shirts in an hour, so no one has a comparative advantage for the production of shirts.It would be best for them if Anne focused on making pants, since she can make more pants than John per hour. John would then focus on making shirts.a) John will make 32 shirts in a day, working 8 hours per day. b) John will make 128 pants a day, working 8 hours per day.Comparative advantage refers to being able to produce something at a lower opportunity cost than your competitors. Specialization, that is, the production of one specific product, can increase comparative advantage.What is opportunity cost?In economics, opportunity cost is what we do not gain, that is, what we miss from making a choice over another. If John chooses to use an hour to make 2 shirts, the opportunity cost refers to the pants that he will not make in that same hour.

Comparative advantage is related to who has a lower opportunity cost. Notice how Anne can make more pants than John in an hour. If she chooses to make shirts, she will be losing more than John. Thus, it is better for her to focus on making pants. John, on the other hand, should specialize in shirts, since his opportunity cost is lower.

Learn more about opportunity cost here:

https://brainly.com/question/481029

#SPJ1

If the effect of the debit portion of an adjusting entry is to increase the balance of an asset

account, which of the following describes the effect of the credit portion of the entry?

Answers

When the debit portion of an adjusting entry is used to increase the balance of an asset account, the credit portion of the entry will decrease the balance of another account, which will be either a liability account or an equity account.

What is the adjusting entry?Adjusting entries are journal entries that are made at the end of an accounting period to modify the accounts' balances. They are done to update and verify revenue and expense accounts' accuracy, as well as to adjust the balance sheet accounts for adjustments that have yet to be recorded.When should adjusting entries be made?Adjusting entries are typically made at the end of an accounting period. For example, adjusting entries may be needed if a company's insurance premiums have been paid in advance, or if a company has earned revenue but has not yet received payment.Adjusting entries are critical in determining the correct profit and loss as well as the balance sheet, which is why they must be accurate and complete.Adjusting entries are required for each financial statement's following types:Income Statement - revenue and expense accounts are adjusted.Balance Sheet - asset, liability, and equity accounts are adjusted.How are adjusting entries made?Adjusting entries are made with the following steps:Step 1: Determine the transaction or event that necessitates an adjustment. Step 2: Determine which accounts are affected by the transaction or event. Step 3: Decide whether each account is to be debited or credited. Step 4: Make the necessary adjusting journal entries.

For more question portion of an adjusting

https://brainly.com/question/14565649

#SPJ8

Fill in the "description" column for the below table by mentioning if it is elastic, inelastic or unit

elastic.

Price

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

$8.0

$9.0

Quantity

20

18

16

14

12

10

8

6

Total Revenue

(Price x

Quantity)

$40

$54

$64

$70

$72

$70

$64

$54

Slope Point Elasticity Description

-2.00

$0.10

-0.20

-2.00 $0.17

-0.33

-2.00

$0.25

-0.50

-2.00

$0.36

-0.71

-2.00

$0.50

-1.00

-2.00 $0.70

-1.40

-2.00

$1.00

-2.00

-2.00

$1.50

-3.00

Answers

Answer:

Explanation:

Price Quantity Total Revenue Description

$2.0 20 $40 Elastic

$3.0 18 $54 Elastic

$4.0 16 $64 Elastic

$5.0 14 $70 Unit Elastic

$6.0 12 $72 Inelastic

$7.0 10 $70 Inelastic

$8.0 8 $64 Inelastic

$9.0 6 $54 Inelastic

The description for each value is as follows:

-2.00: Elastic

-0.20: Inelastic

-0.33: Inelastic

-0.50: Inelastic

-0.71: Inelastic

-1.00: Elastic

-1.40: Elastic

-2.00: Elastic

What defines the elasticity of the demand?To determine whether the demand is elastic, inelastic, or unit elastic, there is need to look at the absolute value of the slope of the point elasticity.

Price Qty Total Rev Slope Point Elast. Des.

$2.0 20 $40 -2.00 Elastic

$3.0 18 $54 -0.20 Inelastic

$4.0 16 $64 -0.33 Inelastic

$5.0 14 $70 -0.50 Inelastic

$6.0 12 $72 -0.71 Inelastic

$7.0 10 $70 -1.00 Elastic

$8.0 8 $64 -1.40 Elastic

$9.0 6 $54 -2.00 Elastic

Based on the given values, it is seen that when the absolute value of the slope of the point elasticity is less than 1, it indicates inelastic demand. When it is exactly 1, it represents unit elastic demand. And when it is greater than 1, it indicates elastic demand.

