Which of the following statements is the most accurate? Sole proprietorships are well suited for people who want to own a business and share in its profits without taking an active role in management. Sole proprietorships are the least risky form of business ownership. Sole proprietorships must receive a state charter before they can legally conduct business. Sole proprietorships are taxed at the owner's personal tax rate.

Answers

Answer:

D. Sole proprietorships are taxed at the owner's personal tax rate

Explanation:

Sole Proprietorship can be defined as a simplest form of owning and starting any business. As the term suggests, this business is onwed by an individual only or shared by married couples.

Sole properietorship is easy to set up because the owner need not to register itself to state government, therefore, because of absence of governmental involvement, it is easy to set up or deconstruct sole proprietorship.

From the given options, the statement which is most accurate about a sole proprietorship is option D. The owner of sole proprietorship pays personal taxes on the profits earned by his/her business.

Therefore, option D is correct.

Related Questions

Which is an example of a diversified portfolio?

A. A variety of stocks, bonds, and bank accounts

B. A variety of high-risk stocks

C. High-yield bonds and growth stocks

D. Multiple bank accounts with high interest

Answers

A variety of stocks, bonds, and bank accounts.

What Is Diversification?

A portfolio's investments are mixed together in a broad variety as part of the risk management approach known as diversification. To reduce exposure to any one asset or risk, a diversified portfolio combines a variety of different asset classes and investment vehicles.

This strategy is justified by the idea that a portfolio made up of many asset classes would, on average, produce superior long-term returns and reduce the risk of any one holding or security.

In order for the beneficial performance of certain assets to offset the bad performance of others, diversification aims to smooth out unsystematic risk occurrences in a portfolio. The benefits of diversity only apply if the assets in the portfolio are not fully linked; in other words, if they react to market factors differently, frequently in opposite directions.

to learn more about Diversification click:

https://brainly.com/question/29558669

#SPJ1

Estate has an ROI of 16% based on revenues of $400,000. the residual income is $14,000 and the investment turnover is 2. what is the hurdle rate? With Explanation

Answers

If Estate has an ROI of 16% based on revenues of $400,000. the residual income is $14,000 and the investment turnover is 2. The hurdle rate is 9%.

How to find hurdle rate?First step is to find the investment turnover using this formula

Investment turnover=Sales/invested capital

Investment turnover = ($14,000 / $400,000) × 2

Investment turnover = 0.035 × 2

Investment turnover =0.07

Second step is to find the hurdle rate using this formula

Hurdle rate = ROI - Investment turnover

Hurdle rate = 0.16 - 0.07

Hurdle rate = 0.09× 100

Hurdle rate = 9%

Therefore the hurdle rate is 9%.

Learn more about hurdle rate here:https://brainly.com/question/29570213?

#SPJ1

A person performs a cost-benefit analysis in order to:

O A. calculate the expenses of multiple businesses competing in the

same market.

B. evaluate the possible positive and negative effects of different

economic decisions.

C. analyze economic data to reach general conclusions about a

country's economy.

O D. determine the tax rates a business will pay depending on its

profits in a year.

SUBMIT

Answers

Answer:

The answer is A. calculate the expenses of multiple businesses competing in the same market.

Explanation:

Cost-benefit analysis is a process used by project leaders, business owners, and practitioners to understand the systematic calculating and later comparing costs and benefits of a project.Problem-6; (chapter 3) SS Ltd. obtained significant influence over YY Ltd by buying 30% of Y's 100,000 outstanding ordinary shares at a cost of Br 18 per share on January 1, 2022. On May 15, YY declared and paid a cash dividend of Br 150,000. On December 31, YY reported net income of Br 270,000 for the year. (a) record acquisition of shares (a) record revenue and dividends

Answers

(a) Record acquisition of shares: Investment in YY Ltd. Dr. Br 540,000, Cash Cr. Br 540,000.

(a) Record revenue and dividends: Dividend Receivable Dr. Br 45,000, Revenue from Investment in YY Ltd. Cr. Br 45,000; Investment in YY Ltd. Dr. Br 81,000, Revenue from Investment in YY Ltd. Cr. Br 81,000.

