According to the information above, which of the following is an appropriate analysis of the sales from the paper supplier? Select the correct answer below: From the data, the paper supplier had continued increasing sales over the 11 days. From the data, the paper supplier had continued decreasing sales over the 11 days. From the data, the paper supplier had decreasing sales from day 0 to day 5. After day 5, the sales increased. From the data, the paper supplier had increasing sales from day 0 to day 5. After day 5, the sales decreased.

Answers

Answer:

From the data, the paper supplier had decreasing sales over the 11 days.

Explanation:

The sales of the paper supplier have been declined over the 11 days. This might be because the demand for the paper is reduce due to lock down offices are closed and mostly work is done online on the soft copies. The paper supply has been increased and demand is decreased resulting in the price fall.

Related Questions

Which change in the price index shows the greatest rate of inflation: 80 to 96, 100-125, or 150-180?

Answers

The price index shows the greatest rate of inflation All changes show the same rate of inflation.

The option (D) is correct.

A price index is a proportion of the proportionate, or rate, changes in a bunch of costs over the long run. A purchaser cost list (CPI) measures changes in the costs of labor and products that families consume.

A price index to expansion rates is only a rate change in a cost record. An expansion rate can be processed at any cost file involving the overall condition for rate changes between two years, whether with regards to expansion. Every day a continuous ascent in the degree of costs in an economy.

Learn more about price index:

https://brainly.com/question/4513076

#SPJ1

This question is not complete, Here I am sttsching the complete question:

Which change in the price index shows the greatest rate of inflation: 80 to 96, 100-125, or 150-180? Group of answer choices

(A) 100 to 125

(B) 80 to 96

(C) 150 to 180

(D) All changes show the same rate of inflation

an increase in the equilibrium nominal interest rate could be caused by which of the following changes?

Answers

The money demand curve moves to the right when prices rise, which raises the nominal interest rate. Ostensible financing costs and bond costs move in inverse headings.

How can the nominal interest rate at equilibrium rise?By making more money available for borrowing, an increase in the money supply—the amount of money in circulation—can raise the equilibrium nominal interest rate. The nominal interest rate rises as a result of the increased demand for loans caused by this additional cash.

The equilibrium nominal interest rate can also rise as a result of an increase in real income, which is measured in terms of purchasing power. The nominal interest rate rises as a result of people borrowing more money as they become wealthier.

Last but not least, a rise in the equilibrium nominal interest rate may result from a decrease in the amount of cash that the general public wants to hold (the demand for money). This is because people are less willing to lend money when there is less demand for it, which raises the nominal interest rate.

To learn more about interest rate visit :

https://brainly.com/question/31074756

#SPJ1

finance and financial planning professionals have to work with clients on a (what) basis?

monthly

daily

weekly or

rare

Answers

Monthly customer interaction is necessary for those in finance and financial planning. As a result, choice (A) is right.

According to common use, a financial planning is a thorough assessment of a person's present financial situation and anticipated future financial status that uses current known variables to forecast future earnings, asset values, and withdrawal schedules.

A budget that organizes a person's finances is frequently included in this, as well as perhaps a list of actions or precise objectives for interaction future spending and saving.

This plan divides up future income into several categories of costs, such rent or utilities, while also setting aside a portion for both short- and long-term savings.

Learn more about financial planning, from :

brainly.com/question/31687151

#SPJ1

A student believes that the average grade on the statistics final examination is 87. A sample of 36 final

examinations is taken. The average grade in the sample is 83.96. The population variance is 144.

a. State the null and alternative hypotheses.

b. Using a critical value, test the hypothesis at the 5% level of significance.

c. Using a p-value, test the hypothesis at the 5% level of significance.

d. Using a confidence interval, test the hypothesis at the 5% level of significance.

Answers

Answer:

(a) H₀: μ = 87 vs. Hₐ: μ ≠ 87.

(b) \(z=-1.52>-z_{\alpha/2}=-1.96\). The average grade on the statistics final examination is 87.

(c) The p-value = 0.1286 > α = 0.05. The average grade on the statistics final examination is 87.

(d) The 95% confidence interval for the average grade on the statistics final examination is (80.04, 87.88).

Explanation:

A statistical hypothesis test is to be performed to determine whether the average grade on the statistics final examination is 87.