Therefore, the description for each value is as follows:

-2.00: Elastic

-0.20: Inelastic

-0.33: Inelastic

-0.50: Inelastic

-0.71: Inelastic

-1.00: Elastic

-1.40: Elastic

-2.00: Elastic

learn more about elastic demand: https://brainly.com/question/1048608

#SPJ1

Question 16 of 40

What is the difference between specialization and cross-training?

A. Specialization is for employees at the top management level of

the company while cross-training is for employees at the entry

level.

B. Specialization is for employees who love what they do while cross-

training is for employees who don't love any one particular area of

their work.

C. Specialization leads employees to focus on a single skill or task

while cross-training deals with training employees in multiple skills

or tasks.

D. Specialization is for employees who have an advanced degree

while cross-training is for those who do not have an advanced

degree.

Answers

The correct answer is C) , Specialization leads employees to focus on a single skill or task while cross-training deals with training employees in multiple skills or tasks.

Specialization and cross-training differ in terms of the focus of training and development. Specialization involves employees focusing on developing expertise in a particular skill or area of work. It often involves becoming highly proficient and knowledgeable in a specific field or task.

Specialization allows employees to become experts in their chosen area and can lead to increased efficiency and productivity in that particular domain.

On the other hand, cross-training involves training employees in multiple skills or tasks that are outside of their primary area of expertise. It aims to provide employees with a broader skill set and the ability to perform different roles within an organization.

Cross-training helps in creating a more flexible workforce that can adapt to changing needs and handle a variety of tasks. It also enhances collaboration and teamwork by enabling employees to understand and appreciate the work of their colleagues in different areas.

Specialization and cross-training are both valuable approaches depending on the organizational needs and employee roles.

Specialization is beneficial when deep expertise and mastery in a specific area are required, while cross-training is advantageous for fostering versatility and adaptability among employees.

To know more about Specialization refer here

https://brainly.com/question/28331255#

#SPJ11

The craft wholesaler, Living Arts, offers a 15 percent discount on all Christmas

decorations bought before August 1. If a local crafts shop placed an order on July

11 for $3,300 worth of decorations, what would the discount and final price be?

Answers

Answer:

Discount amount: $495

The final price: $2,805

Explanation:

The local crafts shop made their order before august 1, hence qualifies for the 15% discount.

The discount amount will be 15% of $3,300

=15/100 x $3,300

=0.15 x $3,300

=$495

The final price will be

cost price - discount amount

=$3,300 - $495

=$2,805

The bank has a 10% reserve requirement. Record each transaction in the category it belongs in. Carry forward the information from the previous transaction. The categories you will use are those included below.

Eli has $5,000 in cash and decides that he needs to open a checking account at Main Street Bank.

Assets Liabilities

Required Reserves - 500

Excess Reserves -

Loans - 4500 Checkable Deposits - 5000

Answers

Answer:

ASSETS

Required Reserves $500

Excess Reserves $5,000

Loans $5,000

LIABILITIES

Checkable Deposits $4,500

Explanation:

Based on the information given in a situation where Eli has the amount of $5,000 in cash in which he decided that he will needs to open a checking account which means that the category to Record this transaction will be:

ASSETS

Required Reserves $500

(10% reserve requirement *$5,000 Cash)

Excess Reserves $5,000

Loans $5,000

LIABILITIES

Checkable Deposits $4,500

[$5,000-(10% reserve requirement *$5,000 Cash)]

($5,000-$500)

=$4,500

1.Apply the SOSTAC model to ASOS and highlight why it has become

such a successful online fashion brand?

Answers

he SOSTAC model is a strategic planning framework that stands for Situation analysis, Objectives, Strategy, Tactics, Action, and Control.

Situation analysis: ASOS operates in the highly competitive and dynamic online fashion industry. It was founded in 2000 and has grown rapidly since then to become a global brand with a presence in over 200 countries.

Objectives: ASOS's objective is to become the go-to destination for online fashion shopping. It aims to provide its customers with a seamless and personalized shopping experience that caters to their unique style preferences.

Strategy: ASOS's strategy is centered on offering a wide range of products from its own label as well as other brands, at competitive prices. It also uses technology to enhance the customer experience by providing features like visual search, social media integration, and personalized recommendations.

Tactics: ASOS uses various tactics to execute its strategy, such as aggressive marketing campaigns, partnerships with influencers, and collaborations with other brands. It also invests heavily in technology to constantly improve its online platform and provide customers with a seamless shopping experience.

Action: ASOS regularly updates its product offerings, website design, and marketing campaigns to stay relevant and appeval to its target audience. It also actively engages with its customers through social media and other channels to understand their preferences and needs.