(a) To record the acquisition of shares by SS Ltd. on January 1, 2022:

Investment in YY Ltd. (30% of 100,000 shares * Br 18) Dr. Br 540,000

Cash Cr. Br 540,000

This journal entry records the purchase of 30% of YY Ltd.'s outstanding shares for a total cost of Br 540,000.

(b) To record revenue and dividends for the year:

On May 15, YY Ltd. declared and paid a cash dividend of Br 150,000. This dividend represents the portion of the company's earnings that will be distributed to its shareholders.

Dividend Receivable Dr. Br 45,000 (30% of Br 150,000)

Revenue from Investment in YY Ltd. Cr. Br 45,000

This entry recognizes the dividend revenue earned by SS Ltd. from its investment in YY Ltd.

On December 31, YY Ltd. reported net income of Br 270,000 for the year. As SS Ltd. has significant influence over YY Ltd., it needs to adjust its investment account for its share of the net income.

Investment in YY Ltd. Dr. Br 81,000 (30% of Br 270,000)

Revenue from Investment in YY Ltd. Cr. Br 81,000

This entry records the revenue earned by SS Ltd. from its share of YY Ltd.'s net income.

For more question on Investment visit:

https://brainly.com/question/29547577

#SPJ8

How has the 'gig economy' impacted variable and fixed costs for businesses?

Answers

Answer:

Throughout the following explanatory section, the essence of this issue is explained.

Explanation:

The Gig economy would be the economy in which employees are temporarily recruited underemployment needs and needs. Throughout the labor market there have been no permanent workers, but freelance employment.

Unless the jobs are recruited on an exclusive system, the variable costs are subject to different conditions and if enough staff is recruited at a certain time, those variable costs would escalate throughout the terms of additional pay.The certain fixed cost remains very similar, as variable costs adjust as employees increase or reduce, but fixed costs change accordingly.Why does an increase in sales tax affect different

income groups?

Answers

Answer:

Because lower-income households spend a greater share of their income than higher-income households do, the burden of a retail sales tax is regressive when measured as a share of current income: the tax burden as a share of income is highest for low-income households and falls sharply as household income rises.

Increase in sales tax affects lower-income groups, as they are likely to spend a greater percentage of their income on goods and services that are subject to sales taxes.

Sales tax is a type of consumption tax imposed by the government on the purchase of goods and services. It is a form of regressive taxation, which is defined as a tax that takes a larger percentage of income from those who have less money.

Food, clothing, and other necessities are typically subject to sales taxes, meaning that lower-income households will bear the brunt of the tax burden. Higher-income households, on the other hand, are more likely to spend a larger share of their income on items that are not subject to sales taxes, such as investments and luxury items.

In addition, higher-income households are more likely to be able to take advantage of certain tax deductions, such as charitable donations or mortgage interest payments, which can reduce their overall tax burden.

Moreover, lower-income households do not have access to these tax deductions, so they are less able to offset the impact of an increase in sales taxes.

Learn more about sales tax:

brainly.com/question/4031945

fill in the blank. a contribution margin income statement ___. multiple select question. separates costs into their fixed and variable components is prepared primarily for external reporting purposes can assist with management decision making reports both gross margin and net income

Answers

The contribution margin must be higher than the total fixed costs, the contribution margin can also be calculated per unit.

The contribution margin is not used when evaluating profitability instead, it is used when trying to understand how much revenue is left over after accounting for variable costs that can be used to cover fixed expenses and subsequently generate potential profit. An income statement that subtracts all variable costs and expenses from revenue to show the contribution margin. From that, fixed costs and expenses are subtracted to arrive at net income.The contribution represents the part of sales revenue that is not consumed in variable costs and, therefore,contributes to the coverage of fixed costs.The variable contribution margin is the margin that results when variable production costs are subtracted from revenue.It is most useful for making incremental pricing decisions where an entity must cover its variable costs,although not necessarily all of its fixed costs.

To learn more about contribution margin please click on below link.

https://brainly.com/question/14950546.

