Vaughn Service Center just purchased an automobile hoist for $34,000. The hoist has an 8-year life and an estimated salvage value of $3,400. Installation costs and freight charges were $4,200 and $800, respectively. Vaughn uses straight-line depreciation. The new hoist will be used to replace mufflers and tires on automobiles. Vaughn estimates that the new hoist will enable his mechanics to replace 5 extra mufflers per week. Each muffler sells for $77 installed. The cost of a muffler is $38, and the labor cost to install a muffler is $14. (a) Compute the cash payback period for the new hoist. Cash payback period years (b) Compute the annual rate of return for the new hoist. (Round answer to 2 decimal places, e.g. 10.52%.) Annual rate of return %

Answers

Answer:

a. Cash payback period years = 6 years

b. Annual rate of return = 9.67%

Explanation:

(a) Compute the cash payback period for the new hoist. Cash payback period years

Total cost of automobile hoist = Purchase cost + Installation costs + freight charges = $34,000 + $4,200 + $800 = $39,000

Weekly profit or cash inflow = (Muffler selling price per unit - Muffler cost per unit - Muffler labor cost per unit) * Number of extra muffler per week = ($77 - $38 - $14) * 5 = $125

Annual cash inflow = $125 * 52 weeks = $6,500

Cash payback period years = Total cost of automobile hoist / Annual cash inflow = $39,000 / $6,500 = 6 years

(b) Compute the annual rate of return for the new hoist

Annual depreciation expenses = (Total cost of automobile hoist - Estimated salvage value) / Useful years = ($39,000 - $3,400) / 8 = $4,450

Expected annual income = Annual cash inflow - Annual depreciation expenses = $6,500 - $4,450 = $2,050

Average investment = (Total cost of automobile hoist + Salvage value) / 2 = ($39,000 + $3,400) / 2 = $21,200

Annual rate of return = Expected annual income / Average investment = $2,050 / $21,200 = 0.0967, or 9.67%

Related Questions

If the labor force averaged 237 million in 2008–2011, by how much in percentage terms did the state and local layoffs described in the "In The News" add to the national unemployment rate, assuming all laid-off workers were actively seeking work?

Instructions: Enter your response rounded to two decimal places.

________ %

Answers

Answer:

Follows are the response to the given question:

Explanation:

unemployed people from 2008 to 2011 = 600,000

labor force from 2008 to 2011 = 237,000,000

Calculating the unemployment rate:

\(= (\frac{total \ unemployed \ people}{labor\ force}) \times 100\)

\(= (\frac{600,000}{237,000,000}) \times 100\\\\= 0.0025 \times 100\\\\ = 0.25\%\)

From 2008 to2011 there is 0.25% of the unemployment rate was added.

Basics Ltd reported current liabilities of R3 000 and a quick ratio of 1,2. The company has current assets of R6 000. If the company reports the cost of goods sold at R4 000 for the given year, what is the inventory turnover?

Answers

The inventory turnover for the given year is 3.33, calculated by dividing the cost of goods sold by the average inventory of R1200.

To calculate the inventory turnover, we first need to determine the inventory value. We can use the quick ratio formula to find the inventory amount.Quick ratio = (Current assets - Inventory) / Current liabilitiesRearranging the formula, we have: Inventory = Current assets - Quick ratio * Current liabilitiesSubstituting the given values, we have:Inventory = R6000 - 1.2 * R3000Inventory = R6000 - R3600Inventory = R2400The inventory value is R2400. To calculate the inventory turnover, we divide the cost of goods sold by the average inventory. In this case, the cost of goods sold is given as R4000. The average inventory is the sum of the beginning and ending inventory divided by 2. Since we don't have information about the beginning and ending inventory, we can assume they are equal, resulting in an average inventory of R2400/2 = R1200.Inventory turnover = Cost of goods sold / Average inventoryInventory turnover = R4000 / R1200Inventory turnover = 3.33Therefore, the inventory turnover for the given year is 3.33.For more questions on inventory

https://brainly.com/question/25947903

#SPJ8

give the meaning of office machine

Answers

Answer: Equipment

Explanation:The equipment used in an office; for example: phones, computers, and printers. ... These markets cover computers and other machines for workplaces.

Hope this helps! Brainlist?

Answer:

What are office machines? The Cambridge Dictionary defines office machinery as the equipment used in an office for example: phones, computers, and printers These markets cover computers and other machines for workplaces.

Explanation:

Partial ownership of a firm that is considered to be the strongest and financially sound is done through what method

Answers

Answer:

The answer is: Buying blue-chip stocks

Explanation:

A firm considered a business enterprise, often involves a partnership of two or more individuals doing business for profit-making as a way of selling shares of the company to individuals in the form of stock which can directly make stakeholders a partial owner of the business depending on the percentage bought. Partial ownership of a firm gives the individual some degree of contributions the individual can make towards decision making.

The correct answer is buying blue-chip stocks. Blue-chip stocks which are considered a secure stock investments because of the stability that investors get are companies that have done so much overtime in ensuring with each profit turn, investors get paid their dividends.

Which step follows the marketing mix step in the process of marketing management?

ОА

market research

ОВ.

market monitoring

OC marketing mix

OD. product development

OE identifying target markets

Answers

Answer:

market monitoring

Explanation:

After the marketing mix step, Implementation, monitoring, and control follows. The strategic marketing process is a continuous effort. Management should always be on the look for places to improve and enhance the plan. Market monitoring assists in pointing out specific opportunities for improvement.

Market monitoring requires the management to keep looking at the set goals and objectives to determine if the marketing process is heading in the right direction.

I

The constant growth formula is a good tool to use to value companies in the

industry.

O technology

2000

о

pharmaceutical

utility

I DON'T KNOW YET

Answers

The constant growth formula is typically applied more commonly in the utility industry.

The constant growth formula, also known as the Gordon Growth Model, is commonly used to value companies in industries with stable and predictable dividend growth rates. It assumes that the company's dividends or earnings will grow at a constant rate indefinitely. However, it may not be the most suitable tool for valuing companies in every industry.

The constant growth formula can be a useful tool for valuing companies in certain industries like utilities, but it may not be the most appropriate choice for valuing companies in the technology or pharmaceutical sectors.

Utility companies often exhibit stable and predictable cash flows, making them suitable candidates for valuation using the constant growth model.

Therefore, the correct option is utility.

For more information regarding utility, visit:

https://brainly.com/question/31683947

#SPJ1

Determine the amount of tax liability in each of the following instances:

a. A married couple filing jointly with taxable income of $32,991.

b. A married couple filing jointly with taxable income of $192,257.

c. A married couple filing separately, one spouse with taxable income of $43,885 and the other with $56,218.

d. A single person with taxable income of $79,436. A single person with taxable income of $297,784.

e. A head of household with taxable income of $96,592. A qualifying widow with taxable income of $14,019.

f. A married couple filing jointly with taxable income of $11,216.

Answers

The determination of the tax liability in each of the following instances is as follows:

Taxable Filing Tax Tax

Income Status Rate Liability

a. $32,991 Joint 12% $3,958.92

b. $192,257 Joint 24% $46,141.68

c. $43,884 Separate 12% $5,266.08

c. $56,218 Separate 12% $6,746.16

d. $79,436 Single 22% $17,475.92

d. $297,784 Single 35% $104,224.40

e. $96,592 Household 24% $23,182.08

e. $14,019 Widow 12% $1,682.28

f. $11,216 Joint 10% $1,121.60

What is a tax liability?A tax liability is the payment that an individual or couple must pay within the tax year to the government. Generally, tax liabilities arise when the individual earns income or sells an investment. Examples of tax liabilities are income taxes or capital gains taxes.

Thus, the tax liability of each instance depends on the tax rate and the filing status of the individual or couple.

Learn more about tax liability at https://brainly.com/question/25641320

Question 5 of 10

The federal government creates the federal budget each year in order to:

A. remove government regulations about mandatory spending.

B. reduce the national debt as much as possible.

c. decide how much money the government will spend.

D. guarantee that the government will have a surplus.

SUBMIT

Answers

Answer: c. decide how much money the government will spend.

Explanation:

A budget simply refers to the estimation that's done with regards to the revenue that will be made and the expenses that'll be incurred for a particular time period.

The federal government creates the federal budget each year in order to decide how much money the government will spend.

The budget isn't created to remove government regulations about mandatory spending or reduce the national debt as much as possible.

Answer:

decide how much money the government will spend.

Explanation:

it been confirm that is the answer

A 15-year bond is currently priced at $900 and pays a semi-annual coupon payment of 8%. The par value is $1,000. What is the yield to maturity

Answers

The yield to maturity of the bond given from the information will be 9.24%.

How to calculate the yield to maturityFrom the information given, the following can be deduced:

Current price = $900Coupon payment = 8%Semi annual payment = 1000 × 0.4 = 40Number of periods = 15 × 2 = 30The price at 5% will be:

= (40 × 15.37) + (1000 × 0.23)

= 846.27

Using 4%, the interpolation to calculate the value will be:

= 4 + [(1000 - 900)/(1000 - 846.27)] × 1

= 4.623%

Therefore, the yield to maturity will be:

= 4.623% × 2

= 9.24%

In conclusion, the yield to maturity is 9.24%.

Learn more about yield to maturity on:

https://brainly.com/question/26657407

The scope, schedule, and budget will require the appropriate stakeholder approval

Group of answer choices

True

False

Answers

True. The scope, schedule, and budget of a project are critical components that must be approved by the appropriate stakeholders. These stakeholders typically include the project sponsor, project manager, and project team members, as well as any other individuals or groups who have a vested interest in the project. Approval of the scope, schedule, and budget ensures that the project is aligned with the goals and objectives of the organization and that resources are allocated appropriately.

What will produce more accurate results when giving a survey?

A. Using the word "frequently" in a question

B. Creating face-to-face interviews

C. Adding boxes to check for answers

D. Creating an open questions

Answers

Answer:

Option B; Creating face-to-face interviews

Explanation:

Research has shown that face-to-face interviews tend to produce more accurate results when giving a survey. So the correct answer is option B.

1. Before there was a federal income tax, what taxes did Americans have to pay?

2. Explain why tariffs are considered regressive taxes.

3. Describe the first institution of the income tax in the United States, the reason behind it, and what happened to it.

4. Even though the amendment that allowed income tax was passed again in 1913, what events led to its being enforced among all Americans?

5. How did the government try to influence citizen’s views of paying income tax? Would this have worked for you?

6. How can the government drive their policies using income tax?

Answers

Answer:

1.local property taxes and tariffs

2.tax applies equally to everyone

3.The system of tax began in America in the year 1861, this was during the civil war, where the Congress passed an Act that included a tax on personal incomes in order to meet up war expenses.

4. The Revenue Act of 1913

5.As in the Civil War, Congress turned to the income tax to quickly raise large amounts of revenue. In 1917, Congress lowered the standard exemption to $1,000 for individuals thus expanding the taxpayer pool. At the same time, the lawmakers increased the base tax rate from 1 percent to 2 percent.

6.when we according rule of tax now the citizen buying the tax the government can drive any purpose

Explanation:

How can you make positive economic choices?

Answers

Answer:

All choices require giving up something in your life whether that is friends or family, or things that you really want. Economic choices require you to think do you really want this and what is the benifit out of it, like what do you get out of making this decision. The economic things are what will be produced, how will it be produced, and how will the output society produces be distributed

Explanation:

International franchising is

Answers

International franchising is a business model that expands the franchising concept into the international marketplace. For example, you can use the rental car concept as a prime example. You can expand the concept of renting a car from a domestic market to an international market.

differences between division of labor and specialisation

Answers

The heart of the golden rule is

O sympathy

O pity

O empathy

O liberty

Answers

Answer:

The answer is empathy

Explanation:

Empathy means to put yourself into another person's perspective, which is precisely what the golden rule "treat yourself how you would like to be treated" encourages.

Twenty-Nine Production Group wants to launch a new album by one of its artists. The album will be geared toward young adults. The production team is looking for ways to effectively market the album through its life cycle, and it wants your advice.

How would you brand, package, and label the product during the intro, growth, maturity, and decline stages of its life cycle?

Teacher Note:

In your response, ensure to include how you will brand, package and label the new album through each of its life cycle. Don't forget to review the lesson to help you out.

Introduction: The main goal here is to draw attention to the new product and create awareness of it.

Growth: In this stage the demand is growing and focuses on building a solid share, brand recognition, and brand loyalty.

Maturity: In this stage, the producer works to retain its market share and faces a lot of competition at this point. Sales begin to decline and they must decide if it is going to continue as is or make improvements.

Decline: In this stage, product sales drop significantly and demand goes down. Eventually, the product is discontinued.

Feel free to use the following sentence starters if you need help.

During the introduction stage, I would …

During the growth stage, I would …

During the maturity stage, I would …

During the decline stage, I would …

Answers

Answer:

During the introduction stage, I would focus on creating buzz and building awareness about the new album. I would brand it as a must-have for young adults, with a catchy and trendy name that appeals to the target market. The packaging should be eye-catching and include images that represent the style and genre of the music. I would use social media platforms and influencers to promote the album and encourage fans to share and talk about it.During the growth stage, I would focus on building brand recognition and loyalty. I would continue to use social media and influencers to create a community around the album and engage with fans. I would consider offering exclusive content or merchandise for fans who purchase the album. The packaging should also include branding elements that are recognizable and consistent with the album's theme and message.During the maturity stage, I would work to retain the album's market share and fend off competition. I would focus on expanding the reach of the album by collaborating with other artists or partnering with brands that appeal to young adults. The packaging should be updated with new designs and features to keep it fresh and appealing to fans. I would also consider releasing special editions or remastered versions of the album to keep fans interested.During the decline stage, I would focus on liquidating inventory and minimizing losses. I would offer discounts or bundle deals to incentivize fans to purchase the album before it is discontinued. The packaging should be streamlined and simple, with clear labeling that indicates that it is a discounted item. I would also use social media to communicate with fans and thank them for their support, while also encouraging them to check out other products or artists that the production group offers.FRY-9C, FRY-14M, FRY-14Q, FRY-2052a, FP&A, CRR

What are these terms exactly mean? How do they work in business? What each term do?

Answers

The terms mentioned above are used in economics and have to do with finance.

What are FRY-9C, FRY-14M, and FRY-14Q?In order to keep an eye on financial institutions in between on-site inspections, the FR Y-9C is the main analytical tool employed. The form, which is the most frequently requested and scrutinized report at the holding company level, contains more schedules than any other report in the FR Y-9 series.

The FR Y-14M report gathers monthly in-depth information on the loan portfolios of bank holding companies (BHCs), savings and loan holding companies (SLHCs), and intermediate holding companies (IHCs). Three loan- and portfolio-level collections, as well as one in-depth address matching collection, make up the report.

On a quarterly basis, the FR Y-14Q compiles comprehensive information on the various asset classes, capital components, and pre-provision net revenue (PPNR) categories of the bank holding companies (BHC), savings and loan holding companies (SLHCs), and intermediate holding companies (IHC).

Learn more about financial institution, from:

brainly.com/question/29641948

#SPJ9

Answer:

According to the case, the five kinds of share are directly relevant and can be calculated from the provided information are:

1. Authorized Capital

2. Issued Capital

3. Un-issued Capital

4. Subscribed Capital

5. Called-up Capital

Explanation:

Authorized Capital:

The authorized capital is known as the registered capital of the company, Authorized capital is the maximum amount of share that a company is authorized to issuing share to its shareholders.

In this case, the Alpha limited company registered on 5th January 2023 with the capital of 500,000 which is divided into 25,000 ordinary shares and the value of each share is Rs. 20.

Issued Capital:

The issued share capital of company is monetary value of shares which legally offers by company to its shareholders.

In this case, the Alpha limited company on 20th of January offered for sale to the public from authorized capital. The company put forward 15,000 and the value of each share is 20 Rs. Consequently, the company’s issued capital is 300,000 Rs (15,000 shares x 20 Rs.) .

Un-issued Capital:

The un-issued share capital reflects the part of authorized capital stock that the company has not yet issued to the public.

In this case, the Alpha limited company has not issued his 10,000 shares, and the value of each share is 20 Rs so its total un-issued capital is Rs. 200,000 (10,000 shares x 20 Rs.).

Subscribed Capital:

The subscribed capital is the portion of issued capital for which the public has been subscribed and the company has accepted.

In this case, the Alpha limited company on 23rd January received applications for 14,500 shares from the public which informed by company’s bank, so the subscribed capital is Rs. 290,000 (14,500 shares x 20 Rs.).

Answers

The five kinds of capital that are directly relevant are:

Authorized Capital: Rs. 500,000Issued Capital: Rs. 300,000Un-issued Capital: Rs. 200,000Subscribed Capital: Rs. 290,000Called-up Capital: Rs. 290,000What is a called-up capital?The called-up capital refers to the portion of the subscribed capital that the company has demanded and the shareholders are required to pay.

In this case, the Alpha limited company called up the entire subscribed capital of Rs. 290,000 on 25th January. Therefore, the called-up capital is also Rs. 290,000.

Summarily,

- Authorized Capital: Rs. 500,000

- Issued Capital: Rs. 300,000

- Un-issued Capital: Rs. 200,000

- Subscribed Capital: Rs. 290,000

- Called-up Capital: Rs. 290,000

learn more about capital: https://brainly.com/question/13372465

#SPJ1

At the beginning of the year, Plummer's Sports Center bought three used fitness machines from Brunswick Corporation. The machines immediately were overhauled, installed, and started operating. The machines were different; therefore, each had to be recorded separately in the accounts.

Machine A Machine B Machine C

Invoice price paid for asset $20,400 $37,300 $22,100

Installation costs 2,300 2,000 600

Renovation costs prior to use 2,900 2,500 1,700

By the end of the first year, each machine had been operating 5,400 hours.

2. Prepare the entry to record depreciation expense at the end of Year 1, assuming the following. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Machine Life Residual Value. Depreciation Method

A 9 years $1,300 Straight-line

B 77,000 hours. 3,300 Units-of-production

C 8 years 3,100 Double-declining-balance

CREATE A JOURNAL ENTRY WORKSHEET

Record the depreciation expense for year 1

Answers

Answer: Debit Depreciation Expense $11,714 Credit Accumulated Depreciation on : Machine A $3,400, Machine B $2,500 Machine C $5,814

Explanation:

9. In cell B15, enter a formula that uses the IF function and tests whether the total sales for Q1 (cell B8) is greater than or equal to 1000000. If the condition is true, multiply the total sales for Q1 by 0.18 to calculate a commission of 18%. If the condition is false, multiply the total sales for Q1 by 0.10 to calculate a commission of 10%.

Answers

Based on the formula being an IF function that tests total sales for being greater than a certain figure, the formula is =IF(B8>=1000000,B8*0.18,B8*0.10).

Why is this the formula?If the amount in B8 is more than or equal to 100,000, the if function would be IF(B8>=1000000).

If the amount meets that criteria, then the IF function will multiply it by 18% and if the amount does not meet this criteria, the amount is multiplied by 10% after the third comma.

The complete formula would then be:

=IF(B8>=1000000,B8*0.18,B8*0.10)

Find out more on the IF Function at https://brainly.com/question/25638609.

A back-up plan is a (an)...

A)waste of time

B)alternative plan

C)first plan

D)all of the above

Answers

one of the first considerations in cash management is ____

group of answer choices a. to have as much cash as possible on hand. b. synchronization of cash inflows and cash outflows. c. profitability. d. to put any excess cash into accounts receivable

Answers

One of the first considerations in cash management is the synchronization of cash inflows and cash outflows. option (b)

This means that a company needs to ensure that it has enough cash available to meet its payment obligations, while also ensuring that it is not holding onto excessive amounts of cash that could be invested elsewhere. By carefully managing the timing of cash inflows and outflows, a company can minimize the risk of cash shortages or excesses, and optimize its cash position for maximum efficiency and profitability.

Learn more about cash management

https://brainly.com/question/27960916

#SPJ4

Where the goth girl at???

Answers

Answer:

im batman

Explanation:

Answer:

RAWR

Explanation:

reasons why managers may be reluctant to participate fully in setting budgets??

Answers

Answer:

Some managers are reluctant to participate in budgeting because they do not like to discuss financial matters. They may also feel like developing a budget stops flexibility.

Managers may be reluctant to fully participate in setting budgets due to several reasons. First, they may fear that by actively participating, they will be held accountable for meeting the budget targets, leading to increased pressure and scrutiny.

Second, managers may have limited knowledge or experience in financial matters, making them hesitant to engage in budgeting discussions. Third, they may perceive budgeting as a time-consuming process that distracts them from their primary responsibilities.

Additionally, managers might have concerns that their departmental needs and priorities will not be adequately considered, resulting in inadequate resource allocation. Overall, these factors can contribute to their reluctance to actively engage in the budgeting process.

Learn more about budgets here

https://brainly.com/question/31952035

#SPJ4

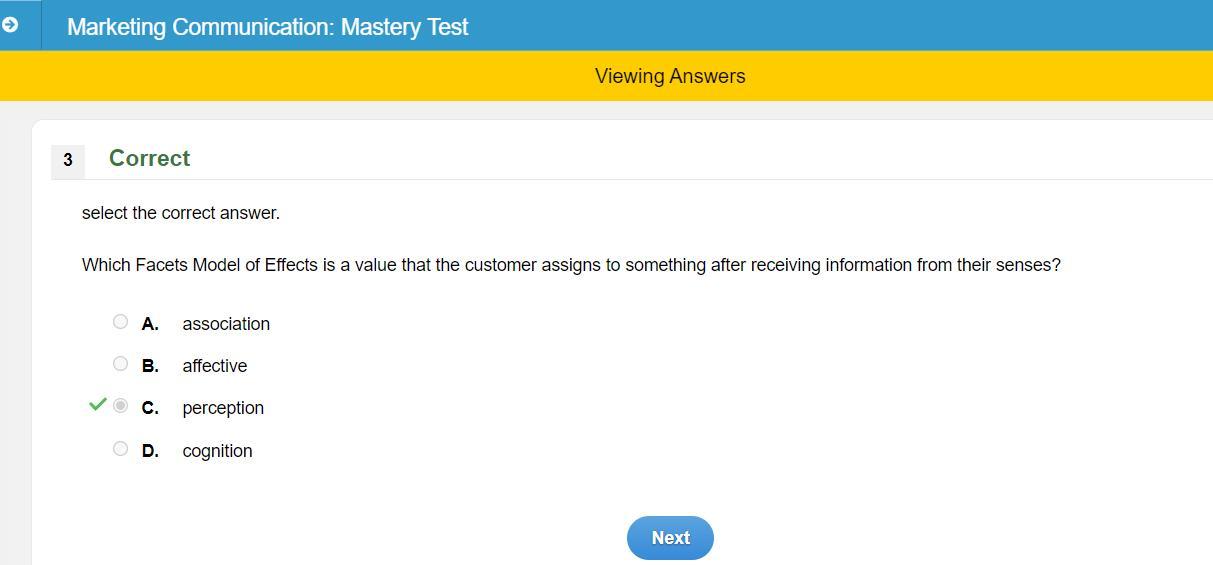

select the correct answer.

