What was this product's net operating income (loss) last year? last year minden company introduced a new product and sold 15,000 units of it at a price of $70 per unit. the product's variable expenses are $40 per unit and its fixed expenses are $540,000 per year. required: 1. what was this product's net operating income (loss) last year? 2. what is the product's break-even point in unit sales and dollar sales? 3. assume the company has conducted a marketing study that estimates it can increase annual sales of this product by 5,000 units for each $2 reduction in its selling price. if the company will only consider price reductions in increments of $2 (e.g., $68, $66, etc.), what is the maximum annual profit that it can earn on this product? what sales volume and selling price per unit generate the maximum profit? 4. what would be the break-even point in unit sales and in dollar sales using the selling price that you determined in requirement 3?

Answers

Answer:

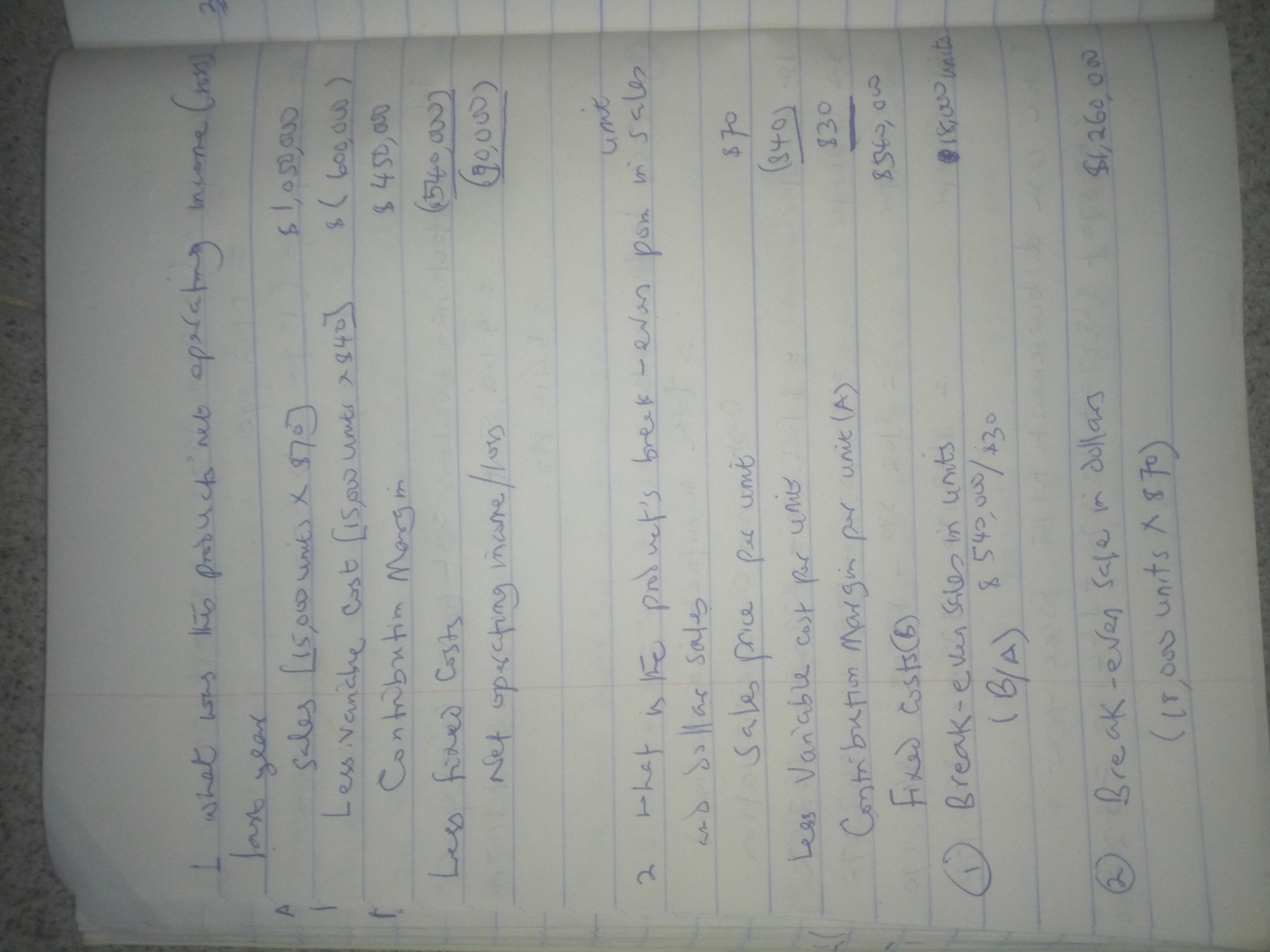

1. What was the product's operating income(loss) last year = $90,000 loss

2. What is the product's Break even point in unit sales and dollars

• Break even sales in units 18,000

• Break even i n sale dollars $1,260,000

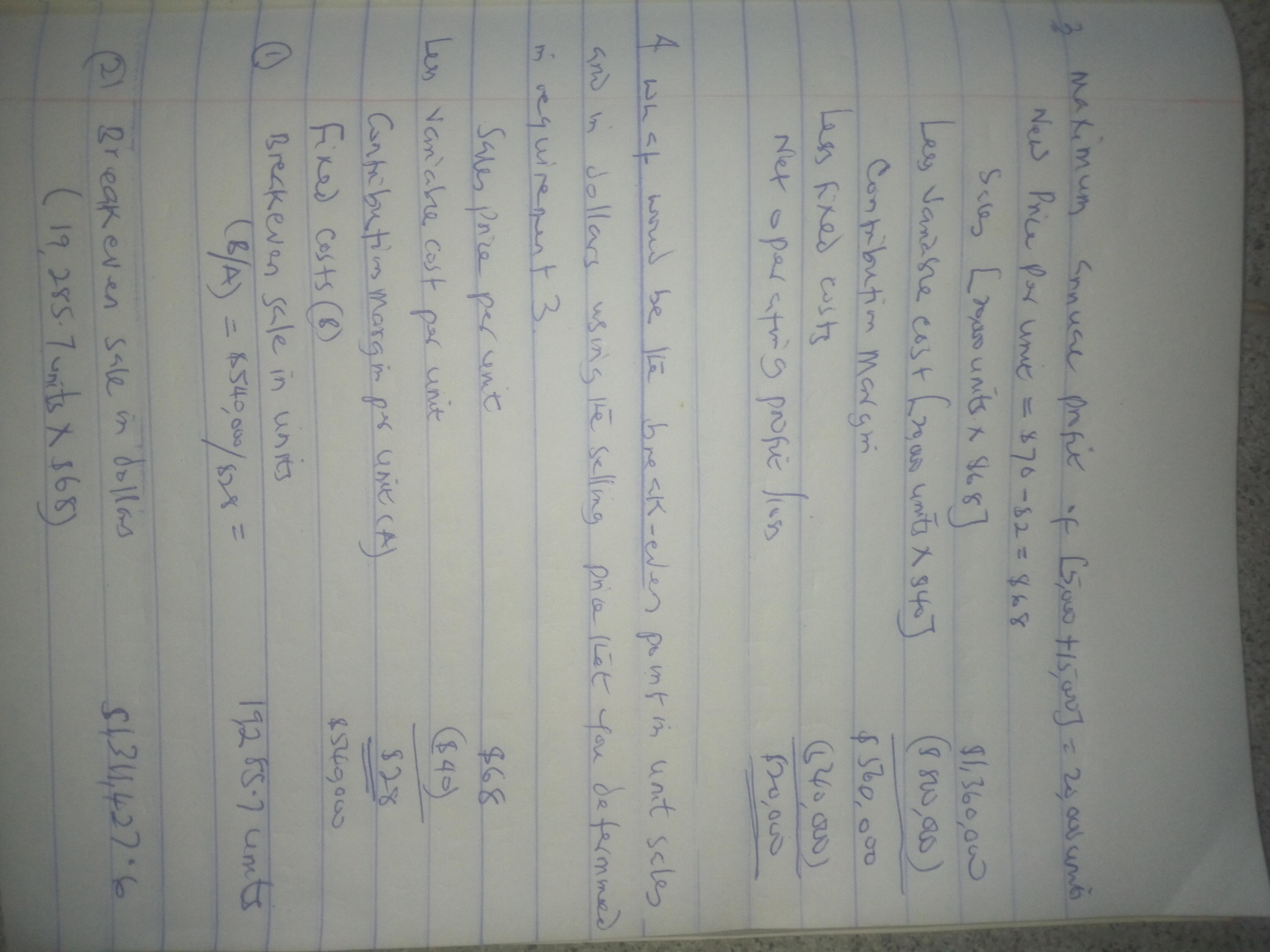

3. Maximum annual profit given an increment of 5,000 units and reduction of sales price per unit by $2.

• Net profit of $20,000

4. What would be the break even point in unit sales and dollars using the selling price that you determined in requirement 3.

• Break even sales units 19,285.7

• Break even in sales dollars $1,311,427.6

Explanation:

Please see attached detailed solution to the above questions and answers.

The product's net operating loss last year was $90,000.

The net operating loss will be calculated thus:

Sales (15000 × 70) = 1050000Less: Variance cost (15000 × 40) = 600000Contribution margin = 450000Less: fixed cost = 540000Net operating loss = 90000The product's break even sales in units will be:

= $540000 / $30

= 18,000

The break even in sale in dollars will be:

= 18000 × 70

= $1,260,000

Read related link on:

https://brainly.com/question/18507538

Related Questions

1. Define business. Explain the functions of business.

Answers

\( \large{ \tt{☄ \: ANSWER}} : \)

↦ Business is an economic activity that is directed towards acquiring and earning profit and wealth through customer's satisfaction. It plays an important role for the economic development of the country and uplift living standard of the people. Some of the functions of business are described below :

Creation of utilities : For the fulfillment of needs of customers , business creates various types of utilities. A business has many components and each component is involved in the creation of the certain utility. For instance : manufacturers create from utility , transportation system created place utility , warehousing time utility and insurance companies risk utility.Generation of employment : Business is a source of employment. Various types of employees are required to a business. In industries , both skilled and unskilled manpower are required for production , distribution and auxiliaries functions. Hence , the development of industry and commerce helps to solve the unemployment problem of a nation.Earning Foreign Currency : Business is the main source of earning Foreign Currency. Foreign currency can be earned by exporting surplus products and services to foreign countries. The development of export trade brings favourable balance in payment.Provides investment opportunities : Business provides investment opportunities to the investors in production and distribution activities. Depending on the nature of investment ; investors receive dividend , interest or other financial benefits. The persons of organizations having sufficient capital can invest their money in production and commercial activities according to their interest , capability and knowledge.\( \large{ \tt{✺ \: STUDY \: TIP}} : \)

FEED YOUR BRAIN : Foods like apples , walnuts and blueberries can improve your ability to focus , retain information and remain mentally alert. ♪

ツ Hope I helped! ♡

☼ Have a wonderful day / evening ! ☪

# StayInAndExplore ! ☂

▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁

What makes buying a foreclosed property risky?

Answers

Answer:

almost everything

Explanation:

A cost-cutting project will decrease costs by $66,100 a year. The annual depreciation will be $15,750 and the tax rate is 35 percent. What is the operating cash flow for this project?

Answers

Answer:

$48,478

Explanation:

Calculation to determine What is the operating cash flow for this project

Operating cash flow = [$66,100 ×(1 -.35)] + [$15,750 ×.35]

Operating cash flow = [$66,100 ×.65)+5,513.

Operating cash flow = 42,965+5,513

Operating cash flow = $48,478

Therefore the operating cash flow for this project will be $48,478

Give an example of an official in public service who failed to show probity, and explain your

answer. :

Answers

Answer:

The perfect and perhaps most commonly known is former U.S. President Richard Nixon.

Explanation:

Nixon was President of the United States from 1969 to 1974, he was elected for two periods, but he only finished one and less than half the other one. The reason is that he was embroiled in the Watergate scandal: an espionage campaign of the Democratic Party from Republican officials, including Nixon himself.

With these acts, Nixon, as the highest public official in the nation, failed to show probity, and dishonored the office of the president. He was quick to renounce the presidency, and would have faced legal challenges if not for his Vice President, Gerald Ford, who became president as his replacement, and issued him a presidential pardon immediately after.

Juniper Design Limited of Manchester, England, is a company specializing in providing design services to residential developers. Last year the company had net operating income of $420,000 on sales of $1,500,000. The company’s average operating assets for the year were $1,700,000 and its minimum required rate of return was 15%.

Required:

Compute the company’s residual income for the year.

Answers

Answer: 165,000

Explanation:

To compute the company’s residual income for the year, we can use the formula:

Residual Income = Net Operating Income – (Minimum Required Rate of Return x Average Operating Assets)

Given: Net Operating Income = $420,000 sales = $1,500,000

Average Operating Assets = $1,700,000

Minimum Required Rate of Return = 15% = 0.15

Residual Income = Net Operating Income – (Minimum Required Rate of Return x Average Operating Assets)

Residual Income = $420,000 – (0.15 x $1,700,000)

Residual Income = $420,000 – $255,000

Residual Income = $165,000

Therefore, the company’s residual income for the year was $165,000.

When comparing cash management options, the higher the

Answers

Answer:

Cost the lower the demand

Company that makes shopping carts for supermarkets and other stores recently purchased some new equipment that reduces the labor content of the jobs needed to produce the shopping carts. Prior to buying the new equipment, the company used 6 workers, who together produced an average of 90 carts per hour. Workers receive $10 per hour, and machine cost was $50 per hour. With the new equipment, it was possible to transfer one of the workers to another department, and equipment cost increased by $10 per hour, while output increased by 6 carts per hour.

A. Compute the multifactor productivity(MFP) (labor plus equipment) under the Prior to buying the new equipment. (Round to 4 decimal places)

B. Compute the % growth in productivity between the Prior and after buying the new equipment. (Round to 2 decimal places)

C. Comment on the changes in productivity according to two measures,and which you believe in the more pertinent for this situation?

Answers

Answer:

A. Compute the multifactor productivity(MFP) (labor plus equipment) under the Prior to buying the new equipment.

multi-factor productivity = 90 carts / ($60 + $50) = 0.8182 carts/$

B. Compute the % growth in productivity between the Prior and after buying the new equipment.

new multi-factor productivity = 96 carts / ($50 + $60) = 0.8727 carts/$

% growth = (0.8727 - 0.8182) / 0.8182 = 6.66% increase

C. Comment on the changes in productivity according to two measures,and which you believe in the more pertinent for this situation?

the multi-factor productivity increased by 6.66% because even though the total cost of the factors of production remained the same, total output increased by 6 units

Barker Company produces and sells a single product with budgeted or standard costs as follows:

Inputs Standards

Direct materials 10 lbs at $10.00 per pound

Direct labor 8 hours at $12.50 per hour

Factory overhead: Variable

Fixed 8 hours at $20.00 per hour

8 hours at $40.00 per hour

Overhead rates are based on 8,000 standard direct labor hours per month, i.e., this is the master budget denominator activity level.

Desired ending inventories of materials are based on 10% of the next months materials needed. Desired ending finished goods are based on 5% of next periods budgeted unit sales.

Unit Sales are budgeted as follows:

January February March April

1,000 1,200 1,600 1,400

The budgeted sales price is $1000 per unit. Sales are budgeted as 80% credit sales and 20% cash sales. Past experience indicates that 60% of credit sales are collected during the month of sale, 38% are collected in the following month, and 2% are uncollectible. A 1% cash discount is allowed to all customers (cash or credit) who pay within the month the sale takes place. Selling and administrative expenses are:

Variable = 20% of sales dollars, Fixed = $250,000 per month. The budget assumption concerning cash payment proportions is that all current purchases of direct material, direct labor, factory overhead and selling and administrative items will be paid for during the current period. The beginning cash balance for February is $10,000. Depreciation and other non-cash fixed costs are: manufacturing = $100,000, selling and administrative = $75,000.

REQUIRED: A Partial Master Budget for February as follows.

1. Sales budget for February, including net sales dollars.

2. Calculate collections for February.

3. Production Budget, i.e., units to be produced for February.

4. Direct Material quantity needed for production for February.

5. Direct Material quantity to be purchased for February.

6. Budgeted cost of direct material purchases for February.

7. Budgeted cost of direct material used for February.

8. Direct labor needed for production for February.

9. Budgeted cost of direct labor used for February.

10. Budgeted factory overhead costs for February.

11. Budgeted cost of goods sold for February.

12. Prepare a simple Budgeted Income Statement for February.

13. Prepare a cash budget for February.

Answers

Sales Budget for February:

Expected unit sales in February: (1,200 units × 80%) = 960 units

Sales revenue: 960 units × $1,000 per unit = $960,000

What are the calculations for other questions?Below are the calculations for all kinds of budget in February:

2. Collections Budget for February:

Credit sales in February: 960 units × $1,000 per unit × 80% = $768,000

Collections from February credit sales (60% collected in February): $768,000 × 60% = $460,800

Collections from January credit sales (38% collected in February): ($960,000 - $768,000) × 38% = $68,640

Cash sales in February: 960 units × $1,000 per unit × 20% = $192,000

Total collections in February: $460,800 + $68,640 + $192,000 = $721,440

3. Production Budget for February:

Expected unit sales in February: 960 units

Add: Desired ending finished goods inventory (5% of next period sales) = 5% × 1,600 = 80 units

Total units required: 960 units + 80 units = 1,040 units

Less: Beginning finished goods inventory (assume zero) = 0

Units to be produced: 1,040 units

4. Direct Material Quantity Needed for Production for February:

Direct materials required per unit: 10 lbs

Total direct materials required: 1,040 units × 10 lbs per unit = 10,400 lbs

5. Direct Material Quantity to be Purchased for February:

Direct materials needed for production: 10,400 lbs

Add: Desired ending materials inventory (10% of next period's materials needed) = 10% × (10,400 lbs) = 1,040 lbs

Total materials required: 10,400 lbs + 1,040 lbs = 11,440 lbs

Less: Beginning materials inventory (assume zero) = 0

Direct materials to be purchased: 11,440 lbs

6. Budgeted Cost of Direct Material Purchases for February:

Direct material purchase price: $10.00 per lb

Direct materials to be purchased: 11,440 lbs

Budgeted cost of direct materials purchases: $10.00 per lb × 11,440 lbs = $114,400

7. Budgeted Cost of Direct Material Used for February:

Direct materials used in production: 10,400 lbs

Direct material purchase price: $10.00 per lb

Budgeted cost of direct materials used: $10.00 per lb × 10,400 lbs = $104,000

8. Direct Labor Needed for Production for February:

Direct labor required per unit: 8 hours

Total direct labor required: 1,040 units × 8 hours per unit = 8,320 hours

9. Budgeted Cost of Direct Labor Used for February:

Direct labor hours required: 8,320 hours

Direct labor rate: $12.50 per hour

Budgeted cost of direct labor used: 8,320 hours × $12.50 per hour = $104,000

10. Budgeted Factory Overhead Costs for February:

Variable factory overhead rate: $20.00 per direct labor hour

Fixed factory overhead: $40.00 per direct labor hour × 8,000 standard direct labor hours per month ÷ 12 months = $26,667

Total factory overhead: ($20.00 per hour × 8,320 direct labor hours) + $26,667 = $186,667

11. Budgeted Cost of Goods Sold for February:

Direct materials: $104,000

Direct labor: $104,000

12. Prepare a simple Budgeted Income Statement for February.

Barker Company

Budgeted Income Statement

For the Month Ended February 28

Sales (1,200 units x $1,000) $1,200,000

Cost of goods sold:

Direct materials used $100,000

Direct labor 120,000

Factory overhead 40,000

Total manufacturing costs 260,000

Add: Beginning finished goods inventory 0

Less: Ending finished goods inventory (5% x 1,200 units x $1,000) (60,000)

Cost of goods sold 200,000

Gross profit 1,000,000

Selling and administrative expenses:

Variable (20% x $1,200,000) 240,000

Fixed 250,000

Total selling and administrative expenses 490,000

Net operating income $510,000

13. Prepare a cash budget for February.

Barker Company

Cash Budget

For the Month Ended February 28

Beginning cash balance $10,000

Cash receipts:

Cash sales (20% x 1,200 units x $1,000) $240,000

Collections on credit sales:

January sales (60% x 1,000 units x $1,000) 600,000

February sales (38% x 1,200 units x $1,000) 456,000

Total collections 1,296,000

Total cash available 1,306,000

Cash disbursements:

Direct materials purchases $100,000

Direct labor 120,000

Factory overhead 40,000

Selling and administrative expenses:

Variable (20% x $1,200,000) 240,000

Fixed 250,000

Total cash disbursements 750,000

Excess (deficiency) of cash receipts over disbursements $556,000

Financing:

Short-term loan (if necessary) 0

Ending cash balance $556,000

It should be noted that the cash budget assumes that all cash payments for direct materials, direct labor, factory overhead, and selling and administrative expenses are paid in the same month. The cash budget also assumes that all current purchases of direct materials, direct labor, factory overhead, and selling and administrative items will be paid for during the current period.

learn more about cash budget: https://brainly.com/question/8707644

#SPJ1

If the order is accepted, by how much will monthly profits increase or decrease? (The order would not change the company’s total fixed costs.) Show and label all computations using words and numbers to explain the steps please (final answer should be incremental profits)

Answers

If the Superior Company accepts the special order, monthly profits will increase by $2,500.

By how much will monthly profits increase or decrease if order is accepted?To determine the impact on monthly profits, we need to calculate the contribution margin per unit on the special order.

Contribution margin per unit = Selling price per unit - Variable costs per unit

= $15 - ($2.50 + $3.00 + $0.50 + $1.50)

= $7.50

The contribution margin ratio is 50% ($7.50 / $15).

The fixed costs are $4.25 + $2.00 = $6.25 per unit.

If the company accepts the special order, it will produce and sell an additional 2,000 units.

Total contribution margin from the special order:

= 2,000 units x $7.50 per unit

= $15,000

Since the order would not affect regular sales, the company's total fixed costs will remain the same. Therefore, the increase in monthly profits would be:

Increase in monthly profits = Total contribution margin from the special order - Incremental fixed costs

= $15,000 - ($6.25 x 2,000)

= $2,500.

Read more about Monthly order

brainly.com/question/28106777

#SPJ1

The city government of Pleasantville promised significant tax breaks to a large retailer if it opened a store in Pleasantville, which would result in nearly 200 new local jobs. However, the retailer decided that it would staff the new Pleasantville store with employees from its other stores, meaning no new jobs were created. As a result, the city of Pleasantville instituted clawbacks by

Answers

As a result, the city of Pleasantville instituted clawbacks by rescinding the tax breaks.

When the government gives you a tax break, it approaches you're getting a reduction to your taxes. A tax spoil can be available in a selection of forms, consisting of claiming deductions or excluding profits from your tax return.

Here are the five biggest tax credits you just might qualify for that could have a prime effect on your income and tax situation.

Earned profits Tax credit score. American Opportunity Tax credit. Lifetime studying credit score. toddler and established Care credit. Savers Tax credit.Learn more about government here: https://brainly.com/question/1078669

#SPJ1

Continuing with the company selected in Unit 2, discuss how the income statement budget would be created for a year starting with the sales budget through the SG&A budget. Be sure to: • Be specific in describing the component line items of each • Identify the individuals that would be involved in developing the budgets

Answers

For a given year, the income statement budget is created through the use of predictions and fore casting.

What is the income statement budget?This is the budget that is made up of the revenue, the expenditure and the profit for a particular year.

The financial report from the former year and the budget for the new period is what is taken into account.

The individuals that develop the income statement budget would be the accountant.

Read more on income statement budget here:https://brainly.com/question/24498019

Knowing your audience: Find an example of when a company or business did not listen to its customers. Investigate the case and explain it.

Answers

Answer:

E.g., Nokia did...

Customers made it clear to them that neither Windows phone nor Symbian will get anywhere near Android or iOS.

They resisted, ignored. They just flat out wanted the customers to adapt to their OS rather the other way around due to the absolute authority in the mobile phone market share.

As with any business which doesn't evolve as per the customer demands, the end was inevitable, and it was just a matter of time.

Brainliest me <3

(214) 1. Distinguish between technical efficiency and allocative efficiency. Use the two concepts of efficiency to compare a perfect market structure with a monopoly.

Answers

Technical efficiency refers to the ability to produce the maximum output from a given set of inputs or resources. It focuses on the production process and achieving the highest output level with the least amount of resources wasted. Technical efficiency emphasizes optimizing the production process to minimize costs and maximize productivity.

Allocative efficiency, on the other hand, relates to the allocation of resources in a way that maximizes overall social welfare. It refers to the ideal allocation of resources that matches consumers' preferences and demands. Allocative efficiency ensures that resources are allocated so that goods and services align with consumer preferences. This results in the best outcome for society.

When comparing an ideal market structure with a monopoly in terms of efficiency, there are significant differences. In an ideal market structure, characterized by complete competition, both technical and allocative efficiency is typically achieved. Many buyers and sellers exist, information is freely available, and no single entity controls the market. Competition drives firms to produce at the lowest cost and offer goods and services that match consumer preferences, leading to technical and economic efficiency.

In contrast, a monopoly represents a market structure where a single firm dominates the industry and has substantial market power. In terms of technical efficiency, a monopoly may not necessarily achieve the same level as a perfectly competitive market. Due to the lack of competition, a monopoly may not have the same incentive to minimize costs or innovate as efficiently as possible. This can result in higher production costs and lower technical efficiency.

Regarding allocation efficiency, monopolies often fail. Without competition, a monopolistic firm can set prices higher than the marginal cost of production, resulting in a suboptimal allocation of resources. The monopolist may prioritize maximizing profits rather than satisfying consumer preferences. This leads to a less efficient allocation of resources than in a perfectly competitive market.

Overall, an ideal market structure exhibits higher levels of technical and allocative efficiency than a monopoly. When true competition promotes resource optimization and consumer satisfaction, resulting in more efficient resource allocation.

What dose it mean to be fully human were interacting with others any virtual space like classroom why or why not

Answers

While interacting with others in a virtual space, to be fully human means for instance such as in a classroom, means having the qualities and characteristics inclusive to humanity, even though the medium of communication being virtual.

It involves identifying and embracing our shared humanity and engaging in meaningful connections with other people like friends family colleagues, even though miles apart and can only see by virtual screens.

Emotional connections, sharing knowledge, expression ,communication collaboration cooperation are the various forms. Therefore, virtual experiences though lack sensory and physical aspects of face-to-face interactions, they still provide a platform for human connection, learning, and growth.

To know more about virtual interaction,

brainly.com/question/31455408

brainly.com/question/32326690

micro environment essay

Answers

Answer:

roses are red violets are blue suger is sweet but why arent you

Use the following chart to explain how the loan repayment period affects the total cost of the loan.

Loan Repayment Period

Principal

Interest Rate

Loan 1

$5,000

6.47 percent

$98

Monthly Payment

Loan Repayment Period 5 years

Total cost of the loan $5,866

Loan 2

$5,000

6.47 percent

$57

10 years

$6,804

Answers

Loan 1 and Loan 2 have the same principal and interest rate but different monthly payments and total loan costs, therefore, the loan repayment periods would be different.

What is the loan repayment period?The loan repayment period refers to the time it takes to repay a loan.

When the amount being repaid is smaller, the loan repayment period tends to be longer, and vice versa.

Data and Calculations:

Loan Repayment Principal Interest Rate Monthly Total cost

Period Payment of the loan

Loan 1 5 years $5,000 6.47 percent $98 $5,866

Loan 2 10 years $5,000 6.47 percent $57 $6,804

Thus, the loan repayment periods are affected by the monthly payments and total costs to reflect the loan terms.

Learn more about loan repayments at https://brainly.com/question/25599836

#SPJ1

A distinguishing characteristic of a telecommuter is that these workers?

Answers

Answer:

Generally work evenings instead of days. Work from the office on some days, and from home on other days. Send their work electronically to a central office.

PittCo has a policy of paying salaries for contract labor on the 15th of the month following the labor services received. In December 2020, the company paid $15,000 in salaries for labor services received in November 2020. In addition, labor services received in December 2020 were $12,000 and will be paid by the company on January 15, 2021. What adjusting entry will PittCo record on December 31, 2020

Answers

Answer and Explanation:

The adjusting entry is shown below:

As on December 2020

Salaries Expense $12,000

Salaries Payable $12,000

(Being salary outstanding is recorded)

To record this, we debited the salaries expense as it increased the expenses and credited the salaries payable as it also increased the liabilities

Therefore this should be the adjusting entry passed

QUESTION 4: PROGRESS REPORT On the 20th of April 2023, The campus manager, Mr Manoto, requested the secretary in the SRC office, to compile a report on the progress of the revival day planning. In your report tasks that are completed are invitations for special guests and booking of live performers; the task committee is still busy with finalizing the design of the banners and T-shirt and sports bottle printing. Due to overspending on budget, you still have not booked catering and security for the day. Your report must be in memo format.

Answers

A sample memo based on the given question prompt is given below:

The MemoMemorandum

To: Mr. Manoto, Campus Manager

From: SRC Office Secretary

Date: April 20th, 2023

Subject: Progress update for Revival Day planning

Esteemed Mr. Manoto,

Please find below a status report detailing advancements made in the preparations of the upcoming Revival Day ceremony. We have accomplished issuing invitations to prominent guests and securing prominent musical acts. Our committees are putting the finishing touches to banner design, T-shirt outfits, as well as customizing sport water bottles.

Conversely, budgetary concerns impede us from booking security or catering caterers essential for event operations. However, we are investigating ways to cut expenses while still delivering quality service. We will be prompt with updates about progress made through these alternative strategies.

Thank you for your kind ownership in this venture; rest assured that our team is steadfastly dedicated to ensuring an excellent Revival Day rally session.

Yours faithfully,

[Your name]

Read more about memo here:

https://brainly.com/question/30389962

#SPJ1

Explain why income statement can also be called a profit and loss statement. What exactly does the word balance mean in the title of the balance sheet? Why do we balance the 2 halves?

Answers

Income can be earned through:

- A permanent job

- A seasonal job

- All of the above

Answers

all of the above

mark me brainliesttt :))

As Human Resource Manager, you have become aware that your coworker Alice is “borrowing” funds from petty cash when she is short before payday. She has explained to you that she always pays it back.

Is this appropriate?

Why or why not?

What should be done about this situation?

Answers

No, Alice's actions are not appropriate.

The first thing to do about the situation is to document it.

Why is taking petty cash with documentation, wrong ?Taking funds from petty cash without proper documentation or approval is a form of theft and is against company policy. Alice's actions can have serious consequences and set a poor example for other employees. It can lead to mistrust and a breakdown in the workplace culture of honesty and integrity.

The first step in addressing the situation should be to document the behavior and discuss it with Alice. The conversation should be conducted in a professional and non-confrontational manner, with the emphasis on educating Alice on the importance of following company policy and the potential consequences of her actions.

If Alice continues , it may be necessary to escalate the situation to higher management or the company's HR department. In severe cases, legal action may need to be taken.

Find out more on petty cash at https://brainly.com/question/30064547

#SPJ1

An organization licensed as a producer business entity based in New York would like to transact insurance in New Jersey. Which of the following is true?

- the organization will need to obtain a nonresident business entity license, and its producers will need to obtain nonresident licenses

Answers

Option d: The organization will need to obtain a nonresident business entity license, and its producers will need to obtain nonresident licenses is correct.

A business entity is an organization established to conduct business. The type of entity incorporated affects how a company is taxed and how it faces liability.

There are mainly he five types of business entities. Sole proprietorships and general partnerships are partnerships. A limited liability partnership provides investors with a degree of liability protection. Corporations and LLCs separate personal and business taxes and responsibilities.

To learn more about business entity, here:

https://brainly.com/question/28333410

#SPJ4

Complete question:

An organization licensed as a producer business entity based in New York would like to transact insurance in New Jersey. Which of the following is true?

a) The organization will not have to obtain a nonresident license, unless more than 50% of its business is conducted in New Jersey. However, its producers will need to obtain nonresident licenses.

b) The organization will not have to obtain a nonresident license, since it is a business entity. However, all of its producers will need to have nonresident licenses.

c) The organization will need to obtain a nonresident business entity license, which will secure nonresident status for the business itself and all of its producers.

d) The organization will need to obtain a nonresident business entity license, and its producers will need to obtain nonresident licenses

What are all expense accounts known as in accounting terminology?

All expense accounts are known as (blank) accounts, as they close at the end of the accounting period.

Answers

All expense accounts are known as temporary accounts, as they close at the end of the accounting period.

What is an expense account?This refers to money expended by an employee during the course of rendering service to his employer, which is now reimbursed.

In other words, an expense account can be defined as a type of account that include an amount of money (funds) that are paid to an employee by an employer of labor, so as to enable the employee spend the fund on things related to his or her job.

In Business management, some examples of an expense account include the following:

RepairsAdvertisingRentInterestHence, all expense accounts are known as temporary accounts, as they close at the end of the accounting period.

Learn more about expense account here: https://brainly.com/question/27864042

#SPJ1

dunn, inc. had 200,000 shares of $20 par common stock and 20,000 shares of $100 par, 6%, cumulative, convertible preferred stock outstanding for the entire current year ended december 31. each preferred share is convertible into five shares of common stock. dunn's net income for the year was $840,000. for the current year ended december 31, the diluted earnings per share is

Answers

Earnings per share is: (net income - preferred dividends)/common shares outstanding. Preferred stock dividends are $100 X 10% X 20,000 shares = $200,000.

Define cumulative, convertible preferred stock ?

Cumulative Convertible Preference Share are a type of preference shares where the dividend payable on the same accumulates, if not paid. After a specified date, these shares will be converted into equity capital of the company.For example, a company issues cumulative preferred stock with a par value of $10,000 and an annual payment rate of 6%. The economy slows down; the company can only afford to pay half the dividend and owes the cumulative preferred shareholder $300 per share.The cumulative preferred stocks are safe and secure regarding financial safety among all other stocks available in the market. The reason behind the same is that they will always get their dividend irrespective of the company's bad performance.To learn more about stock refers to:

https://brainly.com/question/25765493

#SPJ4

The diluted earnings per share is $2.80 for the current year ended December 31.

How to calculate diluted earnings per shares?To calculate the diluted earnings per share for Dunn Inc., we need to determine the total number of shares outstanding on a fully diluted basis. This takes into account not only the common shares outstanding, but also any additional shares that could be issued from the conversion of convertible preferred shares.First, we need to calculate the number of shares that could be issued from the conversion of the preferred stock.20,000 shares of preferred stock x 5 shares of common stock per preferred share = 100,000 potential additional sharesNext, we need to add these potential shares to the number of common shares outstanding to find the fully diluted number of shares.200,000 common shares + 100,000 potential additional shares = 300,000 fully diluted sharesFinally, we can divide the net income by the number of fully diluted shares to find the diluted earnings per share.$840,000 net income ÷ 300,000 fully diluted shares = $2.80 diluted earnings per shareIn summary, the diluted earnings per share is $2.80 for the current year ended December 31.To learn more about stocks and shares refer:

brainly.com/question/25818989

#SPJ4

Jillet Corporation began the year with inventory of 10,000 units of its only product. The units cost $8 each. The company uses a perpetual inventory system and the FIFO cost method. The following transactions occurred during the year: Purchased 50,000 additional units at a cost of $10 per unit. Terms of the purchases were 2/10, n/30. The company uses the gross method to record purchase discounts. The inventory was purchased f.o.b. shipping point and additional freight costs of $0.50 per unit were charged to Jillet. 1,000 units purchased during the year were returned to suppliers for credit. Jillet was also given credit for the freight charges of $0.50 per unit on the original purchase. The units were defective and were returned two days after they were received. The remaining inventory was paid within the discount period. (Hint: The discount applies only to inventory and not the freight.) Sales for the year totaled 45,000 units at $18 per unit. (Hint: The cost of the inventory sold includes the purchase cost of those units plus freight less purchase discount.) On December 28, Jillet purchased 5,000 additional units at $10 each. The goods were shipped f.o.b. destination and arrived at Jillet’s warehouse on January 4 of the following year. 14,000 units were on hand at the end of the year. Required: Determine ending inventory and cost of goods sold at the end of the year. Assuming that operating expenses other than those indicated in the above transactions amounted to $150,000, determine income before income taxes for the year. For financial reporting purposes, the company uses LIFO (amounts based on a periodic inventory system). Record the year-end adjusting entry for the LIFO reserve, assuming the balance in the LIFO reserve at the beginning of the year is $15,000. Determine the amount the company would report as income before taxes for the year under LIFO. Operating expenses other than those indicated in the above transactions amounted to $150,000.

Answers

1A) The cost of goods sold under FIFO perpetual inventory is $440,150.

1B) The Ending Inventory under FIFO perpetual inventory is $144,550.

1C) The income before taxes under FIFO perpetual inventory is $219,850.

2A) The cost of goods sold under LIFO periodic inventory is $463,500.

2B) The Ending Inventory under LIFO periodic inventory is $124,920.

2C) The income before taxes under LIFO periodic inventory is $196,500.

2D) Adjusting journal entry for LIFO reserve:

Debit Cost of goods sold (FIFO) $8,350

Credit LIFO reserve $8,350

What is the difference between FIFO and LIFO methods?The FIFO is the first-in, first-out costing method that assumes that goods bought first are the first to be sold.

LIFO is the last-in, first-out costing method that assumes that the last goods bought are the first to be sold.

What is the difference between a periodic and perpetual inventory system?A periodic inventory system accounts for inventory at the end of the period.

A perpetual inventory system accounts for inventory at the inventory transaction date and not at the end of the accounting period.

Data and Calculations:Beginning inventory units = 10,000 units

Cost per unit = $8

Total beginning inventory value = $80,000 ($8 x 10,000)

Inventory system: Perpetual with FIFO cost method

Transaction Analysis:FIFO method/Perpetual Inventory System:Inventory $500,000 (50,000 units at $10) Accounts Payable $500,000

Terms 2/10, n/30.

Freight-in Expense $25,000 (50,000 x $0.50) Accounts Payable $25,000

Accounts Payable $10,000 Inventory $10,000

Accounts Payable $500 Freight-in Expense $500

Accounts Payable $514,500 Cash Discounts $9,800 Cash $504,700

Cost of goods sold $440,150 ($80,000 + $367,500 - $7,350) Cash Discount $7,350 Inventory $430,000 Freight-in Expense $17,500

Cash $810,000 Sales Revenue $810,000

Ending inventory cost = $144,550 {($10 x 14,000) + ($0.50 x 14,000) - $2,450}

Net income:Sales revenue $810,000

Cost of goods sold $440,150

Operating cost = $150,000

Income before taxes = $219,850

LIFO Method/Periodic Inventory:Cost of goods sold $463,500 ($10 x 45,000 + ($0.50 x 45,000) - $9,000) Cash Discount $7,350 Inventory $450,000 Freight-in Expense $22,500

Cash $810,000 Sales Revenue $810,000

Ending inventory cost = $124,920 {($10 x 4,000) + ($8 x 10,000) + ($0.50 x 10,000) - $800}

Net income:Sales revenue $810,000

Cost of goods sold $463,500

Operating cost = $150,000

Income before taxes = $196,500

LIFO reserve increase = $8,350 ($23,350 - $15,000)

New LIFO reserve = $23,350 ($463,500 - $440,150)

Thus, the LIFO reserve is the difference between the cost of goods sold under FIFO and LIFO costing methods.

Learn more about LIFO reserves at https://brainly.com/question/13779572

#SPJ1

Cost data for Johnstone Manufacturing Company for the month ended March 31 are as follows:

Inventories March 1 March 31

Materials $217,200 $199,720

Work in process $450,840 $527,900

Finished goods $606,300 $637,020

Direct labor $3,620,000

Materials purchased during March $2,757,610

Factory overhead incurred during March: Indirect labor $330,970

Machinery depreciation $217,200

Heat, light, and power $181,000

Supplies $36,090

Property taxes $31,020

Miscellaneous costs $47,270

a. Prepare a cost of goods manufactured statement for March.

b. Determine the cost of goods sold for March.

Answers

Add direct materials, labor, and other manufacturing overhead costs to get the overall manufacturing costs.

Cost of good Manufactured $6,924,200Cost of Goods sold $6,894,500How to calculate Cost of Goods Sold for manufacturing company?Johnstone Manufacturing Company

Statement of cost of goods manufactured

For the Month ended March 31

work in process inventory, March 1 $435,900

Direct Materials:

Material Inventory, March 1 $210,000

Purchases $2,666,200

Cost of materials available for use$2,876,200

Material Inventory, March 31 $193,100

Cost of Direct materials used $2,683,100

Direct labor $3,500,000

Factory Overhead:

Indirect labor $320,000

Machinery Depreciation $210,000

Heat, Light, and power $175,000

Supplies $34,900

Property taxes $30,000

Miscellenious Costs $45,700

Total Factory Overhead $815,600

Total Manufacturing Costs incured during march $6,998,700

Total Manufacturing Costa $7,434,600

Work in process inventory, March 31 $510,400

Cost of good Manufactured $6,924,200

Johnstone Manufacturing Company

Statement of cost of goods manufactured

For the Month ended March 31

Finished goods inventory, March 1 $586,200

Cost of Goods manufactured $6,924,200

Cost of goods available for sale $7,510,400

Finished goods inventory, March 31 $615,900

Cost of Goods sold $6,894,500

To know more about direct materials, visit:

https://brainly.com/question/26245657

#SPJ4

SELECT AN ORGANISATION OF YOUR CHIOCE.