(a)

The hypothesis can be defined as follows:

H₀: The average grade on the statistics final examination is 87, i.e. μ = 87.

Hₐ: The average grade on the statistics final examination is not 87, i.e. μ ≠ 87.

(b)

The information provided is:

\(n=36\\\bar x=83.96\\\sigma^{2}=144\)

As the population variance is provided, we will use a z-test for single mean.

Compute the test statistic value as follows:

\(z=\frac{\bar x-\mu}{\sqrt{\sigma^{2}/n}}=\frac{83.96-87}{\sqrt{144/36}}=-1.52\)

The test statistic value is -1.52.

Decision rule:

Reject H₀ if:

\(z<-z_{\alpha/2}\ \text{or}\ z<z_{\alpha/2}\\\\\Rightarrow z<-z_{0.05/2}\ \text{or}\ z<z_{0.05/2}\\\\\Rightarrow z<-1.96\ \text{or}\ z<1.96\)

The calculated value of \(z=-1.52>-z_{\alpha/2}=-1.96\).

The null hypothesis will not be rejected.

Conclusion:

The average grade on the statistics final examination is 87.

(c)

Decision Rule:

If the p-value of the test is less than the significance level then the null hypothesis will be rejected.

Compute the p-value for the two-tailed test as follows:

\(p-value=2\cdot P(Z<-1.52)=2\times 0.0643=0.1286\)

*Use a z-table for the probability.

The p-value of the test is 0.1286.

p-value = 0.1286 > α = 0.05

The null hypothesis will not be rejected.

Thus, it can be concluded that average grade on the statistics final examination is 87.

(d)

Compute the 95% confidence interval for the average grade on the statistics final examination as follows:

\(CI=\bar x\pm z_{\alpha/2}\cdot \sqrt{\frac{\sigma^{2}}{n}}\)

\(=83.96\pm 1.96\cdot \sqrt{\frac{144}{36}}\\\\=83.96\pm 3.92\\\\=(80.04, 87.88)\)

The 95% confidence interval for the average grade on the statistics final examination is (80.04, 87.88).

As the 95% confidence interval consists of the null value, i.e. 87, the null hypothesis will not be rejected.

Hence, concluding that the average grade on the statistics final examination is 87.

The most important reason the selection committee should review the job

description before screening applications is to ensure that———.

A. the salary matches the job description

B. they do not select an overqualified candidate

C. the screening criteria matches the job requirements

D. the correct key words are used to screen the applications

SUBMIT

Answers

Answer: This might help.

Explanation: Look up chapter 6: selection flash cards.

Which of the following statements is true of penetration pricing?

A) Penetration pricing makes sense only in categories that have a significant group of consumers who would be willing to pay a premium.

B) A company using penetration pricing gains a very high profit on each individual sale.

C) A company using penetration pricing makes profit from the volume of sales.

D)Penetration pricing involves increasing product prices to target upscale consumers.

Answers

(C) A company using penetration pricing makes profit from the volume of sales is true of penetration pricing.

What is penetration pricing?Penetration pricing is a marketing tactic by which a company presents a new product or service at a cheaper price during its initial release.

Penetration pricing strategy seeks to increase market share by luring consumers to test new products in the hopes that they would remain loyal after prices return to normal. An online news website that offers a free trial month for a subscription-based service or a bank that provides a free checking account for six months are two instances of penetration pricing.

Learn more about penetration pricing here https://brainly.com/question/6766111

#SPJ1

The following table shows a money demand schedule, which is the quantity of money demanded at various price levels (P). Fill in the Value of Money column in the following table. Price Level (P) Value of Money (1/P) Quantity of Money Demanded (Billions of dollars) 1.00 2.0 1.33 2.5 2.00 4.0 4.00 8.0

Answers

The Value of Money column in the given table represents the inverse relationship between the price level (P) and the value of money.

As the price level increases, the value of money decreases, and as the price level decreases, the value of money increases. This is reflected in the table as the value of money (1/P) decreases as the price level increases.For example, at a price level of 1.00, the value of money is 1/1.00 = 1.00. As the price level increases to 2.50, the value of money decreases to 1/2.50 = 0.40. This means that at a price level of 2.50, each dollar is worth only 40 cents in terms of purchasing power compared to a price level of 1.00.The quantity of money demanded (in billions of dollars) also varies with the price level, with higher price levels leading to higher demand for money.

To know more about money visit:

https://brainly.com/question/29774002

#SPJ1

With regard to the composition of corporate boards in the United States,

corporate boards average approximately 12 members.

O about half of the directors are "outside" directors.

O five percent have at least one woman on the board.

twenty-five percent of all companies have at least one minority board member.

Answers

With regard to the composition of corporate boards in the United States, option B. About half of the directors are "outside" directors.

Corporate boards in the United States typically consist of a group of individuals responsible for overseeing the management and decision-making of a company. The composition of these boards can vary, but there are some common trends and practices.

Option A states that corporate boards average approximately 12 members. While this may be true for some companies, board sizes can vary significantly depending on the size and nature of the organization. Smaller companies may have fewer board members, while larger corporations may have larger boards to accommodate the complexities of their operations.

Option C suggests that five percent of corporate boards have at least one woman on the board. However, the representation of women on corporate boards has been a topic of discussion and a focus of efforts to improve diversity. Recent studies and reports indicate that progress has been made, and the percentage of women on boards has been increasing over time. However, the exact percentage varies among companies and industries.

Option D states that twenty-five percent of all companies have at least one minority board member. Like gender diversity, the representation of minorities on corporate boards has been a topic of concern and initiatives promoting inclusion. The percentage of companies with minority board members may vary, and efforts are being made to improve diversity in this regard as well.

Overall, it is important to recognize that the composition of corporate boards in the United States is evolving, and there is increasing recognition of the importance of diversity, including gender and minority representation. While specific percentages may vary, there is a growing emphasis on promoting diversity and inclusion in corporate governance practices. Therefore, the correct option is B.

The question was incomplete, Find the full content below:

With regard to the composition of corporate boards in the United States,

A. corporate boards average approximately 12 members.

B. about half of the directors are "outside" directors.

C. five percent have at least one woman on the board.

D. twenty-five percent of all companies have at least one minority board member.

Know more about Decision-making here:

https://brainly.com/question/29675087

#SPJ8

What is sample size?

Answers

Answer:

What is sample size?

Explanation:

= The number of participants included in the population study

OR,

=The total number of persons included in the study .

Answer:

A sample size is a part of the population that is used to answer questions or is used for experiments.

Explanation:

Hope this helps!

Conducting a survey of your friends to see how many might go to a trampoline park is an example of

Answers

Answer: Primary research

Explanation: Primary research is defined as the type of research where the person himself collects information. In this type of research, surveys, observation, and interviews are used.

In the primary research, the information is collected directly and not depending on other research that has been done previously. One of the advantages of this research is that it is carried out around a specific problem and with this information find a solution.

how do you understand the word business finance?

Answers

Answer:

Business Finance means the funds and credit employed in the business. Finance is the foundation of a business. Finance requirements are to purchase assets, goods, raw materials and for the other flow of economic activities

Answer:

in my opinion and own words

Explanation:

Business Finance simply means the activity of managing money in financial status especially in companies or government organizations to run a business or activity or also a project so it simply means using Finances to run a business

.(Thank you and sorry)0

Mr. D is the manager of a local walgreens. His biggest concern is to make sure that his store is always making the most profit possible. He cuts costs by focusing on certain logistical decisions. Every other day walgreens receives shipments from pepsi, evian, hershey, and numerous other manufacturers. Walgreens insists on small shipments every two days, which helps to keep their inventory costs low. What system is mr. D using at walgreens to reduce his costs?.

Answers

The system is mr. D using at walgreens to reduce his costs is just in time inventory.

What is just in time inventory?JIT, or just-in-time inventory management, involves only ordering products from vendors when they are actually needed. This approach's primary goals are to lower the cost of keeping inventory and boost inventory turnover.With a just-in-time (JIT) inventory system, a business receives products as close as feasible to the moment they are actually required. As a result, if an auto assembly facility wants to install airbags, it doesn't maintain a supply on hand; instead, it gets them as the cars are put together.In conclusion. When used properly, JIT inventory can be a terrific method to reduce costs and boost productivity.

To learn more about just in time inventory refer to:

https://brainly.com/question/8842151

#SPJ4

How does the slope of a supply or demand curve differ from elasticity of supply or demand?

Answers

The slope of a supply or demand curve differ from elasticity of supply or demand are to represent quantities to prices because of changes in the level of prices to changes in the level of quantity supply or demand.

What is demand?The term “demand” is believing on people wants and desires to the amount of money of goods and services. Demand is an economic notion that deals with the relation between user demand for goods and services and their market prices.

The slope of a supply curve is upward basis and the demand curve basis on downward to the right was the straight line. It was the change of prices in the level of quantity supply or demand. Elasticity of supply or demand was the quantity to price demanded or supplied.

As a result, the conclusion of the difference between are the aforementioned.

Learn more about on demand, here:

https://brainly.com/question/29761926

#SPJ9

if customers are prepared to pay $1.50 when this is serv

ble within the bakery, what is the new value added per cake

Answers

If customers are prepared to pay $1.50 when this is servable within the bakery $2 is the new value-added per cake.

Bars, bread, cookies, desserts, muffins, pizza, snack cakes, sweet items, and tortillas are among the categories of bakeries and baked products.

A bakery can be started as a retail operation selling baked products to customers from a storefront site or as a wholesale operation selling baked goods to restaurants, grocery stores, and other businesses.

The baking industry has long been seen as recession resistant. This is supported by the fact that people must eat and that many people value and are ready to pay for fresh goods. Comfort meals can be produced as delightful and nutrient-dense baked goods.

Learn more about bakery here:

https://brainly.com/question/26683970

#SPJ9

Kevin owns a toy company. How should he ensure that his customers are receiving a high-quality product

A. Offer a discount on future purchases to customers

B. Repair products that have been sold to customers and are broken

C. Survey customers and ask for suggestions

D. Test a prototype

Answers

Option (d), Kevin owns a toy store. In this method, he may run a prototype test to ensure that his customers are receiving a high-quality product.

How do you know your customer service is top-notch?If you pay attention to your customers, acknowledge their needs, thank them, and create a warm, welcoming environment, they will think highly of you. A satisfied consumer is more inclined to buy more from you again. Additionally, they could suggest others to your business.

Kevin has several alternatives to ensure that his customers receive high-quality products.

One option is to test a prototype first to ensure the finished product satisfies the appropriate quality standards.Additionally, he may improve the quality of the finished product by using customer feedback. He may conduct client surveys and ask for suggestions in order to understand more about their preferences and goals.Kevin may also offer a warranty or guarantee on his goods and repair or replace any defective things that he has sold to customers.By doing this, he could demonstrate his concern for customer satisfaction and enhance his company's reputation as a producer of high-quality items.Learn more about customer satisfaction: https://brainly.com/question/28387894

#SPJ1

what is true about taxes ?

Answers

Answer:

1. TAXES DATE BACK TO AT LEAST ANCIENT EGYPT.

We can trace documented records of taxation all the way back to Ancient Egypt, sometime around 3000 to 2800 BCE. Apparently, there was a biennial event called the Following of Horus, when the Pharaoh went around collecting taxes in his dual roles as head of state and living incarnation of the god Horus. Taxation is even described in the Bible when Joseph tells the people of Egypt to give a fifth of their crops to Pharaoh.

2. THE FIRST TAXES IMPLEMENTED IN THE UNITED STATES CAUSED A REBELLION.

Fans of the Broadway musical Hamilton probably remember the lyric, “Imagine what gon’ happen when you try to tax our whiskey.” What happened was the Whiskey Rebellion, which was largely due to a tax that Alexander Hamilton imposed on—you guessed it—whiskey.

As you might imagine, people were extremely unhappy about it, especially small producers of whiskey, who, because of the way the tax was structured, had to pay nine cents per gallon in taxes, while larger producers were able to get as low as six cents. Violence quickly broke out. Tax officers were assaulted and tarred and feathered for trying to do their jobs, and several people were killed during riots. The Rebellion was eventually quashed in 1794, and the whiskey tax remained in effect until 1802, when Thomas Jefferson repealed it.

3. ABRAHAM LINCOLN GAVE US FEDERAL INCOME TAX.

Abraham Lincoln signed the Revenue Act in 1861, which imposed the first-ever federal income tax. To drum up funds for the Civil War, Lincoln and Congress enacted a modest 3 percent tax on income over $800, which would be roughly $23,000 today. The law was almost instantly replaced with a new revenue act and would be repealed a decade later, but the relief obviously didn’t last: In 1913, the 16th Amendment established the federal income tax system we all know today.

4. TAX DAY WASN'T ORIGINALLY ON APRIL 15.

When the modern federal income tax was established, lawmakers set March 1 as the looming deadline.

Although they gave no reason for this particular date, it was presumably to give people a couple of months to gather paperwork and crunch numbers after the end of the year. By 1919, the government tacked a couple of more weeks on to help panicked filers, making March 15 the date. That date stood until 1955, after Congress acknowledged that doing your taxes was getting more complicated by the year.

To help accommodate all of those changes and give people adequate time to file, the date was bumped by another month—but the change wasn’t entirely altruistic. The IRS acknowledged that the extra month would help their employees as well, spreading the workload out across another 30 days.

5. WE SPEND A LOT OF TIME DOING OUR TAXES.

The amount of time we spend doing our taxes every year suggests that the repeated date changes may have been justified. According to the IRS, the average taxpayer spends about 11 hours doing record-keeping, tax planning, form submission, and other super fun tax-related activities. Of course, if you break it down even further, the amount of time changes based on the type of form the filers use. Business filers spend about 20 hours, including 10 hours on record-keeping alone.

Explanation:

please mark me brainliest and theses are just facts about taxes

QERFEWTDGFSETHWRSTGHBDRAEAGBHSWRTYH

Answers

Answer:

Explanation:na

outline The key success factor for business

Answers

Critical success factor is a management term for an element that is necessary for an organization or project to achieve its mission. To achieve their goals they need to be aware of each key success factor and the variations between the keys and the different roles key result area.

Hope this helps you

Answer:

here are the 5 Key Success Factors of Business:

1. Strategic Focus (Leadership, Management, Planning)

2. People (Personnel, Staff, Learning, Development)

3. Operations (Processes, Work)

4. Marketing (Customer Relations, Sales, Responsiveness)

5. Finances (Assets, Facilities, Equipment)

Give two examples of potential trade-offs of a high real GDP per capita

Answers

"Trade-off" is used in economics to mean the fact that budgeting inevitably involves letting go some of X to get more of Y. Read below about the examples of potential trade-offs.

What are the examples of potential trade-offs of a high real GDP per capita?The following are the examples of potential trade-offs of a high real GDP per capita:

Somebody giving up the intent to see a movie to reading for a test in order to get a good grade. The opportunity cost is the cost of the movie and the enjoyment of seeing it.A business owns its building. If the organisation moves, the building could be rented to another. The opportunity cost of staying there is the amount of rent the organization would get.Therefore, the correct answer is as given above

learn more about GDP per capita: https://brainly.com/question/18414212

#SPJ1

the canton corporation operates in four distinct business segments. the segments, along with information on revenues, assets, and net income, are listed below ($ in thousands): segment revenues assets net income pharmaceuticals $ 3,000 $ 2,000 $ 300 plastics 4,000 2,500 370 farm equipment 3,500 1,750 420 electronics 1,000 350 90 total company $ 11,500 $ 6,600 $ 1,180 required: 1. for which segments must canton report supplementary information according to u.s. gaap? note: you may select more than one answer. single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. any boxes left with a question mark will be automatically graded as incorrect. check all that apply pharmaceuticals plastics farm equipment electronics

Answers

The canton corporation must submit supplementary information report for all the four segments.

According to US GAAP, a company must report supplementary information for any segment that meets the criteria for "reportable segment". The criteria for a reportable segment are:

The segment must generate revenue of 10% or more of the company's total revenue.

The segment must have net income of 10% or more of the company's total net income.

The segment must have assets of 10% or more of the company's total assets.

Based on the information provided, it seems that all four segments of the Canton Corporation meet the criteria for a reportable segment and therefore, the company must report supplementary information for all four segments:

Pharmaceuticals

Plastics

Farm Equipment

Electronics

Learn more about business corporation here: brainly.com/question/28452798

#SPJ4

At Bargain Electronics, it costs $30 per unit ($20 variable and $10 fixed) to make an MP3 player that normally sells for $45. A foreign wholesaler offers to buy 3,000 units at $25 each. Bargain Electronic will incur special shipping costs of $3 per unity. Assuming that Bargain Electronics has excess operating capacity, indicate the net income (loss) Bargain Electronic would realize by accepting the special order.

Reject Order Accept Order Net Income Increase (Decrease)

Revenues

Costs-Manufacturing

Shipping

Net income

The special order should be :__________

Answers

Answer:

The special order should be : Accepted

Explanation:

Analysis of whether or not to accept special order

Revenues (3,000 x $25) $75,000

Less Variable expenses :

Costs - Manufacturing (3,000 x $20) ($60,000)

Shipping (3,000 x $3) ($9,000)

Net Income $6,000

Conclusion :

Since Net Income has increased by $6,000 as a result of special order, it should be accepted

Which report do you produce to see total sales for the company?

Answers

_____________ planning focuses on delivering products or services to consumers as well as warehousing, delivering, invoicing, and payment collection.

Answers

Answer:

Distribution

Explanation:

Distribution is one of the phases in production. It is often said that production is not complete until goods and services gets to the final consumers. Distribution planning entails getting the goods produced to consumers as well as warehousing them. It also entails delivery, invoicing and payment collections.

As the last chain in production processes, distribution planning makes goods and services produced gets to the final consumes whilst also taking care of the logistics involved and payment collections.

Type the correct answer in the box. Spell all words correctly.

Complete the sentence using the correct term.

Heavy industrialization is polluting a natural lake in a certain area. The lake is a habitat for various natural flora and fauna. The local government is looking for ways to improve the condition of the lake and make it a tourist attraction. They should seek the help of a(n)

Answers

Answer:

(i know this is late) im taking the test on plato and I think it's a hydrologist

Explanation:

What steps will allow you to use the Keep Together property to ensure that none of the records are broken between two pages when they are printed?

Answers

Answer: 1. design

2. property sheet

3. yes

Explanation: just did it

Assume that you manage a risky portfolio with an expected rate of return of 17% and a variance of 27%. The T-note rate is 7%. What is the reward-to-volatility ratio of your risky portfolio

Answers

Answer: 0.1925

Explanation:

Reward to volatility ratio = (Expected return - Risk free rate) / Standard deviation

Standard deviation = √27%

= 0.5196

Reward to volatility ratio = (17% - 7%) / 0.5196

= 0.1925

Abburi Company's manufacturing overhead is 40% of its total conversion costs. If direct labor is $105,000 and if direct materials are $21,000, the manufacturing overhead is:

Answers

Explanation:

To calculate the Conversion costs, we need to use the following formula:

Conversion costs= direct labor + manufacturing overhead

Now, if direct labor is 60% of conversion costs, then:

Conversion costs= direct labor / (1 - 0.4)

Conversion costs= 86,400 / 0.6

Conversion costs= $144,000

Finally, we determine the manufacturing overhead:

Manufacturing overhead= 144,000 - 86,400

Manufacturing overhead= $57,600

Problem 8, MacroSoft Inc. has capitalized $600,000 of software costs. Sales from this product were $360,000 in the first year. MacroSoft estimates additional revenues of $840,000 over the product’s economic life of 5 years.

Instructions

Prepare the journal entry to record software cost amortization for the first year. Show all computations.

Answers

Journal Entry:

Date: [First year-end date]

The amortization expense for the first year is $120,000.

Debit: Amortization Expense - Software Cost - Year 1 ($600,000 / 5 years) = $120,000Credit: Accumulated Amortization - Software Cost - Year 1 ($600,000 / 5 years) = $120,000Explanation:To record the software cost amortization for the first year, we need to allocate a portion of the capitalized software costs as an expense. Since the software has an estimated economic life of 5 years, we divide the total software cost ($600,000) by 5 to determine the annual amortization expense. In this case, the amortization expense for the first year is $120,000. We debit the Amortization Expense - Software Cost account to recognize the expense and credit the Accumulated Amortization - Software Cost account to accumulate the amortization over time.For more such questions on Journal Entry

https://brainly.com/question/28390337

#SPJ8

How is an index fund different than an exchange-traded fund?

Answers

Answer:The key differences between index ETFs and index funds is ETFs trade throughout the day while index funds trade once at market close. ETFs are often cheaper than index funds if bought commission-free. Index funds often have higher minimum investments than ETFs.

Explanation: The key differences between index ETFs and index funds is ETFs trade throughout the day while index funds trade once at market close. ETFs are often cheaper than index funds if bought commission-free. Index funds often have higher minimum investments than ETFs.