Which Facets Model of Effects is a value that the customer assigns to something after receiving Information from their senses?

OA association

OB. affective

OC. perception

OD. cognition

Answers

Answer:

The answer is C. Perception!

Explanation:

Perception is when you receive information through your senses and assign it meaning. (There's a quizlet made by slmoon9852 that can teach you more about it!)

Can some one paste the lyrics for never gonna give you up here

Answers

Answer: it says the words are innapropriate

Let MAC1 = 100 – 10E and MAC2 = 50 – 10E. Graph each function and compute the aggregate MAC curve. Let MD = 30E, compute the socially efficient equilibrium. For the equations given above, suppose the government sets the pollution level at four units. What are the net social costs of this policy?

Suppose a technological change occurs that reduces the marginal costs of abatement for polluter 1 in the above equation to that of polluter 2. How does this affect the socially efficient level of pollution? Solve numerically and graphically.

Answers

If the marginal costs of abatement for polluter 1 become equal to polluter 2, it does not impact the socially efficient level of pollution. The level is still determined by equating Marginal Damage with the Aggregate MAC.

To graph each function, we can plot MAC1 and MAC2 on a graph with the quantity of emissions (E) on the x-axis and the marginal abatement cost (MAC) on the y-axis.

For MAC1: MAC1 = 100 - 10E

For MAC2: MAC2 = 50 - 10E

To compute the aggregate MAC curve, we add the individual MAC curves together. So, Aggregate MAC = MAC1 + MAC2.

Aggregate MAC = (100 - 10E) + (50 - 10E) = 150 - 20E

Now, let's calculate the socially efficient equilibrium by setting the Marginal Damage (MD) equal to the Aggregate MAC.

MD = Aggregate MAC

30E = 150 - 20E

Simplifying the equation, we get:

50E = 150

E = 3

Therefore, the socially efficient equilibrium occurs when the quantity of emissions (E) is 3.

Now, let's calculate the net social costs of the policy when the government sets the pollution level at four units.

Net social costs = Aggregate MAC - MD

Net social costs = (150 - 20(4)) - (30(4))

Net social costs = 110 - 120

Net social costs = -10

The net social costs of this policy would be -10, indicating a net benefit to society.

If a technological change occurs that reduces the marginal costs of abatement for polluter 1 to that of polluter 2, it means that MAC1 will become equal to MAC2.

Setting MAC1 equal to MAC2:

100 - 10E = 50 - 10E

Simplifying the equation, we find that E can have any value, as both sides are equal.

Graphically, this change would mean that MAC1 and MAC2 become parallel lines on the graph, with the same slope and intercept. The socially efficient level of pollution would still be determined by equating MD with the aggregate MAC.

In conclusion, if the marginal costs of abatement for polluter 1 become equal to polluter 2, it does not affect the socially efficient level of pollution. The socially efficient level is still determined by equating the Marginal Damage with the Aggregate MAC, regardless of the marginal costs of individual polluters.

For more question on marginal visit:

https://brainly.com/question/14867207

#SPJ8

A survey found that 76% of men preferred darker jeans. if 500 men were sureveyed, how many answered that they preferred darker jeans

Answers

Answer: 380 men preferred darker jeans

Explanation:

76% of 500 is 380

Jordan is considering three choices of spending the new year's eve. Option A is to dine outside at a luxury restaurant; option B is indoor skydiving, and option C is to play video games at a close-by club. If all three options cost the same, explicitly, what can be the economic reason for Jordan choosing option B

Answers

Answer: b. Jordan values option B more than options A and C.

Explanation:

All options cost the same explicitly which means that Jordan's choice was made based on implicit/ opportunity cost factors.

These undisclosed factors led to Jordan valuing option B more than the other options which is why it was picked even thought they all cost the same. Had any other option being more valuable than B, it would have been picked but since B was picked, B was the most valuable.