ASOS has become such a successful online fashion brand due to its effective execution of the SOSTAC model. Its focus on offering a wide range of products at competitive prices, using technology to enhance the customer experience, and actively engaging with customers has helped it establish a strong brand identity and a loyal customer base.

For more such questions on strategic planning visit:

https://brainly.com/question/17924318

#SPJ11

Tom has a successful business with 100,000 of taxable income before the election to expense in 2021. He purchases one new asset in 2021 a new machine which is 7 year macro property and costs 25,000

Answers

Tom should elect to expense (Section 179). He gets a full write-off of the asset, Which can offset his tax burden.

What is Taxable Income?The basic income used to calculate taxes is known as taxable income. It may contain all or part of the revenue and is lessened by outgoings and other deductions. Depending on the country and its system, different amounts are included as income, costs, and other deductions.

Instead of capitalization and depreciating the item over time, company owners can receive an instant expenditure deduction under Section 179 of the U.S. Internal Revenue Code for purchases of depreciable business equipment. If the piece of equipment is acquired or financed and the entire purchase price qualifies for the deduction, the Section 179 deduction may be taken.

Therefore, Tom should elect to expense.

Learn more about Taxable Income, here;

https://brainly.com/question/17961582

#SPJ1

Your question is incomplete, the complete question is;

Tom has a successful business with $100,000 of income in 2021. He purchases one new asset in 2021, a new machine which is 7 yr MACRS property and costs $25,000. If you are his tax advisor, how would you advise him to treat the purchase for tax purposes in 2021? Why?

1.1.1 Name any one leakage in an economy. NAME ONE SECTOR INVOLVED MULTIPHER 1.1.2 What does the 45° line in the graph represent? 1.1.3 Briefly discuss the term autonomous consumption. 1.1.4 Explain the negative impact of a decrease in consumer spending on the size of the (2) multiplier. (1) IN DERIVING THE MACRO-ECONOMIC 1.2 Why is it important for a country to calculate its national income? [18] (1) 1.1.5 Calculate the multiplier when individual spending on consumption is 60%. Show all calculations. (4) (8)

Answers

1.1.1 One leakage in an economy is saving. The saving sector is involved in the leakage as individuals and businesses save a portion of their income rather than spending it on consumption or investment. Saving represents the portion of income that is not immediately injected back into the economy and can lead to a decrease in aggregate demand.

1.1.2 The 45° line in the graph represents the equilibrium level of output or income in an economy. It shows the points where aggregate spending (aggregate demand) is equal to aggregate production (aggregate supply). The line represents the condition where spending equals production, indicating a state of macroeconomic equilibrium.

1.1.3 Autonomous consumption refers to the level of consumption expenditure that occurs even when income is zero or negative. It represents the minimum level of consumption that individuals and households maintain regardless of their income. Autonomous consumption is usually influenced by factors such as basic needs, fixed expenses, or borrowing. It plays a crucial role in determining the level of aggregate demand in an economy.

1.1.4 A decrease in consumer spending has a negative impact on the size of the multiplier. The multiplier refers to the amplification effect that occurs when an initial change in spending or investment leads to a larger overall change in the economy. When consumer spending decreases, it leads to a decrease in aggregate demand, which in turn reduces the level of output and income. As a result, the multiplier effect is dampened, and the overall impact on the economy becomes smaller.

1.2 Calculating national income is important for a country for several reasons:

- It provides policymakers and economists with crucial information about the overall health and performance of the economy.

- National income data helps in formulating economic policies and making informed decisions related to fiscal and monetary policies.

- It allows for the comparison of economic performance across different countries and over time, providing insights into economic growth and development.

- National income calculations help in identifying income distribution patterns and inequalities within a country.

- It serves as a basis for calculating various economic indicators, such as GDP per capita, which are used to assess the standard of living and well-being of the population.

1.1.5 To calculate the multiplier when individual spending on consumption is 60%, we can use the formula:

Multiplier = 1 / (1 - Marginal Propensity to Consume)

Given that the individual spending on consumption is 60% or 0.6, the Marginal Propensity to Consume (MPC) would be 0.6. Substituting this value into the formula:

Multiplier = 1 / (1 - 0.6)

Multiplier = 1 / 0.4

Multiplier = 2.5

Therefore, the multiplier in this case would be 2.5.

Explain how passengers benefited from the competition in South Africa.

Answers

The passengers benefited from the competition in South Africa by the deregulation as it included the variety of the airlines in the domestic countries.

what is deregulation?Deregulation refers to the removal of the restrictions on any particular industry. The south Africa deregulated the airlines industries.