#SPJ4

Explain how utility could be used in a decision where performance is not measured by monetary value

Answers

Utility can be applied in decision-making situations where performance is not solely measured by monetary value.

Utility is a concept that can be used in decision-making scenarios where performance or outcomes are not solely measured by monetary value.

Utility refers to the satisfaction, well-being, or value that an individual derives from a particular outcome or alternative. It provides a framework for decision-makers to consider non-monetary factors and subjective preferences.

In situations where performance is not easily quantifiable in monetary terms, utility can be used to assign subjective values or preferences to different outcomes. Decision-makers can assess the potential utility or satisfaction associated with each alternative and choose the option that maximizes overall utility.

For example, let's consider a decision regarding the selection of a vacation destination. The performance in this case is not directly measured by monetary value, but rather by the level of enjoyment and personal preferences.

Utility theory can be applied by evaluating the potential utility associated with each destination based on factors such as climate, cultural experiences, outdoor activities, and personal interests. Decision-makers can assign subjective values or rankings to these factors and consider their individual utility weights.

By considering utility, decision-makers can make choices that align with their personal preferences and maximize their overall satisfaction or well-being. They may prioritize destinations that offer experiences they value the most, even if it comes at a higher cost or involves trade-offs with other factors.

For more such question on Utility. visit :

https://brainly.com/question/9973074

#SPJ8

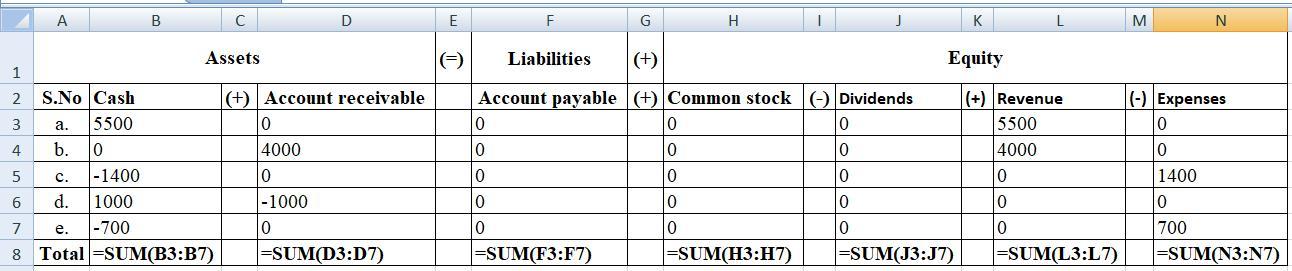

The following transactions were completed by the company.

a. The company completed consulting work for a client and immediately collected $5,500 cash earned.

b. The company completed commission work for a client and sent a bill for $4,000 to be received within 30 days.

c. The company paid an assistant $1,400 cash as wages for the period.

d. The company collected $1,000 cash as a partial payment for the amount owed by the client in transaction b.

e. The company paid $700 cash for this period's cleaning services.

Required:

Write the impact of each transaction on individual items of the accounting equation.

Answers

Therefore we can conclude that the attachment i.e. attached represent the impact of the given transactions on the accounting equation.

Learn more about the accounting equation here: brainly.com/question/14689492

Answer:

OFOFORORIEIEJEJEJEE OFORORIEIEJEJEJEE DE CE EȘTI TU EȘTI ÎN CĂUTAREA DE FURNIZORI ȘI PARTENERI DE LA DE UN MILION BUNĂ ZIUA ÎN AMIAZA BUNĂ ZIUA ÎN AMIAZA

7 the follow table contains the demand from the last 10 months :

Answers

Explanation:

Month Actual Demand Month Actual Demand

1 31 6 36

2 34 7 38

3 33 8 40

4 35 9 40

5 37 10 41

Show Work and answer the following:

a.) calculate the single exponential smoothing forcast for these data using a of .30 and an initial forecast ( F1) of 31.

b.) calculate the exponential smooting with trend forecast for these data using an a of .30, & of .30, and an initial trend forecast ( T1) of 1, and an initil exponentailly smoothed forecast F1 of 30,

c.) calculate the mean absolute deviation (MAD0 for each forecast

ichiro just recived his latest bank statement and discovered the balance was less than the balance on his check register. what is the best explanation for the problem?

A) he deposited money in an ATM

B) he earned more money last month

C) he forgot to enter a withdrawal in the register

D) his employer paid him through direct deposit

Answers

Ichiro just received his latest bank statement and discovered that the balance was less than the balance on his check register. The best explanation for the problem is Option C. He forgot to enter a withdrawal in the register.

A check register is a document used to record transactions made in a bank account. It records the amount of money that has been withdrawn or deposited, as well as any fees or other charges that are associated with the account. A check register is usually kept up-to-date by the account holder. They can use this document to keep track of how much money is in their account, as well as how much money they have spent or received.

This document can be useful for creating a budget and making sure that there are no errors in the account. However, sometimes there can be discrepancies between the balance on a check register and the balance on a bank statement. This can happen for a variety of reasons, such as deposits or withdrawals that were not recorded, checks that were not cashed, or bank errors.

The best explanation for the problem in this scenario is that Ichiro forgot to enter a withdrawal in his check register. This means that he spent more money than he thought he did, resulting in a lower balance than he expected. Therefore, option C is the correct answer: he forgot to enter a withdrawal in the register.

Know more about Bank statement here:

https://brainly.com/question/25118103

#SPJ8

6. Why do employees often feel that appraisals “highlight all the bad things they did all year?”

Answers

Explanation: This is accepted by many employees that their senior discriminate them on aspects of gender, race, colour, etc in spite of work performance only. They claim to take personal revenge too sometimes. So this is a danger for work ethics

Answer:

Explanation:

Performance appraisal is the method by which the performance of an employee is determined by the employer. It's main purpose is to eliminate the performance deficiencies of the employees. It is a part of career management.

The appraisals stress on the need to have more efficient employee and the deficiencies of the employee pointed out by the appraisal are overcome by the employee by taking the required training. Thus the employees feel that appraisals highlight all the bad things they did al year.

How did the use of money solved problems of Bater?please help

Answers

Answer:

Money is accepted as medium of exchange. People exchange goods and services through medium of money when they buy goods or sell products. Thus money acts as intermediary which solves barter's problem of lack of double coincidence of wants.

You can earn 3% interest on a CD and 1.25% interest on a savings account.

How much more interest will the CD earn for one year if you make a deposit of

$1,650?

Financial Lit, please help!!

Answers

Answer:

The CD will earn $49.50 more interest than the savings account for one year if you make a deposit of $1,650.

Consider total cost and total revenue, given in the following table:

In the final column, enter profit for each quantity. (Note: If the firm suffers a loss, enter a negative number in the appropriate cell.)

Total Cost Marginal Cost

(Dollars)

Quantity (Dollars)

0

1

2

3

4

5

6

7

5

6

8

11

15

20

26

35

05

06

07

Total Revenue Marginal Revenue

(Dollars)

(Dollars)

0

6

12

18

24

30

36

42

AAAAAAA

Profit

(Dollars)

In order to maximize profit, how many units should the firm produce? Check all that apply.

04

Answers

The solution to the given question when we consider total cost and total revenue, given in the following table:

The Financial TableQuantity | Total Cost | Marginal Cost | Total Revenue | Marginal Revenue | Profit

------- | -------- | -------- | -------- | -------- | --------

0 | 5 | 5 | 0 | 0 | -5

1 | 11 | 6 | 6 | 6 | 1

2 | 17 | 6 | 12 | 6 | 5

3 | 24 | 7 | 18 | 6 | 4

4 | 31 | 8 | 24 | 6 | -7

5 | 39 | 8 | 30 | 6 | -9

6 | 47 | 8 | 36 | 6 | -11

7 | 55 | 8 | 42 | 6 | -13

As you can see, the firm's profit is maximized at quantity 3. This is because the marginal revenue is equal to zero at this point, which means that the firm is not making any additional profit by producing more units. In fact, if the firm produces more units, it will actually start to lose money.

Therefore, the answer to the question is 3.

In summary:

The firm's profit is maximized at quantity 3.This is because the marginal revenue is equal to zero at this point.If the firm produces more units, it will start to lose money.Therefore, the answer to the question is 3.Read more about marginal revenue here:

https://brainly.com/question/13444663

#SPJ1

The dean of the School of Fine Arts is trying to decide whether to purchase a copy machine to place in the lobby of the building. The machine would add to student convenience, but the dean feels compelled to earn an 10 percent return on the investment of funds. Estimates of cash inflows from copy machines that have been placed in other university buildings indicate that the copy machine would probably produce incremental cash inflows of approximately $13,000 per year. The machine is expected to have a three-year useful life with a zero salvage value.

Use Present Value Appendix PV of $1, to determine the maximum amount of cash the dean should be willing to pay for a copy machine.

Note: Round your intermediate calculations and final answer to 2 decimal places.

Use Present Value Appendix PVA of $1, to determine the maximum amount of cash the dean should be willing to pay for a copy machine.

Answers

The dean should be willing to pay up to $32,324.40 for the copy machine, given the expected incremental cash inflows and the three-year useful life of the machine.

To determine the maximum amount of cash the dean should be willing to pay for a copy machine, we need to calculate the present value of the incremental cash inflows.

Using the Present Value of $1 table with a 10% discount rate, we can find the present value factor for a three-year period: 0.751.

Therefore, the present value of the incremental cash inflows is:

$13,000 x 0.751 = $9,763

This means that the maximum amount of cash the dean should be willing to pay for the copy machine is $9,763.

To calculate the present value of an annuity of $1, we can use the Present Value of an Annuity of $1 table. In this case, we need to use the same 10% discount rate and a three-year period.

The present value factor for an annuity of $1 for three years at 10% is 2.4868.

So, the maximum amount of cash the dean should be willing to pay for the copy machine, taking into account the incremental cash inflows over the three-year useful life of the machine, is

$13,000 x 2.4868 = $32,324.40

To know more about cash inflows here

https://brainly.com/question/31086720

#SPJ1

If Chelsea decides to wait two years

before making the down payment,

instead of one, how much money

will she have after two years?

Answers

List 3 components of a property management system

Answers

Answer:

Maintenance, Minimizing expenses and Managing debt and risk.

Explanation:

These are the three M's of a property management system. Maintenance refers to a set of processes and practices which aim to ensure the continuous and efficient operation of machinery, equipment, and other types of assets typically used in business, Minimizing expenses refers to lowering prices when it comes to hospitality, supply expenses, and modernizing. Managing debt and risk in business usually refers to controlling expenses in a business and controlling financial stability throughout a business.

When an alphabetic arrangement is converted to a consecutively numbered arrangement, where will the

general folders in the alphabetic file be located in the numeric storage arrangement? Will records in there

folders be coded with a number? Why or why not?

Answers

1. The general A to Z folders will be the location of the alphabetical records storage.

2. The records in the folder will be coded with a letter. It won't be coded with a number. This is important for easier access.

How to illustrate the information?Sequential numbering is a method of arranging sequential numbering records in ascending order from the lowest to the greatest number. The consecutive numbering technique includes the numbered files, alphabetic index, and accession log.

The universal A to Z folders will become the common alphabetical file in front of the numerical storage arrangement in alphabetical records storage.

Until there are enough documents to warrant a separate numbered folder, the records in the folders will be coded with the letter G. During this time, the records will be coded with their respective file codes, arranged into numbered folders, and filed in the numerical component of the file.

Learn more about alphabetic on:

https://brainly.com/question/26971639

#SPJ1

Marshall Company purchases a machine for $200,000. The machine has an estimated residual value of $80,000. The company expects the machine to produce four million units. The machine is used to make 440,000 units during the current period. If the units-of-production method is used, the depreciation expense for this period is:

Answers

Answer:

The depreciation expense for this period is: $13,200

Explanation:

The depreciation charge using units of production is calculated as follows :

Depreciation Expense = (Cost - Salvage Value) × (Period`s Production / Total Expected Production)

= ($200,000 - $80,000) × 440,000 units / 4,000,000 units

= $13,200

Conclusion:

The depreciation expense for this period is: $13,200

do you think the action of taking the property is fair? Why or why not?