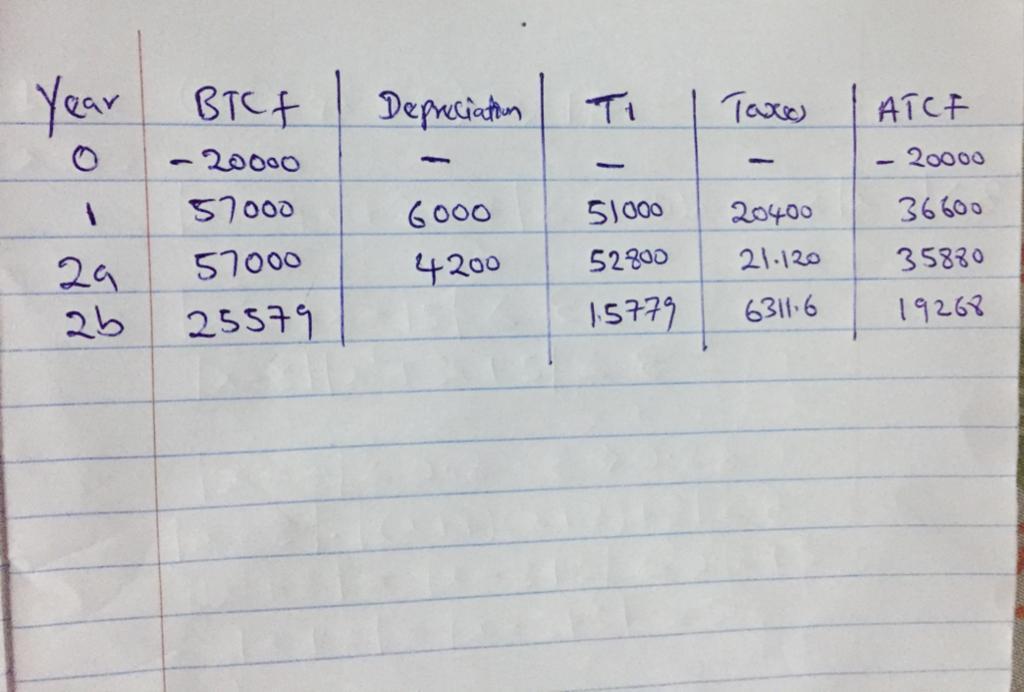

A manufacturer of hardboard and fiber cement sidings and panels purchased new equipment for its new product line for $20,000. A declining balance depreciation at a rate of 1.5 times the straight line rate with a 5-year recovery period and an estimated salvage value of $8000 was used to write off the capital investment. The company expects to realize net revenue of $57,000 each year for the next 5 years. However, due to the sudden change in business direction, the company decided to sell the equipment after 2 years of operation for $21,000. Assuming an effective tax of 40% and an after-tax MARR of 12% per year, calculate the future worth of the after-tax cash flow at the end of year 2.(HINT: skip $ and comma symbols) Year BTCF ATCF 0 -20000 -20,000 1 57,000 36,600.00 2a 57,000 35,880.00 2b 25579 ...

Answers

Answer:

Hello from your question there is a mix up of the figures for the BTCF AFTER 2 years and the BTCF given in the table so i would work with the value contained in the table i.e ( 25579 )

answer : 71052

Explanation:

Declining balance amount can be expressed/calculated using this formula a

\(\frac{1.5}{N} ; d_{k} = B ( 1 - k )^{k-1} (R ) ;\\ Bv_{k} = B ( 1 - R )^{k}\) also R = 1.5 / 5 = 0.3 , k = 2 years

therefore Bv\(_{2}\) = 20000 ( 1 - 0.3 \()^{2}\) = 9800

Mv = 25579

Recapturing depreciation = Mv - Bv = 25579 - 9800 = 15779

BTCF is calculated as = ( capital investment + GI - expense incurred )

TI = GI - Expense - Depreciation + Depreciation recapture + capital gain

ATCF = BTCF - taxes

taxes = TI (l)

The future worth of the after-tax cash flow at the end of Year 2

Fw = -20000(f/p,12%,2) + 36600(f/p,12,1) + 35880 + 19268

= -20000(1.2544) + 36600(1.1200) + 55148 = 71052

attached below is the complete table used for the calculation