1.1 SUMMARISE THE NATURE OF BUSINESS

1.2 SUMMARISE THE BUSINESS MODEL

1.3 WHAT ARE THE KEY BUSINESS DRIVERS

2.1 NATURE OF DECISION DESCRIBING WHAT DECISION NEEDED TO BE MADE AND WHY

2.2 SUMMARISE HOW WAS THE DECISION MADE

2.3 ANALYSE THE DECISION MADE AND DESCRIBE IF A QUALITATIVE OR QUANTITATIVE APPROACH WAS USED AND JUSTIFY YOUR RESPONSE

2.4CONFIRM WHY WAS THIS APPROACH TAKEN BY THE BUSINESS AND APPRAISE THIS APPROACH FROM RISK MODELLING PERSPECTIVE

3.1 USING THE SELECTED BUSINESS DECISION FROM ABOVE, IDENTIFY AT LEAST 5 RISKS THAT NEEDED TO BE CONSIDERED TO MAKE THE SAME

3.2 USING THE RISK REGISTER IN THE PREVIOUS SECTION, CONDUCT A QUALITATIVE RISK ANALYSIS FOR THESE 5 RISKS BY PROPOSING THE PROBABILITY OF OCCURRENCE AND IMPACT FOR EACH RISK

3.3 USING A MATRIX INCLUDED IN APPENDIX A, PLOT THE RISKS ON A HEAT MAP AND EXPLAIN WHAT THE MAP MEANS

4.1 USING THE REGISTER DERIVED IN QUESTION 3.1, CALCULATE THE AVERAGE IMPACT (EXPECTED MONETARY VALUE) USING AGGREGATION OF STATIC VALUES

4.2 SUMMARISE WHAT DOES THIS AVERAGE IMPACT VALUE MEANS FOR THE ORGANISATION

5.1 USING THE REGISTER FROM 3.1, CALCULATE THE 5 POSSIBLE EXPECTED MONETORY VALUES USING THE AGGREGATION OF THE RISK DRIVEN OCCURRENCES METHODOLOGY

5.2 DESCRIBE THE RESULT OF THIS METHODOLOGY USING AN APPROPRIATE DIAGRAM

5.3 SUMMARISE WHAT DOES THIS AVERAGE IMPACT VALUE MEANS FOR THE ORGANISATION

Answers

An organization that will be analyzed in this context is Coca-Cola.1.1 Summary of the nature of the business:Coca-Cola is one of the most well-known beverage manufacturers in the world. They create fizzy drinks, juices, and water for a variety of markets.

Their drink portfolio includes more than 200 brands sold in over 200 countries.1.2 Summary of the business model:Coca-Cola Company follows a business model based on creating strong brands that generate significant customer demand.

Their main goal is to build and enhance brand equity. They engage in extensive advertising and promotion campaigns to attract more consumers.1.3 What are the key business drivers:Coca-Cola's essential business drivers are its brand, extensive distribution network, market reach, product innovation, customer satisfaction, and product differentiation.2.1 Nature of decision describing what decision needed to be made and why:The business decision that was taken by Coca-Cola was regarding the selection of the right marketing mix, which is a critical decision.

This allowed them to gain valuable insights into how the consumers perceive their products, which they could use to develop targeted marketing strategies. From a risk modeling perspective, the approach is beneficial because it allows the company to minimize the risks by identifying the issues that consumers may face with their products.3.1 Using the selected business decision from above, identify at least 5 risks that needed to be considered to make the same:1. Competition from other beverage manufacturers2. Consumer preferences and behavior3. Changes in market trends4. Fluctuating economic conditions

5. Changing health and safety regulations3.2 Using the risk register in the previous section, conduct a qualitative risk analysis for these 5 risks by proposing the probability of occurrence and impact for each risk:The following table shows the qualitative risk analysis for the five risks that were identified:RiskProbabilityImpactCompetitionMediumHighConsumer preferences and behaviorHighHighChanges in market trendsLowHighFluctuating economic conditionsHighMediumChanging health and safety regulationsLowMedium3.3 Using a matrix included in Appendix A, plot the risks on a heat map and explain what the map means:The risks were plotted on a heat map, as shown below:The heat map shows that the competition and consumer preferences risks have a higher probability of occurrence and impact, while the changes in market trends and health and safety regulations have a lower probability of occurrence and impact.4.1 Using the register derived in question 3.1, calculate the average impact (expected monetary value) using aggregation of static values:

The five possible expected monetary values are calculated by multiplying the probability of each risk and the range of possible impacts.RiskProbabilityImpactRange of possible impactsExpected Monetary ValueCompetitionMedium$2,000,000-$4,000,000$1,200,000Consumer preferences and behaviorHigh$3,000,000-$5,000,000$3,000,000Changes in market trendsLow$1,000,000-$3,000,000$300,000Fluctuating economic conditionsHigh$1,000,000-$2,000,000$1,200,000Changing health and safety regulationsLow$500,000-$1,000,000$50,000Total Expected Monetary Value$5,750,0005.2 Describe the result of this methodology using an appropriate diagram:The following diagram shows the possible expected monetary values for the five risks:5.3 Summarize what does this average impact value mean for the organization:

The average impact value means that the Coca-Cola Company could potentially lose an estimated $5,750,000 due to the five risks that were identified. This value represents the range of possible impacts that the company may face, given the probability of occurrence of each risk. The company can use this information to identify the risk mitigation strategies that are required to minimize the impact of these risks.

For more such questions on Coca-Cola

https://brainly.com/question/30371353

#SPJ8

If a country engages in international trade to gain access to natural resources, they

Answers

Answer:

4578754445765567854456765455675567

QUESTION 1

1. What button is used to format a table's text to make it more interesting in PowerPoint?

Answers

The format button is used to format a table's text to make it more interesting in PowerPoint.

What is the work of the Format button?As the name suggests, the Format button is used to format the text, table, size, etc. And make more interesting in the PowerPoint, MA word, MS Excel.

The formatting button is used to make the more interesting and attractive texts, tables, pictures, etc.

Therefore, the formatting button is used to make more interesting the text of the table.

Learn more bout the format button, refer to:

https://brainly.com/question/8517487