Answers

Depending on the purpose, the action of taking property by a government is fair, in that the government can legally take land privately for public purposes, provided that this taking of property is properly compensated to the owner of the property.

What is the right to property?It is the 17th article of the Constitution, which stipulates that every citizen has the right to property, which must not be arbitrarily withdrawn or deprived of it.

The taking of government property is generally carried out for public purposes, being intended for the benefit of society, such as for transformation into schools and hospitals for example.

Therefore, the action of taking a property is fair and constitutional, but the owner of the property must be financially rewarded for it to become legal.

Find out more about right of property here:

https://brainly.com/question/22370263

#SPJ1

Keyser Mining is considering a project that will require the purchase of $980,000 in new equipment. The equipment will be depreciated straight-line to a zero book value over the 7-year life of the project. The equipment can be scraped at the end of the project for 5 percent of its original cost. Annual sales from this project are estimated at $420,000. Net working capital equal to 20 percent of sales will be required to support the project. All of the net working capital will be recouped. The required return is 16 percent and the tax rate is 35 percent. What is the amount of the after-tax salvage value of the equipment?

A. $17,150

B. $31,850

C. $118,800

D. $237,600

E. $343,000

Answers

The amount of the after-tax salvage value of the equipment is $31,850. Option B

How to find the amount of the after-tax salvage value of the equipment?To determine the after-tax salvage value of the equipment, we need to calculate the salvage value at the end of the project and then apply the tax rate.

Therefore, the salvage value is:

Salvage Value = 5% of $980,000

= 0.05 * $980,000

= $49,000

The tax rate is given as 35 percent, so we can calculate the after-tax salvage value as:

After-Tax Salvage Value = Salvage Value - Tax on Gain

= $49,000 - (Tax Rate * Gain)

= $49,000 - (0.35 * $49,000)

= $49,000 - $17,150

= $31,850

Therefore, the amount of the after-tax salvage value of the equipment is $31,850.

Learn more about salvage value at https://brainly.com/question/31441389

#SPJ1

Department 1 of a two department production process shows: Units Beginning Work in Process 10,000 Ending Work in Process 50,000 Total units to be accounted for 160,000 How many units were transferred out to Department 2?

Answers

Answer:

20000 for ending work 100000 total & 320000 are accounted for

If you were seleted for this position, how quickly would you be able to start?*

Answers

If I were selected for the position, I would be able to start immediately, provided that all the formalities have been completed and all the requirements have been fulfilled.

As a responsible individual, I would like to make sure that I do not leave my current employer stranded and would provide them with adequate notice as required. I believe in fulfilling my professional obligations and would like to do the same in my current position. I would work with my current employer to ensure that I am released from my current position in a professional and amicable manner. This would include ensuring that all my work is up-to-date and handing over my responsibilities to my successor in a systematic and thorough manner.

Once the notice period is over and all the formalities have been completed, I would be able to start working in my new position. I understand the importance of being punctual and professional and would make sure that I arrive at work on time and fulfill all my responsibilities to the best of my abilities. I believe in teamwork and would work closely with my colleagues to ensure that the objectives of the organization are met.

In conclusion, if I were selected for the position, I would be able to start immediately, provided that all the formalities have been completed and all the requirements have been fulfilled. I would work with my current employer to ensure that I am released from my current position in a professional and amicable manner and would arrive at work on time and fulfill all my responsibilities to the best of my abilities.

Know more about Teamwork here:

https://brainly.com/question/33124678

#SPJ8

you are a consultant to a firm evaluating an expansion of its current business. The cash flow forecasts (in millions of dollar) for the project as follows: on the basis of the behavior of the firm's stock, you believe that the beta of the firm is 1.30. Assuming that the rate of return available on risk-free investments is 5% and that the expected rate of return on the market portfolio is 15% what is the net present value of the project

Answers

Question

you are a consultant to a firm evaluating an expansion of its current business. The cash flow forecasts (in millions of dollar) for the project as follows:

Year cashflow

0 -100

1-10 15

0n the basis of the behavior of the firm's stock, you believe that the beta of the firm is 1.30. Assuming that the rate of return available on risk-free investments is 5% and that the expected rate of return on the market portfolio is 15% what is the net present value of the project

Answer:

NPV= -$32.58

Explanation:

The net present value of the investment is the cash inflow from the investment discounted at required rate of return. The required rate of return can be determined using the the formula below:

Ke= Rf +β(Rm-Rf)

Ke =? , Rf- 5%,, Rm-15%, β- 1.30

Ke=5% + 1.30× (15-5)= 18%

The NPV = Present value of cash inflow - initial cost

= A×(1-(1+r)^(-10)/r - initial cost

A- 15, r-18%

NPV = 15× (1-1.18^(-10)/0.18 - 100= -32.58

NPV = -$32.58

Calculate the present value of the following sequence of willingness to pay: $150 this year; $150 next year; $150 in year 2, and $50 in year 3. Use a 5% discount rate. Recalculate using an 3% discount rate. Show your work. What is the effect of using a lower discount rate on the present value of the stream of willingness to pay

Answers

Answer:

$472.10

$482.78

decreasing the discount rate increases the present value of the willingness to pay

Explanation:

Present value is the sum of discounted cash flows

Present value can be calculated using a financial calculator

Cash flow in year 0 - 2 = $150

Cash flow in year 3 = $50

PV when I is 5% = 472.10

PV when I is 3% = 482.78

To find the PV using a financial calculator:

1. Input the cash flow values by pressing the CF button. After inputting the value, press enter and the arrow facing a downward direction.

2. after inputting all the cash flows, press the NPV button, input the value for I, press enter and the arrow facing a downward direction.

3. Press compute

1. A person risks losing most or all of his or her money in (a) a savings account (b) an elective savings program (c) a speculative investment (d) a conservative investment

Answers

Cabinaire Inc. is one of the largest manufacturers of office furniture in the United States. In Grand Rapids, Michigan, it assembles filing cabinets in an Assembly Department. Assume the following information for the Assembly Department:

Direct labor per filing cabinet 30 minutes

Supervisor salaries $117,000 per month

Depreciation $32,000 per month

Direct labor rate $12 per hour

Prepare a flexible budget for 70,000, 80,000, and 90,000 filing cabinets for the month ending February 28 in the Assembly Department.

Answers

Answer:

For 70,000 just add 117,000 and 32,000.Convert 12$ into Naira,multiply it with 70,000 and divide the result by 30

For 80,000 just add 117,000 and 32,000.Convert 12$ into Naira,multiply it with 80,000 and divide the result by 30

For 90,000 just add 117,000 and 32,000.Convert 12$ into Naira,multiply it with 90,000 and divide the result by 30

Which type of bond is sold at face value?

SEP

CD

Series I Savings Bond

Series EE Savings Bonds

Answers

The type of bond sold at face value are Series I savings bond and Series EE savings Bonds.

An IOU-like debt security is called a bond. Borrowers issue bonds to attract capital from investors ready to extend a loan to them for a specific period of time. When you purchase a bond, you are making a loan to the issuer, a corporation, a government, or a municipality.

Governments and businesses both issue bonds to raise money. By purchasing a bond, you are making a loan to the issuer, who agrees to repay the face value of the loan on a specific date and you pay along the way, you will receive periodic interest payments—typically twice a year.

The correct answer are both "3rd and 4th" option.

To know more about bonds, click here.

https://brainly.com/question/14294177

#SPJ1

Hercules PDF for accounting

Answers

Its goal is to scrutinize the fiscal state of a company by meticulously analyzing its income, expenditures, assets, and debts.

What is Accounting?The meticulous discipline of creating an accurate and comprehensive record of financial transactions is known as accounting.

It employs principles and concepts that assist in generating detailed reports which reflect the commercial performance and status over a specified time frame.

The importance of accounting for businesses transpires from monitoring and managing their financial resources with clarity, enabling informed decisions benefiting business longevity, and adhering to legal and regulatory obligations.

Read more about accounting here:

https://brainly.com/question/1033546

#SPJ1