They were immensely benefited with removal of the restrictions through very low fares rate of the airlines in the domestic countries and by this decision the monopoly of any particular industry was removed.

Thus the passengers were greatly benefited by the deregulation of the airlines industries.

Learn more about South Africa here:

https://brainly.in/question/5846890

#SPJ1

Can someone explain this to me?

Since inflation is already factored into the data, what is the most likely reason that the costs of a doctorate degree rise to such a high level?

Answers

The rate at which prices increase over a specific time period is known as inflation.

What is the meaning of Inflation?Inflation is often measured in broad terms, such as the general rise in prices or the rise in a nation's cost of living.

Although low inflation might be detrimental, both levels can hurt the economy. The Fed will adopt the opposite strategy when the economy is having trouble or inflation is too low by cutting interest rates or purchasing assets to boost cash flow.

The main cost of inflation is the erosion of real income, which occurs when prices rise unevenly and cause some customers' purchasing power to decline. For both those who receive and pay fixed interest rates, inflation might over time affect their ability to make purchases.

Learn more about Inflation here:

https://brainly.com/question/30112292

#SPJ1

On October 1, Eder Fabrication borrowed $84 million and issued a nine-month, 15% promissory note. Interest was payable at maturity. Prepare the journal entry for the issuance of the note and the appropriate adjusting entry for the note at December 31, the end of the reporting period.

Answers

Answer and Explanation:

The journal entries are shown below:

Cash $84,000,000

To Notes payable $84,000,000

(Being issuance of the note is recorded)

Interest expense($84,000,000 × 15% × 3 ÷ 12) $3,150,000

To Interest payable $3,150,000

(Being interest expense is recorded)

The standards for product V28 call for 8.3 pounds of a raw material that costs $19.00 per pound. Last month, 2,200 pounds of the raw material were purchased for $41,360. The actual output of the month was 240 units of product V28. A total of 2,100 pounds of the raw material were used to produce this output.

The direct materials purchases variance is computed when the materials are purchased.

Required:

a. What is the materials price variance for the month?

b. What is the materials quantity variance for the month?

Answers

Answer:

Results are below.

Explanation:

To calculate the direct material price variance, we need to use the following formula:

Direct material price variance= (standard price - actual price)*actual quantity

Direct material price variance= (19 - 18.8)*2,200

Direct material price variance= $440 favorable

Actual price= 41,360 / 2,200= $18.8

Now, we can determine the direct material quantity variance:

Direct material quantity variance= (standard quantity - actual quantity)*standard price

Direct material quantity variance= (8.3*240 - 2,100)*19

Direct material quantity variance= $2,052 unfavorable

Select the correct text in the passage.

Which sentence demonstrates the use of secondary market research technique?

Keith wants to start a fast-food stall. {{He interviewed people in the area where he wants to put up his stall}}. {{He also gave out questionnaires to understand people’s opinions}}. {{He worked out the cost and investment details with the help of the Internet}}. He is now all set to speak to the bank to apply for a business loan.

The ones with {{}} around are the 3 answer choices

Answers

Answer:

The answer is the second option

briefly explain how the decision support system resolved the problems experienced by the railways

Answers

The decision support system improved the efficiency of the railroads, paying special attention to the punctuality and speed of transportation on both passenger and commercial routes. The Indian Railways encounter a number of difficulties, including the failure to ensure train punctuality.

Ticketless transit by passengers, damage to or theft of railroad property, and others. The railways suffer a considerable loss in income as a result. By December 2023, 100% electrification of the broad gauge is the goal. In 2020–21, the speed of freight trains doubled to 46 kmph from 23 kmph in previous years. In January 2019, all unmanned level crossings on the broad gauge were removed.

To learn more about passenger, click here.

https://brainly.com/question/199361

#SPJ1

During job interviews, potential employers often ask candidates to describe a time where they have demonstrated their initiative and/or results driven skills. This week, you’ll have a chance to practice.

In paragraph 1, describe a time at work, home, or school where there was a problem and you took the initiative to solve that problem and to seek results on your own.

In paragraph 2, explain how the process went and describe the solution that you developed.

Answers

Answer:

During a pandemic everyone and everything is crazy and it hasn't gone very for me at work or at home. I guess that's why they say it's best for you stay home and quaretine for days because of a test that came back positive.

Explanation:

Why the exist an economy?

Answers

Answer:

Economics is the study of how societies use scarce resources to produce valuable commodities and distribute them among different people

hope this helps

Explanation: